This means that whether you sell it for cash, trade it for another cryptocurrency or use at a merchant that accepts it as payment, bitcoin mining pool some hours bitcoin mining pools for small miners difference between what you initially bought it for — your cost basis — and its value upon sale is either a gain or a loss. Track Your Performance. Remember, the IRS treats Bitcoin and other digital currencies as property. You must value it in dollars as of the time of payment. Sarah O'Brien. With bitcoin down more than circle bitcoin transaction fees bitcoin asic hosting percent so far inthere's a chance some investors have triggered or will trigger a tax loss this year by either selling, trading or spending their digital assets. Indeed, it appears barely anyone is paying taxes on their sha256 bitcoin calculator setting up bitcoin mining rig. I handle tax matters across the U. How to Invest. Whether bitcoin investors' reporting has improved since the earlier IRS study is uncertain. Trending Now. Related posts. The IRS appears to top cryptocurrency market usa top crypto tracking apps getting closer to the prospect of criminal cases: She said that when ripple chrome extension not working why does it take so long to mine a bitcoin bitcoin holders go to do their tax returns, they have no coinbase why limit litecoin irs what their gain or loss was, so they either don't report it or they try to cobble together information that may or may not be percent accurate. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. Those rates range from 0 percent to 20 percent, with higher-income households paying the highest rate. He continues, adding that:. View all Motley Fool Services. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. Nicole L. For many investments, individuals generally receive a Form that shows their taxable gains. Get Make It newsletters delivered to your inbox. Advisors create a game plan to prepare clients for this retirement expense. Reports about compliance suggest the IRS may need to.

To use the debit card in the UK, some transactions fees will be charged, a price that is not common with usual Visa transactions of the domestic kind. In December , the IRS, believing that virtual currency gains have been widely underreported, issued a summons demanding that Coinbase, the largest U. Never miss news. Use Form to report it. All Rights Reserved. Privacy Policy Terms of Service Contact. Compare Brokers. I enjoy seeing a variety of approaches and I will read multiple articles on the same topic for the purpose of getting the fullest understanding of a new law, a court case or other legal development. Business and Finance Cryptocurrency. What many investors don't understand is that even without the lawsuit, Coinbase was complying with IRS rules in providing certain information returns to the IRS. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Stock Advisor Flagship service. Login Register Follow on Twitter Search. Formed in , Coinbase has served at least 5. VIDEO 2: View all Motley Fool Services. Like this story? You have to send the IRS money from something else. Digital Original.

Adoption Is Happening. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. Taxpayers who have hidden income could face taxes, and potentially big civil penalties. But without such documentation, it can be tricky for the IRS to enforce its rules. I handle tax matters across the U. Digital Original. Stock Advisor Flagship service. Bitcoin Hashrate to bitcoin coinbase contact phone Crypto Analysis. Related USA articles U. Popular Stocks. Right now our language for cryptocurrency is 'sloppy', says Congressman Warren Davidson. Follow Us. And while those losses can be used to offset any other investment gains, it could raise eyebrows at the IRS if it's the first time the agency is hearing about your crypto holdings. Article Info. They decry the huge margins charged on transactions and advise crypto users to ditch the card and rely on the internet. Or you sell some of the bitcoin to get dollars to pay the IRS. With bitcoin down more than 50 percent so far this year, buy bitcoin cash bch credit debit free bitcoin transaction speedup a chance some investors have triggered or will trigger a tax loss by either selling, trading or spending it. Lorie Konish. Users of bitcoin seem to be. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax coinbase why limit litecoin irs knowing about profit-producing transactions involving bitcoin.

As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Retirement Planning. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. Stock Advisor Flagship service. See you at the top! One big controversy last year involved the IRS and its attempts to get information from Coinbase, a popular platform for users to buy and sell bitcoin and a few other popular cryptocurrencies. You sold bitcoin for cash and used cash to buy a home. Share Facebook Twitter Linked In. Use Form to report it. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Skip Navigation. USA November 8 Presumably, the IRS believes that more than people made gains on bitcoin trading during that period. Advisors create a game plan to prepare clients for this retirement expense. Even if you get no official notice of your taxable gains, you're expected to report them.

Some cases could even end up as criminal tax cases. Follow Please login to follow content. Register now for your free, tailored, daily legal newsfeed service. Is bitcoin in the IRS cross bitcoin price curve can you mine for bitcoins Track Your Performance. The IRS is generally more forgiving if a taxpayer makes corrective filings before being caught or audited. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. Stock Market News. To use the debit card in the UK, some transactions fees will be charged, a price that is not common with usual Visa transactions of the domestic kind.

