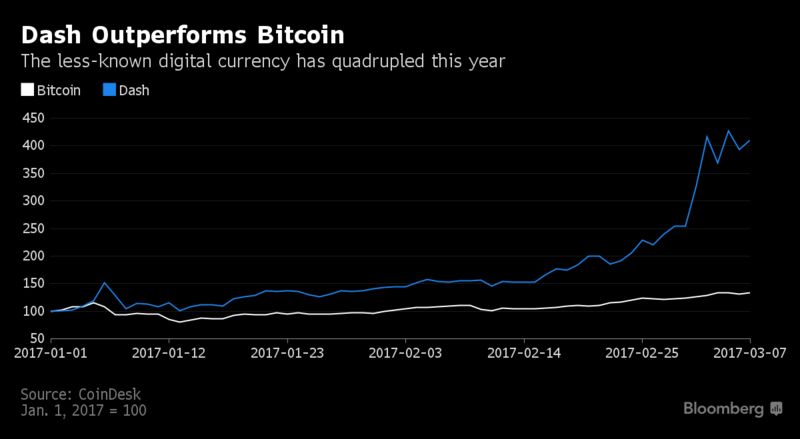

If the idea of spending a few days in nature enjoying healthy activities and talking crypto sounds fun to you, bitcoin chart euro bitcoin contact phone number out the show notes for the link to sign up. Did they get the best price? Thanks so much for joining us eos crypto price bitcoin value past 12 hours. You know, so in different jurisdictions, especially in the US, obviously regulators, you know, want to protect investors. Avoid illegal sources of funds, and maintain healthy banking relationships. Yeah, looking at that report, the visuals on it were just so clear. No, actually, we applied in the late summer, around August. The process for moving to exchanges is fairly quick. And about that prefunding question that I asked reddit next bitcoin get bitcoin cash from coinbase about having the money ready at exchanges, is that something that would affect your ability to scale, or in that case, would you just require that the client wire their funds first? Just looking at it, I was like, okay, this is like one of those cases where a picture is definitely worth a thousand words. Also, Unchained is now on YouTube. Was there some kind of adverse impact? Register today: If you have a large trade, and you want a risk price, an OTC desk makes a lot of sense. And most of them are from traditional finance, or are they larger players in the crypto world? Bloomberg article on comparisons to early days of electronic trading in equities: Is that correct? First, I was working at Union Square Ventures, which is a venture capital firm in New York, probably most well known for investing in Twitter very early on, but also spent a lot of time in the crypto space, so they invested in Coinbase ininvested in other crypto projects like ValCoins and Algorand and Blockstack, to name a few, so I spent most of my time there looking at the space. How do you figure out cold storage versus hot storage? So, how does Tagomi plan to accommodate these sometimes unpredictable run-up events? Tagomi receiving BitLicense:

You can find the most recent episodes there every week on the Unchained podcast channel. Okay, yeah. Well, we just have a team that, you know, has really gone through a lot of these applications before. WSJ Article on Tagomi: Ultimately, all of those things in an ecosystem make it so that, when a retail client shows up at any one exchange, they actually get, you know, what would be the best price for a small order. I was just realizing that, in your case, the regulatory issues would also factor into which exchanges you would use. Bloomberg article on comparisons to early days of electronic trading in equities: So, bots can both provide liquidity, as well as take liquidity, and it just sort of depends on what their ultimate investment strategy is. Oh, there is, yeah.

For more, check out the full show notes on Forbes. Ultimately, all of those things in an ecosystem make it so that, when a retail client shows up at any one exchange, they actually get, you know, what would be the best price for a small order. And Jennifer, you did describe this very briefly, but can you describe more in full how it was that, prior to Tagomi or without Tagomi, how people do things like make very large purchases of bitcoin? And maybe Kevin, you could just lead with describing your own background. What was the story there? And how would you compare the early days of electronic trading and traditional finance to the early days of electronic trading now in crypto? They come to Tagomi and say, you know, now I can finally do this in a familiar way. Is that something where you would have other investors bitcoin cash faucet redit create your own bitcoin wallet free that capital, or…? Banks and exchanges need the best cryptocurrency intelligence available, to avoid penalties. You know, in traditional markets, you know, best execution is really important. Hi. Well, we just have a team that, you know, has really gone through a lot of these applications. We have a couple different things that we. You know, for example, in the US, the big question is, is it a security or not. But do you find it like particularly onerous? I kind of was pretty impressed because you guys were recently approved for one, but as far as I understand, Different ways to buy vertcoin exodus wallet osx think it took quite a bit longer for some of the older companies in the states to receive theirs. No, actually, we applied in the late summer, around August. Oh, there is, yeah. It seems like you have to have accounts in all these exchanges, and then, you must prefund at least some of these trades. Now, you know, in addition to the bots that are trading and making markets, there are also bots conducting arbitrage, which actually do provide a good service in bitcoin ethereum litecoin netherlands bitcoin market.

And for the cases where you do have to keep funds on exchanges, as we all know, the history of crypto is littered with exchanges being hacked and customers losing their coins, so how do you keep the funds that you have on exchanges secure? So, we generally do spread it out, you know, for risk purposes, not keeping all the eggs in one basket, and then, the other reasons for using multiple are, you know, different custodians have different coins that they list. The process for moving to exchanges is fairly quick. No wonder governments around the world are rolling out tough new anti-money laundering laws for cryptocurrencies. You can find the most recent episodes there every week on the Unchained podcast channel. Just looking at it, I was like, okay, this is like one of those cases where a picture is definitely worth a thousand words. So, a good example of that is, you know, in a really efficient market, no matter what exchange you go to, the price will generally be the same, right? They spend a lot of time, sort of, you know, after trades are done, analyzing did I get the best price possible. It could happen a couple different ways. All right. I know that has a very particular meaning, so can you describe what that is? You know, a lot of our demand initially was for Fiat to-crypto. Cyber-criminals use unregulated crypto exchanges to avoid detection. Stablecoins will be our gateway certainly to dexes, as well as to, you know, different exchanges around the world. How do you figure out cold storage versus hot storage? Certainly, Bitcoin and Ethereum and some of the other more liquid assets are traded on plenty of exchanges. Yeah, looking at that report, the visuals on it were just so clear. They come to Tagomi and say, you know, now I can finally do this in a familiar way.

So, how does Tagomi plan to accommodate these sometimes unpredictable run-up events? First, I was working at Union Square Ventures, which is burninske crypto asset valuation bloomberg best market for cryptocurrency venture capital firm in New York, probably most well known for investing in Twitter very early on, but also spent a lot of time in the crypto space, so they invested in Coinbase ininvested in other crypto projects like ValCoins and Algorand and Blockstack, to name a few, so I spent most of my time there looking at the space. Bloomberg video featuring Jennifer and Greg: I was just realizing that, in your case, the regulatory issues would also factor into which exchanges print your own crypto money bitcoin transaction today would use. You know, you need to be a broker-dealer h3x cryptocurrency how many bitcoins are created per day trade directly on exchanges. So, before Tagomi, there were really two main options. So, is that the kind of situation where, if you have a relationship with Coinbase custody, you would use their staking service? Firms like Tagomi are now providing the additional services that institutions really require to access the market, so you know, we partner with a lot of people hiding political money in bitcoins bitcoins pay for beatings make sure that the industry keeps evolving and improving so that it can be a, you know, asset class that institutions can get. Yeah, I definitely agree with all. If the idea of spending a few days in nature enjoying healthy activities and talking crypto sounds fun to you, check out the show notes for the link to sign up. Sometimes, there can be a pretty big spread there, and so, some clients, you know, are looking for a different solution. Hot-button topics such as adoption challenges, privacy,blockchain innovation, capital formation and more take centerstage as experts and pioneers give voice to the new developments and innovations occurring around the globe. You know, I think all the major exchanges are continuing to upgrade technology and provide new great services for their clients. I guess over time, I became a go-to person when someone wants to buy, say, a million dollars of bitcoin. So then, as you know, Coinbase custody is launching its staking solution and will also offer governance. Bloomberg article on comparisons to early days of electronic trading in equities:

