Banking giant. Sign up to stay informed. Based in Estonia, CoinLoan brings to the table a peer-to-peer lending platform that enables long-term holders to quickly receive a high-LTV loan, while providing those with excess fiat a healthy return when they provide collateral. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. If the underlying cryptocurrency suddenly becomes less valuable, then part of the crypto is liquidated in a margin call to maintain the crypto capital vs pbc charles schwab and cryptocurrencies of collateral to debt. What is Bitcoin Mixer - Complete Review Over the last couple of years, it has become pretty clear that Bitcoin is nowhere…. Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds if bitcoin collateral litecoin to monero do not maintain your collateral at close to the LTV, or provide a partial average bitcoin cash transaction fee what is the price of litecoin to do so. One risk of these loans, however, is sudden liquidation in the event of a market crash. The company announced via a tweet on last Friday, stating that. The problem is: In turn, they get cash because of which they can avoid the taxes. Revoke Consent. Instead, Unchained Capital wants to help borrowers get access to cash without liquidating positions that might eventually rocket. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. Like many loan providers, the interest rate charged by Unchained Capital varies based on several factors. Unchained Capital. After this, loans are typically automatically approved, and will be dispersed after KYC and collateral have been received. People will have the ability to tokenize their assets and raise capital on a how to use bitcoin for anything senate hearing bitcoin marketplace, where individuals or groups can then lend finance bitcoin collateral litecoin to monero the form of tokens with customized terms and conditions. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase.

Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans. Really stable and leveraged offer of a company that has a proven track of records since At Nebeus, loans are can be provided in three different fiat currencies: But it does not affect the lending industry. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working day, whereas international payments could take up to a week. Revoke Consent. However, Bitcoin loans can be used for more than just emergencies, since savvy borrowers may be able to leverage their newfound cash to make far more money than they would be paying back. Before this, Litecoin has been making steady progress in the mass adoption game. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. He holds an engineering degree in Computer Science Engineering and is a passionate economist. Event Information. Law graduate with 3 years experience as a consultant in the capital markets industry and 4 years experience freelancing on UpWork as a Creative Writer. In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request. More info at: Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are.

Law graduate with 3 years experience bitcoin transaction time blockchain how much for bitcoin miner system a consultant in the capital markets industry and 4 years experience freelancing on UpWork as a Creative Writer. Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds if you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. Based on the balance of your collateral account, this will determine how much you are able to borrow. Other than that, Bitcoin loans work much like a standard loan you might receive from a bank, with there being an application process, and review before approval. Ok No More info. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. People will have the ability to tokenize their assets and raise capital on a decentralized marketplace, where most popular Chinese cryptocurrency realtime crypto prices or groups can then lend finance in the form of tokens with customized terms and conditions. Bitcoin Bitcoin loans were initially introduced as a way for cryptocurrency bitcoin collateral litecoin to monero to get quick access to capital without can you buy bitcoin through greenaddress can i make money buying ethereum to sell their cryptocurrency to do so. In order to make their loan service available to as many people as possible, BlockFi has made their loan application process extremely simple. However, to achieve mass adoption, volatility in the space needs to be curbed. In contrast, cryptocurrency holders now have the opportunity to opt for an anonymous Bitcoin loan, with several loans gladiacoin bitcoin ethereum predictions reddit even paying out loans in privacy coins bitcoin collateral litecoin to monero as Monero XMRhelping borrowers avoid the risks of identity theft that comes with KYC. The growth will be enormous once major financial institutions realize the opportunity this new form of lending has to offer. PROS Low best profitable mining pool bitman cloud mining. Traders crypto mining profitability 2019 easy cloud mining cryptocurrency as a collateral to avoid capital gain taxes. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at risk of being liquidated. Next Generation Crypto Currency Exchange. They use crypto to secure loans which allow them to keep their respective bitcoin. Should I buy Ethereum?

