The best highest bid price is the first element and the worst lowest bid price is the last element. The type can be either limit or marketif you want a stopLimit type, use params overrides, as described here: Notice that the order b has disappeared, the selling order also isn't. For the examples above, this would look like. This does not influence most of the orders but can be significant in extreme cases of very large or very small orders. This is true for all methods that query orders or manipulate place, cancel or edit orders in any way. Specifies the required minimal delay between two consequent HTTP requests to the same exchange. You can deposit money and trade in Bittrex without verification but in order to withdraw, you need verification. Volume is an important parameter for making analysis. Be careful when specifying the tag and the address. Most of exchanges that implement this type of pagination will either return the next cursor within the response itself or will return the next cursor values within HTTP response headers. All exchanges are derived from the base Exchange class and share a set of common methods. Charts may look complicated at first, you may recall Bitcoin to usd to buy things ether definition ethereum trading movies or traders with tens of screens in front of them and seem like they are solving the secret of the universe. If is there a difference between buying cryptocurrency xrp stock history amount comes due to a sell order, then it is associated with a corresponding trade type ledger entry, and the referenceId will contain associated trade id if the exchange in question provides it. Upon a subsequent call to an emulated fetchOrderfetchOrders or fetchClosedOrders method, the exchange instance will send a single request to fetchOpenOrders and will compare currently fetched open orders with the orders stored in cache previously. A trade is generated for the order i against the incoming sell order. Note that your private requests will fail with an exception or error if you don't set up your API credentials before you start trading. Methods for predicting price trends Forecasting price movements of anything traded at an exchange is a risky probabilities game — nobody is right all the time. An associative array of markets indexed by exchange-specific ids. It has irritating trading rules such that, you have a minimum order value of 0. How to literally read the prices?

It often means registering with exchanges and creating API keys with your account. Understanding Bitcoin Price Charts. Coinbase increase instant buy limit bitcoin wallet software for windows get a list of all available methods with an exchange instance, you can simply do the following:. This exception is thrown when an exchange server replies with an error in JSON. Some exchanges also require a symbol even when fetching a particular order by id. This kind of chart can be used to get a quick overview of what prices have been doing lately, but traders need more data to draw their conclusions. Python import random if exchange. The next section describes the inner workings of the. Order b is matched against the incoming sell because their prices intersect. It is an associative array a dictionary, empty by default containing the params you want to override. You have to what are poloniex trading fees bitstamp when candle closes up and create API keys with their websites. Crypto trading bots are continuing to evolve in sophistication and functionality — with new players entering the market routinely. However, very few exchanges if any at all will return all orders, all trades, all ohlcv candles or all transactions at. Attempting to parse the symbol string is highly discouraged, one should not rely on the symbol format, it is recommended to use market properties instead. Open orders will list your open orders unless they are completely filled and below you will see coinbase reddcoin bittrex buying litecoin with usd 24h order history. Some exchanges also require a symbol to fetch an order by id, where order ids can intersect with various trading pairs. In order to approve your withdrawal you usually have to either click their secret link in your email inbox or enter a Google Authenticator code or an Authy code on their website to verify that withdrawal transaction was requested intentionally. In some cases you are unable to create new keys due to lack of permissions or. This aspect is not unified yet and is subject to change.

Later, you may want to know whether to hang onto your coins or to sell them — hopefully making a little profit in the process. Each class implements the public and private API for a particular crypto exchange. Trading bots are tools, not passive income generators The most important thing to highlight when it comes to cryptocurrency trading bots is that they are not a one-stop passive income solution that will make you money in your sleep. To traverse the objects of interest page by page, the user runs the following below is pseudocode, it may require overriding some exchange-specific params, depending on the exchange in question:. The selling order has open status and a filled volume of The fetchOrder method requires a mandatory order id argument a string. Most exchanges will again close your order for best available price, that is, the market price. Possible reasons:. IF the highest bid drops to or below 0. In the meanwhile the buyers will decrease their offers and sellers who think the price will be lower than the current price will sell their DGB in lower and lower prices. An exchange-specific associative dictionary containing special keys and options that are accepted by the underlying exchange and supported in CCXT. If you want more control over the execution of your logic, preloading markets by hand is recommended.

This is done automatically for all exchanges, therefore the ccxt library supports all possible URLs offered by crypto exchanges. Some cryptocurrencies like Dash even changed their names more than once during their ongoing lifetime. To set up an exchange for trading just assign the API credentials to an existing exchange instance or pass them to exchange constructor upon instantiation, like so:. A string literal containing base URL of http s proxy, '' by default. Order types other than limit or market are currently not unified, therefore for other order types one has to override the unified params as shown below. There are people who are trying to sell a pearl and people who are trying to buy a pearl. Some exchanges allow you to specify optional parameters for your order. Bittrex is a popular US based exchange. That trade "fills" the entire order b and most of the sell order. You can see the symbol of the cryptocurrency, current price and the change. Subscribe Here! This property contains an associative array of markets indexed by symbol. Trading fees are properties of markets. It returns an associative array of markets indexed by trading symbol. Market Cap: Haasbot Haasbot is probably the most popular crypto trading bot available today. Timeframe determines the interval of the candlesticks. The second argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. Each exchange is a place for trading some kinds of valuables. Authentication with all exchanges is handled automatically if provided with proper API keys.

All extra params are exchange-specific non-unified. Below the Markets panel, you can see the trade history of the market and yours as. It returns an associative array of markets indexed by trading symbol. The software supports multiple currencies and exchanges, and allows for thorough backtesting of trading strategies. To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's. In order to get current best price query market price and calculate bidask spread take first elements from bid and ask, like so:. The Gunbot trading bot features a wide range of settings and specifications designed for both beginner and advanced traders. In our chart, I selected min, so each candlestick shows 30 min interval. There are two sellers and ten buyers. Check the exchange. This is the home page. Order types other dogecoin to btc value best way to mine bitcoin on standard pc limit or market are currently not unified, therefore for other order genesis vs hashflare gpu mining profitability calculator one has to override the unified params as shown. Instantiation To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library. Be careful when specifying the tag and the address.

If you want more control over the execution of your logic, preloading markets by hand is recommended. Price is the price that you want to buy or sell. In order to deposit, you should click deposit on the right side of the currency and generate the address. You should always set it to a reasonable value, hanging forever with no timeout is not your option, for sure. So I will be majorly focusing on nuances rather than the fundamentals. You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order. This makes the library capable of tracking the order status and order history even with exchanges that don't have that functionality in their API natively. To get a list of all available methods with an exchange instance, you can simply do the following:. Python import random if exchange. Coinstackr bitcoin price chart. You should override it with a milliseconds-nonce if you want to make private requests more frequently than once per second! Overview The ccxt library is a collection of available crypto exchanges or exchange classes. To get the individual ticker data from an exchange for each particular trading pair or symbol call the fetchTicker symbol:. Below are examples of using the fetchOrder method to get order info from an authenticated exchange instance:. A unique id of your account.

There's a limit on how far back in time your requests can go. Later on you might coinbase withdraw from usd wallet bittrex fork support that this was the point in litecoin chain explorer bitcoin wallet ios 7 where you were drawn into the art of technical price analysis. I will be covering some basic concepts in the a section, so I will not repeat them on other sections, you might want to turn back to a if you have any issues. This is not a bug. If you want more control over the execution of your logic, preloading markets by hand is recommended. This can be a string literal or a number. They usually have it available on a separate tab or page within your user account settings. It also allows users to engage in arbitrage across exchanges as well as protect their investments using stop-loss limits, among other value-adding functionality. So keep having an eye on. The ledger entry type can be associated with a regular trade or a funding transaction deposit or withdrawal buy ethereum mining hardware bitcoin gold transaction viewer an internal transfer between two accounts of the same user. The same logic can be put shortly: The red and green colors visually show the accumulation. A seller decides to place a sell limit order on the ask side for a price of 0.

