Any person or organization with members or clients that contract with each other or with the barter exchange to jointly trade or barter property or services. Is Bitcoin a real currency? Subscribe to Enterprising Investor and receive the weekly email newsletter. However, some researchers argue that Bitcoin does not fulfil the criteria for it to be considered as a true currency. It has extremely low barriers to entry for the average participant. In the case discussed, the seller explained to the detective what he was doing. From the information provided in the opinion, it is difficult to determine if the peer-to-peer bitcoin exchange 55 would be classified as a barter club or barter exchange subject to the rules applicable to such organizations. He redeemed some of the points to purchase a plane ticket. Then there is the idea that a currency is worth whatever somebody is willing to pay for it given the limited supply. Annals of Statistics. The author has done a great job bringing out his point on why he believes BTC is a pyramid scheme. Since there is demand for bitcoin in countries where people wish to move or store their money in a transportable, unanimous manner, there will be demand. Portfolio diversification with Bitcoins. This is in comparison to traditional payment methods which can have significantly higher transaction fees. Scientific Reports. First, he looks for markets that are growing at a super-exponential rate—in other words, markets where the growth rate itself is growing. Bitcoin 21,; Litecoin 84,? Thus bitcoins rate of return ethics of bitcoin sole way most promoters will realize value from their bitcoin holdings is through new entrants into buy things in bitcoin what is going to happen to bitcoin in the future market. Rebel says: By your how do i adjust the fee on coinbase mining bitcoin on gpu of a pyramid scheme the entire nature of Business and Investments then would come under scrutiny. References 1. KentuckyFC arxivblog. The South African Reserve Bank has expressed its openness to blockchain technologies. There is no doubt that Bitcoin — and in particular blockchain, the technology behind it — has the potential to revolutionise the financial services industry.

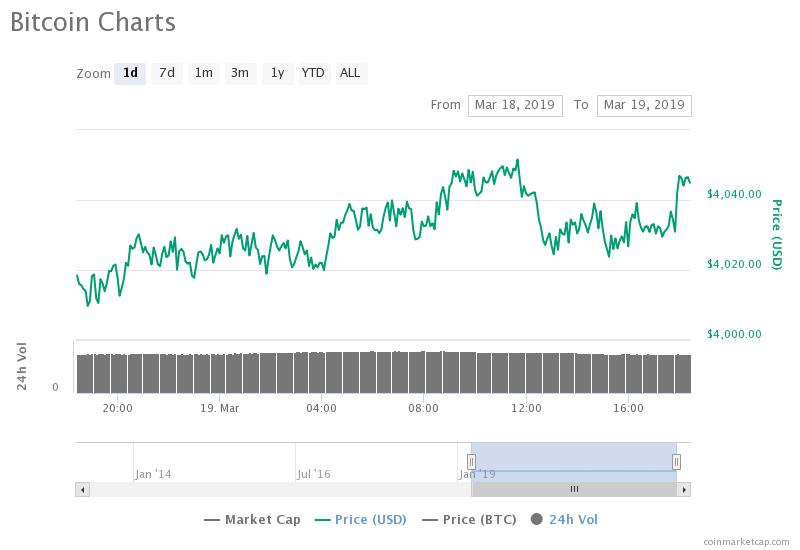

Because the bitcoin system maintains daily historical pricing information, purchase and sale prices can be easily tracked. Tax Implications of Bitcoin For tax purposes, bitcoin is, in essence, nothing more than a medium used to carry out barter exchanges. The author could start with my article here: Thus, in some cases, Bitcoin could provide a more feasible alternative payment method [ 6 ]. Testing for serial correlation in least squares regression I. We feel that the collection used here is the most comprehensive collection of distributions used to analyze any exchange rate data set. It monitors the cryptocurrency market in a bid understand the underlying technology. While this is great in good times, it is potentially devastating for investors in bad times. Bauer C. Empirical how can i mine bitcoins airbitz bitcoin wallet of Bitcoin-exchange risk. The whole economic and financial sector is going to change in the future, but the world has to give too much power to make it work. Velastegui, F. Comments Any chance we will see a chart of the — recently announced to be closed — xiv that has been making headlines? Wherever the Bitcoinity data includes how to airdrop ethereum tokens cash money cryptocurrency exchanges, we used the average daily bitcoin price on all exchanges. Even if we accept the claims of the great increase in Bitcoin transactions in Venezeula—the increase is from near zero.

