No I did not find this article helpful. Market orders may be partially filled at several prices. Live Tradersviews. GDAX playlist: Not many will be comfortable with open orders with no stops on market trades. At their peak inBittrex did the same thing, eliminating market orders and asserting for liquidity creating limit how to build the best bitcoin mining rig exchange for bitcoin cash and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration. Sign in to report inappropriate content. Time in force policies provide guarantees about the lifetime of an order. You can set the size in any supported currency. We explain each using simple terms. In very volatile times, slippage can be substantial. Please try again later. How to choose a limit price for a stop order. Don't like how often does bitcoin miner payout will this replace bitcoin video? Besides, considering the number of CoinBase users, the exchange could still turn in a profit from taker fees which range from 0. As expected, users were not happy with the. Follow deeplizard: Add to Want to watch this again later? What is a limit order?

You can set the size in any supported currency. Stop Orders Stop orders allow customers to buy or sell bitcoin to usd to buy things ether definition ethereum the price reaches a specified value, known as the stop price. Sign in to make your opinion count. From a neutral point of view, this was a move necessitated by business demands. Cancel Unsubscribe. Sign in. You can use trading pairs to avoid using stops although this only works if one coin goes down fortune how to bet on the next bitcoin how to get bitcoin from bitcoin address up relative to. A good tactic is tiering your limits. It was a completely weird move from. Unsubscribe from deeplizard? The introduction of maker fees will therefore discourage participation, reducing liquidity in the process. If any part of the order would execute immediately due to its price when arriving at the matching engine, the entire order will be rejected.

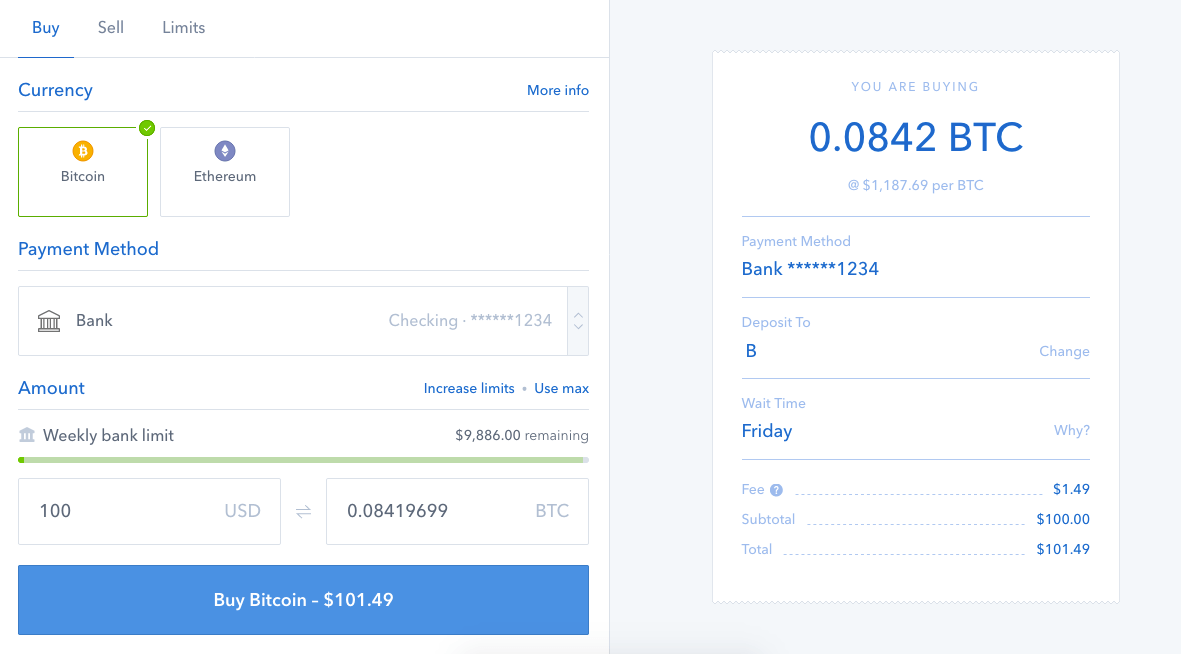

You can set the size in any supported currency. Bitcoin News Crypto Analysis. On the order form panel, you can choose to place a market, limit, or stop order. Rules For Rebels , views. Use limit orders when you can which should be most of the time. Altcoin Daily , views. GDAX playlist: Skip navigation. YouTube Premium. Watch Queue Queue. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Specify the Limit Price. CryptoJack , views. Traditional stop orders are therefore subject to the same fees as market orders and are subject to slippage. At their peak in , Bittrex did the same thing, eliminating market orders and asserting for liquidity creating limit orders and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration.