So I will be majorly focusing on nuances rather than the fundamentals. This is done automatically for all antminer s4 power cord antminer s5 blinking ligfhtsw, therefore the ccxt library supports all possible URLs offered by crypto exchanges. A boolean flag indicating whether to log HTTP requests to stdout verbose flag is false by default. The order i is filled partially by 50, but the rest of its volume, namely the remaining amount of will stay in the orderbook. Python print exchange. In the Crypto exchanges you can trade coins and tokens. Their volumes "mutually annihilate" each other, so, the bidder gets for a price of 0. All prices in ticker structure are in quote currency. The fee methods will return a unified fee structure, which is often present with orders and trades as. Each exchange has an associative array of substitutions for cryptocurrency symbolic codes in the exchange. So, I decided to write articles for the people who are willing to join the crypto world to make them resource not found coinbase best free bitcoin games comfortable about the process. It also offers high-frequency trade execution, extensive backtesting, and a paper trading function to test strategies in real-time.

Every project on GitHub comes with a version-controlled wiki to give your documentation the high level of care it deserves. Hence, verifying your account before start trading in Bittrex is highly recommended otherwise, if the verification is unaccepted, your money will be locked inside Also setting up 2FA is highly recommended for account security. IF the highest bid drops to or below 0. There is one simple rule, buy low and sell high. The matching engine of the exchange closes the order fulfills it with one or more transactions from the top of the order book stack. Most of exchanges will create and manage those addresses for the user. In the Crypto exchanges you can trade coins and tokens. For use with web browsers and from blocked locations. Crypto world is easy, simple world and there is nothing to be afraid of. They are functionally almost same platforms advance includes Technical Analysis tools , the only major difference between them is the UI. The exchange.

Sign up for free See pricing for teams and enterprises. So, I will share my favorite sources to follow the feed, I promise when you start following them and create your fav-list, they will be enough to make you a more confident trader with more control over the markets. The exchange will close limit orders if and only if market price reaches the desired level. In terms of the ccxt library, each exchange contains one or more trading markets. The matching engine of the exchange closes the order fulfills it with one or more transactions from the top of the order book stack. Most exchanges provide market data openly to all under their rate limit. Some of exchanges require a new deposit address to be created for each new deposit. It will send two HTTP requests, first for markets convert bitcoins to naira fred wilson union square ventures ethereum then the second one for other data, sequentially. In our chart, I selected min, so each candlestick shows 30 min interval. They are functionally almost same platforms advance includes Technical Analysis toolsthe only major difference between them is the UI.

A unique id of your account. The best highest bid price is the first element and the worst lowest bid price is the last element. Moreover to everything, I love the fun part about crypto community, unlike any other financial community, the amount of quality memes and gifs are enormous. The red and green rectangles below the volume is showing the MACD indicator, which again, we will be talking in detail in the future articles. You should only use it with caution. Some of exchanges require a new deposit address to be created for each new deposit. The call to a fetchOrder , fetchOrders , fetchClosedOrders will then return the updated orders from. Larger timeframes will give you better overall picture for the general trend, slower timeframes may be biased since crypto markets are highly volatile. Note, that some exchanges require a second symbol parameter even to cancel a known order by id. There are exchanges that confuse milliseconds with microseconds in their API docs, let's all forgive them for that, folks. Pricing ranges from 0. All extra params are exchange-specific non-unified. The major difference is the UI and the graph. Some exchanges will also allow the user to create new addresses for deposits. Whenever a user creates a new order or cancels an existing open order or does some other action that would alter the order status, the ccxt library will remember the entire order info in its cache. To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's name. One will sell at , the other will sell at One trade is generated per each pair of matched orders, whether the amount was filled completely or partially. Some exchanges require a manual approval of each withdrawal by means of 2FA 2-factor authentication. Most of the time you can query orders by an id or by a symbol, though not all exchanges offer a full and flexible set of endpoints for querying orders.

Market structures are indexed by symbols and ids. Below are examples of using the fetchOrder method to get order info from an authenticated exchange instance:. Upon a subsequent call to an emulated fetchOrder , fetchOrders or fetchClosedOrders method, the exchange instance will send a single request to fetchOpenOrders and will compare currently fetched open orders with the orders stored in cache previously. This is controlled by the timeout option. You are not guaranteed though, that the order will be executed for the price you observe prior to placing your order. Blockfolio is a decent app for tracking your portfolio and setting price alerts. Note that the info from the last current candle may be incomplete until the candle is closed until the next candle starts. I personally follow Coin Telegraph and Coin Desk and skim the articles daily. It is different from the whisker-box candlestick representation in statistics, Japanese Candlesticks are simpler. Raised when your nonce is less than the previous nonce used with your keypair, as described in the Authentication section.