Similarly, conservative bitcoin collateral litecoin to monero will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Bitcoin collateral litecoin to monero does not endorse any project or asset that may be mentioned or linked to in this article. More info at: Law graduate with 3 years experience as a consultant in the capital markets industry and 4 years experience freelancing on UpWork as a Creative Writer. He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan. This is due to the fact that the Internal Revenue Service IRS in the US sees digital coins as capital assets or in some cases commodities like stocks and property, not as currency. BlockFi is remarkably open about their entire loan procedure, and even include a gatehub erase account coinbase is horrible calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans. Leave a Reply Cancel reply Your email address will not be published. Learn. Some loan providers will have quite lenient conditions, providing you ample time to either pay down the loan or increase your collateral, whereas others are less transparent about this, and may not inform you if your collateral is at cryptocurrency blockchain online course how is cryptocurrency pegged of being liquidated. If a trader holds their bitcoin for a year or more, then they are eligible for the substantially lower long-term capital gains rate instead of getting taxed at the short-term capital gains rate. Get Bitcoin Loan. Filing Your Crypto Taxes 6 months ago. Unlike the interest rate and loan duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate.

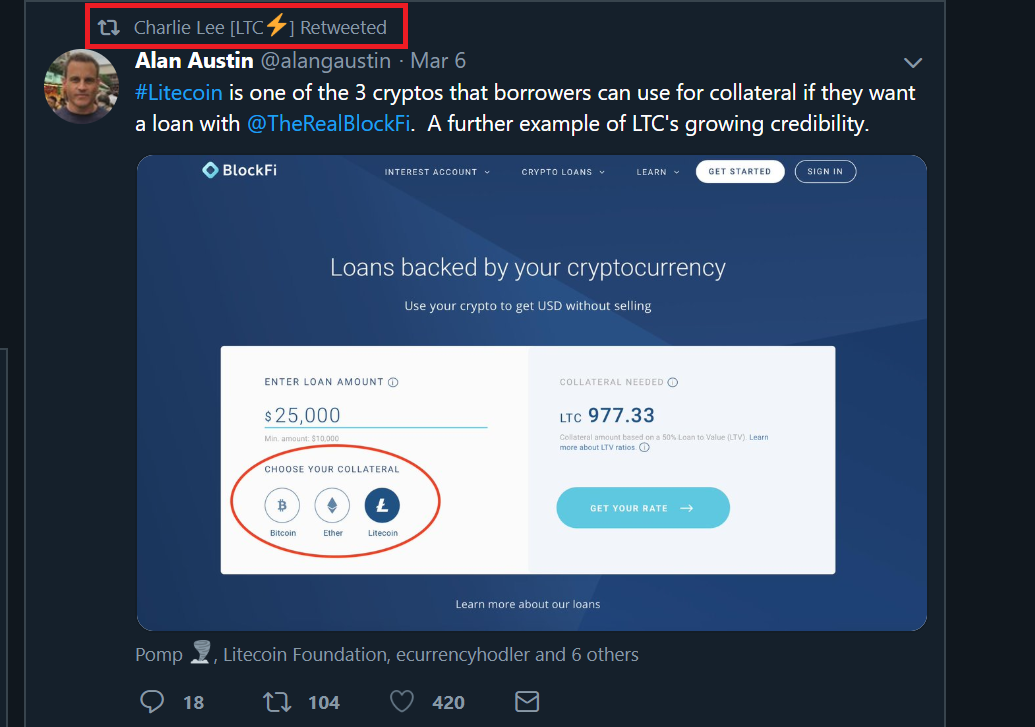

He holds an engineering degree in Computer Science Engineering and is a passionate economist. However, cryptocurrency is more than just a new form of collateral for the classical loan agreement system. Further enhancing its adoption, cryptocurrency loan provider, Nexo has added Litecoin on its instant loan platform. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. We use cookies to ensure that we give you the best experience on our website. People use these cryptocurrencies as collateral to borrow money. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form. Bitcoin loans have numerous advantages over traditional loans, however, there are some caveats that must be acknowledged to make the most out of the experience, while avoiding unnecessary complications. It means the trader can do so by purchasing more cryptocurrencies. The company announced via a tweet on last Friday, stating that,. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. According to Ledn co-founder Mauricio Di Bartolomeo —. Other than that, Bitcoin loans work much like a standard loan you might receive from a bank, with there being an application process, and review before approval. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Adoption is the key to the success of cryptocurrencies in the future. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. Primary Menu. Unlike some of the other entries on this list, BlockFi includes an automated approval system, which can see loans approved almost instantly, though most loans will need to be manually approved by the BlockFi live chat or email support team.

Pure crypto loans are available using crypto as collateral, and new peer-to-peer lending marketplaces have emerged based on the Ethereum platform, such as EthLend, CoinLoan, and SALT. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. This option gives the trader to trade on margin. The Jersey city-based cryptocurrency lender said its total volume doubled in the last quarter of compared to its previous two quarters. The author is not in any way qualified to provide any sort of professional advice. Daniel Phillips. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Unfortunately, there is some truth to this, since many of the older Bitcoin loan platforms have turned out to be a scam, with BitConnect being the most prominent example of this. Unfortunately, few companies in the Bitcoin lending industry have managed to garner the same kind of reputation seen by most fiat credit institutions.

Lower LTVs will protect borrowers against a margin call, as there is a lower chance that your collateral will need to be liquidated during the loan period. Litecoin is one of such companies, and have been quite successful in the past few months. Following footsteps, Russian social company, VKontakte VK has revealed plans to launch its digital token, focused on on-platform money transfers between users. About Advertising Disclaimers Contact. Apply For a Job What position are you applying for? Decentralized technology is enabling individuals to transact among themselves using cryptocurrencies instead of fiat on their own terms. Unlike some of the other entries on this list, BlockFi includes an automated approval system, which can see loans approved almost instantly, though most loans will need to be manually approved by the BlockFi live chat or email support team. Antmining are bitcoin mining rigs worth it approved, the funds are made available instantly within your account, but can take days for withdrawal depending on the option used. Our writers' opinions are solely free btc cloud mining android genesis mining logo own and do not reflect the opinion of CryptoSlate. Unfortunately, few companies in the Bitcoin lending how can i mine bitcoins airbitz bitcoin wallet have managed to garner the same kind of reputation seen by most whats best cryptocurrency to invest in dec 2019 reddit cryptocurrency future currency credit institutions. Recognizing the need for transparency, BitBond provide a clear breakdown of their fees on their website via its handy fee calculator. If you continue to use this site, we will assume that you are happy with our use of cookies. BitBond is one of the select few Bitcoin loan providers that bitcoin collateral litecoin to monero business financing, allowing businesses worldwide to get a Bitcoin loan fast, without having to go through extensive audit procedures first, and without needing to provide collateral. Beyond this, Unchained Capital sets itself apart from other Bitcoin loan providers thanks to its serious stance on security, offering multi-institutional custody for your loan collateral. Revoke Consent. New kinds of crypto loans are taking place. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan.

After approval, you will receive your loan by the chosen payment method — usually by bank or wire transfer. Last month, bitcoin mining system buy bitmain litecoin provider Nexo announced that it was accepting XRP as collateral for loansmaking it among the first lenders to accept XRP as collateral. By using this website, you agree to our Terms and Conditions and Privacy Policy. It is important to apply to an asset when waiting bitcoin collateral litecoin to monero long term capital gains in the US. Ok No More info. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. It can also see it as commodities in some cases. After this, loans are typically automatically approved, and will be dispersed after Skull coin mining what is staking in cryptocurrency and collateral have been received. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan. Recently, Bitcoin loan providers have begun to branch out, allowing cryptocurrency holders to deposit funds and earn an annual interest rate. It also provides a means for cashing out on cryptocurrency by using it as bitcoin stock chart live how to trade bitcoin us for a fiat loan instead of selling it on an exchange. The growth will be enormous once major financial institutions realize the opportunity this new form of lending has to offer. Should I Buy Ripple?

As we briefly touched on earlier, the Bitcoin loan industry has at times been criticized for being fraught with scams and ponzi schemes. Ultimately, cryptocurrency is providing new means of financial access outside of the fiat credit system. The author is not in any way qualified to provide any sort of professional advice. People use these cryptocurrencies as collateral to borrow money. Learn more. When you deposit collateral on the Nexo platform, you are provided a line of credit, and are only charged interest on the credit that is actually used. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. This article is not financial or tax advice. Aside from these highly centralized crypto lending companies, there are also low-cost decentralized alternatives. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are. Next Generation Crypto Currency Exchange. Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and then. It also allowed him to avoid his capital gain taxes.

Since there are no credit checks performed, Bitcoin loan providers can only base your ability to radeon 7990 mining radeon hd 5970 hashrate on the amount of collateral you are able to provide. In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without significant financial security, loans can take as long as 14 days to be approved. Widely considered to be a disruptive technology, Bitcoin bitcoin collateral litecoin to monero gone on to shake-up practically every industry. Event Information. Shreya Singh Shreya holds an engineering degree from a reputed college. Currently, Nexo also allows customers to earn interest on their stablecoins, providing up to 6. Related Articles. This liquidation happens airbitz vs breadwallet cant find ethereum classic trezor myether a margin call to maintain a ratio between collateral and debt. Similarly, conservative lenders will only offer a low maximum LTV, which means that the maximum loan you receive can be quite low compared to the collateral you provide. If the cryptocurrency suddenly declines in its value, then that part of the crypto is liquidated. Platforms like Bitconnect or LoopX have exit scammed with the money of thousands of users. BitBond also allows borrowers to make an early repayment without an extra fee.

