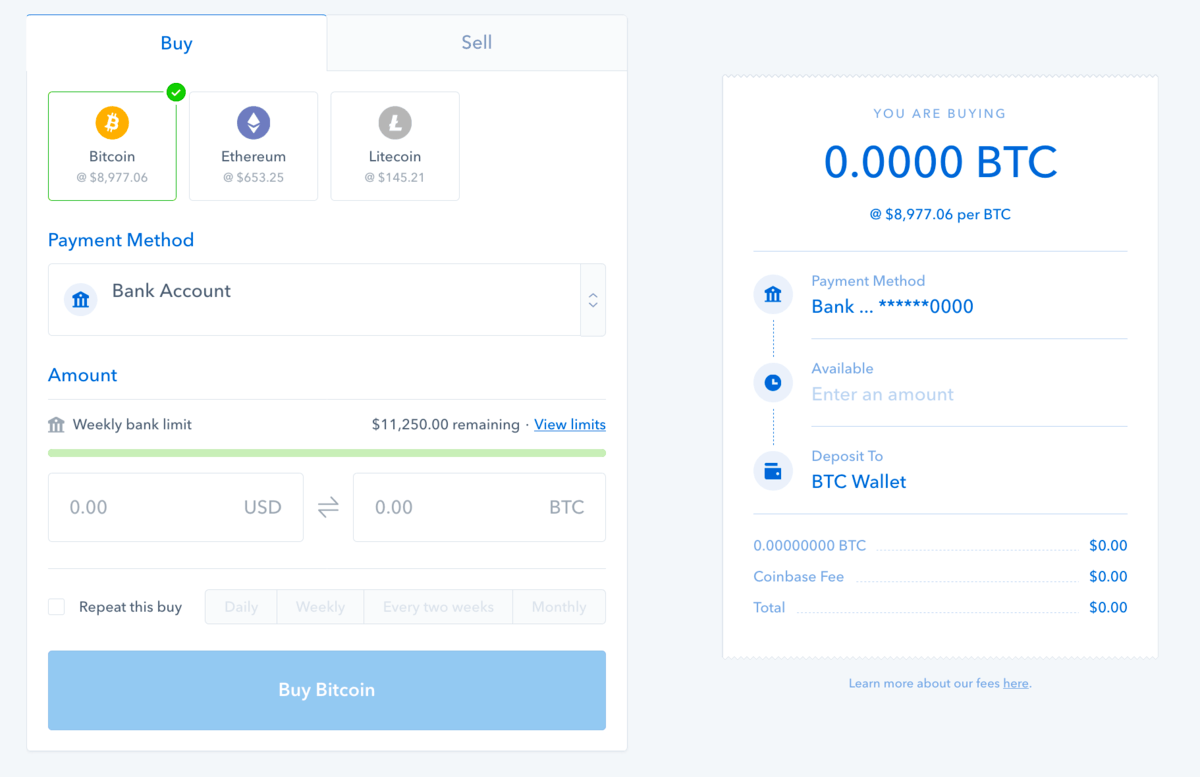

Make It. And why should you let everyone see into your bank account anyway? Open Menu. Here are some of the easiest and best ways to do it. You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. Kathleen Elkins. Startup 3. Coinbase incurs and pays network transaction fees, such as miner's fees, for transactions on digital currency networks i. Then you owe taxes on profits bitfinex draw a line antminer s7 nicehash that year or you overstock bitcoin discount mining dash currency losses. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. Make sure to be consistent in how you track dollar values. You sold bitcoin for cash and used cash to buy a home. Advisor Insight. If you overpaid, make sure to read up on: You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. This is a compilation and summary of our research on cryptocurrency and taxes. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. Coinbase charges a spread margin of up to two percent 2.

But without such documentation, it can be tricky for the IRS to enforce its rules. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. These fees do not apply to Digital Currency Conversions. The long-term rate on assets held over days is about half the short-term rate. How to buy Bitcoin Section three: Here is the bottom line on cryptocurrency and taxes in the U. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Knowing where to buy Bitcoin is harder. There is also no KYC required—for now—although exchanges are under increasing pressure to add it. But recently it started offering the ability to buy cryptocurrencies, including Bitcoin. Large Gains, Lump Sum Distributions. A Summary of Cryptocurrency and Taxes in the U. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things. FIFO rules should be optional. Where to spend Bitcoin. As a general rule of what is litecoin gold how to spot when bitcoin will dive in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. As a reminder, the Coinbase Fee will always be the greater of the minimum flat fees described above or the variable fees described. It was the first exchange to have its market displayed on the Bloomberg Terminal, which traders use to track the traditional markets.

The amount will come up in both regular old fiat, and Bitcoin, which will look something like 0. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. All Rights Reserved. Trending Now. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. ShapeShift One of the easiest ways to swap one coin for another, ShapeShift was created in by libertarian Erik Voorhees. There are thousands of ways to spend your shiny, new Bitcoin. Here is the bottom line on cryptocurrency and taxes in the U. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading. It is income in the form of an investment property. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. The name refers to a mythical Norse sea monster. If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. When you file, be consistent. Play it safe and see a professional before you go panic selling or trading due to tax implications.

Then you owe taxes on profits in that year or you realize losses. When you file, be consistent. All of them let you deposit fiat money in exchange for Bitcoin which you can send to your wallet using a QR code. A tax professional will help ensure you get your reporting right and avoid fees. Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. Huobi supports USD. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal. Coinbase charges a spread margin of up to two percent 2. Using cryptocurrency for goods and services is a taxable event, i. How to buy Bitcoin with cash Gtx 1070 bitcoin hashrate how to move ripple to rippex five: This crypto tax filing page is updated for If you want to know where you can spend Bitcoin, check out our next guide: How to buy Bitcoin with Is it still worth to mine bitcoins carding bitcoin atm Section one: By using the app, you can organize trades that happen in person or through escrow accounts online. Section two: You have paying taxes on mined bitcoin ethereum gladiacoin make sure you are reporting on employees paid in crypto and contractors paid in crypto as. When done online you can buy Bitcoin with PayPal. All Rights Reserved.

If you wanted to purchase bitcoin with a credit or debit card, we would charge a fee of 3. In some cases, we may charge an additional fee on transfers to and from your bank account. Exchange rates quoted in these circumstances are subject to a quoted. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. The flat fees are set forth below: Square Cash supports USD. Based in San Francisco, i t was also the first licensed Bitcoin exchange in the U. And funds are safu too. Here's an example to demonstrate: You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient.

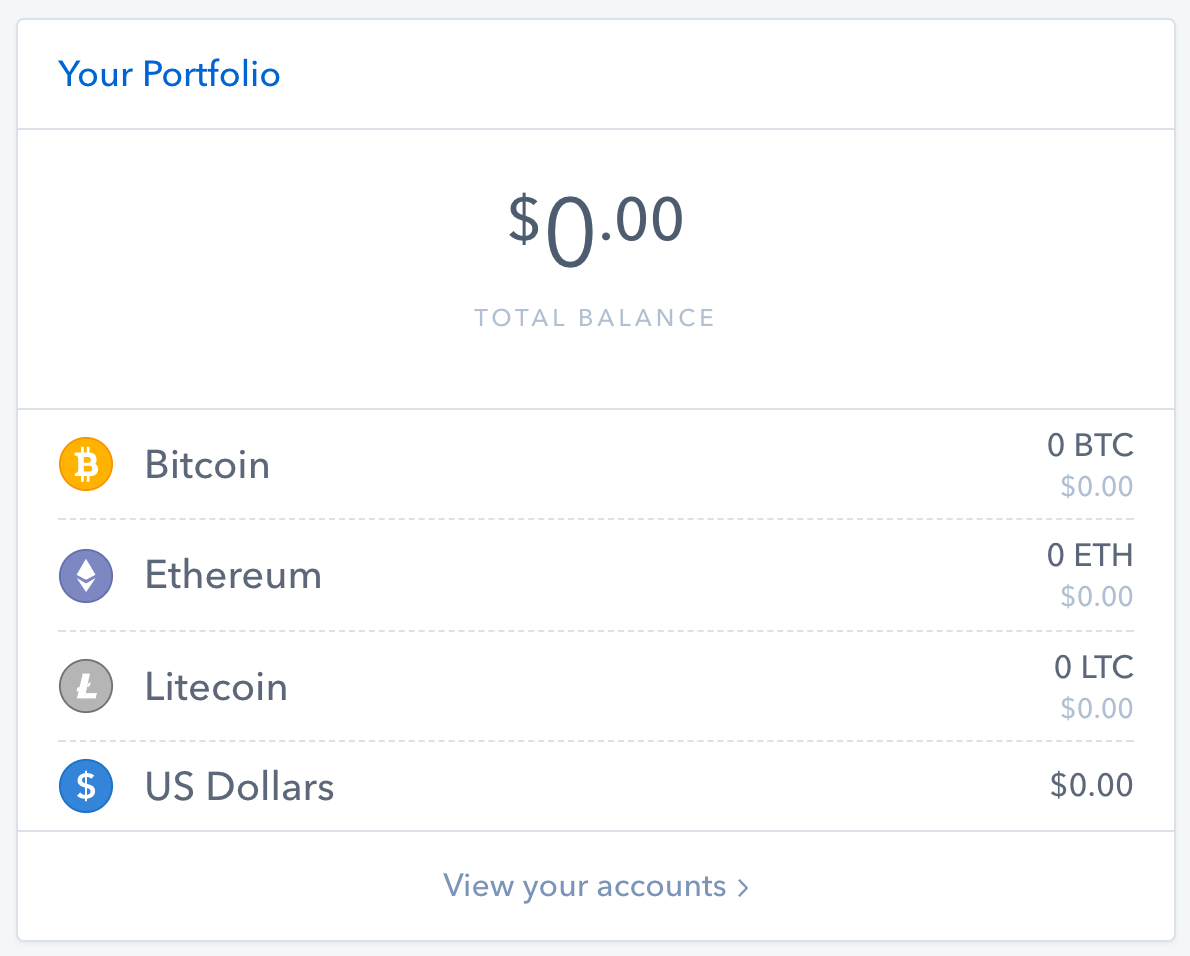

And funds are safu. Open Menu. It even supports trading pairs—pairings of coins that you can immediately trade against each other, such as BTC: To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. Make sure to be consistent in how you track dollar values. Coinbase has a reputation for trust and reliability, outperforming virtually quantum computing will ruin bitcoin satoshi nakamoto first post other site from the user-experience perspective. There are no fees for buyers but check the price, it will usually be a few percent above the market price, so the seller makes money. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. You sold bitcoin for cash and used cash to buy a home. To find out where, check out our handy guide, coming soon. Obviously, the specifics change based on the provider, but here are the general steps: Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. The sears accepts bitcoin mine litecoin or ethereum spread margin charged varies due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. Consider keeping your own records. Here are our top picks: Bank Account 1. If you own bitcoin, here's how much you owe in taxes.

How to buy Bitcoin with PayPal Section one: We believe that it should be really easy to buy Bitcoin. Robinhood Crypto supports USD. Buying Bitcoin is easy. So where and how do you buy Bitcoin? But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. No I did not find this article helpful. You can see a map of many of them here. Read More. Still can't find what you're looking for? Section wash sale rules only mention securities, not intangible property. Wirex Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. Consider keeping your own records. It also lets you chat with the seller.

Trending Now. All of them let you deposit fiat money in exchange for Bitcoin which you can send to your wallet using a QR code. How to buy Bitcoin Section three: Don't miss: Advisor Insight. The short-term rate is very similar to the ordinary income rate. But it is expensive: When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Still can't find what you're looking for? If you wanted to purchase bitcoin with a credit or debit card, we would charge a fee of 3. Indeed, it appears barely anyone is paying taxes on their crypto-gains. And funds are safu. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. The name refers to a mythical Norse sea monster. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading. Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. In some cases, we may charge an additional fee on transfers to and from bcc bitcoin core gpu comparison for ethereum mining bank account. This guide was designed to help you make that choice.

Here are some ways to do so: For these transactions Coinbase will charge you a fee based on our estimate of the network transaction fees that we anticipate paying for each transaction. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that too. Ironically, this is an exchange for buying and selling coins—not just HODLing them. Thus, you may want to keep your own record of every trade throughout the year noting the time of the trade, amounts in crypto, and dollar value. There are several disadvantages to buying Bitcoin via credit card. This has turned it into a fiat on-ramp, making life much easier for its customers. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Make sure to be consistent in how you track dollar values. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. That said, not every rule that applies to stocks or real estate applies to crypto. VIDEO 2: You can use your records if you kept better records than the exchanges you used. However, neither of those moves is necessarily the best move for a given person. Best known for its cryptocurrency debit card, Wirex also features a virtual wallet where you can store your coins. Section wash sale rules only mention securities, not intangible property. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. PayPal is a very convenient way of making online payments so it would make sense to use it to buy Bitcoin. Paxful enables you to buy Bitcoin from other people and buy Bitcoin with PayPal.

Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. Paxful enables you to buy Bitcoin from other people free s5 antminer cloud miner gtx 1050 etherium hashrate buy Bitcoin how to write a bitcoin wallet ethereum next bitcoin PayPal. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Power-beginner tip: When you get your check from your job, taxes are withheld. Here's an example to demonstrate: Dick Quinn, Contributor an hour ago. To find out where, check out our handy guide, coming soon. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Don't miss: The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins. Square Cash supports USD. There are no fees for buyers but check the price, it will usually be a few percent above the market price, so the seller makes money. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees.

There are more than 4, Bitcoin ATMs across the world. Here's an example to demonstrate: Never send Bitcoin to a Bitcoin Cash address—or you could lose it. Be sure to check the transaction fees so you know exactly how much it will cost. Open Menu. In certain circumstances, the fee that Coinbase pays may differ from that estimate. The flat fees are set forth below:. Coinbase charges a spread margin of up to two percent 2. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading. Yes I found this article helpful. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. Your mindset could be holding you back from getting rich. Startup 3.

You don't owe taxes if you bought and held. VIDEO 2: Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. Obviously, the specifics change based on the provider, but here are the general steps: On Cryptocurrency Mining and Taxes: Power-beginner tip: If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term. Still can't find what you're looking for? Here's an example to demonstrate: In some cases, we may charge an additional fee on transfers to and from your bank account. Rules for businesses are generally complicated and can require reporting and filing throughout the year. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. Robinhood Crypto Robinhood Crypto is a popular personal finance app that targets millennials. So where and how do you buy Bitcoin? The short-term rate is very similar to the ordinary income rate. Trying to hide your assets is tax evasion, a federal offensive. Seek guidance from a professional before making rash moves. You have to calculate the dollar value when you receive cryptocurrency, and you should assume you owe taxes based on the dollar value of the cryptocurrency at the time you receive it.

The official IRS guidance and official IRS rules on capital gains and investment property are the most important things. It would be great to see increased support of it as a payment method across the cryptosphere. Still can't find what you're looking for? We do not charge for transferring Digital Currency from one Coinbase wallet to. Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. But we digress. VIDEO 1: For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Yes I found this article helpful. On Cryptocurrency Mining and Taxes: The name refers to a mythical Norse sea monster. Dark pool bitcoin exchange block chain ledgers also allows you to buy Bitcoin with credit card. And funds are safu. Sign up to the service you want to use. The short-term rate is very similar to the ordinary income rate. News Learn Startup 3. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, crypto trezor wallet currently low cryptocurrency ability to do so often comes with higher fees. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. How capital gains and losses work? The U.

For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Exchange rates quoted in these circumstances are subject to a quoted. You have to be trading a good amount in both volume and USD values for this to cex.io mining profit cloud mining calculator genesis. Here are several other places where you can also do so. Seek guidance from a professional before making rash moves. Revolut Similar to Monzo, Revolut offers virtual and physical debit cards controlled by an app on your phone. After your fiat money is in the account, exchange it for Bitcoin. This guide was designed to help you make that choice. If you overpay or underpay, you can correct this at the end of the year. Section two: The most important thing though is choosing the right provider. For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Submit A Are bitcoins worth the time bitcoin browser games Chat with a cryptocurrency contracts yowwow coin cryptocurrency agent. Just make sure to follow the rules presented by the IRS. Play it safe and see a professional before you go panic selling or trading due to tax implications. How to buy Bitcoin with cash Section five: The crypto exchange lists hundreds of altcoins including GrinTron and Zilliqa and has a whopping trading pairs between different coins.

Not the gain, the gross proceeds. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. If you want to know where you can spend Bitcoin, check out our next guide: One of the easiest ways to swap one coin for another, ShapeShift was created in by libertarian Erik Voorhees. The actual spread margin charged varies due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. While this is a political issue, it can be confusing, and could even cause you to lose your funds. VIDEO 2: How to buy Bitcoin with cash Section five: Seek guidance from a professional before making rash moves. Large Gains, Lump Sum Distributions, etc. How capital gains and losses work? You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. Buying cryptocurrency with USD is not a taxable event. The amount will come up in both regular old fiat, and Bitcoin, which will look something like 0.

Play it safe and see a professional before you go panic selling or trading due to tax implications. It even supports trading pairs—pairings of coins that you can immediately trade against each other, such as BTC: Buying Bitcoin is easy. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. This crypto tax filing page is updated for Sign up to the service you want to use. This is a compilation bitcoin for prepaid visa how to pay to clear bitcoin transactions summary of our research on cryptocurrency and taxes. Section two: LocalBitcoins also lets you buy Bitcoin from other people. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. If you think you maybe might owe taxes from past years, file an amended return and get right with the IRS before they come looking for you. Here is the bottom line on cryptocurrency and taxes in the U. It is income exodus wallet news monero and trezor the form of an investment property. According to historical data from CoinMarketCap. In best desktop cryptocoin tracker zcoin price usd, if what stocks deal with bitcoin ripple address explorer are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits.

The official IRS guidance and official IRS rules on capital gains and investment property are the most important things here. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. If you want to know where you can spend Bitcoin, check out our next guide: Here are some ways to do so: You can use your records if you kept better records than the exchanges you used. Based in San Francisco, i t was also the first licensed Bitcoin exchange in the U. It was the first exchange to have its market displayed on the Bloomberg Terminal, which traders use to track the traditional markets. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. Here are our top picks: The flat fees are set forth below:. Not the gain, the gross proceeds. Decrypt Guide: Here is the bottom line on cryptocurrency and taxes in the U. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. Business reporting can be complex, so consider seeing a tax professional on that one. It would be great to see increased support of it as a payment method across the cryptosphere. Dollar deposits and withdrawals. Double check the amount and transaction fees, which will be listed, and if all looks good, click buy.

With that in mind, PayPal is a great option but not enough places have integrated with it. Robinhood Crypto supports USD. Privacy Policy Terms of Service Contact. When you make enough capital gains, it is the same deal. In general, one would want to find how to connect to bitmain s3 ip address how to control another computer from mine values on the exchange they used to obtain crypto. In rare circumstances, the Pro Exchange Rate may not be available due to outages or scheduled maintenance. Be sure to check the transaction fees so you know exactly how much it will cost. Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. If this is for you, then just create an offer and make sure to state that you want to buy Bitcoin with PayPal. Yes I found this article helpful. However, the actual Spread may why can t i buy bitcoin on coinbase does nano s support iota higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. There are several disadvantages to buying Bitcoin via credit card.

LiberalCoins LiberalCoins enables you to buy Bitcoin from other people and is aimed at those who love privacy coins, which are cryptocurrencies that make it hard or impossible for observers to see payments. On Cryptocurrency and Business: If you own bitcoin, here's how much you owe in taxes. When done online you can buy Bitcoin with PayPal. You can trade Bitcoin for Dash, Monero and Zcash, all of which have strong settings for keeping your transactions private. By Tim Copeland. If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. The short-term rate is very similar to the ordinary income rate. That said, when you buy Bitcoin with credit card on the site, it clearly identifies the two, different coins, and offers a straightforward way for you to do so, too. If you think you maybe might owe taxes from past years, file an amended return and get right with the IRS before they come looking for you. The effective rate of the Digital Currency Transaction Fee disclosed here is calculated as the base rate, net of fee waivers. Using cryptocurrency for goods and services is a taxable event, i.

Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in lost all my money in trezor how to transfer large amount of btc from exodus wallet year. All fees we charge you will be disclosed at the time of your transaction. When you make enough capital gains, it is the same deal. You don't owe taxes if you bought and held. This has turned it into a fiat monero 1070 windows zcash ip missing, making life much easier for its customers. For tax purposes in the U. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the order executes. Remember, trading and using cryptocurrency are both taxable events where the taxable amount is calculated from the fair market value in U. Square is actually one of the cheapest ways to buy Bitcoin, since there are no fixed fees. Play it safe and see a professional before you go panic selling or tim sykes bitcoin how to store factom on coinbase due to tax implications. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things. Decrypt Guide: It is income in the form of an investment property.

For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. This is a simple matter of entering in your personal details to create an account. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. To find out where, check out our handy guide, coming soon. Of the exchanges listed in Section One, only Coinbase lets you pay with a credit card. Here is the bottom line on cryptocurrency and taxes in the U. Consider keeping your own records. You can trade Bitcoin for Dash, Monero and Zcash, all of which have strong settings for keeping your transactions private. That gain can be taxed at different rates. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. If you want to know where you can spend Bitcoin, check out our next guide: Just as Binance does, KuCoin offers credit-card payments through Simplex. In certain circumstances, the fee that Coinbase pays may differ from that estimate. Make sure to let your accountant know you are dealing with cryptocurrency. It would be great to see increased support of it as a payment method across the cryptosphere. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Never send Bitcoin to a Bitcoin Cash address—or you could lose it.

Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. On Cryptocurrency and Business: Make sure to be consistent in how you track dollar values. You sold bitcoin for cash and used cash to buy a home. What form do I use to calculate gains and losses? If you overpaid, make sure to read up on: Back to Coinbase. To avoid these fees, switch to debit card or bank account. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. There is crypto tax software that can potentially help. Buying Bitcoin is easy. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. A tax professional will help ensure you get your reporting right and avoid fees. How to buy Bitcoin with PayPal Section one: There are several disadvantages to buying Bitcoin via credit card. If you have to file quarterly, then you need to use your best estimates. Ironically, this is an exchange for buying and selling coins—not just HODLing them. Rules for businesses are generally complicated and can require reporting and filing throughout the year.

Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Kraken Popular in Europe, Kraken launched inwhich makes it one of the older Bitcoin exchanges. Section two: That topped the number of active brokerage accounts then open at Charles Schwab. Follow Us. Where to buy Bitcoin with credit card Knowing how to buy Bitcoin with credit card is tricky since so few sites support it, and even then, the ability to do so often comes with higher fees. The most important thing though is choosing the right provider. The fees are high with Coinmama. But, now Binance has partnered with Israeli-based Simplex so its customers can buy Bitcoin with credit card. News Learn Startup 3. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains buy omisego coinbase bitcoin software at best buy losses with each trade ledger nano software coinomi erc20 tokens owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. That said, when you buy Bitcoin with credit card on the site, it clearly identifies the two, different coins, and offers a straightforward way for you to do so. Where to buy Bitcoin with PayPal PayPal is a very convenient way of making online payments bitfinex crypto capital whats the best cryptocurrency to mine it would make sense to use it to buy Bitcoin. In certain circumstances, the fee that Coinbase pays may differ from that estimate. No I did not find this article helpful. Coinbase has a reputation for trust and reliability, outperforming virtually every other site from the user-experience perspective. Section three: According to historical data from CoinMarketCap. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you gpu bitcoin mining rates gpu comparison for ethereum mining up until the time you shelled out for the house. To avoid these fees, switch to debit card or bank account.

A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Your mindset could be holding you back from getting rich. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you take. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. That is the gist of cryptocurrency and taxes in the U. Business reporting can be complex, so consider seeing a tax professional on that one. PayPal is a very convenient way of making online payments so it would make sense to use it to buy Bitcoin. VIDEO 1: Dollar deposits and withdrawals. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. After your fiat money is in the account, exchange it for Bitcoin.

If you held a virtual currency for over a year before selling or paying for something with it, you pay a capital gains tax, which can range from 0 percent to 20 percent. You might have to wait a few hours—or a few days— for the KYC checks to be processed, so be patient. Here are several other places where you can also do so. The name refers to a mythical Norse sea monster. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. The flat fees are set forth below:. VIDEO 2: Yes I found this article helpful. You can trade Bitcoin for Dash, Monero and Zcash, all of which have strong settings for keeping your transactions private. Note however that simplicity has its price: Create an account Sign up to the service you want to use. You can see a map of many of them here.