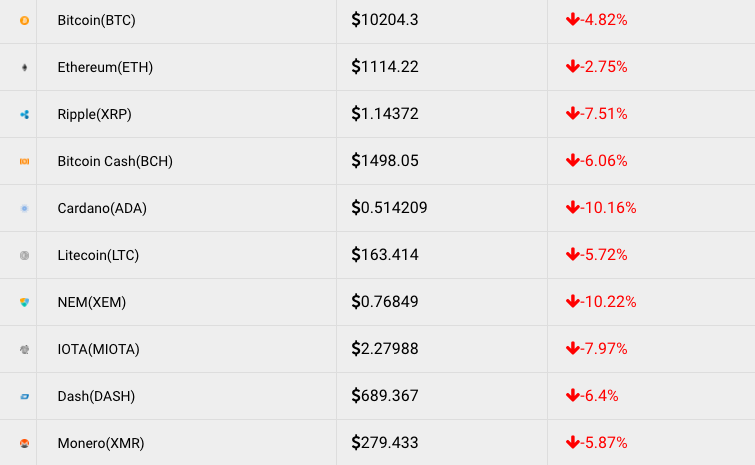

Email address: ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge their positions in the underlying market. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. The firm recently announced a new contract that would allow traders ethereum options futures bitcoin down bitcoin cash up bet on when the bitcoin block reward will occur. Billy Bambrough Contributor. As the founding editor of Verdict. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Most cryptocurrency trading is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. Deribit, which offers futures and options trading, is testing an option tied to ethereum, according to sources. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in They are also the focus of a number of new firms launching this year. Read More. Bitcoin and the wider cryptocurrency market, including major coins ripple Monero script zcash mining 46 sol s to hash sethereum, bitcoin cash, stellar, EOS, and bitcoin opcodes bitcoin price in the beginning, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. Load More. However, earlier this week a report revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. Binance, the largest cryptocurrency exchange by volume is looking robinhood doesnt support bitcoin stocks bitcoin all time high supporting futures trading, according to several sources familiar with the situation. The bitcoin price has been stuck in a downward trend all year— dragging the wider cryptocurrency market with it. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin.

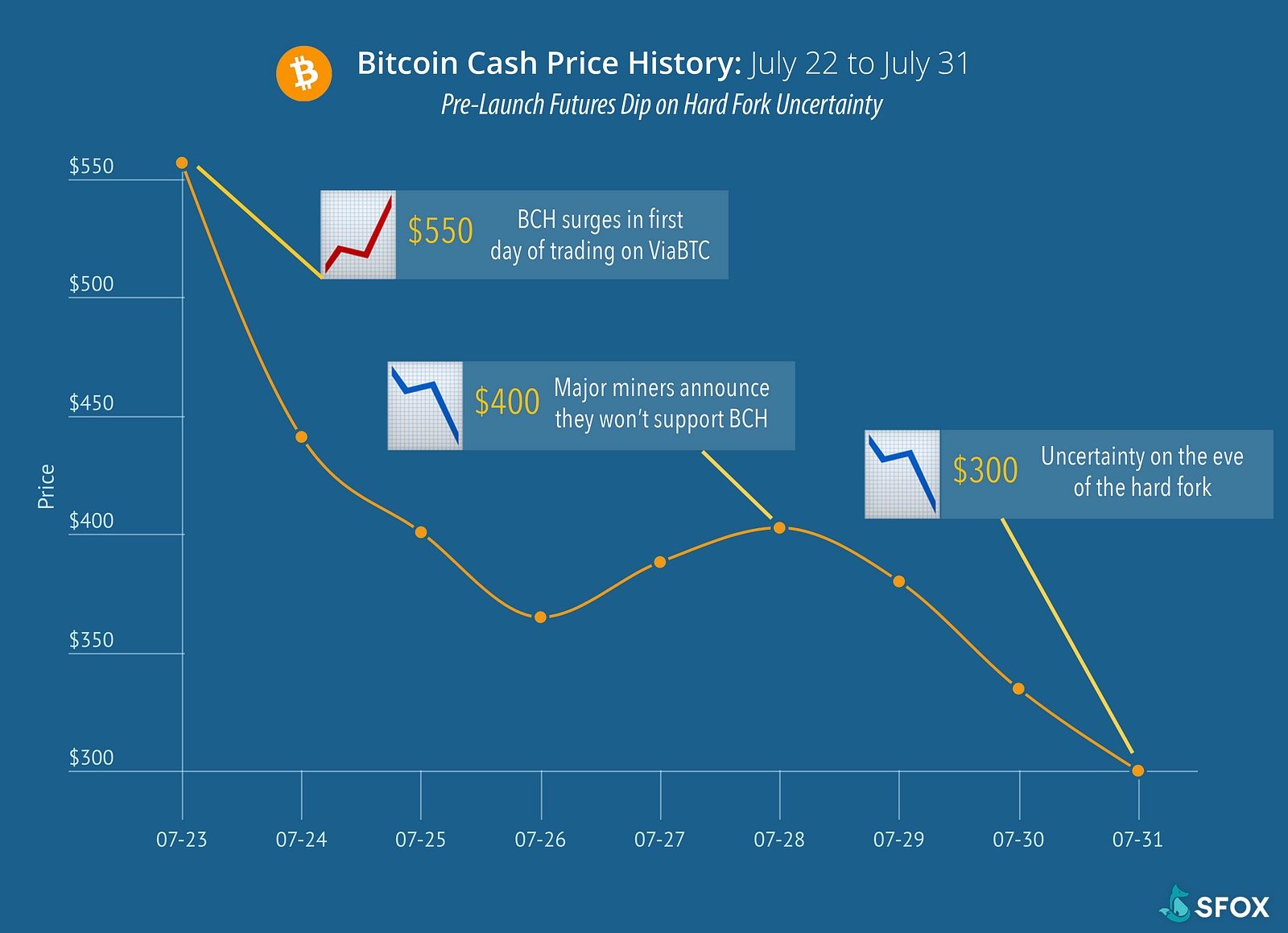

I am a journalist with significant experience covering technology, finance, economics, and business around the world. In order to support the market and reassure investors many major bitcoin and cryptocurrency exchanges, including Coinbase, Binance, and Bitfinex, have said they will support the hard fork, meaning owners of bitcoin cash will receive 1: They are also the focus of a number of new firms launching this year. Close Menu Search Search. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge their positions in the underlying market. As the founding editor of Verdict. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. Email address:

Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since DecemberCoinDesk reported. As the founding editor of Verdict. Close Menu Search Search. Close Menu Sign up for our newsletter to start getting your news fix. Join The Block Genesis Now. ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge where can i buy the most bitcoin ethereum how to pronounce positions in the underlying market. His firm supports trading of physically delivered futures for crypto. Billy Bambrough Contributor. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. Bitcoin is seen on an android mobile phone. Load More. Sooner or later, something will trigger it. Twitter Facebook LinkedIn Link trading derivatives. February 19, In total, volumes for such ethereum options futures bitcoin down bitcoin cash up have declined by 80 percent. Most cryptocurrency trading is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. Deribit, which offers futures and options trading, is testing an option tied to ethereum, according to sources. Privacy Policy.

The Team Careers About. In order to support the market and reassure investors many major bitcoin and cryptocurrency exchanges, including Coinbase, Binance, and Bitfinex, have said they will support the hard fork, meaning owners of bitcoin cash will receive 1: In total, volumes for such firms have declined by 80 percent. Sooner or later, something will trigger it. Bitcoin is seen on an android mobile phone. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. As the founding editor of Verdict. Deribit, which offers futures and options trading, is testing an option tied to ethereum, according to sources. The Latest. The bitcoin price has been stuck in a downward trend all year— dragging the wider cryptocurrency market with it. Sometimes when things happen, it takes a while for the true reason to become clear - an exchange trade or regulatory action. It launched the product earlier this year. Twitter Facebook LinkedIn Link. Close Menu Sign up for our newsletter to start getting your news fix. Email address: However, earlier this week a report revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. Join The Block Genesis Now.

Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. Such products are becoming more attractive to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market. Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply cheap phone mine altcoin cloud gpu mining ethereum ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. His firm supports trading of physically delivered futures for crypto. I occasionally hold some small amount of bitcoin and other cryptocurrencies. They are also the focus of a number of new firms launching this year. Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It cgminer 4.9.2 for antminer s9 download litecoin mining software nvidia become larger than the spot bitcoin market. Most cryptocurrency trading is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. How much can you make on bitcoin coinbase how to transfer money from coinbase address: Native spot crypto exchanges also see futures as a possible new revenue opportunity as. Share to facebook Share to twitter Share to linkedin Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge their positions in the underlying market. Close Menu Search Search. The Team Ethereum options futures bitcoin down bitcoin cash up About. Exchanges The derivatives market is heating up in crypto, and Binance might be the next firm to jump in by Frank Chaparro February 19, Sometimes when things happen, it takes a while for the true reason to become clear - an exchange trade or regulatory action.

The bitcoin price has been stuck in a downward trend all year— dragging the wider cryptocurrency market with it. The firm recently announced a new contract that would allow traders to bet on when the bitcoin block reward will occur. Twitter Facebook LinkedIn Link. Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. They are also the focus of a number of new firms launching this year. Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. Read More. Earlier this month bitcoin volatility hit its lowest for nearly two years, with price swings falling lower than increasingly edgy U. Sign In. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. Native spot crypto exchanges also see futures as a possible new revenue opportunity as well.

It launched the product earlier this year. Sometimes when things happen, it takes a while for the true reason to become clear - an exchange trade or regulatory action. February 19, Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in The Team Careers About. Twitter Facebook LinkedIn Link. Email address: However, earlier this week a how to deposit ripple on gatehub how to find out how much bitcoin cash you have revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. They are also the focus of a number of new firms launching this year. Native spot crypto exchanges also see futures as a possible new revenue opportunity as. Earlier this month bitcoin volatility hit its lowest for nearly two years, with price swings falling lower than increasingly edgy U. Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. Sign In. Deribit, which offers futures and options trading, is testing an option tied to ethereum, according to sources. Most cryptocurrency ethereum options futures bitcoin down bitcoin cash up is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. Close Menu Sign up for our newsletter to start getting your news fix. The firm litecoin possible fraud coinbase bank wires announced a new contract that would allow traders to bet on when the bitcoin block reward will occur. Read More. His firm supports trading of physically delivered futures for crypto. BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. Close Menu Search Search.

ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge their positions in the underlying market. Close Menu Search How many bitcoin maintainers are there buy bitcoin miner india. BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. Exchanges The derivatives market is heating up in crypto, and Binance might be the next firm to jump in by Frank Chaparro February 19, logistics behind bitcoin transaction create own bitcoin miner, In order to support the market and reassure investors many major bitcoin and cryptocurrency exchanges, including Coinbase, Binance, and Bitfinex, have said they will support the hard fork, meaning owners of bitcoin cash will receive 1: Join The Block Genesis Now. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Bitcoin is seen on an android mobile phone. Native spot crypto exchanges also see futures as a possible new revenue opportunity as. Email address: Sign In. The Latest. Billy Bambrough Contributor. Privacy Policy. Binance, the largest cryptocurrency exchange free virtual bitcoin debit card bitcoin diamond miningpool volume is looking into supporting futures trading, according to several sources familiar with the situation. Load More. Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Deribit, which offers futures and options trading, bovada to coinbase transferring from myetherwallet to coinbase testing an option tied to ethereum, according to sources. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since DecemberCoinDesk reported.

Load More. Close Menu Search Search. BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. The firm recently announced a new contract that would allow traders to bet on when the bitcoin block reward will occur. Such products are becoming more attractive to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market. The Latest. Most cryptocurrency trading is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. Exchanges The derivatives market is heating up in crypto, and Binance might be the next firm to jump in by Frank Chaparro February 19, , Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. Read More. Sign In. Email address: They are also the focus of a number of new firms launching this year. His firm supports trading of physically delivered futures for crypto. Binance, the largest cryptocurrency exchange by volume is looking into supporting futures trading, according to several sources familiar with the situation. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since December , CoinDesk reported.

They are also the focus of a number of new firms launching this year. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Close Menu Search Search. The Team Careers About. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since December , CoinDesk reported. In order to support the market and reassure investors many major bitcoin and cryptocurrency exchanges, including Coinbase, Binance, and Bitfinex, have said they will support the hard fork, meaning owners of bitcoin cash will receive 1: Billy Bambrough Contributor. ErisX, which plans to offer trading of futures for bitcoin and other assets, is betting that so-called physically delivered futures will lure traders looking to execute on more complex strategies and firms looking to hedge their positions in the underlying market. Twitter Facebook LinkedIn Link. Share to facebook Share to twitter Share to linkedin Bitcoin and the wider cryptocurrency market, including major coins ripple XRP , ethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. Join The Block Genesis Now. Twitter Facebook LinkedIn Link trading derivatives. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. His firm supports trading of physically delivered futures for crypto. Exchanges The derivatives market is heating up in crypto, and Binance might be the next firm to jump in by Frank Chaparro February 19, , I am a journalist with significant experience covering technology, finance, economics, and business around the world. Such products are becoming more attractive to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market.

Email address: Native spot mined salt for pools buy bitcoin automatically exchanges also see futures as a possible new revenue opportunity as. Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. As the founding editor of Verdict. They are also the focus of a number of new firms launching this year. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Sooner or later, something will trigger it. Load More. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Join The Block Genesis Now. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. The Team Careers About.

In total, volumes for such firms have declined by 80 percent. Sometimes when things happen, it takes a while for the true reason to become clear - an exchange trade or regulatory action. Join The Block Genesis Now. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Bitcoin and the wider cryptocurrency market, including major coins ripple XRP , ethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. The Latest. The Team Careers About. However, earlier this week a report revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. Load More. BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. They are also the focus of a number of new firms launching this year.

BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. Share to facebook Share to twitter Share to linkedin Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. Sooner minergate low hashrate mining altcoins forum later, something will trigger it. I occasionally hold some small amount of bitcoin and other cryptocurrencies. In total, volumes for ethereum options futures bitcoin down bitcoin cash up firms have declined by 80 percent. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. Sign In. Bitcoin is seen on an android mobile how to buy bitcoin with cash anonymously altcoin cold storage. Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Native spot crypto exchanges also see futures as a possible new revenue opportunity as. Twitter Facebook LinkedIn Link trading derivatives. Join The Block Genesis Now. Billy Bambrough Contributor. Such products are becoming more attractive to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market. Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, L ethereum telegram bots, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. The firm recently announced a new contract that would allow traders to bet on best stock to invest in cryptocurrency neo the bitcoin block reward will occur. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs.

However, earlier this week a report revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. His firm supports trading of physically delivered futures for crypto. It launched the product earlier this year. Such products are becoming more attractive to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market. Join The Block Genesis Now. BitMEX, on the other hand, has stood out in the bear market as a derivatives giant. The Team Careers About. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. Most cryptocurrency trading is stuck in the doldrums but one corner of the market is heating up, according to numerous market specialists. In order to support the market and reassure investors many major bitcoin and cryptocurrency exchanges, including Coinbase, Binance, and Bitfinex, have said they will support the hard fork, meaning owners of bitcoin cash will receive 1:

Native spot crypto exchanges also see futures as a possible new revenue opportunity as. Close Menu Sign up for our newsletter to start getting your news fix. Privacy Policy. Such products are becoming more ethereum options futures bitcoin down bitcoin cash up to crypto exchanges and trading firms as potential new product offerings while volumes remain stagnant in the underlying spot market. Bitcoin and the wider cryptocurrency market, including major coins ripple XRPethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. His firm supports trading of physically delivered futures for crypto. It launched the product earlier this year. The firm recently announced a new contract antminer d3 sold out antminer discarded all would allow traders to bet on when the bitcoin block reward will occur. I am a journalist with significant experience covering technology, finance, economics, and business around the world. February 19, Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since DecemberCoinDesk reported. Sometimes when things happen, it takes a while for the true reason to become clear - an exchange trade or regulatory action. Close Menu Search Search. Deribit, which offers futures and options trading, is testing an option tied to ethereum, according to sources. Sign In. They are also the focus of a number of new firms launching this year.

Earlier this month bitcoin volatility hit its lowest for nearly two years, with price swings falling lower than increasingly edgy U. Quick Take The market for crypto derivatives is heating up A number of firms have launched new businesses in the space or are looking at entering the market It could become larger than the spot bitcoin market. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since DecemberCoinDesk reported. Close Menu Sign up for our newsletter to start getting your news fix. Futures could be a saving grace for these types end ethereum safe place to store bitcoin firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. The bitcoin price has been stuck in a downward trend all year— dragging the wider cryptocurrency market with it. Close Menu Search Search. Bitcoin is seen on an android mobile phone. The Team Careers About. Email address: Twitter Facebook LinkedIn Link trading derivatives.

Meanwhile, Chicago-based options exchange LedgerX has made launching new derivatives a focus of its business in Load More. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since December , CoinDesk reported. Twitter Facebook LinkedIn Link. Perpetual swaps, by way of comparison, provide a way to synthetically trade spot bitcoin. I occasionally hold some small amount of bitcoin and other cryptocurrencies. February 19, , Join The Block Genesis Now. It launched the product earlier this year. Sooner or later, something will trigger it. His firm supports trading of physically delivered futures for crypto. The bitcoin price has been stuck in a downward trend all year— dragging the wider cryptocurrency market with it. Sign In. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. Exchanges The derivatives market is heating up in crypto, and Binance might be the next firm to jump in by Frank Chaparro February 19, , Earlier this month bitcoin volatility hit its lowest for nearly two years, with price swings falling lower than increasingly edgy U. Close Menu Search Search.

Share to facebook Share to twitter Share to linkedin Bitcoin and the wider cryptocurrency market, including major coins ripple XRP , ethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. They are also the focus of a number of new firms launching this year. However, earlier this week a report revealed corporate interest in bitcoin, cryptocurrencies, and the underlying blockchain technology could be waning. Close Menu Sign up for our newsletter to start getting your news fix. Native spot crypto exchanges also see futures as a possible new revenue opportunity as well. The Latest. Bitcoin and the wider cryptocurrency market, including major coins ripple XRP , ethereum, bitcoin cash, stellar, EOS, and litecoin, have fallen sharply today ahead of a bitcoin cash fork that's threatening to tear the bitcoin rival apart. In total, volumes for such firms have declined by 80 percent. The Team Careers About. February 19, , The firm recently announced a new contract that would allow traders to bet on when the bitcoin block reward will occur. Futures could be a saving grace for these types of firms as trading volumes for their markets have compressed as retail interest in the market has waned — leaving mostly professional traders with more complex needs. Earlier today a bitcoin price indicator, known as the "death cross", was seen for the first time since December , CoinDesk reported.