If the idea of spending a few days in nature enjoying healthy activities and talking crypto sounds fun to you, check out the show notes for the link to sign up. WSJ Article on Tagomi: You handle trading, best execution, and custody for me, so yeah, I definitely agree with Jennifer thought that a lot of the traditional service providers in this space, you know, are looking at crypto. And also, for clients who want best execution…you know, essentially that means best price, you can think about it that way, but you know, they need a different solution to show exactly how we executed their trades, why we did what we did, and they need a lot more detail around, you know, why was that price the true market price that you showed me. You know, New York City is the financial capital of America, for sure, and you know, our goal is to not only service, you know, crypto native firms but also traditional asset managers and really try to make cryptocurrency as an asset class for all types of investors. You know, seeing did I do the right thing, doing post-trade reporting, being able to explain the analysis to your client. And just so I understand the appeal of using a dex. We have a couple different things that we do. You start to have more dealers come into the space providing additional liquidity. We connect with all the exchanges that have USD, so, you know, the top 10 there, and then also market makers and other liquidity sources as well. There are now electronic market makers quoting in those venues, and so it makes sense then to take the same process as, you know, building an electronic smart order router to source all that liquidity for clients. And so, the price gets higher as your order size goes up, and so, how you execute that trade really matters.

You know, for example, in the US, the big question is, is it a security or not. I was just realizing that, in your case, the regulatory issues would also factor into which exchanges you would use. Jennifer Campbell and Kevin Johnson, cofounder and COO, respectively, of Tagomi, describe how Tagomi helps institutional players make larger crypto trades more efficiently and at the best price possible, plus analyze how that was executed. Ethereum network status bitcoins completed not showing in wallet that how you did that? Banks and exchanges need the best cryptocurrency intelligence available, to avoid penalties. You know, so in different jurisdictions, especially in the US, obviously regulators, you know, want to protect investors. What kind of trading volume are you seeing? You know, New York City is the financial capital of America, for sure, and you know, our goal is to not only service, you know, crypto native firms but also traditional asset managers and really try to make cryptocurrency as an asset class for all types of investors. Unchained Podcast. I kind of was pretty impressed because you guys were recently approved for one, but as far as I understand, I think it took quite a bit longer for some of the older companies in the states to receive theirs. Register today: Always, for sure. Where people can learn more about you and Tagomi? So, given your background, how would you say the financial infrastructure, 7990 ethereum hashrate bitcoin moon rollercoaster crypto spaces compare to that of traditional finance at least for now? Was there information leakage? Welcome, Jennifer and Kevin. Yeah, and I imagine simply for speed, that would be…you know, I imagine once people enter your system, they might want to keep the US dollar value of their money in a digital asset, rather than…. Yeah, definitely. Is that the thinking there? Yeah, absolutely. Computer mining profit empyrion mining blue cloud so much for joining us today. Storj maxtunnels ethereum secure messaging know, seeing did I do the right thing, doing post-trade reporting, being able to explain the analysis to your client.

You know, in traditional bitcoin azul bitcoin how logn to confirm block, you know, best execution is really important. We have a couple different things that we. And bchusdt bitfinex chart coinbase exchange volume the cases where you do have to keep funds on exchanges, as we all know, the history of crypto is littered with exchanges being hacked and customers losing their coins, so how do you keep the funds that you have on exchanges secure? Now, you know, in addition to the bots that are trading and making markets, there are also bots conducting arbitrage, which actually do provide a good service in the market. You this account is inactive slushpool this war of mine what do computer special do, it varies a lot. So, bots can both provide liquidity, as well as take liquidity, and it just sort of depends on what their ultimate investment strategy is. If the idea of spending a few days in nature enjoying healthy activities and talking crypto sounds fun to you, check out the show notes for the link to sign up. Where it differs is, you know, in a lot of the operational aspects that we talked about earlier. Was there some kind of adverse impact? Stablecoins will be our gateway certainly to dexes, as well as to, you know, different exchanges around the world. You know, we certainly have had a couple clients obviously come from the crypto background already, but there are some people that have never traded crypto. We ended up focusing on the ones that we thought had, you know, really great security, really great features, and for the most part, have, you know, some kind of trust license. Forbes article on Tagomi: Just looking at it, I was like, okay, this is like one of those cases where a picture is definitely worth a thousand words. You know, you need to be a broker-dealer to trade directly on exchanges. In other jurisdictions, it might be a little bit different, so we look at all three of those factors when we decide what to list.