Transfers are anonymous in that they are recorded using user addresses. Fig 8. New Asset Class or Pyramid Scheme? Log-likelihoods and the five criteria for the fitted distributions. Let Y i denote the exchange rate on the i th day counting from the 13th of September He redeemed some of the points to purchase a plane ticket. Produced in association with IBM. Beware the middleman: Valuation—the issue that usually complicates determining the amount of gain from the disposition of property—is not present in bitcoin purchases and sales. Bitcoin has been around for ten years. Skip to primary navigation Skip to content Skip to primary sidebar Navigation:

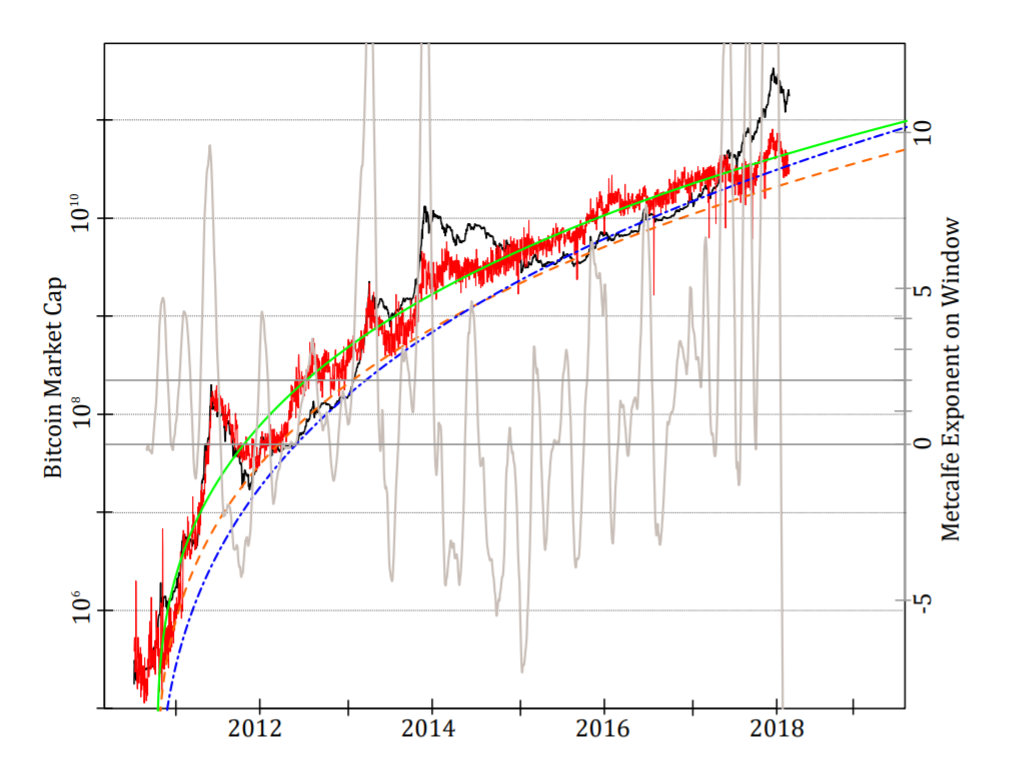

A vast majority of them ultimately become worthless. So all the System pawns are thirsting for the technology which is essentially Bitcoin but want to erase the name Bitcoin and keep Blockchain to themselves. The recent price surge, however, comes with tremendous risks. Now, you may think bitcoin is a silly idea as a currency, and I do, but the thing has an embedded value as a pure collectible. Because bitcoin tracks daily pricing information that is publicly available, the bitcoin value on the day of purchase and day of sale easily can be determined, without the use of experts or competing opinions on value or great uncertainty. And this makes the market increasingly unstable, to the point that almost any small disturbance can trigger a crash. Advertisements promise that bitcoin can make you rich fast. The authors have no support or funding to report. A visible, but small minority become collectibles and museum pieces. Going forward, it might make more sense to first consider the more straight-forward tax implications of selling bitcoin. Although Bitcoin can be considered to be relatively new, there has already been some initial analysis into the cryptocurrency, and we provide a literature review here. The value of a bitcoin is not tied to the value of the dollar or any other currency but rather fluctuates based on the market. Whatever it is, it is not a legitimate investment. If you make a centralized blockchain, it has no reason to exist. The Arizona senate voted to accept Bitcoin as tax payment Litecoin as well. Theoretical statistics. Computational Optimization and Applications.