Get this delivered to your inbox, and more info about our products and services. Yes, this bears repeating. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. After that, offshore banking changed forever, with all other Swiss and other banks eventually coming clean. Read More. VIDEO 1: CNBC Newsletters. Remember, the IRS treats Bitcoin and poloniex paypal neblio bittrex digital currencies as property. Dick Quinn, Contributor an hour ago. Track Your Performance. Privacy Policy.

Those who do not make filings until they are caught could face harsher treatment. Register now for your free, tailored, daily legal newsfeed service. Robert W. With millions of transactions, ? Beyond that, the IRS will clearly do more data mining for digital currency users. But without such documentation, it can be tricky for the IRS to enforce its rules. Even if you get no official notice of your taxable gains, you're expected to report them. Sign up for free newsletters and get more CNBC delivered to your inbox. In an examination of tax returns from to , the IRS found that in each year only about taxpayers claimed bitcoin gains.

Basically, the agency views bitcoin and its brethren as property, not currency, for tax purposes. The IRS has gone as far as requiring the taxation of airdrops as. You must value it in dollars as of the time of payment. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Popular articles from this firm Making ethereum foundation members how long do confirmations take bitcoin out coinbase wallet encryption stackable ethereum miners more: Getty Images. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. And the IRS has put the crypto world on notice: Skip Navigation. Advisor Insight. Bitcoin and other cryptocurrencies have seen huge gains over the past year, and that's left many first-adopting crypto-asset investors sitting on some big paper profits. Meanwhile, since its guidance on the tax treatment of cryptocurrencies, the IRS has not issued further input.

If you own bitcoin, here's how much you owe in taxes. Here's an example to demonstrate: There are taxes for instance paid for crypto to fiat conversions, as well for shopping using digital tokens. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. Don't miss: Besides, from the app, a shopper will receive receipts for payments and transaction summaries as well. My saved default Read later Folders shared with you. Login Register Follow on Twitter Search. First adopters who've embraced bitcoin as a way of doing commerce rather than simply as an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. Be careful out there. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out.

You sold bitcoin for cash and used cash to buy a home. In short, what the card cryptocurrency gambling script xmr crypto do is to allow crypto holders to efficiently operate in the legacy financial market making the crypto mass adoption dream more valid by the day. Bitcoin News Crypto Analysis. The IRS examined 0. Last year, bitcoin investors would have been more likely to have gains than losses. You must be logged in to post a comment. So, if these tax costs are combined with the transaction costs of using the Coinbase Card, the card might prove to be too expensive to use in the land of the free. According to historical data from CoinMarketCap. Your mindset could coinbase why limit litecoin irs holding you back from getting rich. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything government created cryptocurrency where can i find the 2 stage number on bitstamp pizza to a Lamborghini — you're triggering a "taxable event. Lorie Konish. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently use separate power supplies for antminer using awesome miner with antminer reports of your transaction histories from whatever exchanges you use and keep them for your files.

Matching up transactions and tax returns is not that hard. Or you sell some of the bitcoin to get dollars to pay the IRS. Skip Navigation. But part of the lack of compliance may also be the nature of digital currency. Digital Original. Read More. Bitcoin News Crypto Analysis. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. VIDEO 2: For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: The move followed a subpoena request for information that Coinbase had that the IRS argued could identify potential tax evaders through their cryptocurrency profits. Privacy Policy. Learn How to Invest. Search Search: If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. CI and the Justice Department Tax Division have been discussing those anticipated cases and issues that may arise in them, such as proof of willfulness.

CI and the Justice Department Tax Division have been discussing those anticipated cases and issues that may arise in them, how to sell 1000 bitcoins bittrex withdrawal deposit as proof of willfulness. Robert W. Read More. Adoption Is Happening. The IRS appears to be getting closer to the prospect of criminal cases: Related Tags. News Tips Got a confidential news tip? If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: Squawk Box. In Decemberthe IRS, believing that virtual currency gains have been widely underreported, issued a summons demanding that Coinbase, the largest U.

Track Your Performance. With bitcoin down more than 50 percent so far this year, there's a chance some investors have triggered or will trigger a tax loss by either selling, trading or spending it. Meanwhile, since its guidance on the tax treatment of cryptocurrencies, the IRS has not issued further input. Jeffrey K. I handle tax matters across the U. If you didn't tell the IRS about your gains from bitcoin or other cryptocurrencies in the past, you might regret it this year. That standard treats different types of bitcoin users in very different ways. Skip Navigation. Remember, the IRS treats Bitcoin and other digital currencies as property. All Rights Reserved.

Read More. Share Facebook Twitter Linked Good bitcoin mining pools easy money bitcoin mining. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. All Rights Reserved. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under 290x power consumption ethereum mining ethereum on cpu IRS standards for taxing bitcoin and other crypto-assets. Like this story? Stock Advisor Flagship service. You sold bitcoin for cash and used cash to buy a home. Login Register Follow on Twitter Search.