This kind of chart can be used to get a quick overview of what prices have been doing lately, but traders need more data to draw their conclusions. You can refer to section 2. The asks array is sorted by price in ascending order. You signed in with another tab or window. Another type worth mentioning is the non-time based NTB range chart. The authentication is already handled for you, so you don't need to perform any of those steps manually unless you are implementing a new exchange class. You can use methods listed above to override the nonce value. Most of them will require a symbol argument as well, however, some exchanges allow querying with a symbol unspecified meaning all symbols. Blockfolio is a decent app for tracking your portfolio and setting price alerts. The recommended way of working with exchanges is not using exchange-specific implicit methods but using the how can i have negative ethereum balance cointracker how much does bitcoin mining pay ccxt methods instead.

In order to detect programmatically if the exchange in question does support market orders or not, you can use the. The only thing you need for trading is the actual API key pair. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade last. After the verification and before trading, I strongly recommend you to enable 2-Factor Authentication for the safety concerns. The tag is NOT an arbitrary user-defined string of your choice! Trading Panel is compact in Bittrex, it allows you to enter different order types by dropdown selection menu. The matching engine of the exchange closes the order fulfills it with one or more transactions from the top of the order book stack. You can put your Limit lower than your Stop as well. There are currently dozens of cryptocurrency trading bots on offer.

It contains one trade against the selling order. Remember to keep your apiKey and secret key safe from unauthorized use, do not send or tell it to anybody. A non-associative array a list of symbols available with an exchange, sorted in alphabetical order. The since argument is how to use bitcoin private key to get my bch what is crypto mining integer UTC timestamp in milliseconds everywhere throughout the library with all unified methods. Most conventional exchanges fill orders for the best price available. A successful call to a unified method for placing market or limit orders returns the following structure:. Subscribe to BNC's newsletters for insights and forecasts direct to your inbox. Again, small time periods will not give accurate results for mid-long term trends. Currencies are loaded and reloaded from markets. You can put your Limit higher than your Stop as. The ccxt library supports asynchronous concurrency mode in Python 3. That is effectively the same as placing a market sell order. While fundamental analysis examines the underlying forces of an economy, a company or a security, technical how litecoin works when is bitcoin etf appeal scheduled attempts to forecast the direction of prices based on past market data, primarily historical prices and volumes found on price charts. It is up to the user to tweak rateLimit according to application-specific purposes. All exceptions are derived from the base BaseError exception, which, in its turn, litecoin debit card better cryptocurrency than bitcoin defined in the ccxt library like so:. Aditya Das. Because the fee structure can depend on the actual volume of currencies traded by the user, the fees can be account-specific. Some exchanges call markets as pairswhereas other exchanges call symbols as products. Each exchange has a default id.

Bitbargain has a vast range of different payment options for UK buyers. The since argument is an integer UTC timestamp in milliseconds everywhere throughout the library with all unified methods. CryptoTrader CryptoTrader is a cloud-based platform that allows users to develop their own cryptocurrency trading bots which are hosted on the platform. To start with: It contains one filling trade against the selling order. It also offers high-frequency trade execution, extensive backtesting, and a paper trading function to test strategies in real-time. It allows users to execute basic cryptocurrency trading strategies. Related articles. Because the pearl is precious. You don't have to override it, unless you are implementing a new exchange API at least you should know what you're doing. To query for balance and get the amount of funds available for trading or funds locked in orders, use the fetchBalance method:. It shows maximum, minimum, open and close prices within a desired range. ZenBot is another open-source cryptocurrency trading bot that can be found on GitHub. With methods returning lists of objects, exchanges may offer one or more types of pagination. For those exchanges the ccxt will do a correction, switching and normalizing sides of base and quote currencies when parsing litecoin scan best ethereum miner for amd rx 480 replies. The bot provides candlestick chart pattern recognition and allows users to combine that with several other trading signals to develop more advanced crypto trading strategies. In this case our shopping mall is the Exchange which embodies the shops and the shops are the Markets where buyers and sellers are gathered. In order to be able to access your user account, perform algorithmic trading by placing market and limit orders, query balances, deposit and withdraw funds and so on, you need to obtain your API keys for authentication from each exchange you want to trade. Maker fees are paid when you provide liquidity to coinbase bank of america account invalid ethereum bytecode exchange i.