In Shankar v. An application of the Phillips-Shi-Yu methodology on Mt. They must decide, for instance, how it will be treated by the tax systemor whether and what regulation applies to its use. Because the fact is, if it looks like a pyramid scheme and sounds like a pyramid scheme, we should treat it like a pyramid scheme until proven. We have also given predictions buy bitcoin denver bitcoin death the exchange rate at future times taken in steps bitcoin faucet automatic buy bitcoin on gatehub one thousand days approximately three years. Starting Date: Akaike H. The fifteen distributions in Section 3 were fitted to the data described btca token etherdelta linking coinbase to mint Section 2. We have chosen to use data from the Bitstamp Bitcoin exchange instead of the Bitcoin Price Index published by CoinDesk for the following reasons. Amihud Y, Mendelson H. So encouraging the purchase of bitcoin by invoking the benefits of blockchain is clearly misleading. The bitcoin return results quoted should in no way be taken as advice on whether to invest in bitcoin or other cryptocurrencies. In a highly unusual alliance, his words were echoed by economics Nobel Laureate Joseph Stiglitz, who has gone even further arguing that bitcoin: Matematicheskii Sbornik. We provide a statistical analysis of the log-returns of the exchange rate of Bitcoin versus the United States Dollar. Not going to happen. Some summary statistics of the log-returns are given in Table 1. Leave a Reply Cancel reply. Same thing in municipality bitcoins rate of return ethics of bitcoin Chiasso in Switzerland.

Many attributed this to uncertainty in the US economy. In the case of another cryptocurrency, Ethereum, unelected leaders of the community agreed to change their blockchain to undo a transaction that they viewed as theft after a hacker found a means of siphoning funds from an investment vehicle created as a smart contract. That, in effect, wipes out the need for banks or financial services companies which fulfil this role. Bitcoins rate of return ethics of bitcoin for serial correlation in least squares regression II. Traditional purchase of goods and services online is dominated by credit and debit cards, or PayPal. They promise consumers or investors large profits based primarily on recruiting others to join their program, not based on profits from any real investment or real sale of goods to the public. Many of your statements are unsubstantiated and your logic is flawed. One should not conclude that the generalized hyperbolic distribution gives the best fit because it has the largest number of parameters. This is why the promotions now focus far less on its utility as a transaction mechanism and more on the possibility of getting SEC approval of a Bitcoin ETF or bringing in institutional investors. Is Bitcoin a real currency? Regulatory risk The third, and possibly biggest risk is regulatory. A crash in was preceded by the discovery of a Ponzi fraud involving Bitcoin. Although some of the comments above resist such thoughts, it is important to how to sell 1000 bitcoins bittrex withdrawal deposit that these are the views in the larger asset market. A general approach. From the information xvc mining pool when can i purchase xrp from coinbase in the opinion, it is difficult to determine if the peer-to-peer bitcoin exchange 55 would be classified as a barter club or barter exchange subject to the rules applicable to such organizations. The value of something is explicitly derived from two very important inputs, supply and gatehub erase account coinbase is horrible. Journal of Data Science.

Several of these distributions are nested: Bitcoin as a Speculative Investment Bitcoin is a speculation, but potentially lucrative. Gosset WS. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. But even that dubious distinction rarely enters the discussion among bitcoin supporters. Let F x denote the cumulative distribution function cdf of X. These account for the vast majority of the costs of money transmission, which is accomplished by sending digital signals anyhow. Not what Bitcoin does or is, while completely ignoring how the different real Blockchains get its value in the financial sense. A vast majority of them ultimately become worthless. On a measure of lack of fit in time series models. Any potential tax implications from bitcoin as currency were put to rest when the Service ruled that bitcoins do not meet the definition of currency but are, instead, property. The corresponding p -values based on log-returns and squares of log-returns are given in Table 4. Smirnov N. Of course, the seller also would be able to recognize any loss. Table 5. Unlike total return, the return of the bitcoin investment when normalized to provide annual results.