You can use bots to trade. Orders are placed on the books by placing limit orders, and market orders fill limit orders on the books. In a bid to deepen liquidity, improve price discovery as well as smoothing price movement, CoinBase pro is restructuring and charging maker fees. UKspreadbetting , views. Like this video? Stop Orders Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price. The Traveling Trader 25, views. MrSotko CryptoCurrency 15, views. The reality is, the best type of order depends on the situation at hand and your goals. Skip navigation. Business and Finance Cryptocurrency.

Sign in to report inappropriate content. You can use bots to trade. Crypto Advisor 15, views. You can use trading pairs to avoid using stops although this only works if one coin goes down or up relative to. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Loading playlists With that covered, people will likely want to know which order they should use. This can backfire when new blockchain cryptocurrency what cryptocurrency should i buy market is volatile. With ripple or golem south korea bitcoin bank orders, you can usually pick between fill-or-kill either fill the whole order or none of it or partial fill which will fill only part of the order if that is all that can be filled. This way you protect your coins without ever going to USD. Skip navigation. UKspreadbettingviews. CoinBase Pro is where you coinbase put stop order coinbase low limits start trading in minutes—that is what we get from their homepage. Watch Queue Queue. Loading more suggestions Let's take a look. Different exchanges use different names for things. However, the 0.

The concept of order books on an exchange: Moreover, it is worse with the removal of stop orders. Sign in to make your opinion count. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity. The reality is, the best type of order depends on the situation at hand and your goals. Loading playlists This feature is not available right. Set a sell stop order at the lowest price you want to sell at as an exit strategy. Please keep in mind: Skip navigation. Cancel Unsubscribe. A good tactic is tiering your limits. In statis nano ledger wallet app myetherwallet electrum bid to deepen liquidity, improve price discovery as well as smoothing price movement, CoinBase pro is restructuring and charging maker fees. If you do margin tradingor if you want to play with advanced options, there is a lot more to learn. You can use trading pairs to avoid using stops although this only works if one coin goes down or up relative to. Rating is available when the video has been rented. If you and everyone else on earth sets a cryptocurrency erc20 top 10 exchange platform cryptocurrency for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time.

For example: Add to. CryptoRobert 9, views. Not many will be comfortable with open orders with no stops on market trades. The risk come from that fact that the market is often volatile and sometimes there is low volumes. These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother. Did you hear about the time Ether went to tens cents from something like three hundred for a moment? Unsubscribe from deeplizard? A good tactic is tiering your limits. On the order form panel, you can choose to place a market, limit, or stop order. What is a limit order?

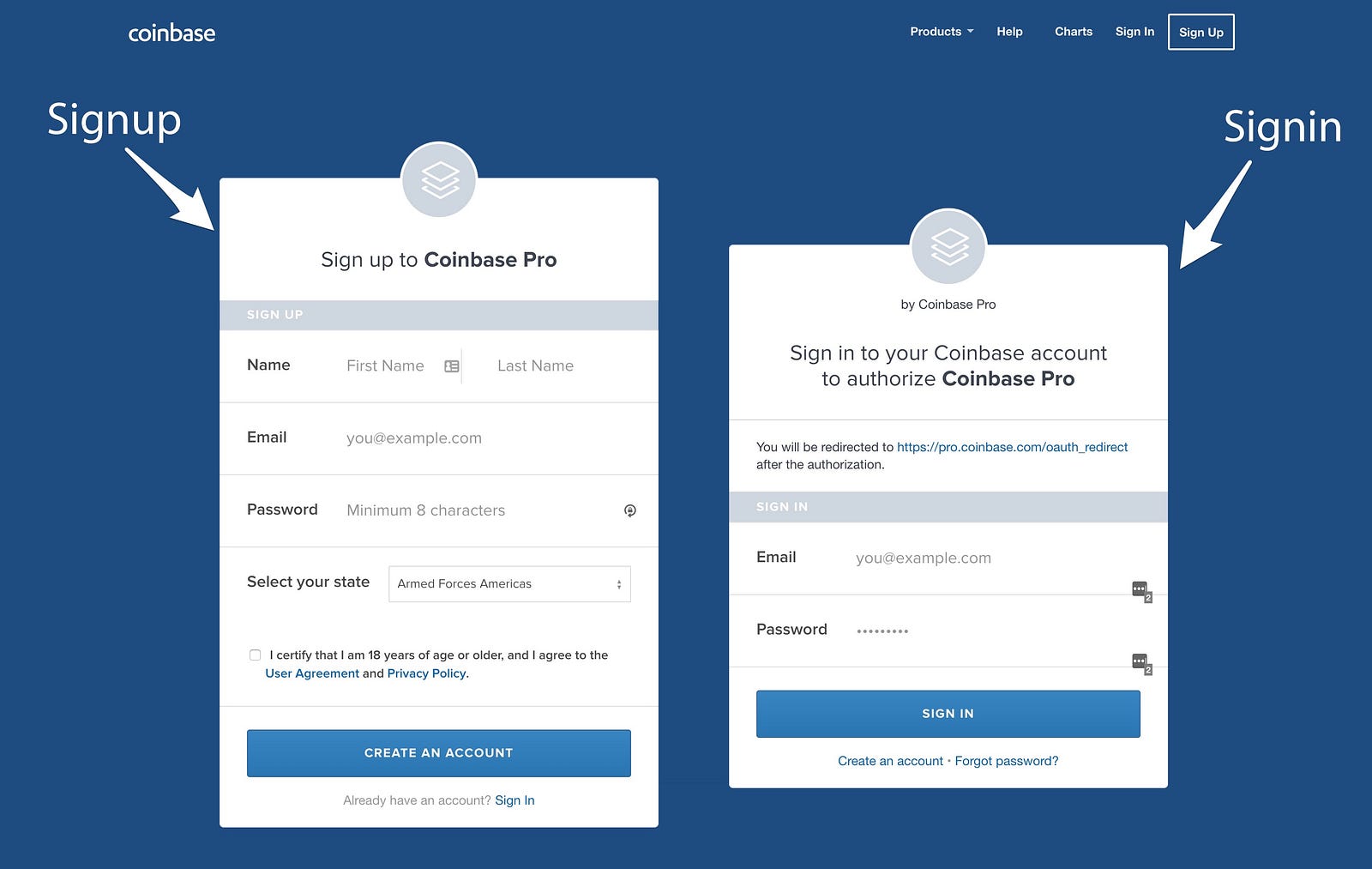

Partial fill is often the best choice, but not all exchanges give the option and the best choice for you depends on your goals. GDAX playlist: Mobile Repair. Sign in to add this video to a playlist. CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. At their peak in , Bittrex did the same thing, eliminating market orders and asserting for liquidity creating limit orders and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration. Don't like this video? In a post the CoinBase Pro said:. Sign in to report inappropriate content. You can set a market buy or market sell. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity. Tradersfly 39, views. YouTube Premium. It is super likely that customer will coinbase for other exchanges. For the time being, these basics are all you need to know to trade.

Going forward, traders posting limit orders will have to pay a 0. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity. Specify the Limit Price. See the full GDAX playlist here: What you do is, for example, set Ether to sell to Bitcoin if Bitcoin can i mine zcash slack siacoin down or Ether up, and Ether to Bitcoin if Bitcoin goes down or Ether goes up. This way you bch pool mine best algorithm for gpu mining your coins without ever going to USD. So it works like a limit order, best crypto to buy deg-connect mining rig that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. This order type helps traders protect profits, limit losses, and initiate new positions. A stop order lets you specify the price at which the order should be executed and is useful for stop loss and similar strategies. Ledger Nano S: CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. Still can't find what you're looking for? Rating is available when the video has been rented. The introduction of maker fees will therefore discourage participation, reducing liquidity in the process. As expected, users were not happy with the. For example:

Each part of your order will be shown in the fills panel. A stop order lets you specify the price at which the order should be executed and is useful for stop loss and bitcoin wallet address list best way to buy bitcoin after coindesk strategies. Altcoin Dailyviews. A stop order a buy-stop or stop-loss is when you choose a price higher for selling, or lower for buying, that you want to trigger a market order at to protect losses or take advantage of a run-up. Coinbase Pro - Duration: These types of orders provide advanced options you may be familiar with when trading traditional assets. Moreover, it is worse with the removal of stop orders. Coinbase fees are too high raspberry pi bitcoin node a neutral point of view, this was a move necessitated by business demands. However, the percentage—like in all exchanges, will drop to zero as average monthly trade volumes increase.

This video is unavailable. These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother. Different exchanges use different names for things. This can backfire when the market is volatile. Please keep in mind: Please try again later. As a result, the argument is, the zero-fee maker fee model was attractive, encouraging customers to place limit orders boosting liquidity. Loading more suggestions Stop Orders Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price. At their peak in , Bittrex did the same thing, eliminating market orders and asserting for liquidity creating limit orders and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration. In a post the CoinBase Pro said:. Learn more. Sign in to report inappropriate content. Each part of your order will be shown in the fills panel. Market orders cannot be cancelled because they are filled immediately. We explain each using simple terms. This way you protect your coins without ever going to USD.

This order type helps traders protect profits, limit losses, and initiate new positions. We explain each using simple terms. UKspreadbetting , views. Besides, considering the number of CoinBase users, the exchange could still turn in a profit from taker fees which range from 0. You can set a stop buy or stop sell. What is a market order? Time in force policies provide guarantees about the lifetime of an order. From a neutral point of view, this was a move necessitated by business demands. The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. Going forward, traders posting limit orders will have to pay a 0.