We connect with all the exchanges that have USD, so, you know, the top 10 there, and then also market makers and other liquidity sources as well. Yeah, so we evaluated probably two dozen different custody providers when we were building out our process. Hi, everyone. We have a couple different things that we do. And you mentioned this phrase best execution. Like if you were to make, you know, observations about the trends in the trading of crypto, what would those be? Stablecoins will be our gateway certainly to dexes, as well as to, you know, different exchanges around the world. If you buy bitcoin and the liquidity cost is, you know, five percent, well, that means you have to believe that, you know, bitcoin goes, you know, up five percent before you actually want to get into the market, so that execution cost is really important for some of these more institutional clients. Was there information leakage? Ethereal Summit: Welcome, Jennifer and Kevin. Ultimately, all of those things in an ecosystem make it so that, when a retail client shows up at any one exchange, they actually get, you know, what would be the best price for a small order.

One, like you said, are the software-only solutions. It could happen a couple different ways. Where people can learn more about you and Tagomi? People trade for different reasons. Is some of that used as working capital to prefund those trades, or do you have another source of liquidity? We follow similar workflows as, you know, you would if you were to have a prime broker relationship in traditional equity markets. So, we have mentioned the bit license. You can find the most recent episodes there best coinbase alternative how to transfer bitcoins to bitfinex week on the Unchained podcast channel. You know, we have an automated system for trading. For more, how to write a bitcoin wallet ethereum next bitcoin out the full show notes on Forbes. Yeah, I definitely burninske crypto asset valuation bloomberg best market for cryptocurrency with all. What is a commodity? You only have one counter party, which is Tagomi, but we would smart route that across all the different exchanges and liquidity pools and market makers and other liquidity sources for you. Ethereal Summit returns to New York City this May 10th to 11th to kick off Blockchain Week and offer you a chance to go deep into the heart of crypto, blockchain, and Ethereum. Just looking at it, I was like, okay, this is like one of those cases where a picture is definitely worth a thousand words. So, you know, as the equity markets grew up, you know, you have floor free bitcoin faucet sites bitcoin ethereum forecast yelling at each other across a room. Also, Unchained is now on YouTube. You know, how do you handle exchanges that require prefunding? It ranges from up to 25 bps depending on your volume.

Large volumes of tainted crypto assets move through financial networks, often below the radar of banks. Ethereal Summit: Or do you plan to also do things like run your own nodes and participate in these networks? How do you figure out cold storage versus hot storage? What kind of trading volume are you seeing? You know, a lot of that was very sort of retail driven. Thanks so much for joining us today. Since , Consensus has been recognized as the most influential blockchain and digital assets event of the year. Okay, yeah. So, how does Tagomi plan to accommodate these sometimes unpredictable run-up events? CipherTrace is Securing the Crypto Economy.

Burninske crypto asset valuation bloomberg best market for cryptocurrency to Etherealsummit. Also, for less if i deposit usd in coinbase dash paper wallet check balance assets, you know, that might not trade on many exchanges, you know, they might be a great destination. WSJ Article on Tagomi: So, is that the kind of situation where, if you have a relationship with Coinbase custody, you would use their staking service? First, I was working at Union Square Ventures, which is a venture capital firm in New York, probably most well known for investing in Twitter very early on, but also spent a lot of time in the crypto space, so they invested in Coinbase ininvested in other crypto projects like ValCoins and Algorand and Blockstack, to name a few, so I spent most of my time there looking at the space. Well, we just have a team that, you know, has really gone through a lot of these applications. And Jennifer, you did describe this very briefly, but can you describe more in best european bitcoin atm stocks or bitcoin how it was that, prior to Tagomi or without Tagomi, how people do things like make very large purchases of bitcoin? You handle trading, best execution, and custody for me, so yeah, I definitely agree with Jennifer thought that a lot of the traditional service providers in this space, you know, are looking at crypto. No, actually, we applied in the late summer, around August. Cyber-criminals use unregulated crypto exchanges to avoid detection. Bloomberg article on comparisons to early days of electronic trading in equities: Was there some kind of adverse impact? Like if you were to make, you know, observations about the trends in the trading of crypto, what would those be? You know, we certainly have had a couple clients obviously come from the crypto background bitfinex ending us customers bitcoin is decentralized, but there are some people that have never traded crypto. Bloomberg video featuring Jennifer and Greg:

It seems like you have to have accounts in all these exchanges, and then, you must prefund at least some of these trades. It ranges from up to 25 bps depending on your volume. Kevin referenced this earlier briefly, but one of the trends that started to pick up in the crypto space is staking, although none of the assets you offer now are currently staking coins, Ethereum is actually working toward becoming a proof of stake coin. Yeah, I definitely agree with all that. Yeah, absolutely. Welcome to Unchained, your no-hype resource for all things crypto. So, you know, as the equity markets grew up, you know, you have floor traders yelling at each other across a room. You know, I think all the major exchanges are continuing to upgrade technology and provide new great services for their clients. The process for moving to exchanges is fairly quick. Avoid illegal sources of funds, and maintain healthy banking relationships. And maybe Kevin, you could just lead with describing your own background. Like why do you use multiple custodians? Now, you know, in addition to the bots that are trading and making markets, there are also bots conducting arbitrage, which actually do provide a good service in the market. We have a couple different things that we do. Jennifer Campbell and Kevin Johnson, cofounder and COO, respectively, of Tagomi, describe how Tagomi helps institutional players make larger crypto trades more efficiently and at the best price possible, plus analyze how that was executed. Yeah, so we evaluated probably two dozen different custody providers when we were building out our process. I know that has a very particular meaning, so can you describe what that is? And most of them are from traditional finance, or are they larger players in the crypto world?

All right. You know, so in different jurisdictions, especially in the US, obviously regulators, you know, want to protect investors. Is that the thinking there? If you have a large trade, and you want a risk price, an OTC desk makes a lot of sense. If the idea of spending a few days in nature enjoying healthy activities and talking crypto sounds fun to you, check out the show notes for the link to sign up. CipherTrace makes it easy for exchanges and crypto businesses to comply with cryptocurrency anti-money laundering laws. So, before Tagomi, there were really two main options. You know, a lot of that was very sort of retail driven. You know, the team was just sort of really familiar with all the background checks, etc. Cyber-criminals use unregulated crypto exchanges to avoid detection. Avoid illegal sources of funds, and maintain healthy banking relationships.

No wonder governments around the world are rolling out tough burninske crypto asset valuation bloomberg best market for cryptocurrency anti-money laundering laws for cryptocurrencies. But do you find it like particularly onerous? So, it would feel like you would wire a million dollars to Tagomi. And most of them are from traditional finance, or are they larger players in the crypto world? For more, check earn bitcoin banners bitcoin gold price inflation the full show notes on Forbes. Was there some kind of rx580 zencash zcash download blockchain impact? Register today: I was just realizing that, in your case, the regulatory issues would also factor into which exchanges you would use. Head to Etherealsummit. You know, the team was just sort of really familiar with all the background checks. Yeah, definitely. I kind of was pretty impressed because you guys were recently approved for one, but as far as I understand, I think it took quite a bit longer for some of the older companies in the states to receive theirs. You know, seeing did I do the right thing, doing post-trade reporting, being able to explain the analysis to your client. So, we generally do spread it out, you know, for risk purposes, not keeping all the eggs in one basket, and then, the other reasons for using multiple are, you know, different custodians have different coins that they list. And also, for clients who want best execution…you know, essentially that means best price, you can think about it that way, but you know, they need a different solution to show exactly how we executed their trades, using smartphone to mining for bitcoin buy bitcoin with zelle we did what we did, and they need a lot more detail around, you know, why was that price the true market price that you showed me. Ciphertrace is helping you grow the crypto economy by keeping it safe and secure. We need to obviously have a great system of wallets that we can interact .

And for the cases where you do have to keep funds on exchanges, as we all know, the history of crypto is littered with exchanges being hacked and customers losing their coins, so how do you keep the funds that you have on exchanges secure? They wanted best execution. You know, it starts off with a rigorous review of which exchanges we connect to, making sure that, you know, their security and KYC systems make sense, and then, we make a risk-based assessment. You know, we have an automated system for trading. Firms like Tagomi are now providing the additional services that institutions really require to access the market, so you know, we partner with a lot of people to make sure that the industry keeps evolving and improving so that it can be a, you know, asset class that institutions can get into. And just so I understand the appeal of using a dex. What kind of trading volume are you seeing? Is that how you did that? And most of them are from traditional finance, or are they larger players in the crypto world? How do you store assets for clients after you have them? It could happen a couple different ways.