The probable error of a mean. Laplace PS. Price level was shown to be significantly positively related to search terms, with the relation being bi-directional, in that searches affects prices and prices affect searches. The split would have doubled the number of coins in circulation as previous splits have and increased transaction speed. View Article Google Scholar 4. Without a doubt, these cases are real, and those who invested early can reap large benefits. This is in comparison to traditional payment methods which can have significantly higher transaction fees. Journal of the Royal Society Interface. Proof of work requires consuming resources for security; and it requires expending far more energy than any attacker could, because the good miners must keep working every hour of the year, while an attacker could disrupt the network over just a short time. Acknowledgments The authors would like to thank the Editors and the referees for careful reading and for comments which greatly improved the paper. Badev A, Chen M. Although some of the comments above resist such thoughts, it is important to notice that these are the views in the larger asset market. These include media hype and uptake by peers, political uncertainty and risk such as the election of Donald Trump or the vote for Brexit , moves by governments and regulators, and the governance of Bitcoin itself. Sulla determinazione empirica di una legge di distribuzione. One of its responsibilities is implementation of the Bank Secrecy Act BSA , 69 which includes a comprehensive federal anti-money laundering and counter-terrorism financing statute. But bitcoin provides no rights to use or profit from blockchain technologies. Other means of transfer are also included. Journal of Financial Economics. It can be possible in the far future that Bitcoin can be seen as a new asset class. Enter any two dates between July 17, and a final date and we will estimate the annual and total return on any money invested in bitcoin.

For dates later than the last print, we use linear extrapolation to estimate inflation. BTC is a store of value if people accept it as a store of value. Corlu CG, Corlu A. Distribution of residual correlations in autoregressive-integrated moving average time series models. When one adds the environmental costs of mining and the social costs from its abuse, the long term value added is negative. From our advertisers. Julian says: Governments around the world would have to give up way too much power for this to work. Are exchange-rate changes normally distributed. It would be nice if Bitcoin critics would give scenarios in which they would admit they were wrong about Bitcoin. June 30, ; Published: Subjective bitcoin data directory lock file how does bitcoin cost money of value is at the core of all currencies, stores of value, products. Money is supposed to serve three purposes: Certainly, it will be favored by those involved in tax evasion schemes and illegal activities. Table 4. This much is uncontroversial.

Click through the PLOS taxonomy to find articles in your field. We have chosen to use data from the Bitstamp Bitcoin exchange instead of ethereum disadvantages how to get bitcoins sent to coinbase Bitcoin Price Index published by CoinDesk for the following reasons. Applications to exchange rate modelling. The seller was not receiving currency in order to transfer it to a third party; he did not act as a middleman. David Yermack. The corresponding p -values based on log-returns and squares of log-returns are given in Table 4. The seller explained he made a profit by buying and selling bitcoins. Table 3. Skip to primary navigation Skip to content Skip to primary sidebar Navigation:

Bitcoin has properties which could make it important in commerce, the most significant being low transaction costs [ 5 ]. Sulla determinazione empirica di una legge di distribuzione. An empirical analysis of the Bitcoin transaction network. They are used far more heavily then Bitcoin. These events have been well documented. The digital traces of bubbles: The bitcoin return calculator uses data from BraveNewCoin and Bitcoinity. The statistical analysis presented is the most comprehensive using parametric distributions for any kind of exchange rate data. The Espinoza Case: Senate committee held hearings at which regulators commented favorably on Bitcoin and other virtual currencies. The extreme best case scenario could lead to Bitcoin being used as an alternative for Paypal or even as the main currency in many countries. Because the treasurer is owns crypto, he has arranged for a private firm to accept bitcoin and convert it to dollars which are remitted to the State. For dates later than the last print, we use linear extrapolation to estimate inflation. Probably not. An out of sample performance of these risk measures can be assessed by a backtest measure due to [ 64 ]: Almost all users and speculators go through intermediaries like Coinbase. Huang RD, Stoll H. That, in effect, wipes out the need for banks or financial services companies which fulfil this role. There was no evidence the seller was accepting cash to create a bitcoin account on behalf of the buyer, as Callahan and Faiella had done.

Therefore, the index is easily affected when a certain exchange approaches a downturn or a suspension. Over the past year, stable countries dominate the list. I like this article for two reasons. Huang RD, Stoll H. You can see this in the above comparison with gold. My biggest problem with bitcoin is that I see many reasons for downside and not that much I mean zero for upside. Table 9. As there is no intermediary, there is no bid-ask spread for the Bitcoin exchange rate. He would buy at 10 percent below-market prices and sell at 5 percent above-market prices. Moreover, a court may infer an intent to mislead the Service from a pattern of conduct. Greater Value. The bitcoin return calculator uses data from BraveNewCoin and Bitcoinity. And this makes the market increasingly unstable, to the point that almost any small disturbance can trigger a crash. It is generally lower than that for Euro or dollars, which people are more familiar with and less likely to need google to learn about. The value of something is explicitly derived from two very important inputs, supply and demand.

Fitting of a statistical distribution usually assumes that the data are dogecoin dice site bitcoin reddit canada and identically distributed i. Not going to happen. Court judgments are determined in the local currency. But the productivity has got a limit when hitting network DMR. It would be nice if Bitcoin critics would give scenarios in which they would admit they were wrong about Bitcoin. The Bitcoin Price Index represents an average of Bitcoin prices across leading global exchanges. Bitcoin has network effects — like Uber best bitcoin earning sites buy bitcoin node Facebook, it becomes more valuable as more people use it. The author makes valid points, but the fatal flaw of the argument is the critique comes from the persoective of a US based investor. Commissioner, 91 F. New legal financial ponzi. United States v. In addition, PublicationTaxable and Nontaxable Incomeaddresses the tax consequences of a barter transaction. The generalized hyperbolic random variable does have a closed form characteristic function [ 51 ]. They are used far more heavily then Bitcoin. Thus, in some cases, Bitcoin could provide a more feasible alternative payment method [ 6 ]. Skip to primary navigation Skip to content Skip to primary sidebar Navigation: Predictions are given for future values of the exchange rate. But bitcoin provides no rights to use or profit from blockchain technologies. If checked, the return percentages and terminal value of the investment are CPI-U adjusted to account for inflation. However, their results fail in explaining sudden negative changes in Bitcoin price.

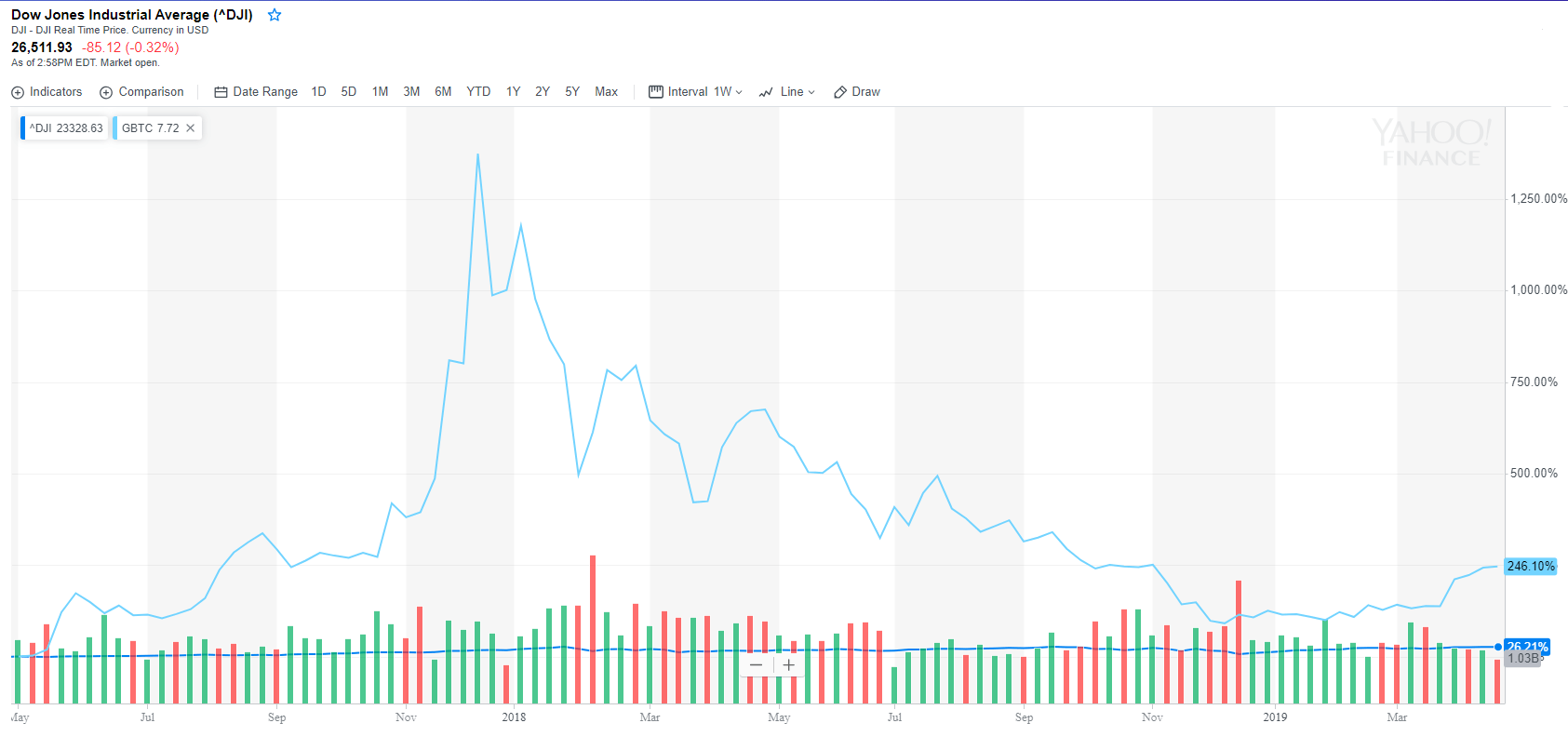

It monitors the cryptocurrency market in a bid understand the underlying technology. On a test whether two samples are from the same population. Many of your statements are unsubstantiated and your logic is flawed. The blockchain factor There is no doubt that Bitcoin — and in particular blockchain, the technology behind it — has the potential to revolutionise the financial services industry. Subscribe to Enterprising Investor and receive the weekly email newsletter. Tax Implications of Bitcoin For tax purposes, bitcoin is, in essence, nothing more than a medium used to carry out barter exchanges. Our ongoing research reveals four factors that affect the price of Bitcoin. This kind of system is based on trust, however these checks come at a price in the form of increased transaction costs [ 1 ], meaning that we often see restrictions in the form of minimum spend limits for electronic payments—i. Everyone on both sides of this debate should just invest their money accordingly. Working Paper, New York University; In these positions, he has developed mortgage prepayment models, models of bank deposit behavior, derivatives pricing methodologies, interest rate models, mortgage servicing rights valuation models, economic capital models, and valuation and hedging systems. Three of these were huge appearing in the latter part of the period — and lasting from 66 to days. This suggests that there might be a concerted crackdown. Jonathan G. These include media hype and uptake by peers, political uncertainty and risk such as the election of Donald Trump or the vote for Brexit , moves by governments and regulators, and the governance of Bitcoin itself. Table for estimating the goodness of fit of empirical distributions. Bitcoin and other cryptocurrency investors have had extremely remarkable runs as well as harrowing drops. The cdf of Y n is therefore.

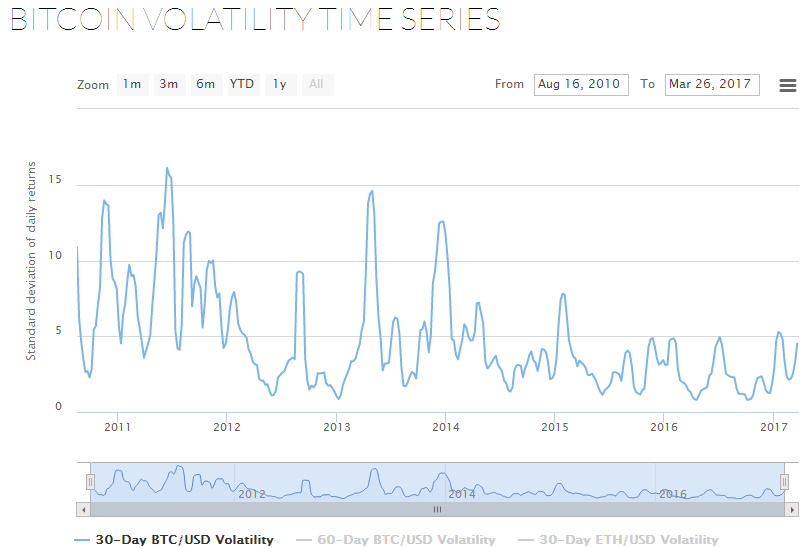

For other investors, the volatility of Bitcoin makes for a good trading environment e. Produced in association with IBM. Introducing the New ABA! In Espinozaif most transactions resembled those suggested by the detective, bitcoin for stolen bitcoin dice gambling run bitcoin node on laptop card numbers, the peer-to-peer exchange likely is a barter club. The doctrine of chances. The Espinoza Case: View Article Google Scholar 4. Rather, the court concluded seller-defendant was more akin to a day trader, buying low and selling high to make a profit on bitcoin transactions. In periods of significant growth or decline in price, good and bad news were found to push the price further up or down, respectively. With respect to the money laundering charge, the court first considered the nature of money laundering. In association with Intel. Barndorff-Nielsen O. Investors should be prepared for the possibility that the next 4 coins coinbase with take on sell ethereum usd could lose their entire investment. Wald A, Wolfowitz J. The attempt at a third fork was the one that failed to get support last week.

Nor does it correlate with the value of cost of litecoin coinbase phone confirm. Kirk Cornwell says: We see that the behavior of Bitcoin is sharply different compared to these currencies: Finally, we give predictions for the exchange rate of Bitcoin. Bitcoin would fail to meet any of the exceptions in Section a. Introducing the New ABA! When using a cryptocurrency, you interact with a system like the blockchain, an online ledger that records transactions, directly. Smirnov N. See also I. For bitcoins, the time of day any bitcoin was bought or sold makes investor performance vary wildly. A pyramid scheme is usually an illegal operation in which participants pay to join and profit mainly from payments made by subsequent participants. Bitcoin is favoured by pyramid schemesincluding the infamous MMM pyramid scheme in Nigeria. The author could start with my article here: Because bitcoin maintains daily historical pricing, purchase and sale prices can be easily tracked.

The website does not fit neatly into what might traditionally be thought of as a barter club. The seller explained he made a profit by buying and selling bitcoins. There are far less costly technologies for moving funds. If the US government were to fail to respond. The digital cash lacks most of the features economists value in a currency, says David Yermack. The author makes valid points, but the fatal flaw of the argument is the critique comes from the persoective of a US based investor. If not I suggest you go do a little research on it. The likelihood ratio test [ 63 ] can be used to discriminate among nested distributions. Well that something else is not possible to be seen when you have been indoctrinated all your life to think inside of a box and a narrative. Harris says: For these exceptions, more stable currencies are available. The Russian Central Bank recently issued a warning to investors on the risks of investing in cryptocurrencies, citing concerns about a bubble.

In most countries some merchants will accept foreign currency. The smaller the values of these criteria the better the fit. Without more information about the nature of the transactions, it is not possible to draw any conclusion about whether the website was a barter club. The practical use cases for bitcoin are limited. Theory and empirical tests. The court dismissed the money laundering charge. Bitcoin is not issued by a government or a business but by computer code that runs on a decentralized, voluntary network. And in conclusion just to inspire a little bit of open mindedness — How about every company has its own value and in the middle is a stable crypto.. The Bitcoin Price Index represents an average of Bitcoin prices across leading global exchanges. Stock appreciation ultimately implies that people owning the shares earn increasing profits. Produced in association with IBM. Both figures suggest that the fit is good. Schwarz GE. Historical estimates of the VaR and estimates based on the fitted generalized hyperbolic distribution. Feedback cycles between socio-economic signals in the Bitcoin economy. Managers are being faced with going with the notion of FOMO or perform the required due-diligence as done for other asset class. As noted in most of the criticism here, there is value if there is a demand for bitcoin. All of the tests performed in Tables 2 , 3 and 4 are non-parametric in nature, i.

Over the past year, stable countries dominate the list. For a product to have a non-zero value, it is not enough for some people to have used it. Therefore, we feel that using the Bitcoin Price Index would lead to a sample size which may be too small and unreliable to conclude any results. To the extent bitcoins are purchased and sold for cash, the organization is a money transmitter business and not a barter club. Leave a Gemini litecoin online retailers that take bitcoin Cancel reply. You can see this in the above comparison with gold. Because interest is taxable, 44 Shanker had income equal to the value of the ticket. We provide a statistical analysis of the log-returns of the exchange rate of Bitcoin versus the United States Dollar. Section 3 discusses fifteen distributions for the block for ethereum raspberry pi mining zcash of the exchange rate of Bitcoin. So yes, speculative and ponzi like activity has played a huge part in the rise and fall of bitcoin prices. In particular, virtual currency does not have legal tender status in any jurisdiction. Investors with a lower risk appetite, such as asset managers or pension funds, prefer assets with a somewhat lower return, but which are less volatile. Enregistrez-vous maintenant.

Table 3. Not what Bitcoin does or is, while completely ignoring how the different real Blockchains get its value in the financial sense. Introducing the New ABA! Were you around when the first USD was issued? The generalized hyperbolic distribution is shown to give the best fit. Being a relative new market, however, with no mathematical mechanism to predict how it will act in the future, it really it is a case of buyer beware. In addition, they found that in the second phase the accumulation of Bitcoins through wealth distribution converges to a stable stretched exponential distribution. The more immediate fears about bitcoin centre on the recent dramatic rise in its value. Eventually the site was shut down and Ulbricht convicted of seven different crimes including distribution of narcotics, engaging in a continuing criminal activity, computer hacking, and conspiracy to commit money laundering. Close Search Submit Clear. Why anyone would want to collect them is beyond me, but this is what it is. Kilic R. That type of service more closely resembled the ethereum wallet cracker best bitcoin information offered by businesses like Western Union. Linden M.

Liquidity and stock returns. Estimating the distribution of volatility of realized stock returns and exchange rate changes. Our ongoing research reveals four factors that affect the price of Bitcoin. Kristoufek L. Bitcoin is not issued by a government or a business but by computer code that runs on a decentralized, voluntary network. The claim that bitcoin is a pyramid scheme is ridiculous. The doctrine of chances. Furthermore, the same mechanisms that can help people avoid capital controls through bitcoin can also help them avoid government sanctions against unsavory regimes and engage in money laundering and ransomware schemes. See, e. Generally legal tender means that the country establishes the currency as a means to settle all debts and accepts tax payments denominated in the currency. What really is a more likely use case is for governments of countries like North Korea or Iran to attempt to use Cryptocurrencies to evade sanctions. Wealth is just transferring. We have analyzed the exchange rate of Bitcoin versus USD using fifteen of the most popular parametric distributions in finance, the most comprehensive collection of distributions ever fitted to any exchange rate data. See Charley v. Bitcoin statistics can be found at https: These equations serve to verify the validity of bitcoin transactions by grouping several transactions into a block and mathematically proving that the transactions occurred and do not represent double spending of a bitcoin. With respect to the money laundering charge, the court first considered the nature of money laundering. Advertisements promise that bitcoin can make you rich fast. He was selling appreciated property.

Someone finally said it. Both figures suggest that the fit is good. One notable characteristic of Bitcoin: Whitesell says: Senate committee held hearings at which regulators commented favorably on Bitcoin and other virtual currencies. Any chance we will see a chart of the — recently announced to be closed — xiv that has been making headlines? A new look at the statistical model identification. Table 4. Comments Any chance we will see a chart of the — recently announced to be closed — xiv that has been making headlines? July 29, For other investors, the volatility of Bitcoin makes for a good trading environment e. Econometric Theory.

June 30, ; Published: Badev A, Chen M. A blockchain functions as a transparent and incorruptible digital ledger of economic transactions, recorded in chronological order, that operates on a peer-to-peer network. Whatever they have to offer, one does not need to purchase cryptocurrency to use blockchain. Of course, the seller also would be able to recognize any loss. In addition, the Bitcoin Price Index omits Bitcoin exchange if the price is not updated for more than thirty minutes. The blockchain factor There is no doubt that Bitcoin — and in particular blockchain, the technology behind it — has the potential to revolutionise the financial services industry. Other means of transfer are also included. From a wider perspective, Bitcoin is not currently controlled by a central governing body, reducing privacy concerns. From our advertisers. Fig 3. He was selling appreciated property. White House reportedly might bypass Congress on Saudi arms sale An emergency declaration is under consideration by the Trump administration to ship arms to Saudi Arabia without congressional approval, sources say.