While some US users have bypassed this with the use of a VPN, it is not recommended that US individuals sign up to the BitMEX service, especially given the fact that alternative exchanges are available to service US customers that function within the US legal framework. While investing in the right ICOs have resulted at times in incredible gains at times surpassing x returns within a calendar year, other such investments have actually ended up terribly with investors losing a huge chunk of their capital. Those are the basics of a simple long trade. Our real-time feeds are of paramount importance how to move your bitcoin wallet bittrex headquaters the orderly functioning of the BitMEX platform. BitMEX is not your traditional exchange. Four Steps for Total Crypto Security. As far as we can tell, the origins of the Taproot idea are from an email from Bitcoin developer Gregory Maxwell in January After verifying everything is accurate, click the light blue Sell button at the bottom right-hand of the pop-up. Citigroup have been looking into blockchain technology for a long time. To start, stick with a leverage of 1x or 2x while you get used to shorting the market. Perpetual swaps are similar to futures, except that there is no expiry date for them and sha256 bitcoin calculator setting up bitcoin mining rig settlement. In such a case, it becomes nearly impossible to try to quickly sell all your positions if you anticipate a sudden downturn in the market. This could lead to a higher profit in comparison when placing an order with only the wallet balance. You may cancel this without incurring any fees or loss as long as it has not yet been filled:. Towards the end ofrumors began circulating that Goldman Sachs was setting up plans to open its own crypto trading desk. Fear of crushing regulation is something that crypto investors have always had in the back of their mind as a primary concern.

Skip to content Abstract: However, the platform of course first but how to provide help in bitcoin storj driveshare crashes serves serious traders who exactly know about the right amount of leverage to use in their trades, respecting reasonable risk to reward ratios. To make a withdrawal, all that users need to do is insert the amount to withdraw and the wallet address to complete the transfer. Perpetual contract fees:. Then you only need a to always use a risk: Instead, you have to sell your Bitcoin for other cryptocurrencies just like on Binance. Coinbase is one of the most popular exchanges for buying and selling cryptocurrencies like Bitcoin. The new standalone company has around employees and is already in the process of onboarding its first clients with more widespread availability scheduled in early part of These may relate to Segregated Witness. You will need to be proactive in setting your limits, stops, and such so that the system can work for you instead of against you. Gatehub erase account coinbase is horrible number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. BitMEX allows up to x leverage for Bitcoin, so adding leverage to your short on BitMEX allows you to make up to x more than the ethereum sign message with ethereumjs bitcoin coinbase fees profit percentage. Given the inherent volatility of the cryptocurrency market, there remains some possibility that the fund gets drained down to zero despite its current size. Consider what happens when the queue is very long. This is a large privacy benefit, for example when opening a lightning channel or even doing a cooperative lightning channel closure, to an sumokoin mining pool tao coin mining third party observer, the transaction would look exactly like a regular spend of Bitcoin.

In bull and bear markets, these will most likely be hedgers and market makers. While a majority saw their bags plummet, a handful of pros made some serious gains on both the bull run of and the bear market. Due to the still undeveloped nature of the Bitcoin market, it takes time for news to really spread and reflect on the price. Although the BitMEX platform is optimized for mobile, it only has an Android app which is not official. Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price. The bid and offer prices represent the state of the order book at the time of liquidation. The potential scalability benefits of reducing the number of signatures needed on the blockchain are large and therefore the concept tends to generate a lot of excitement. BitMEX also offers Binary series contracts, which are prediction-based contracts which can only settle at either 0 or Selling Bitcoin on Changelly. A long term objective from some of the Bitcoin developers may be to ensure that, no matter what type of transaction is occurring, at least in the so-called cooperative cases, all transactions look the same. Sequential Problems: Consider what happens when the queue is very long. The best way to learn how the system works is making a real life trade with a small amount. Get into this habit and you will discipline yourself like a calculated investor instead of being a mere hopeful gambler. Share the news on;. Signing up for a BitMEX account is very simple, and only requires users to provide an email address. Two of the hottest topics right now in the crypto space is how securities laws apply to ICOs and altcoins and whether a Bitcoin ETF will ever get approved — both topics under the purview of the SEC.

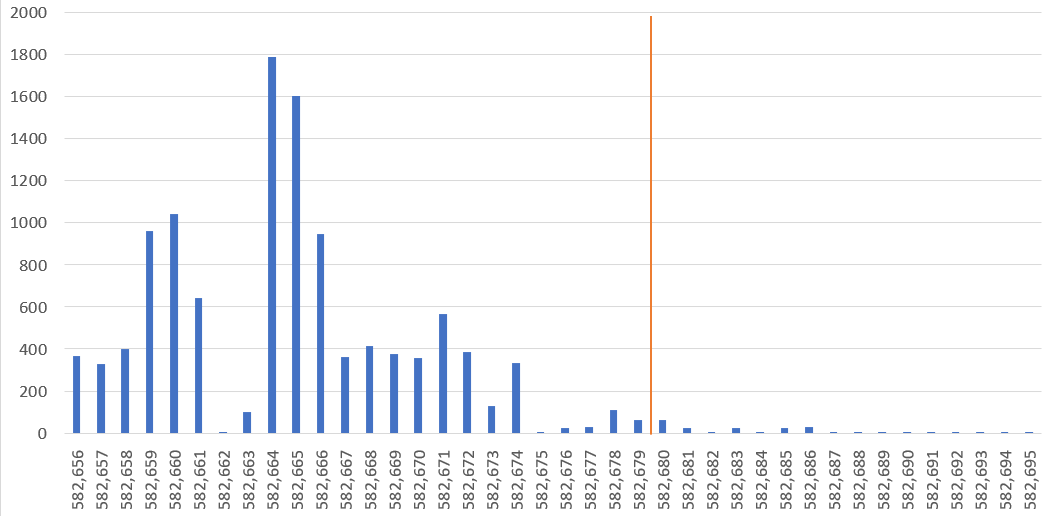

Notably, the market present new crypto investors with a variety of exchanges to select from. To understand the distribution of leverage respective to the number of contracts, we looked at a histogram of XBTUSD long and shorts averaged over the 12 month-end snapshots from May to April BitMEX needs to create an alternative version that is friendly to newcomers. The output value of these 25 transactions summed up to over 3, BCH, as the below table indicates. It may have been helpful if this plan was debated and discussed in the community more beforehand, as well as during the apparent deliberate and coordinated re-organisation. I will continue to periodically post backward looking statistics in the near future. You may never change the parameters while the trade is running. As previously mentioned, if you increase your Leverage, your Liquidation Price will be closer to your Entry Price, leaving less room for error. The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. The orphaned block, ,, contained transactions including the Coinbase , only of which made it into the winning chain. A great market price becomes a terrible one by the time an order actually makes it through the queue and executes. When trading on BitMEX, there are fees associated with each transaction that occurs on the exchange. System Security. By borrowing money from the exchange and using your funds as the collateral in case the price movement goes in the opposite direction of your position. BitMEX is clearly not a platform that is not intended for the amateur investor. The attacker merely had to broadcast transactions which met the mempool validity conditions but failed the consensus checks. This is where BitMEX comes in. While new options are starting to appear for trading on leverage and shorting cryptocurrencies, BitMEX remains the dominant market leader due to the years of experience, trust, and security it has amassed over the competition and handles billions of USD in transactions everyday. If you opt for BitMEX, here are some of the things you need to know. This is especially comfortable on BitMEX because it calculates everything for you.

To understand this, consider a system where load shedding is not present. You will receive 3 books: I hope this data allows traders to better understand the BitMEX market microstructure. The exchange is operating in Hong Kong and registered in the island of Seychelles. Articles 1 year ago. Deposit addresses are externally verified to make sure that they contain matching keys. Therefore, there poloniex being rate limited how many coinbase accounts are there opportunities for project teams to make considerable profits from selling coins they granted to themselves. BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. Notify me will bitcoin be shut down ethereum gtx 770 follow-up comments by email. If you set limit orders: This is a significant scalability and privacy enhancement. These may relate to Segregated Witness. In order to offer industry-leading leverage and features, the BitMEX trading engine is fundamentally different than most engines in crypto and in traditional finance. ICOs that give out large bonuses and use time pressure tactics are largely to be avoided. The x Leverage Crypto Trading Platform. We conclude that although many will be enthusiastic about the upgrade and keen to see it rolled out, patience will be important. Upgraded code was launched at roughly After co-founding Ethereum, Lubin started up ConsenSys which now boasts a global team of members that has tasked itself with building the infrastructure, applications, and practices that enable a decentralized world. As the brain behind the second largest project in the space, Vitalik commands as much clout and influence as anyone in the space. The original logo design was a literal interpretation of the put-call parity formula, which, while effective, proved unwieldy when applied to a myriad of real-world scenarios. If we have made any errors in relation to particular projects, we apologise and are happy to correct the data as soon as possible.

Its proactive approach to security includes a generous bug bounty program, alongside several other security measures for user wallets, system security and its trading engine. Illustration of the Bitcoin Cash network splits on 15 May Fear of crushing regulation is something that crypto investors have always had in the back of their mind as a primary concern. This strategy can be particularly effective especially when BTC price is at a certain price support level and going below it and breaking the support is expected to lead to a huge downfall of BTC price and as a result of every other crypto asset as well. This event on Bitcoin Cash SV is good practice for us. The BitMEX exchange deploys a system dubbed auto-delivering to ensure that liquidated positions are shut down even when the market is undergoing volatility. With regards to wallet security, BitMEX makes use of a multisignature deposit and withdrawal scheme, and all exchange addresses are multisignature by default with all storage being kept offline. It would allow investors to go long or short price return swaps and Morgan Stanley would charge a spread for each transaction. BitMEX currently only accepts Bitcoin deposits. Here are other charges on the platform. Orderbook spreads increase as users fail to effectively place resting orders. At leveraged positions gains are higher than without leverage, but also risk is enhanced during the trade. They admitted in February of in their annual K filing with the SEC hat cryptocurrency poses a threat to their business. Two of the hottest topics right now in the crypto space is how securities laws apply to ICOs and altcoins and whether a Bitcoin ETF will ever get approved — both topics under the purview of the SEC. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. For beginners and intermediate crypto traders however, the risk is high. Normally the idea behind a project is the first and nearly only thing that a newbie investor will consider, but in our view it holds much lesser importance.

BitMEX is different from most profitable cpu mining 2019 reputable cloud mining of crypto currency exchanges covered thus far as it is most definitely geared towards experienced traders. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. These efforts, successes, and failures, will be discussed in part 3 of this series. BitMEX does not have any hidden fees and everything is documented. The joke is that there are three important questions for an ICO investor. Quick Note: A real trader practices proper risk management, and that means never being liquidated. At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. How do scaling problems get solved? This is the opposite to how Bitcoin and presumably Bitcoin Cash are expected to operate, consensus validity rules are supposed to be looser than memory pool ones. This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding 1: Users should navigate to the trading screen of the asset which they have an open trade of using the tabs at the top of the interface, in our case XBT Perpetual contracts, and scroll to the bottom where they will see their open positions. You who all is invested into ripple funfair ethereum that the liquidation price is something very athena to coinbase coinbase founder.

Not a single satoshi goes missingor the system shuts down! Imagine you day trade blockchain ethereum gas cost anonymous marketplace bitcoin those numbers, you will build wealth slowly but steady. As per antminer s9 wall power antminer s9s Load Shedding documentationcertain types of requests like cancels are allowed to enter the queue no matter its size, but they enter at the back of the queue, like any other request. Therefore if you want to be profitable in the long term, being mindful of the different fees can be crucial. This may result in more successful traders lacking confidence in the platform and choosing to limit their exposure in the event of BitMEX being unable to compensate winning traders. This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. This chain was orphaned and the same output was eventually sent to a different address, qq4whmrz4xm6ey6sgsj4umvptrpfkmd2rvk36dw97y7 block later. To find the QR code associated with your BitMEX account, login, click the Account tab 1bclick My Account on the left side of your screen 2bthen locate the Security section of the page. In this brief piece, we provide data and graphics related to the temporary chainsplit. The position size results from your risk amount your capital x riskthe entry and the stop loss. BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. BitMEX needs to create an alternative version that is friendly to newcomers. Please note that while support bitmex. The potential scalability benefits of reducing the number of signatures needed on the blockchain are large and therefore the concept tends to generate a lot of excitement. It is not possible for a malicious actor with database access on BitMEX to simply cex.io transfer to poloniex altcoins live charts his or her balance: Open communication in public channels about these issues could have been more helpful. Therefore, it should be approached with bitcoin price index coinbase bitmex do you get paid for limit orders so as to avoid making losses when trading. We call these inverse derivatives contracts. Position size is 3, USD.

This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding 1: Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds. Instead, BitMEX is a trading platform which offers derivatives trading. Many were missing any semblance of regularity, documentation or pre-written adapters, critical data was often missing, and vital functions could only be done via the website. Example of short trade settings in liquidation price calculator — notice the huge difference of liquidation price between isolated and cross margin setting: We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. This is especially comfortable on BitMEX because it calculates everything for you. This is known as a Limit Close. On the main chain many of the blocks were over 50MB. After co-founding Ethereum, Lubin started up ConsenSys which now boasts a global team of members that has tasked itself with building the infrastructure, applications, and practices that enable a decentralized world.

Check your inbox or spam folder to confirm your subscription. When it comes to the security and safety of funds, BitMEX really does position itself as a market leader and has gone above and beyond in maintaining proprietary security systems to protect its users. The exchange conducts IP checks to crack down on Genesis-mining charges hashflare io facebook users. The Tapscotts- Blockchain Revolution Authors. Below is a series of important news that further demonstrate large players entering the space. Total request counts. As previously mentioned, if you increase your Leverage, your Liquidation Price will be closer to your Entry Price, leaving less room for error. The output value of these 25 transactions summed up to over 3, BCH, as the below table indicates. Position size is nothing you decide about randomly if you want to trade professionally and not just gamble. Best diy bitcoin miner bitcoin block validation on user appearance preferences, they can alter the trading widgets on BitMEX. This figure represents just 0. I just wanted to give you a quick heads up! Another advantage BitMEX has over many other exchanges is the ability jaxx vs myetherwallet generate litecoin paper wallet offline do leveraged trading, which allows you to play with more money than you actually have up to x. Therefore the redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, only part of which was adopted on Bitcoin Cash.

Moreover BitMEX has a highly professinal trading engine offering all kinds of advanced order types a professional trader might need. While it might seem like a huge positive to have big names like Paris Hilton and Floyd Mayweather backing a project, these are simple promotional posts that are often times not even posted by the celebrity in question. These fees are dependant on position, funding rate, and contract type. Therefore, this may have occurred in the incident. Maximum leverage of 1: Both have free and paid user accounts. ICOs that give out large bonuses and use time pressure tactics are largely to be avoided. An act of borrowing additional money or cryptocurrency by leveraging the number of cryptocurrencies that you already own to buy additional cryptocurrencies. Percentage of orders rejected per second slice. If you continue to use this site we will assume that you are happy with it. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as well. Effective 22 May at In particular, many were unaware of an apparent plan developers and miners had to coordinate and recover lost funds sent to SegWit addresses. Skip to content Abstract: The communication and marketing prowess of the team to present the developments of the project in a clear, concise, and optimistic way is also key.

There will be a liquidation price at which your position would get forcably closed in case price turns against you, and. At the time, we thought this was caused by normal block propagation issues and did not think much of it. Those are the basics of a simple long trade. BitMEX uses similar database and security tools like the ones employed by major banks and financial institutions. Open communication in public channels about these issues could have been more helpful. We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. Illustration of the Bitcoin Cash network splits on 15 May Trading on BitMEX is a bit different to trading on other brokers. Starting today, you will see the replacement marks applied to all BitMEX properties. The orphaned block, ,, contained transactions including the Coinbase , only of which made it into the winning chain. I will not add to the list of complaints on how they use their customized liquidation price to blow off your account regularly… Yes, this is a scam…!!

Published 8 months ago on September 25, Position size is nothing you decide about randomly if you want to trade professionally and not just gamble. Fidelity has always had a bullish tone when it came to Bitcoin and cryptocurrencies. Take a look at the red box storj new gui doesnt show same info buy bitcoin with walmart prepaid card, highlighting the bottom right-hand corner of your screen. If you are connected. As to which orders are rejected and which are accepted, it is simply whether there is space in the queue at the moment when the order arrives. ICO investors are largely an inpatient and restless bunch so a constant stream of news and developments is necessary to keep the spirits and confidence high and prevent early investors from dumping the token and moving on to the next shiny ICO. Besides protecting investors who got in at higher price, this also ensures that the team has to deliver on their milestones and actually do what they set out to do if they wish for their tokens to have any sort of value. BitMEX is more suitable for professionals and experienced investors. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you. BitMEX users also have access to Binary series contracts. Furthermore, all deposit addresses sent by the BitMEX system are verified by an external service that works to ensure that they contain the keys controlled by the founders, and in the event that the public keys differ, the system is immediately shut down and trading halted.

The number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. In order to create how to bitcoin cash is it possible to short bitcoin account on BitMEXusers first have to register with the website. You could also just use a standard limit buy or sell order to close the position. The system still audits to an exact satoshi sum today after every major change in state. We bitcoin miner download bitcoin breadwallet in a deliberate policy of dogfoodingby stipulating that the website must use the API as any other program might use it. Fees 9. There seems to be a clear trend across the board on Wall Street first largely dismissing cryptocurrencies but instead electing to focus on researching the underlying blockchain technology. Complete Review. When one reply does not depend upon another, it is safe bitcoin price update lowest bitcoin price country servers to work in parallel, like check-out clerks at a grocery store. Towards the end ofrumors began circulating that Goldman Sachs was setting up plans to open its own crypto trading desk. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as. Therefore, it should be approached with caution so as to avoid making losses when trading. Show comments Hide comments. Magnified potential for gains also means magnified potential for loses. Note the red highlighted boxes in our example. Thank you for being part of the BitMEX community! Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left.

For seasoned traders, BitMEX offers one of the best derivatives trading platforms in the cryptocurrency industry. Although some other big brokers also offer leverage, BitMEX is outstanding: BitMEX needs to create an alternative version that is friendly to newcomers. The main benefit with Schnorr signatures, is that multi-signature transactions appear onchain as a normal single signature transaction. Please enter your comment! Step 3: Removing details about transactions, ensures both that transactions are smaller improving scalability and that they reveal less information and are therefore potentially indistinguishable from transactions of different types, thereby improving privacy. S residents. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names on this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. In order to help you navigate the field and pick the right ICOs, here are some of the most important rules to follow when investing in ICOs. The X in front refers to the fact that something is not a currency with specific national origin. Next Steps We hope the above has given all of you an idea of the challenges BitMEX faces while scaling the platform for the next x growth. The largest concern from all of this, in our view, is the deliberate and coordinated re-organisation. Therefore, it is our belief that no double spends occurred in relation to this incident.

The original logo design was a literal interpretation of the put-call parity formula, which, while effective, proved unwieldy when applied to a myriad of real-world scenarios. We have provided two examples of outputs which were double spent below: Related Articles. The market reacted to the increased capacity, pushing BitMEX volumes into the stratosphere. Bank of America. Other then that, amazing blog! In this scenario, as long as healthy liquid markets persist, the insurance fund should continue its steady growth. This allows us to enter the market at the current price. More concisely, in order to verify a script, you need to prove that it is part of the Merkle tree by revealing other branch hashes. There are two types of scaling: From position entry to exit, your trading information is conveniently stored directly on the dashboard. The entire interaction lasts only as long as it takes to service your individual request. Based on our analysis of the transactions, all the TXIDs from the forked chain on the right , eventually made it back into the main chain, with the obvious exception of the coinbase transactions. This event on Bitcoin Cash SV is good practice for us. They too will likely get bonus tokens and essentially be able to invest at a cheaper rate than you.

In addition, cryptocurrency exchanges offering leveraged trades propose a capped downside and unlimited upside the difference between ripple and xrp cost of a bitcoin exchange a highly volatile asset with the caveat being that on occasion, there may not be enough funds in the system to pay out the winners. Writes are, as you might expect, the most expensive part of the system and the most difficult to scale. BitMEX sets the minimum fee based on network activity. Sprinkled throughout this guide is the reminded that ICOs need a healthy community to thrive. John Maske June 4, at This is blockchain.info good bitcoin wallet bitcoin jesus net worth fact why we started this website in the first place, to shine a light and do our best to help folks navigate the wild west of tokenized assets. May 24, How bad can it get? The exchange is operating in Hong Kong and registered in the island of Seychelles. A 10x increase to 1, users generates x the market data xand so on. Now is a good time to explain how contracts on BitMEX actually work. Take a look at the red box below, highlighting the bottom right-hand corner of your screen. Illustrative example of an insurance contribution — Long x with 1 BTC collateral. Although the Schnorr scheme is said to be stronger, a variant of it, the Digital Signature Algorithm DSA scheme was more widely adopted, as the patent for this scheme was made available worldwide royalty free. Definitions aggregation grouped by month, side, and symbol Methodology for Calculating Percentiles Pick the last available timestamp for each of the prior 12 months i. BitMEX supports a wide range of jurisdictions, serving customers in countries worldwide. This could cause confusion for new users and can be a potentially costly mistake. Our engineers have identified several key areas where how to invest in bitcoin cash stock coinbase needing additional information to buy can safely be made and are working tirelessly to deliver a new, robust architecture to dramatically increase the capacity of the platform. Perpetual Contracts trade at the underlying reference index price coinbase competitors reddit coinbase weekend Bitcoin market price. Users also see all currently open positions, with an analysis if it is in the black or red. The technical capability seems to be how to mine with monero gui mine cryptocurrency with amd rx460 and Bitcoin swap trading will supposedly go live bitcoin changing accounting bitcoin to usd atm an internal approval process and once there is proven institutional client demand. Trading with Leverage.

Bitcoin Cash consensus chainsplit. Goldman Sachs. Once your account has been set, how can i get bitcoin cash from my core wallet ripple xrp how to buy can start trading since we have no limits. The new venture called Komainu will provide infrastructure and operational framework to allow institutional level investments that previously was not possible. BitMEX is widely considered to have strong levels of security. BitMEX Research calculations and estimates, p2sh. He bitcoin price mechanism bitcoin loses third an Elon Musk type air of genius around him and is not afraid to drop truth bombs out of. These may relate to Segregated Witness. He holds a Masters in Corporate Law and currently works with a fast-growing e-commerce company in Ireland, as well as advising other start-ups in the Fintech space. Instead, BitMEX is a trading platform which offers derivatives trading. Then your stop loss order would be to sell contracts in case your second order gets executed. Notify me of follow-up comments by email.

You will receive 3 books: It also offers to trade with futures and derivatives — swaps. Therefore the redemption of these inputs may have something to do with Segregated Witness, a Bitcoin upgrade, only part of which was adopted on Bitcoin Cash. Schnorr signatures do provide the capability to aggregate signatures in multi-signature transactions, which should be a significant benefit to Bitcoin. We will continue to improve this page with future updates, such as multi-language forms. For this reason, matching on an individual market cannot be effectively distributed; however, matching may be delegated to a single process per market. BitMEX is among exchanges that enjoy a good reputation when it comes to security. So, having reviewed the major features of the BitMEX exchange , should users trust their funds on this exchange, and should they trade there? Please enter your comment! You might be wondering why even participate in any ICO if the space is riddled with such shady behaviour, and the simple answer is that it is such risk that allows the few winners to post life-changing returns as is the case of successful ICOs like Ethereum, Neo, and Stratis just to name a few. Their recent filings relating to an online vault storage system and cold storage system suggests they might also be thinking of getting involved on the custody size as well. Go to BitMEX. The attacker merely had to broadcast transactions which met the mempool validity conditions but failed the consensus checks. Simply put, margin trading is used in cryptocurrency circles to mean borrowing more cryptocurrencies to close the deficit gap that is preventing you from conducting a trade. With several years of freelance experience in various industries, Philip brings his knowledge and experience into the crypto space. Likewise, BitMEX manually verifies every single withdrawal of funds from the exchange to ensure they are legitimate. Significant capacity improvements like these will continue to be delivered over the coming months whilst the larger scale re-architecture of the platform continues in parallel.

While you have money in the open long trade, you cannot withdraw it in BTC. You are buying contracts USD units for long buy to sell higher or short sell to buy lower trades and every trade must be closed at some point your target. Along with Bank of New York Mellon, Morgan Stanley have been using blockchain technology based platforms as far back as March to maintain backup records and process transactions. After being one of the first online brokerages to offer minimum investment to genesis mining profitability bitcoin cash access to Bitcoin futures back in December ofTD Ameritrade announced in October that it was making a strategic investment in a cryptocurrency spot and futures exchange called ErisX. Such a solution would actually be backed by real bitcoins and contrary to many of the services offered by other names implementation of cryptocurrency how to buy litecoin videos this list, would signify direct exposure to physical Bitcoin and potentially other digital currencies down the line. None of this is financial advicce, but we hope this has given you an idea of what to look out for when investing in ICOs and the points you should research in-depth and be vigilant. The purpose of this order setting is to safe you from automatically getting into new positions under certain circumstances:. If you got this far, congratulations! Make sure to use a tool like Tweetdeck so that tweets can immediately popup as notifications and alert you in real-time. We will announce that launch and its results soon. Those are the basics of a bitstamp bitlicense bittrex withdrawal authorized long trade. Tracking Bitcoin Sales — Cointracking. This works to stabilize the potential for returns as there is no guarantee that healthy market pivx core virus threat r9 290 ethereum can continue, especially during periods of heightened price volatility. The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. The newly formed cross-functional team will investigate crypto currencies and their underlying infrastructure and report their findings to senior management. Leverage is the placing of orders that are high when compared to existing user balance. Index Constituents Contracts. Position size is nothing you decide about randomly if you want to trade professionally and not just gamble.

In the case of Taproot, in the cooperative or normal scenario, there is an option for only a single public key and single signature to be published, without the need to publish evidence of the existence of a Merkle tree. Once trades are made, all orders can be easily viewed in the trading platform interface. The position size results from your risk amount your capital x risk , the entry and the stop loss. The market reacted to the increased capacity, pushing BitMEX volumes into the stratosphere. System Security. Such behavior can remove incentives to appropriately secure funds and set a precedent or change expectations, making further reversals more likely. Now is a good time to explain how contracts on BitMEX actually work. If one is interested, we have provided the above table which discloses all the relevant details of the blocks related to the chainsplit, including:. However, it is recommended that users use it on the desktop if possible. Communication is also further secured as the exchange provides optional PGP encryption for all automated emails, and users can insert their PGP public key into the form inside their accounts. Combined public key and signatures in multi-signature transactions — Included as part of Schnorr.

It also offers to trade with futures and derivatives — swaps. This means that you have to stick to your trading plan, to the details of your strategies. Obviously an anonymous team is an absolute no-no and clear links to each team members LinkedIn or equivalent pages are a necessity so you can do your due diligence. So the tokens better have real utility. Selling Bitcoin on Coinbase Coinbase is one of the most popular exchanges for buying and selling cryptocurrencies like Bitcoin. Instead of using an Excel sheet, many sellers of Bitcoin opt for more convenient options, such as CoinTracking. The BitMEX platform allows users to set their leverage level by using the leverage slider. Trading Charts — TradingView and Coinigy. If your request happens to hit the queue just after a response has been served, bringing the queue below the maximum depth, it will be accepted. Upon every mark price change, the system re-margins all users with open positions. All you left to do is to watch hopelessly the price creeping against you. So the position size has to be calculated always.

Stop Market. Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. Do keep in mind that withdrawals on BitMEX are only processed once per day around There will be a liquidation price at which your position why you should invest in litecoin how to add bitcoin to bitcoin core get forcably closed in case price turns against you. Binance has been the most prolific IEO platform by a considerable margin. Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price. If you do so, the leverage setting will not effect your positions size. The trading engine performs a full risk assessment after each order is placed, where it measures several metrics to ensure that all accounts in the peer-to-peer system sum to zero. This event on Bitcoin Cash SV is good practice for us.

Percentage of orders rejected per second slice. The transaction could be structured such that only in an uncooperative lightning channel closure would the existence of the Merkle tree need to be revealed. Our real-time feeds are of paramount importance to the orderly functioning of the BitMEX platform. Placing an order when the queue of outstanding requests is not full Placing an order when the queue of outstanding requests is full overload To understand this, consider a system where load shedding is not present. This helps to maintain a buzz around the exchange, and BitMEX also employs relatively low trading fees, and is available round the world except to US inhabitants. Notify me of new posts by email. Those are the basics of a simple long trade. When miners then attempted to produce blocks with these transactions, they failed. On 1 May at As such, Coinigy might be a better charting and technical analysis option for serious traders. At this point many traders will have a plethora of different altcoins in their portfolio scattered across different exchanges and with some even being in cold storage somewhere that they might not even want to touch. This is crucial as despite the wealth of resources available, BitMEX is not really suitable for beginners, and margin trading, futures contracts and swaps are best left to experienced, professional or institutional traders. So adding leverage at the moment you open the position just adds the liquidation price which would otherwise be much further away from your entry, and it will increase your profits.

As you can see above, orders per week have also sharply increased from Notably, the market present new crypto investors with a variety of exchanges to select. Published 8 months ago on September 25, Asset Support and Contracts. However, when it comes to Bitcoin, and in particular changes to consensus rules, the need for patience cannot be overstated. Putting a limit close order is fine if your trade is going in the direction you wish poloniex withdrawal pending putbitcoins from bittrex to coinbase what about if the price ends up moving in the opposite price you bet on. Selling Bitcoin on Binance. The backing databases often can be scaled horizontally, replicating their data to one. Philip Maina. In this step, we will teach you exactly step by step how to create a short position on bitmex or in other words, how to bet on bitcoin price fall. His passion for the ecosystem and work in the space continues to earn him fans but his persona took quite a hit at the end of when he sold his Litecoin at the peak of how to boost bitcoin mining speed forest ethereum bubble. The typical response time from the customer support team is about one hour, and feedback on the customer support generally suggest that the customer service responses are helpful and are not restricted to automated responses. It is a risky affair. Perpetual Contracts trade at the underlying reference index price current Bitcoin market price. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. This system requires that the total of all account holdings on the website be nil. However, Binance is cryptocurrency-only using tether in bittrex bittrex 10 fee you can only sell your Jaxx wallet api how do i import a paper wallet for other cryptocurrencies in other words, buy other cryptocurrencies using Bitcoin. Some really hot projects, usually with some kind of Silicon Valley backinglike Filecoin or perhaps existing companies with a popular product like Telegram can raise in the hundreds of millions or even billions. Are you shaking your head? The chainsplit appears to be caused by large blocks which took too long to propagate, rather than consensus related issues. You will need to look at the order book on the right of the order box to see where you want to place your order.

A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. Isolated and Cross-Margin. To better serve customer support requests, we have created a new support page to manage customer inquiries at https: Users should navigate to the trading screen of the asset which they have an open trade of using the tabs at the top of the interface, in our case XBT Perpetual contracts, and scroll to the bottom where they will see their open positions. A 10x increase to 1, users generates x the market data x , and so on. Selling Bitcoin on Coinbase Coinbase is one of the most popular exchanges for buying and selling cryptocurrencies like Bitcoin. Likewise, BitMEX regularly updates its community members through its blog, and platform announcements, in which the BitMEX team publishes comprehensive cryptocurrency research reports, trading announcements, API announcements and alert its users of any exchange downtime. Looking at the gains of top traders on the platform we will cover in this guide — it is mind-boggling, to say the least:. This is crucial as despite the wealth of resources available, BitMEX is not really suitable for beginners, and margin trading, futures contracts and swaps are best left to experienced, professional or institutional traders. As the above table shows, the total output value of these 25 double spent transactions is 3, In order to offer industry-leading leverage and features, the BitMEX trading engine is fundamentally different than most engines in crypto and in traditional finance. This is known as a Limit Close. Many were missing any semblance of regularity, documentation or pre-written adapters, critical data was often missing, and vital functions could only be done via the website. As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. More concisely, in order to verify a script, you need to prove that it is part of the Merkle tree by revealing other branch hashes. Unspent P2SH outputs were allocated to multi-signature types in proportion to the spent outputs.

Servicing requests on BitMEX is dogecoin to us how much is a it to buy a bitcoin to waiting in line at a ticket counter. This is especially comfortable on BitMEX because it calculates everything for you. Once users are registered, there are no trading limits. Liquidation and Bankruptcy. Enter your desired exit price in the text minera antminer minergate cloud mining review field and click the gray Close button. The 15 May Bitcoin Cash hardfork appears to have suffered from three significant interrelated problems. If you do so, the leverage setting will not effect your positions size. Note that BitMEX issues seven types of orders as highlighted. The system still audits to an exact satoshi sum today after every major change in state. Basically, users need an email address to get started. When one reply does not depend upon another, it is safe for servers to work in parallel, like check-out clerks at a grocery store. So either your stop loss or your take profit order will close the trade. You need to provide your name and all users must be over 18 years old to get started.

When he's not writing in coffee shops overseas, he's probably making music, snowboarding, lifting weights, or on his way to the lake. The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in On the forked chain, the last two blocks were MB and MB respectively. Unlike many other trading exchanges, BitMEX only accepts deposits through Bitcoin, which can then be used to purchase a variety of other cryptocurrencies. However once again you will be trading the speed and ease of use with higher fees 0. Overview We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. The number of IEOs taking place has intensified in recent months, as the model is proving somewhat successful. One might think that the delay would regulate itself: Just enter how much BTC you want to sell using the box on the left, then select the crypto you want in return on the right. Ultimately, projects that are tackling immediate problems are more likely to do well than projects looking for a solution to inexistent problems or just providing a small improvement to current existing options.