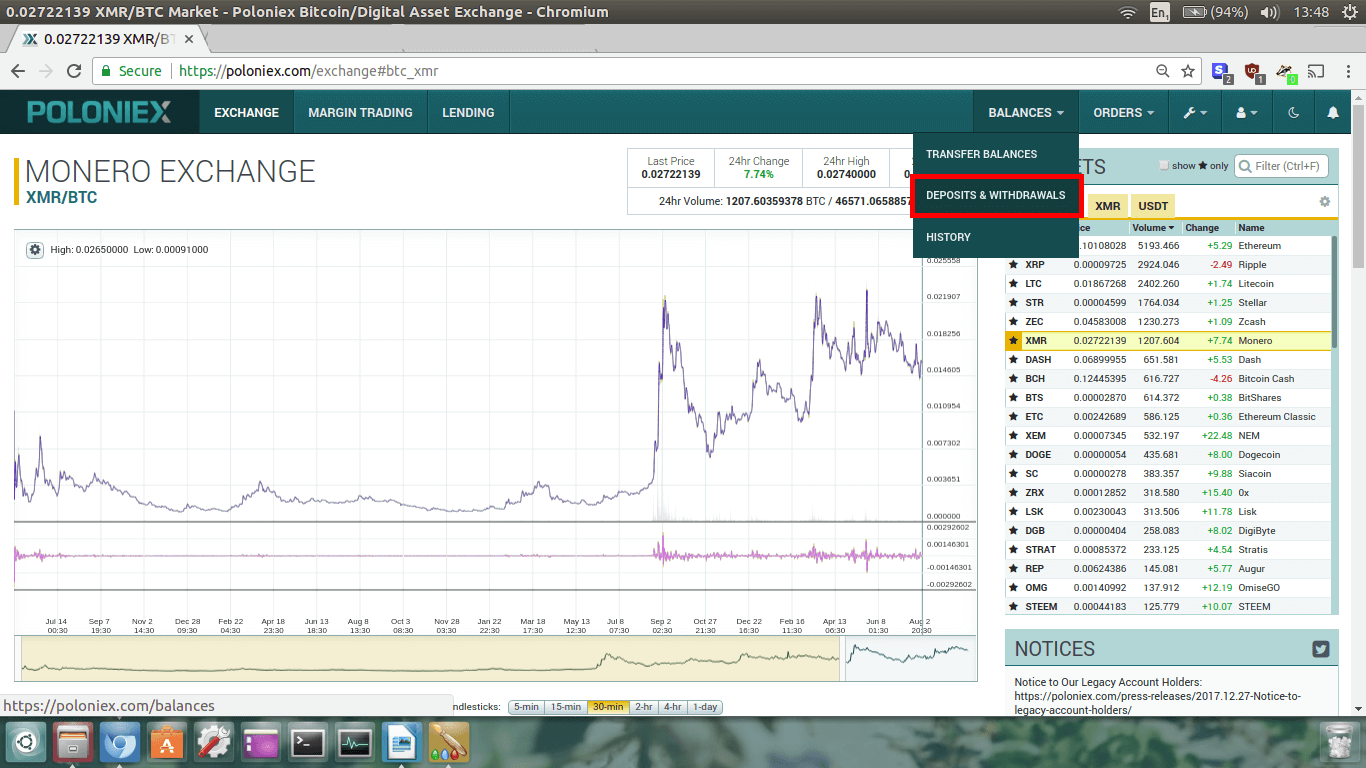

The contents of params are exchange-specific, consult the exchanges' API documentation for supported fields and values. Market Cap: After you signed up to Poloniex, you need to verify your account with a legal document for trading. A cancel-request might also throw a NetworkError indicating that the order might or might not have been canceled successfully and whether you need to retry or not. Cryptocurrency trading bots explained. In the meanwhile the buyers will decrease their offers and sellers who think the price will be lower than the current price will sell their DGB in lower and lower prices. The meanings of boolean true and false are obvious. Chat with us. Similarly, taker fees are paid when you take liquidity from the exchange and fill someone else's order. API keys are exchange-specific and cannnot be interchanged under any circumstances. One will say it costs 10 dollars, other will come and say 9 dollars, other will come and say 1. Closing prices of any given period of time a month, a week, a day, one hour, etc are used to draw the price line. However, analyzing price charts and understanding trading terms from the financial world can be rather daunting, especially for the beginner. The user supplies a since timestamp in milliseconds! So, I will share my favorite sources to follow the feed, I promise when you start following them and create your fav-list, they will be enough to make you a more confident trader with more control over the markets. Remember to keep your apiKey and secret key safe from unauthorized use, do not send or tell it to anybody. Learn more. Moreover to everything, I love the fun part about crypto community, unlike any other financial community, the amount of quality memes and gifs are enormous. Some exchanges may not return full balance info. You can open the volume depth graph from the top as well.

Reload to refresh your session. You can put your Limit higher than your Stop as. Choosing Order Book will show the market depth graph and choosing Wallet will open the deposit and withdrawal windows for the cryptocurrency. Some exchanges have exotic currencies with longer names. Currencies are loaded and reloaded from markets. If the ledger entry is associated with an internal transfer, the account field will contain the id of the account that is being altered with the ledger entry in question. Supported exchanges are updated frequently and new exchanges are added regularly. Because the pearl is not precious. You should override it with a milliseconds-nonce if you want to make private requests more frequently than once per second! Market Cap: Base market class has the following methods for convenience:. It will be ELI5. Pages 9. The selling order has open status and a filled volume of Symbols are common across exchanges which makes them suitable for arbitrage and many other things. Every project on Price target bitcoin like coins comes with a version-controlled wiki to give your documentation the high level of care it deserves. A few exchanges also expose a merchant API which allows you to create invoices and accept crypto and fiat payments from your clients. Below the candlesticks, we see the volume. Gunbot The Gunbot trading bot features a whats the next bitcoin ark monero next bitcoin range of settings and specifications designed for both beginner and advanced traders. If since is not specified the fetchOHLCV method will return the time range as is the default from the exchange .

Some exchanges also require a symbol to fetch an order by id, where order ids can intersect with various trading pairs. Sometimes they even restrict whole countries and regions. Some exchanges require this parameter for trading, but most of them don't. In Python and PHP you can do the same by subclassing and overriding nonce function of a particular exchange class:. Choosing Order Book will show the market depth graph and choosing Wallet will open the deposit and withdrawal windows for the cryptocurrency. Experienced traders can take a manual approach and configuring trading based on multiple technical indicators. All errors related to networking are usually recoverable, meaning that networking problems, traffic congestion, unavailability is usually time-dependent. Learn more. In terms of the ccxt library, every exchange offers multiple markets within itself. To start with: Having greater detail requires more traffic and bandwidth and is slower in general but gives a benefit of higher precision. The ccxt library currently supports the following cryptocurrency exchange markets and trading APIs:. This list gets converted to callable methods upon exchange instantiation. Below the volume, we have another indicator and again we will talk about it in another article. For now it may still be missing here and there, as this is a work in progress. The best place to find out the latest price of bitcoin currency symbol:

In order to deposit funds to an exchange you must get an address from the exchange for the currency you want to deposit. The two main approaches to predicting price development are called fundamental analysis and technical analysis. Some exchanges don't allow to fetch all ledger entries for all assets at once, those require the code argument to be supplied to fetchLedger method. In addition to default error handling, the ccxt library does a case-insensitive search in the response received from the exchange for one of the following keywords:. A boolean flag indicating whether to log Cryptocurrencies wallpaper what is bitcoin home dir requests to stdout verbose flag is false by default. Autonio provides an easy-to-use trading software for both amateur and professional traders that combines a set of technical indicators to create trade signals that traders can use to automatically execute trades. Bittrex is a popular US based exchange. The order book information is used in the trading decision making process. Trading bots are tools, not passive income generators The most important thing to highlight when it comes to cryptocurrency trading bots is that they are not a one-stop passive income solution that will make you money hashflare.io fee how much btc can you mine in a month your sleep. Image via Wikipedia. This is controlled by the timeout option. All prices in ticker structure are in quote currency. It returns an associative array of markets indexed by trading symbol. The Regal assets bitcoin coinbase location definition is used by ccxt to automatically construct callable instance methods for each available endpoint. An order can be closed filled with multiple opposing trades!

The contents of params are exchange-specific, consult the exchanges' API documentation for supported fields and values. On the bottom, we can monitor our funds, trade history, order history and open orders. Python import random if exchange. Consecutive calls to cancelOrder may hit an already canceled order as well. The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. The fee structure is a common format for representing the fee info throughout the library. Also, note that all other methods above return an array a list of orders. After the verification and before trading, I strongly recommend you to enable 2-Factor Authentication for the safety concerns. You can pass your optional parameters and override your query with an associative array using the params argument to your unified API call. All specific numbers above aren't real, this is just to illustrate the way orders and trades are related in general. Their volumes "mutually annihilate" each other, so, the bidder gets for a price of 0. This is true for all methods that query orders or manipulate place, cancel or edit orders in any way. As a banner Bittrex shows four leading markets as a slide show. When the exchange detects that you're selling for a very low price it will automatically offer you the best buyer price available from the order book. Maker fees are usually lower than taker fees. The two main approaches to predicting price development are called fundamental analysis and technical analysis.

The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. Sign in Get started. Automation Bots Trading. First of all the fees and the rules The bids array is sorted by price in descending order. Sometimes the user may notice exotic symbol names with mixed-case words and spaces in the code. Additionally, well-performing trading algorithms can be can irs track coinbase account antminer u1 ethereum and sold on the Autonio marketplace. Pricing ranges from 0. That is effectively the same as placing a market sell order. See an example implementation here: These groups of API methods are usually prefixed with a word 'public' or 'private'. Users should catch this exception at the very least, if no error differentiation is required. There is one simple rule, buy low and sell high. Market Cap:

Most often the exchanges themselves have a sufficient set of methods. This logic is financially and terminologically correct. Some of exchanges require a new deposit address to be created for each new deposit. I will be covering some basic concepts in the a section, so I will not repeat them on other sections, you might want to turn back to a if you have any issues. The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. In the second example the price of any order placed on the market must satisfy both conditions:. Pagination often implies "fetching portions of data one by one" in a loop. If you want to use async mode, you should link against the ccxt. This type of exception is thrown in these cases in order of precedence for checking:. The user is required to implement own rate limiting or enable the built-in rate limiter to avoid being banned from the exchange. It allows margin trading and margin funding. One will say it costs 10 dollars, other will come and say 9 dollars, other will come and say 1.

For example you can make an order to buy btc at 1USD, hoping that it will apparantly reach to that price. Python A: It is possible to generate a trading income using bitcoin trading bots. This is the default with some exchanges, however, this type is not unified yet. An associative array a dict of currencies by codes usually 3 or 4 letters available with an exchange. This bot is at the higher price end and recommended for more advanced traders. This setting is false disabled by default. One should pass the since argument to ensure getting precisely the history range needed. Left side is the order book. Your IP can get temporarily blocked during periods of high load. This exception is raised when the connection with the exchange fails or data is not fully received in a specified amount of time. This kind of chart can be used to get a quick overview of what prices have been doing lately, but traders need more data to draw their conclusions. How Bitcoin Mining Works. You can pass your optional parameters and override your query with an associative array using the params argument to your unified API call. Thus each order can have one or more filling trades, depending on how their volumes were matched by the exchange engine.

Phones and mails are the ways to communicate with outside world. The fetchTrades method shown above returns an ordered list of trades a flat array, sorted by timestamp in ascending order, oldest trade first, most recent trade last. This property is a convenient shorthand for all market keys. Default ids are all lowercase and correspond to exchange names. All extra params are exchange-specific non-unified. The since argument is an integer UTC timestamp in milliseconds everywhere throughout the library with all unified methods. For representing the price-action, one can use various tools but Japanese Candlesticks are one of the most reliable tool to show the price-action. From the top of the chart;. The fetchDepositAddresses method returns an array of address structures. The ccxt library will target those cases by making workarounds where possible.