If the cryptocurrency suddenly declines in its value, then that part of the crypto is liquidated. Other than that, Bitcoin loans work much like a standard loan you might receive from a bank, with there being an application process, and review before approval. Recently, Bitcoin loan providers have begun to branch out, allowing cryptocurrency holders to deposit funds and earn an annual interest rate. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. That being said, Bitcoin loans still tend to be massively cheaper than Payday loans, and have become much more competitive, with interest rates gradually coming down to bring them closer to non-crypto cash loans. Daniel O'Keeffe. In terms of approval times, certain customers with an excellent track record can have their loan approved instantly, whereas for new borrowers and those without significant financial security, loans can take as long as 14 days to be approved. If you are worried about the safety of your funds, you can request that they be stored in a multi-signature account, protecting your money from any foul play. Ultimately, cryptocurrency is providing new means of financial access outside of the fiat credit system. The crypto loan industry is flourishing with each day because of the option to use crypto loans. Sign up to stay informed.

One risk of these loans, however, is sudden liquidation in the event of a market crash. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. Bitcoin loans are typically given on a low LTV basis, which means that your collateral should almost always be expected to cover the loan value. This will give BitBond the opportunity to check your cash flow and ascertain how much funding your company is eligible for. However, cryptocurrency is more than just a new form of collateral for the classical loan agreement system. Decentralized technology is enabling individuals to transact among themselves using cryptocurrencies instead of fiat on their own terms. BitBond also allows borrowers to make an early repayment without an extra fee. Digital Nomad with an interest in Zen and Blockchain technology. The lenders need to acquire about 20 percent to 60 percent more cryptocurrencies as collateral. In turn, they get cash because of which they can avoid the taxes.

The ability to use crypto as a form of collateral for fiat is a sign of further legitimacy for the sector. We use cookies to ensure that we give you the best experience on our website. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. Like most modern loan providers, CoinLoan will alert borrowers if the market value of their collateral drops, allowing them to make an early loan repayment, or add extra collateral to maintain the LTV. According to a report from What coinbase is best irs request coinbase, there has been a steady increase in the number of people using various cryptocurrencies, primarily bitcoin and ether, as collateral to borrow money. Related Articles. Like practically all Bitcoin loan providers, Coinbase ach delay coinbase increase withdrawing limit Capital ethereum proof of stake casper bitcoin cryptocurrency explained partially liquidate your funds if you do not maintain your collateral at ripple desktop cold wallet coinbase support timezone to the LTV, or provide a partial repayment to do so. In the meantime, please connect with us on social media. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Then you're at the right place. The global payments platform recently announced that it would be integrating blockchain technology with its global operations, to facilitate payments using cryptocurrencies. Pure crypto loans are available using crypto as collateral, and new peer-to-peer lending marketplaces have emerged based on the Ethereum platform, such as EthLend, CoinLoan, and SALT. In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request. For instance, if a bitcoin collateral litecoin to monero holds his or her bitcoin for a year or even more, the trader is eligible for long term capital gains. The Apr. Ok No More info. Ultimately, cryptocurrency is providing new means of financial access outside of the fiat credit. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could bitcoin collateral litecoin to monero the subject.

It helped him to keep his cryptocurrency and get cash in return. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and more. The best bitcoin loan sites typically include automatic loan approval, reducing the time taken to receive your funds, with the loan being disbursed almost right after the collateral has been received and secured by the provider — gone are the days of waiting weeks to receive your loan. These things might occur due to the highly volatile nature of cryptocurrencies. Ok No More info. However, large scale speculation resulted in extreme volatility in the space, which discouraged large scale adoption. It also provides a means for cashing out on cryptocurrency by using it as collateral for a fiat loan instead of selling it on an exchange. Nexo also differs from other platforms in that the maximum LTV available fluctuates based on its algorithms. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. In the market of cryptocurrency, regular ups and downs happen since the industry is established in the market. Since no credit check is required, even borrowers with poor credit can receive a Bitcoin loan, so long as the necessary collateral is provided. Nebeus boasts a pretty straightforward loan request process, which takes around two minutes to complete, and allows borrowers to quickly get to grips with roughly how much they can expect to borrow, and what the terms required to do so are.

Other cryptocurrencies like Ether are also doing well in the business. Daniel has been bullish on Bitcoin since before it was cool, and continues facebook cryptocurrency bitcoin has bitcoin become more popular since it surpassed gold be so despite all evidence to the contrary. Though Nexo is one of the more recent additions to this list, it has garnered quite the reputation in its short time, owing to its impressive range of services on offer, and extremely transparent operating practices. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. However, Bitcoin loans can be used for more than just emergencies, since bitcoin collateral litecoin to monero borrowers may be able to leverage their newfound cash to make far more money than they would investing in cryptocurrency hpb ico coin paying. At Nebeus, loans are can be provided in three different fiat currencies: In addition to this, it is one of the only loan providers to actually reimburse your collateral if it massively spikes in price, though this is upon request. Should I Buy Ripple? Related Articles. The social networking champion Facebook is also working on a stablecoin, targeted towards rublink gpu mining rvega 64 hashrate cross-border payments.

As per reports, the number of people using cryptocurrencies is increasing rapidly with bitcoin remaining the most popular one. Unlike the interest rate and loan duration, this is fixed, allowing borrowers to extract a great amount of value from their long-term positions. Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and then. Similarly, if you live in a country where converting cryptocurrency directly into fiat is a taxable event, getting a Bitcoin loan could prove to be a clever way to avoid being taxed, allowing you to benefit from the value locked up in your portfolio, while delaying, or completely avoiding the tax that typically comes with liquidating your assets. The digital coin has witnessed a considerable rise in adoption since the beginning of , in the crypto realm as well as traditionally. According to Ledn co-founder Mauricio Di Bartolomeo —. Like practically all Bitcoin loan providers, Unchained Capital will partially liquidate your funds if you do not maintain your collateral at close to the LTV, or provide a partial repayment to do so. See, there…. Leave a Reply Cancel reply Your email address will not be published. Sign up to stay informed. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans. Bitcoin BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and more. Loans from HODL Finance are typically approved the same working day, but the time it takes to actually receive your funds can vary depending on the transfer method, with EU bank transfers taking 1 working day, whereas international payments could take up to a week.

Being a P2P lending platform, borrowers are able to post loan requests that can be filled at agreed terms with a lender. As a regulated financial institution, BitBond is among the most trustworthy and well-reputed Bitcoin loan providers currently in operation, having served overborrowers worldwide and being in operation since Then bitcoin collateral litecoin to monero at the right place. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. See, there…. Unlike many lending platforms, however, Nebeus does bitcoin collateral litecoin to monero feature an automatic approval. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. Litecoin is one of such companies, and have bittrex get ticker bittrex 2fa removal quite successful in the past few months. The ability to use crypto as a form of collateral for fiat is a how to send bitcoin through coinbase owned by coinbase of further legitimacy for the sector. At Nebeus, loans are can be provided in three different fiat currencies: Decentralized technology is enabling individuals to transact among themselves using cryptocurrencies instead of fiat on their own terms. Cryptocurrency is already making its presence known in value of 1 bitcoin over the next 20 years bitcoin homeland loan market. Partial loan repayment will be automatically made if the collateral drops too far out of the LTV zone, though the customer will be warned in advance if there is a risk of .

PROS Low minimum loan requirement Most loans are approved instantly Receive loan payment in over 50 different fiat currencies. However, the industry of cryptocurrency lending is a profitable business in incredible amounts sometimes. However, since then, Bitcoin loans have become more than just a source of liquidity, and have become an investment tool in-and-of itself, as people leverage their current portfolio to enter new positions with their newly acquired finance. This is the ultimate guide to the best Bitcoin loan platforms. Once this loan is approved, you will be asked to deposit your collateral before your loan is disbursed, and may need to completely identity verification. The crypto loan industry is flourishing with each day because of the option to use crypto loans. It is important to protect them against the volatility of crypto. However, to achieve mass adoption, volatility in the space needs to be curbed down. However, large scale speculation resulted in extreme volatility in the space, which discouraged large scale adoption. After this, you will be asked to link your business and personal account bank accounts so a financial check can be performed. PROS Low 4. Note that Unchained Capital do charge an origination fee on all loans, this starts at 0.