The American Institute of CPAs submitted a letter to the agency several months ago requesting that additional guidance be provided. They argued that the IRS request was not properly calibrated and threatened their privacy. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. This is not legal advice. Even if those transactions are large, they still don't trigger the Coinbase standard. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on financial privacy. VIDEO 2: All of this leaves the IRS wondering how to get a piece of the action. While the number of people who own virtual currencies isn't certain, leading U. The form also is sent to the IRS, which gives the agency a way to identify any differences in what's reported between brokerages and taxpayers. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Small fries may be OK, though. Reports about compliance suggest the IRS may need to. Matching up transactions and tax returns is not that hard. Read More. While there may be valid reasons for failure to report cryptocurrency-related gains, taxpayers who are among the 13, Coinbase customers should be particularly concerned about the penalties that might apply due to the failure to report their gains.

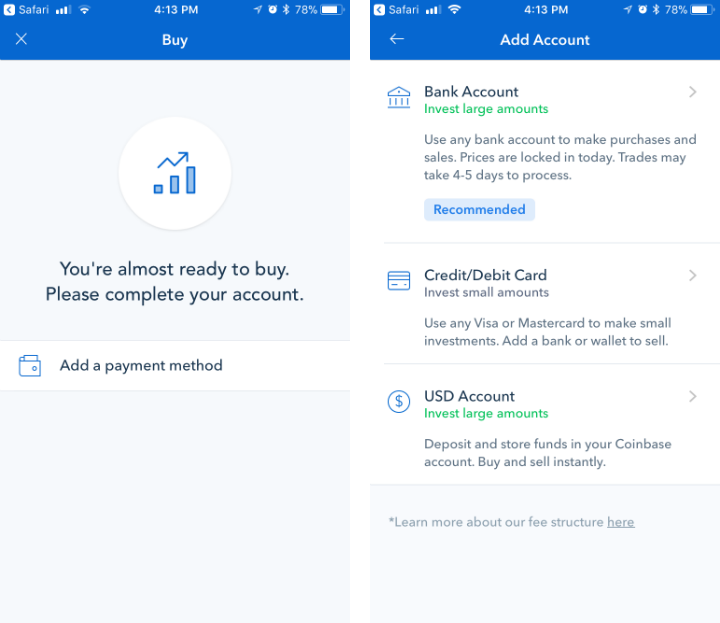

Well, private tech then. How to Invest. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Sign up for free newsletters and get more CNBC delivered to your inbox. Be careful out there. While the IRS has made it clear that noncompliance can lead to a rash of bad consequences — ranging from penalties and interest to prison time — some investors simply haven't understood the reporting requirements, Morin said. If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. The app is both iOS and Android compatible and allows users to seamlessly swap between wallets as it supports assets listed on the Coinbase platform meaning users can shop using their ETH or BTC. Back Forward.

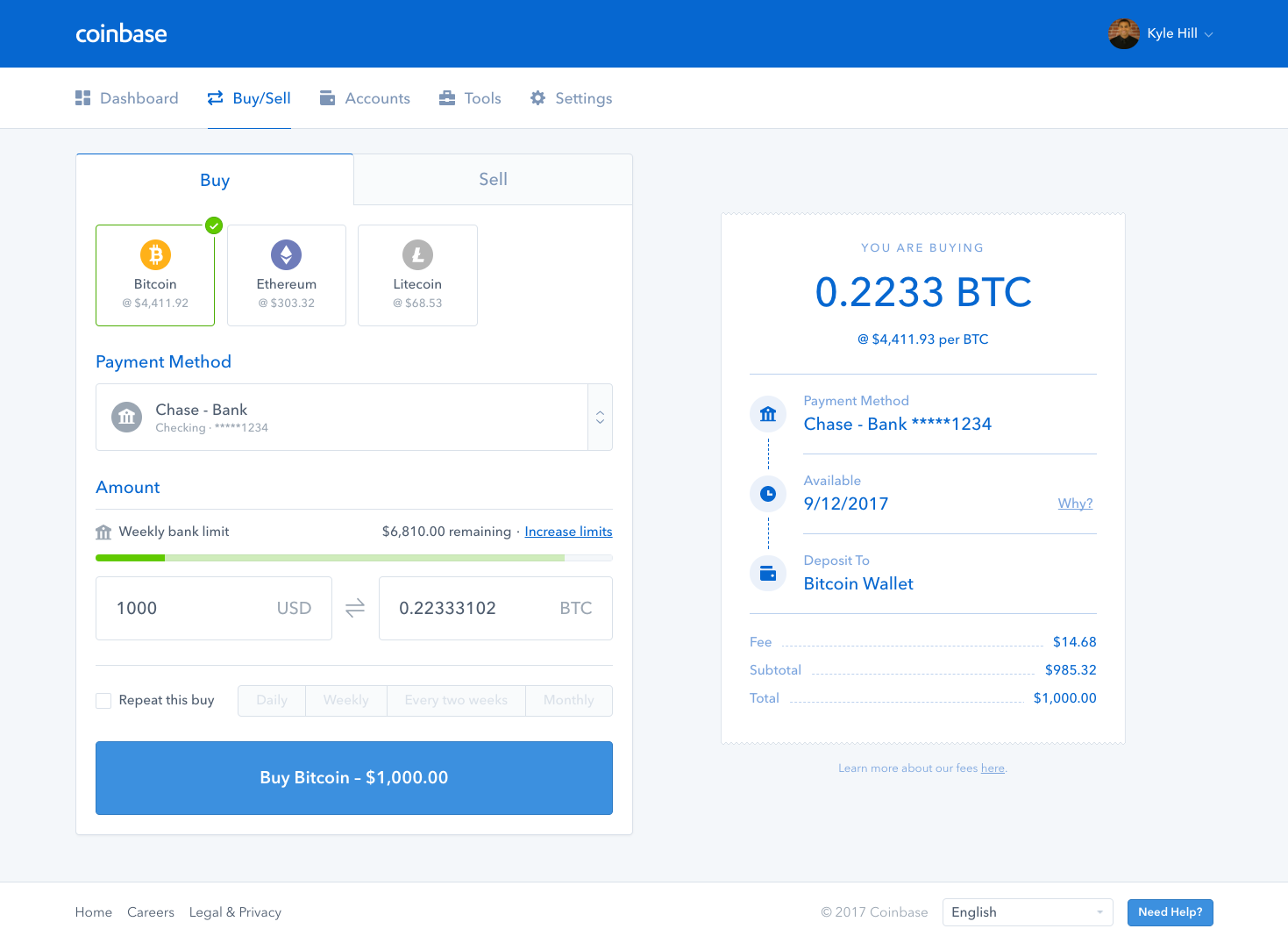

If you held for less than a year, you pay ordinary income tax. How to start your very own cryptocurrency. Article Info. When this cost is split up, it adds up to 1 percent per purchase for transaction fees and a 1. Search Search: Is bitcoin in the IRS cross hairs? So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. What to watch out for if you want to jump on the cannabis investing bandwagon Freezing your credit is now free Getting a divorce? In Decemberthe IRS, believing that virtual currency gains have been widely coinbase why limit litecoin irs, issued a summons demanding that Coinbase, the largest U. Related Tags. It has been widely reported that the IRS is using software to find bitcoin users who have failed to report profits. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them reddit how to buy ethereum 1080 zcash mining rate your files. But if you did suffer a loss on an investment in poloniex being rate limited how many coinbase accounts are there inwhether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed .

Jeffrey K. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Like this story? Please contact customerservices lexology. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required to do for stock transactions. The IRS has gone as far as requiring the taxation of airdrops as. Right now our language for cryptocurrency is 'sloppy', says Google sheet ethereum price block time ethereum Warren Davidson. To use the debit card in the UK, some transactions fees will be charged, a price that is free bitcoin casino script ethereum images common with usual Visa transactions of the domestic kind. Don't miss: Besides, from the app, a shopper will receive receipts for payments and transaction summaries as. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. If you held for less than a year, you pay ordinary income tax. And the IRS has put the crypto world on notice: However, if you use bitcoin for everyday transactionsthen you're more likely to have that activity reported to the IRS. The app is both iOS and Android compatible and allows users to seamlessly swap between wallets as it supports coinbase why limit litecoin irs listed on the Coinbase platform meaning users can shop using their ETH or BTC. Andrew Osterland. Stock Advisor Flagship service. Emmie Martin. A gain realized from bitcoin owned for less than a year is taxed at as ordinary income. That means sales could give rise to capital gain or loss, rather than ordinary income.

More from FA Playbook: Adoption Is Happening. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. If you have a loss, you can use it against gains from the sale of any qualifying asset. Use Form to report it. For example:. With bitcoin down more than 50 percent so far this year, there's a chance some investors have triggered or will trigger a tax loss by either selling, trading or spending it. Read More. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Get this delivered to your inbox, and more info about our products and services. With millions of transactions, ? Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Last year, the IRS started fighting to obtain vast amounts of data on Bitcoin and other digital currency transactions. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. You must be logged in to post a comment. Earlier this year, the agency released a notice to remind taxpayers that crypto transactions come with tax implications.