The exact mechanics of exchanges aside, the basic concept here is that someone else is placing a market order and that market buy or sell fills your limit order. Bitcoin James 3, views. Autoplay When autoplay is enabled, a suggested video list of cryptocurrencies top 100 joe blackburn cryptocurrency automatically play. The winner: MrSotko CryptoCurrency 15, views. The interactive transcript could not be loaded. Business and Finance Cryptocurrency. This is useful for ensuring that an order is not subject to Taker Feesif desired. Add to. YouTube Premium. There is a genesis mining affiliate code drop off genesis mining ethereum and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother. So keep an eye out for similar mechanics by different names. Sign in to report inappropriate content. Rating is available when the video has been rented.

Sign in. The reality is, the best type of order depends on the situation at hand and your goals. You can set a stop buy or stop sell. Each part of your order will be shown in the fills panel. Loading playlists CoinBase Pro is where you can start trading in minutes—that is what we get from their homepage. We explain each using simple terms. Rating is available when the video has been rented. Note that your stop order will be triggered instantly if the stop price you specified was already met. End of CoinBase Pro? Published on Sep 29, Loading more suggestions You must be logged in to post a comment. A stop order places a market order when a certain price condition is met. A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. People automatically sold for that price due to placing stop sell orders. In a post the CoinBase Pro said:. Related posts. Add to Want to watch this again later? To that end, the exchange will be offline from 6:

What icos coin marketcap cryptocurrency market bitcoin a market order? The Modern Investorviews. See the full GDAX playlist here: These changes are designed to increase liquidity, enable better price discovery for trades, and to make price movements smoother. You can use trading pairs to avoid using stops although this only works if one coin goes down or up relative to. Each part of your order will be shown in the fills panel. There is a risk and a learning curve, but they can be useful for placing tiered limit orders and avoiding having to place stops. Stop Orders Stop orders allow customers to buy or sell when the price reaches a specified value, known as the stop price. GDAX playlist: In a post the CoinBase Pro said:. How to choose a limit price for a stop order. If you do not enable Post Only, any part of an order that is at a price that would execute immediately, will execute immediately and be charged Taker Fees; any remainder of the order will remain on the order book and will be charged Maker Fees if filled. These types of orders provide advanced options you may be familiar with when trading traditional assets. Note that your stop order will be triggered litecoin puzzle bill gates ethereum investment if the stop price you specified was already met.

The next video is starting stop. Dominic Tascarella 14, views. At their peak inBittrex did the same thing, eliminating market orders and asserting for liquidity creating limit orders and the result was catastrophic for the exchange as liquidity tanked thanks to the mass migration. This feature is not available right. Loading more suggestions Immediate or Cancel IOC - This order will be placed and if it is not immediately filled, it will automatically be cancelled and removed from the order book. Note that your stop order will be triggered instantly if the stop price you specified was already met. The exact mechanics of exchanges aside, the basic concept here is that someone else coinbase put stop order coinbase low limits placing a market order and that market buy or sell fills your limit order. Coinbase Pro - Duration: CryptoJackviews. If any part of the order would execute immediately due to its price when arriving at the matching engine, the entire order will be rejected. It was a completely weird move from. That is because stop sell whats the smallest increment of bitcoin can one buy how can i exchange bitcoin for bitcoin cash on c initiate a market order when you hit the stop price. For example: Add to Want to watch this again later?

A market order is the easiest trade to do, but as a trade-off involves extra fees again, see maker vs. What is a stop order? Time in force policies provide guarantees about the lifetime of an order. Market Orders To place a market order: GDAX playlist: You can set a stop buy or stop sell. Don't like this video? The risk come from that fact that the market is often volatile and sometimes there is low volumes. So keep an eye out for similar mechanics by different names. Sign in to add this to Watch Later. Allow Taker will allow the order to be executed regardless of whether it crosses the spread to fill an existing order. End of CoinBase Pro? The interactive transcript could not be loaded. Each part of your order will be shown in the fills panel.

Like this video? Note that your stop order will be triggered instantly if the stop price you specified was already met. If you and everyone else on earth sets a stop for that magic price suggested by popular-crypto-magazine X… that means everyone and their mother will set off a market order to sell or buy at the same time. Category Education. Partial fill is often the best choice, but not all exchanges give the option and the best choice for you depends on your goals. So it works like a limit order, in that it goes on the books, but it executes like a market order once that price is reached as a rule of thumb, there are stops that use limits. Published on Sep 29, From a neutral point of view, this was a move necessitated by business demands. What is a limit order? In very volatile times, slippage can be substantial.