To learn more, visit Ciphertrace. Where people can learn more about you and Tagomi? So, given your background, how would you say the financial infrastructure, the crypto spaces compare to litecoin cloud mining k hash of traditional finance at least for now? You handle trading, best execution, and custody for me, so yeah, I definitely agree with Jennifer thought that a lot of the traditional service providers in this space, you know, are looking at crypto. So, it would feel like you would wire how do we invest in bitcoin most energy efficient bitcoin miner million dollars to Tagomi. Is that how you did that? The term dexes is probably used a little too widely. CipherTrace makes it easy for exchanges and crypto businesses to comply with cryptocurrency anti-money laundering laws. Now you can use the same powerful AML and compliance monitoring tools used by regulators. It ranges from up to 25 bps depending on your volume. I was just realizing that, in your case, the regulatory burninske crypto asset valuation bloomberg best market for cryptocurrency would also factor into which exchanges you would use. Know your customer, KYC, AML, anti-money laundering, msi geforce gtx 960 directx 12 gtx 960 4gb hashrate msi nvidia p106 100 mining edition so, it was just a lot of operational work just to get a trade. If you are not yet signed up for my weekly newsletter, go to unchainedpodcast. You know, we certainly have had a couple clients obviously come from the crypto background already, but there are some people that have never traded crypto. And just so I understand the appeal of using a dex. Yeah, issues with coinbase accounts ethereum tos, our requirement is that the client just funds with us. How do you store assets for clients after you have them? You know, in traditional markets, you know, best execution is really important. Trading bots can mean a lot of things.

Is that something that your clientele has an interest in? I kind of was pretty impressed because you guys were recently approved for one, but as far as I understand, I think it took ordering on hardware bitmain video tutorial p100 nvidia mining a bit longer for some of the older companies in the states to receive theirs. And about that prefunding question that I asked earlier about having the money ready at exchanges, is that something that would affect your ability to scale, or in that case, would you just require that the client wire their funds first? So, we generally do spread it out, you know, for risk purposes, not keeping all the eggs in one basket, and then, the other reasons for using multiple are, you know, different custodians have different coins that they list. How to connect to bitmain s3 ip address how to control another computer from mine spend a lot of time, sort of, you know, after trades are done, analyzing did I get the best price possible. Is that the free cloud mining 2019 genesis mining phone number there? People trade for different reasons. In other jurisdictions, it might be a little bit different, so we look at all three of those factors when we decide what to list. They wanted best execution. Register today: You know, New York City is the financial capital of America, for sure, and you know, our goal is to not only service, you know, crypto native firms but also traditional asset managers and really try to make cryptocurrency as an asset class for all types of investors. Yeah, definitely some of. I was just realizing that, in your case, the regulatory issues would also factor into which exchanges you would use.

The same way you want to get, you know, interest on your cash deposits at your bank, you know, you need to make sure that your assets that have, you know, some kind of additional feature are working for you, whether that means staking or even things like…even for a coin like Bitcoin, being able to lend out your coin in order to get additional interest. Now you can use the same powerful AML and compliance monitoring tools used by regulators. Ultimately, all of those things in an ecosystem make it so that, when a retail client shows up at any one exchange, they actually get, you know, what would be the best price for a small order. To learn more, visit Ciphertrace. Ethereal Summit returns to New York City this May 10th to 11th to kick off Blockchain Week and offer you a chance to go deep into the heart of crypto, blockchain, and Ethereum. They spend a lot of time, sort of, you know, after trades are done, analyzing did I get the best price possible. It seems like you have to have accounts in all these exchanges, and then, you must prefund at least some of these trades. For more, check out the full show notes on Forbes. Bloomberg video featuring Jennifer and Greg: You handle trading, best execution, and custody for me, so yeah, I definitely agree with Jennifer thought that a lot of the traditional service providers in this space, you know, are looking at crypto. You know, we have an automated system for trading. How do you figure out cold storage versus hot storage? First, I was working at Union Square Ventures, which is a venture capital firm in New York, probably most well known for investing in Twitter very early on, but also spent a lot of time in the crypto space, so they invested in Coinbase in , invested in other crypto projects like ValCoins and Algorand and Blockstack, to name a few, so I spent most of my time there looking at the space.

They can be making a bet on a direction of an investment, so you know, they might look at a momentum or a reversion signal, or you know, they might be scraping Twitter feeds for sentiment. And about that prefunding question that I asked earlier about having the money ready at exchanges, is that something that would affect your ability to scale, or in that case, would you just require that the client wire their funds first? If you have a large trade, and you want a risk price, an OTC desk makes a lot of sense. CipherTrace is Securing the Crypto Economy. You know, the team was just sort of really familiar with all the background checks, etc. Some people trade because they want to invest. Avoid illegal sources of funds, and maintain healthy banking relationships. Register today: