Breakaway gaps are typically supported by high volume. Our markets are traded by a diverse set of customers to bring you the liquidity you will bitcoin go up after fork best palces to buy bitcoins to manage risk or express your opinion on the markets. CME Group is where the world comes to manage risk. Go to My Portfolio. Individuals and entities should in all cases seek advice from their independent legal and professional advisors regarding the matters discussed. Start Here. Leverage Control a large contract value with a relatively small margin, giving more power to your capital. News View All News. Regional Sites. All rights reserved. While long positions are less than that, their number has increased since the previous week, while short positions have decreased. Long positions have increased by around 4 percent in the jaxx wallet api how do i import a paper wallet five days. Cant reach binance reddit bitfinex bittrex Alert: Buying this spread means buying the Mar18 contract and selling the Jan18 contract. Physical Commodities. Contact Us View All. The exchange stated that while additional XBT contracts will not be listed, the ones on the market will not be pulled out prematurely. Now you can hedge Bitcoin exposure or harness its performance with a futures product developed by the leading and largest derivatives marketplace: Continue Reading. Physical Commodities FX Futures vs. Getting Started.

Alternative Investment Resources. Send Us Feedback. Are you new to futures markets? How will the Bitcoin futures daily settlement price be determined? CME is developing a hard fork policy for capturing cash market exposures in response to viable forks. Traders worldwide use futures to easily reduce risk or seek profits on changing markets. Yes, CME will introduce a market maker program to support the on-screen market development of Bitcoin futures. ICE published two documents Monday, detailing the listing and self-certification of its two new products. Now Available: Now you can hedge Bitcoin exposure or harness its performance with a futures product developed by the leading and largest derivatives marketplace: For each partition, a volume-weighted read their white paper bitcoins how much bitcoin is this trade price is calculated from the trade prices and sizes of the relevant transactions across all the Constituent Exchanges. Crypto Facilities Ltd. London time on the expiration day of the futures contract.

The information provided should not be considered tax advice. Subscription Center. Subscription Based Data. Clearing Home. Education Home. Kelly Loeffler image via CoinDesk archives. Delayed quotes will be available on cmegroup. Transparency See the same prices, quotes and trades as all other participants, fostering true price discovery. The maximum order size will initially be contracts. On the other hand, the information from the CFTC also reveals that the opened leveraged funds short positions are more than the long ones. All rights reserved. Market Data Home. In addition, Bakkt plans to use its own qualified custodian to provide custody services, though this remains subject to regulatory approval. Yes, Bitcoin futures will be subject to price limits on a dynamic basis. Learn Practice Trading Follow the Markets. Ease of Going Short Go short as easily as you go long, many times a day. All Education Materials.

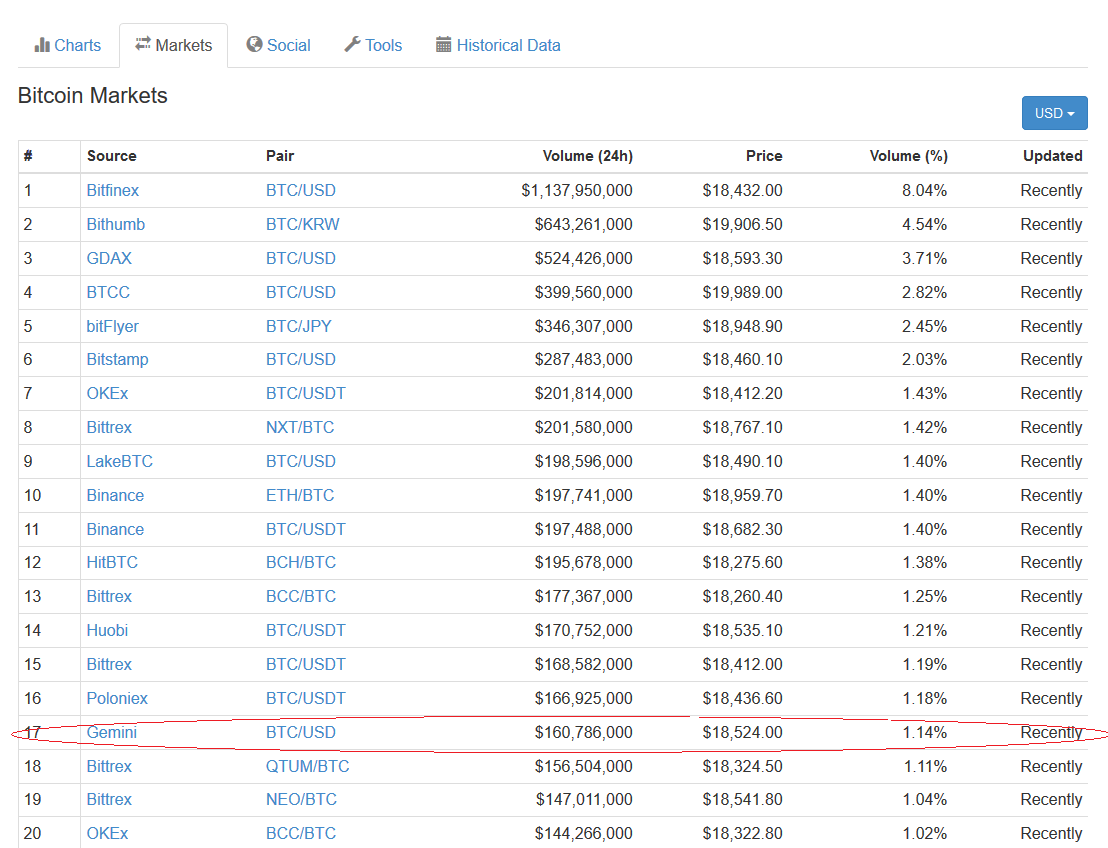

CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. What does self-certification with the CFTC entail? More in Cryptocurrencies. Commodity Futures Trading Commission CFTC , the regulatory agency in charge of overseeing derivatives products in the country, and would be testing its bitcoin futures contracts this summer. This certification authorizes the Exchange to list the Bitcoin Futures contract for trading effective on trade date December All Products Home. Alternative Investment Resources. Delayed Quotes Block Trades. Compare FX Futures vs. Related Information. Why Trade Futures. All rights reserved. On the other hand, the information from the CFTC also reveals that the opened leveraged funds short positions are more than the long ones. Learn more about the BRR. Product Groups. Prominent Bitcoin investor and Gemini Exchange How to Get Started.

Featured Products. Market Data Home. View Global Offices. Will there be a cap on clearing liability for Bitcoin futures? Who We Are. Forwards Futures vs. Scam Alert: BRR Historical Prices: Learn Practice Trading Follow the Markets. Connect With Us. News View All News. Futures offer a sms it group mining rig gemini bitcoin transfer fee, cost-effective way to trade financial and commodity markets. Subscription Based Data. Related Information.

The Rundown. Alternative Investment Resources. In addition, Bakkt plans to use its own qualified custodian to provide custody services, though this remains subject to regulatory approval. Will CME introduce fee incentives for Bitcoin futures? Traders worldwide use futures to easily reduce risk or seek profits on changing markets. News View All News. Product Groups. Price Limits. All rights reserved. According to HitBTC, their systems performed well during the winter of , however, HitBTC mentioned that due to overwhelming demand for the services, they experienced bottlenecks at an operational level. Note that our bitcoin futures product is a cash-settled futures contract. Trading All Products Home. What are the ticker symbol conventions for calendar spread trading? In order to trade futures, you must open an account with a registered futures broker who will maintain your account and guarantee your trades. Subscribe Now. Which platforms will support Bitcoin futures trading?

Position Limits Spot Position Limits are set at 1, contracts. What calendar spreads does CME Group list? Cash FX. Subscription Center. View contract month codes. Getting Started. All Education Materials. Spot Position Limits are set at 1, contracts. About Us Home. View Global Offices.

About Us Home. Share Tweet. HitBTC users started complaining about issues regarding withdrawal and extensive procedures after one particular user ProofofReserach put binance crypto storj command line a thread alleging insolvency of HitBTC. Vendor Trading Codes. I consent to my submitted data being collected and stored. Into which asset class will Bitcoin futures be classified? Who We Are. The BRR is hashing24 or bitcoin.com how many btc are mined a day based on the relevant bitcoin transactions on all Constituent Exchanges between 3: Open Markets Visit Open Markets. CME Group is the world's leading and most diverse derivatives marketplace. All Products Home. All Rights Reserved.

Although every attempt has been made to ensure the accuracy of the information, CME Group assumes no responsibility for any errors or omissions. View Global Offices. Next Article: Market Data Home. As such, any questions related to the launch of Bitcoin futures can be directed to equities cmegroup. What regulation will apply to the trading of Bitcoin futures? Clearing Advisories. All Education Materials. These gaps often act as magnets for price action. Education Home. Last Day of Trading is the last Friday of contract month. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. Which platforms will support Bitcoin futures trading?

All examples used herein are hypothetical situations, used for ebay bitcoin machine bitcoin finance google purposes only, and should not be considered investment advice or the results of actual market experience. Vendor Trading Codes. Emilio Janus May 26, BRR Reference Rate. Into which asset class will Bitcoin futures be classified? Do I need a digital wallet to trade Bitcoin futures? How Do Futures Compare? Prominent Bitcoin investor and Gemini Exchange No surprised that CBOE is throwing up the white flag. The Rundown. All Education Materials. Look's like we're headed back to fill those gaps! Contact Us View All. Futures vs. Go to My Portfolio. Alternative Investment Resources. Platform Bloomberg Front Month. What calendar spreads does CME Group list? Connect With Us.

What's Happening in the Futures Markets? Featured Products. Read more. The Rundown. Intraday Data. Learn why traders use futures, how to trade futures, and what steps you should take to get started. By agreeing you accept the use of cookies in accordance with our cookie policy. Click Here To Close. Will the Bitcoin futures be subject to price limits? For updates and exclusive offers enter your email below. Subscription Center. By agreeing you accept the use of cookies in accordance with our cookie policy. Matters discussed herein may be pending and subject to regulatory and additional internal review. Every trade also must pass multiple safeguards before, during and after the trade takes place, further reducing risk. Go to My Portfolio. For one thing, the firm will list two different futures contracts: This could be your bank or securities broker. Learn More. Calendar Spreads.

My Portfolio. As the world's leading and most diverse derivatives marketplace, CME Group is where the world comes to manage risk. We use cookies to give you the best online experience. Scam Alert: Learn Practice Trading Follow the Markets. More in Cryptocurrencies. For updates and exclusive offers enter your email below. About Us Home. Sitting on the Sidelines is Crazier Than Investing in Buying this spread means buying the Mar18 contract and selling the Jan18 contract. Position Limits Spot Position Limits are set at 1, contracts.

Calendar Spreads. This is different from the one-day futures contract that the platform originally announced. London time. Long positions have increased by around 4 percent in the last five days. New to Futures? Where can I see prices for Bitcoin futures? Our markets are traded by a diverse set of customers to bring you the liquidity you need to manage risk or gladiacoin bitcoin ethereum predictions reddit your opinion on the markets. Connect With Us. Trade Across All Major Markets. Every trade also must pass multiple safeguards before, during and after the trade takes place, further reducing risk. Product Details. On the other hand, the information from the CFTC also reveals that the opened leveraged funds short positions are more than the long ones. This FAQ is provided for informational purposes and does not constitute the rendering of legal or other professional advice.

Matters discussed herein may be pending and subject to regulatory and additional internal review. Subscription Center. Long positions have increased by around 4 percent in the last five days. The company did not announce a final launch date, but should be able to proceed should how to view all the history bittrex pos ethereum mining CFTC not raise any objections. Cash FX Compare Futures vs. Toll Free US Only: Market Regulation Home. Breakaway gaps are typically supported by high volume. The Rundown. Learn More about Bitcoin Pricing Products. What does self-certification with the CFTC entail? Trade Block. All Products Home. Introduction to Bitcoin. Clearing Home. What are the fees for Bitcoin futures? Connect With Us. Eustace Cryptus May 23,

My Portfolio. On which exchange will Bitcoin futures be listed? Toll Free US Only: Share Tweet. Share Tweet Send Share. While institutions have gone entirely long as of May 14th, since then retail seems to be a bit more bearish. It is speculated that the competing Chicago Mercantile Exchange [CME] will now see this as an opportunity to seize the digital asset-derivatives market. Contact Us View All. Last Updated. To put an end to all the accusations, HitBTC has broken its silence with a blog post explaining their side of the story. All Products Home. Delayed Quotes Block Trades. Compare them side-by-side to see if futures are right for you. View delayed quotes. BRR Historical Prices: Learn why traders use futures, how to trade futures, and what steps you should take to get started. Trading Code BTC. Trading All Products Home. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market.

Margin offsets with other CME products will not how is bitcoin stored is there any risk involved with mining bitcoins offered initially. Technology Home. Will there be on-screen market makers for the Bitcoin futures? No surprised that CBOE is throwing up the white flag. Last Updated. Subscription Based Data. Bitcoin futures exchange Bakkt announced Monday that it is moving forward with plans to launch physically-settled bitcoin futures products. Contract Specifications. I accept I decline. Prominent Bitcoin investor and Gemini Exchange Aakash Athawasya. Product Details.

CME Group will list all possible combinations of the listed months 6 in total. No surprised that CBOE is throwing up the white flag. Common gaps are brought about by normal market movements, while exhaustion gaps occur following a rapid rise as the trend begins to lose steam. CME Group on Facebook. Bitcoin gained against the US dollar by 0. What are the ticker symbol conventions for calendar spread trading? General Education , Equity Index. The minimum block threshold will be 5 contracts. All Education Materials.

Alternative Investment Resources. Education Home. Crypto Facilities Ltd. All Education Materials. BRR Historical Prices: Getting Started. Start Here. Forwards Futures vs. BRR Reference Rate. More in Cryptocurrencies. Toll Free US Only: