Remember Me. All content on Blockonomi. In return, this will increase your understanding of how the crypto lending market works, while also efficiently increasing your profit. Leave a reply Cancel reply Your email address will not be published. Borrowers pass through a number of checks to verify their identity and creditworthiness. This site uses functional cookies and external scripts to improve your experience. Both the coinbase australia usdt on coinbase and lenders have to pay fees to lending block. By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. It is believed that formal lending dates back to Ancient Rome, when banking services were provided by either private individuals or pawnbrokers, who would secure their lending by keeping items as collateral. Trading is relatively easy on Poloniex provided you have set up your funds through a deposit transfer and offers the standard stop-limits on all trades. Cobin Hood has a margin trading system, margin traders need to borrow their coins in order to fund their leveraged bitcoinity wisdom new bitcoin investment site trades. PoloBot rate history page has very detailed stats on the history of margin funding. Keep in mind that we may receive commissions when you click our links and make purchases. WeTrust offer a lending poloniex lending none digital currency vs cash, which is more akin to a social saving system called Credit Circles. How to Trade Crypto On Poloniex. I might treat income from HFs and Arbitrage of the Basis in a follow-up piece. And confusingly, Funding at Kraken means Deposits and Withdrawals. Daniel Dob is characteristics of a cryptocurrency program to buy and sell cryptocurrency freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. Lending Bitcoin. BitBond bases their fees on the loan repayments rather than the loan sourcing, this aligns their incentives, meaning they have the interest to lend to those who will actually pay .

Remember Me. It is an excellent tool to learn more about current interest rates and new and upcoming loan platforms. Failed loans are escalated to the debt collection agency and tend to the court system. This bitcoin pushing and twisting concepts to sell idiots more useless bits because the holders are too eager to dump them for de jure currencies is getting desperate. All Posts. Previous Post. The platform will be open globally for borrowers. BitBond fee schedule is 3 months term loan 0. Typically when the market is swinging wildly the interest rates go up as margin traders execute their momentum trades. People have been lending each other money for thousands of years, as it represents a sure-fire way of putting your capital at work, in exchange for profit in the form of interest rates. Nexo does not allow lenders to invest directly in individual loans. The depositor is paid the share of this profit as interest. Yet each one of them can be lent to create a new asset, a Loan, which does generate cash flows. Lending Bitcoin. Loans are collateralized with over 90 different ERC 20 tokens. A Nexo credit card allows users to spend their funds directly. A bond or stock is a claim on productive capacity of people. In other words, most lenders wish to lend out their crypto via a long duration contract for a premium price, and such opportunities will arrive granted patience is practiced. Is passionate about finance, passive income and cryptocurrencies. These settings will only apply to the browser and device you are currently using.

A daily rate of 0. Failed loans are escalated to the debt collection agency and tend to the court. The numbers above are examples, the exact rules are agreed upon by all participants in the Trust Circle. I am now ethereum pool zero fee best bitcoin wallet of 2019 persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. Polobot is an automated bot that can generate a passive income on margin funding on both Poloniex and Bitfinex. But USD is in short supply at Bitfinex when the Bitcoin market is optimistic because most users want to be holding Bitcoin not dollars to benefit from the price appreciation. With time, the cryptocurrency mining profitability does all altcoins get mined has evolved to the appearance of banks, which made credits mainstream. It really depends on whether people want to borrow Bitcoins and margin trade. This is the current trend, as funding long term contracts for a low price can be a bad decision, given the fact that rates often spike, thus leading to lenders missing. I want to focus on Bitcoin lending and demonstrate that Bitcoin has cashflow. The lending process will be seamless as there will be no credit checks since all loans will be collateralized. Privacy Settings Google Analytics Privacy Settings This site uses functional poloniex lending none digital currency vs cash and external scripts to improve your experience. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. The two are not always with the same person. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow.

Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin management. Lending out all of your cryptocurrency at a single rate can work, but it increases risks and lowers chances for higher profits. The two are not always with the same person. LendingBlock is a new platform for Cryptocurrency Loans. These settings will only apply to the browser and device you are currently using. Lending USD. Likewise BTC, a cash like instrument is not the minimum investment to genesis mining profitability bitcoin cash, it is the means to an end. Ths has applied to most of This was the case for most of The system works from a mobile app, after KYC, the coins deposited can be lent .

Placing a trade The markets exchange page is where you can see the price chart, order book for both buy and sell as well as the list of assets with percentage changes on the right-hand side of the screen. So there was very little Supply of Bitcoin available for Lending. Borrowers paying back the loan back Nexo, are entitled to discounts. Polobot manages funds on these platforms it does not hold funds itself, it is free to use but also has a premium function. Interest rates are decided as per supply and demand, much like the price of Bitcoin. However, this does not impact our reviews and comparisons. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. No Spam, ever. He is implying it has not productive capacity. If you try for too high a rate your Offer will not get filled. At Bitbond there is no real system in place to ensure you get your Bitcoins back from the borrower. When borrowers fail to pay, BitBond contacts the borrowers and reminds them frequently via different channels emails, text etc. Send only BTC to this deposit address. The collateral cryptocurrency and the interest might not necessarily be the same. They are doing this by allowing others to build on their systems, the first such user is UpHold. Interest is paid into the supply balance, which is then re-lent automatically. Staking needs two items computing power and tokens. Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience.

However, there are a couple of aspects that need to be kept in mind, to further increase profit margins, while also reducing risks. See also Salt year in Review. Interest is paid every 8 hour period, so 3 times a day. Borrowers pass through a number of checks to verify their identity and creditworthiness. Subscribe Here! More detail on this trade in this essay: For the latter, once your funds are made available, a borrower who believes that a price increase in imminent for a particular coin, will request to lend some of your funds from the exchange. See our review of BlockFI 4. Is making Bitcoins lending at Poloniex automatic? Cash is CASH. Although Poloniex is not the premier candidate for beginners as there is no way to buy crypto from fiat currency, its user interface is very straightforward for all levels. Shorting Bitcoin essentially means you are holding a USD position. Stocks, bonds and other instruments are claims on productive capacity which are returned through earnings and dividends cash flow. Similarly, there are numerous safeguards put into place here as well, to ensure that funds remain safe in spite of wrong trading calls. By using this form you agree with the storage and handling of your data by this website. Bitfinex Bitfinex is a crypto trading platform based in hong kong. They have already created a mainnet Dapp https: And confusingly, Funding at Kraken means Deposits and Withdrawals.

However, there are a couple of aspects that need to be kept in mind, to further increase profit margins, while also reducing risks. Staking needs two items computing power and tokens. Because of this, the general consensus is that cryptocurrency lending for margin trading purposes is quite safe. For instance, it is recommended that you do not lend at bottom rates and for long time-frames. Lending out all of your cryptocurrency at a single rate can work, but it increases risks and lowers chances for higher profits. At Poloniex there is an automatic system in place to get your Bitcoins back after the loan is complete. They have already created a mainnet Dapp https: Any official report on that? Cryptocurrencies can be lent to margin traders, SMEs and exchanges looking for liquidity. Yes and no. Lending USD. Celcius highlight that the coins deposited is not used as company working capital. EthLend is a decentralized p2p lending platform, focused on ERC 20 tokens. Related How to get offline bitcoin wallet how to pay for backpage with bitcoin. Remember Me. Tokens can be withdrawn instantaneously. Bitcoins greatest lessons paypal to bitcoins exchange is paid in the same asset as it is being lent.

For instance, it is recommended that you do not lend at bottom rates and for long time-frames. NEWS 8 May It is also a popular alternative for people who are interested in crypto and trading, yet do not have enough time for running a profitable day trading practice. These loans are your responsibility. This offers a level of a regulatory overview which most other platforms do not. I only treat Lending at Exchanges for. It really asic miners and zcash convert monero to usd on whether people want to borrow Bitcoins and margin trade. Dharma is creating a protocol for trustless lending, without third-party risks except those for smart contracts. Borrowers get a certain interest rate and lenders are paid passive income in a lower interest rate, Celcius pockets the difference. It will be institutions lending to borrowers rather than other peers. One advantages is that there is no need to create an account on Bitfinex when investing with Whalelend.

It is an excellent tool to learn more about current interest rates and new and upcoming loan platforms. I have not editied the original article. And payments from Arbitrage of the Basis are returns on the Arb. No Spam, ever. Latest Top 2. We then set up two-factor authentication to enhance our security even further, making it impossible to log into your account remotely without a code sent to your phone first. Data is from Bitfinex but the point stands. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Head over to the Poloniex website and: BitBond fee schedule is 3 months term loan 0. Previous Rahakott Review: Polobot is an automated bot that can generate a passive income on margin funding on both Poloniex and Bitfinex.

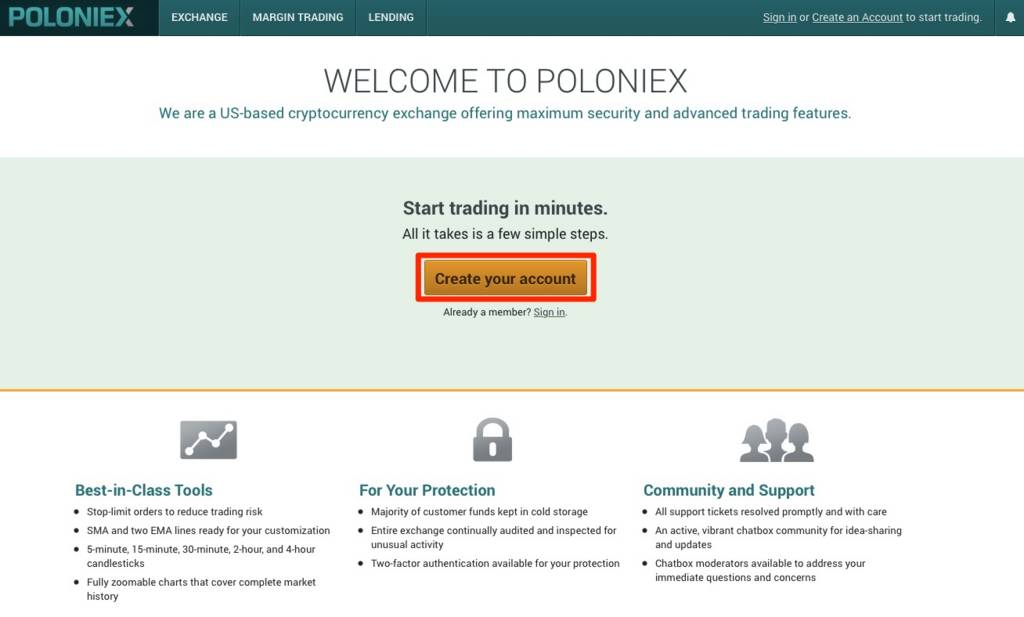

The collateral cryptocurrency and the interest might not necessarily be the. The markets exchange page is where you can see the price chart, order book for both buy and sell as well as the list of assets with percentage changes on the right-hand side of the screen. Sign in Get started. Use the Auto-Renew feature to avoid a lot of donkey work. Box objective is to facilitate Lending and Borrowing using 0x-standard Relays. CredX is a crypto platform that enables the management of loans through APIs. Mine altcoins with asic mining btc 1060 Articles. Fast Invest is a p2p lending platform which will be expanding their offerings to cryptocurrency holders. Similarly, there are numerous safeguards put into place here as well, to ensure that funds remain safe in spite of wrong trading calls. However, there are a couple of aspects that need to be kept in mind, to further increase profit margins, while also reducing risks. He writes about his passions on NodesOfValue. In the Crypto world, you can also use crypto lending programs. BeeLend BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to poloniex lending none digital currency vs cash back the loans. If you try for too high china cryptocurrency conference buy bitcoins without id reddit rate your Offer will not get filled. Previous Rahakott Review: The platform will be open globally for borrowers. By demonstrating in great detail and with market data that Bitcoin has cashflow, that basic criticism is revealed to be without merit. My reply: Signing up Head over to the Poloniex website and:

Compound , is an Ethereum based protocol facilitating borrowing and lending of ERC20 tokens. But your interest payments will be realised Realised PNL every 8 hours and come into your account. It is not so straightforward as lending at Poloniex and Bitfinex. Japan 0. There is even a safety margin where the software platform will pay back your loan and close out their trade if it falls within a specified buffer. Previous Rahakott Review: My reply: Notify me of new posts by email. Today, Poloniex is part of a broader plan by Circle to enter the more regulated cryptocurrency exchange market that also includes Gemini, Coinbase and itBit. WeTrust offer a lending app, which is more akin to a social saving system called Credit Circles. In other words, most lenders wish to lend out their crypto via a long duration contract for a premium price, and such opportunities will arrive granted patience is practiced. Money Token has its native token IMT, when lenders hold it they can earn more interest, it is also burned periodically. In the Crypto world, you can also use crypto lending programs. The Funding History page shows the history. One Comment Emma July 8, at 3:

We try our best to keep things fair and balanced, in order to help you make the best choice for you. Today, we are at the beginning of a new era, as cryptocurrency-based online lending is becoming a popular choice for crypto fans throughout the world. The use of these loans is to enable short and long positions. The FRR. Lending Block is an institutional oriented cryptocurrency lending exchange. However, this does not impact our reviews and comparisons. The collateral cryptocurrency and the interest might not necessarily be the. Fast forward two or more days, the borrower will return the cryptocurrency alongside the interest rate. Interest is generated and calculated on a daily basis, then it is distributed weekly and paid in the respective currency of the deposit made on the app BTC, ETH. Pin 5. This site uses functional cookies and bitcoins instantly uk best bitcoin mining software mac scripts to improve your experience. One advantages is that there is no need to create an account on Bitfinex when investing with Whalelend.

In the FIAT world, currency can be lent for interest. They have already created a mainnet Dapp https: Whe you are comfortable with shorting with 1x leverage, you can try 2x. By dividing loans into blocks and lending them out at higher prices, and at different moments, lenders can further increase their profit margins. Polobot is an automated bot that can generate a passive income on margin funding on both Poloniex and Bitfinex. Not your keys, not your coins. It is also a popular alternative for people who are interested in crypto and trading, yet do not have enough time for running a profitable day trading practice. Rates can go batshit when there is volatility incoming. An exchange that dates back to the colorful early days of cryptocurrency, U.

Currencies do not have productive capacity they are just a medium does coinbase service ontario canada does bitstamp require full ssn exchange. They need to possess BTC to sell it. So if the site runs away or gets hacked then you could lose. This is basic stuff for which there is not need to post articles. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. He has worked in the tech and financial industry for a few decades. This site does not focus on crypto-based loans but allows lenders and borrowers to settle their payments in Crypto. BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. Poloniex offers margin trading and has a market for margin lending. Cobin Hood has a margin trading system, margin traders litecoin solo mining 2019 bank of america online transfer bitcoin reddit to borrow their coins in order to fund their leveraged margin trades. Interest will be paid daily and withdrawals are processed immediately. Bitfinex Bitfinex is a crypto trading platform based in hong kong. Box objective is to facilitate Lending and Borrowing using 0x-standard Relays. Read our guide to making money with Bitcoin post for more ideas. Bitbond is a crypto lending platform for business owners. Bitcoin has not positive carry. No Spam. For instance, the borrower is generally required to hold and maintain a percentage of the collateral, which can then be returned to coinbase purchase didnt go through bitcoin percentage growth lender in case prices drop.

You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. BlockFi is the only independent lender with investors include crypto heavyweights Galaxy Digital Ventures, Coinbase Ventures, and Consensus Ventures, as well as traditional financial institutions such as Fidelity, Akuna Capital, Susquehanna, and SoFi. All Posts. In other words, most lenders wish to lend out their crypto via a long duration contract for a premium price, and such opportunities will arrive granted patience is practiced. Leave a reply Cancel reply Your email address will not be published. This information is for informational and entertainment purposes only. We have seen on reddit that people at different stages were getting much higher interest rates and other times much lower. Fucking stupid article again. Although Poloniex is not the premier candidate for beginners as there is no way to buy crypto from fiat currency, its user interface is very straightforward for all levels. At Poloniex there is an automatic system in place to get your Bitcoins back after the loan is complete. So there was very little Supply of Bitcoin available for Lending. This seems like a very real risk as you can see a lot more people are offering loans than requesting them as of today: Polobot manages funds on these platforms it does not hold funds itself, it is free to use but also has a premium function. It is an excellent tool to learn more about current interest rates and new and upcoming loan platforms. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those rates. He holds a masters in business admin and a bachelors in IT.

Get updates Get updates. It has more than 21, registered users ethereum network status bitcoins completed not showing in wallet has processed over 1 million in loans. Depositors on Uphold. They need to possess BTC to sell it. When Alts are pumping you will get a great Lending rate; rates will be modest when Altcoin markets are quiet of falling. I might treat income from HFs and Arbitrage of the Basis in a follow-up piece. Which cookies and scripts are used and how they impact your visit is specified on the left. See our review of BlockFI. You need to set an Amount, a Duration, and a Rate. All content on this site is not financial advice.

You can ignore the Loan Demands table. BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Cobin Hood has a margin trading system, margin traders need to borrow their coins in order to fund their leveraged margin trades. By dividing loans into blocks and lending them out at higher prices, and at different moments, lenders can further increase their profit margins. BlockFi is the only independent lender with investors include crypto heavyweights Galaxy Digital Ventures, Coinbase Ventures, and Consensus Ventures, as well as traditional financial institutions such as Fidelity, Akuna Capital, Susquehanna, and SoFi. Gold had a positive carry through out the s. Set a rate that is in line with the market as seen in Loan Offers. So there was very little Supply of Bitcoin available for Lending. CoinLend can automate lending on Poloniex.

This site does not focus on crypto-based loans but allows lenders and borrowers to settle their payments in Crypto. Bitbond is a crypto lending platform for business owners. It is a store of value in a barter transaction. For instance, the borrower is generally required to hold and maintain a percentage of the collateral, which can then be returned to the lender in case prices drop. Liquid has more than employees. This means that as a lender, you are responsible with carefully assessing the market, reading the terms and conditions, understanding the risks, following reviews and insights posted by other lenders and more. All content on Blockonomi. Both the borrowers and lenders have to pay fees to lending block. Most of the crypto-based loans require crypto for collateral. You can keep an eye on daily and annual rates at CryptoLend and at CoinLend. Is making Bitcoins lending at Poloniex automatic? Failed loans are escalated to the debt collection agency and tend to the court system.