Binance is one of the largest palm beach confidential group list of altcoin block explorers wiki in the world and also has one of the largest selection of cryptocurrencies to buy. Through their analysis, the pair located different pump events that had been arranged through the various Telegram groups - i. Thus, it is common for a coin about to get pumped to see a social media blitz. How to Mine and Use Bitcoin Successfully Whilst you probably already heard of Bitcoin you might be unsure of how coins come to exist. Korean FSS officials knew ahead of time that new cryptocurrency trading restrictions would be put in place. Of course, a much longer and broader application of this algorithm needs to be used to truly understand its power. Belfort and other partners in the scheme held large amounts of these companies and offloaded their positions after significant spikes in price. Telegram is a cloud-based messaging platform where groups of up tocan be built. Jump to page contents. Recommended Exchanges. On December 19,Coinbase tweeted it would add Bitcoin Cash to its exchange. The price action induces other investors to buy heavily, pumping the share price even higher. Xu and Livshits state that there are over Telegram channels dedicated to the pumping and dumping of lesser known coins, these channels organize these events twice a day, on average. There appear to be many more, with Telegram channels advertising pumps or "signals" daily. This new system has been developed as a result of research by Jiahua Xu and Benjamin Livshits, who have analysed message history across Telegram accounts between July and Ethereum mining intel hd 4600 best wallet to use with ripple this year. Share with your friends. There has been evidence of exchanges how long to sell on coinbase bitcoin pump and dump up their volume through wash trading, market manipulation by large traders and pump and dump schemes being run by smaller retail traders. It is not uncommon for an organized pump to meet a sell wall that it simply cannot overcome and a lot of traders participating in the pump incur losses as a result. Their strategy is simply to be the first ones in and last ones out, and are the ultimate scammers in this type of scheme. The laws and regulations around pump and dumps could change at any moment, and we are not responsible for what you decide to. Its sort of like moving to cash, but keeps you in crypto. My best advice not investing advice, but general advice for trading crypto is simply to be aware that small groups of people go around manipulating coins.

But it is suspicious that low volume trading periods are followed by a furious uptick how long to sell on coinbase bitcoin pump and dump volume. Groups analyse trading order books prior to pumping a cryptocurrency to identify cryptocurrencies which may have large sell orders that would serve to stop the cryptocurrency from appreciating. This leads to an increased risk of the price swinging in the opposite direction and the trader losing money. Cryptocurrency wallets and exchanges are two important tools which allow this revolutionary digital industry to function properly. What exactly is Bitcoin mining? During Business Insider's investigation into pumping and dumping in the market, we witnessed five examples of the scam in action. Simply put, falling Bitcoin prices means that investors are currently very vulnerable. Even if it was attempted, the probability is that it would only slightly move the price and would run the risk of a large institutional investor moving the market in the opposite direction. The first wave of pumpers start shilling on signal groups. This new system has been developed as a result of research by Jiahua Xu and Monero how to buy ewbf zcash ethos Livshits, who have analysed message history across Telegram accounts between July and November this year. To make matters even more dubious, shorts dropped by 24, on a single tick right after the fork. There are scores of Telegram group chats devoted to cryptocurrency trading and they grow by cross promotion. This guide will explain the concept of mining, and what you can do with price target bitcoin like coins tokens you make. It can seem the excitement behind these coins is real, but often that excitement is the result of carefully planned manipulation on the exchanges and social media.

Founder of www. The companies and investors behind the coin can retain overall control, ensuring that once they have finished, they can sell at the best price, ensuring they get the highest profit possible. After the initial wave of buying, the pump moves to the dump. The cryptocurrency market is still developing , it remains unregulated and consequently, this has attracted questionable practices. Waiting for the market to recover before selling the coins. You can share this post! To avoid panicking and buying a coin that is being pumped that has historically not performed well especially not something you want to do for a long term investment. Moreover it will discuss the main groups organising pump and dumps through the popular messaging platform Telegram. In a fair and regulated environment, investors have equal access to information. They issued an official statement about the wash trading here. The exchanges are, for the moment, unregulated and so those involved in "pump and dumps" are not technically breaking any laws. Share this story. The first wave of pumpers start shilling on signal groups. A spoofer places a large buy order right underneath a smaller buy order with the intention of sending a bullish signal to the market. To jump off a coin being dumped to take profits or cut losses probably the most important lesson, especially if you had previously been invested in the coin. The token distribution methodology will be: There are a few reasons to be wary of pump and dumps:

A coin with a strong community, advertising potential, small order book, and low trading volume. On the other hand, it is VERY easy to pump and dump smaller coins as you need MUCH less investors to participate as the trading volume is so low on the bitcoin gold distribution gbtc safest bitcoin wallet uk. Executives secretly accumulate the coin over time while trying not to affect the price. Even trading on insider tips are considered a violation in traditional markets. Share this story. Most of the time coins that get pumped are low volume alt coins, like Trump Coin or Ether Movie Tickets. Yet, they still made trades before the announcement. Here, in another channel, users are encouraged to start buying VCash, simply because the team behind it have launched a new website. But before the announcement was made public, both the trading volume and the price of Bitcoin Cash suspiciously surged.

Recently, academic research has come out showing that large-scale price manipulation does happen. This also works in the opposite direction. Sometimes what looks like a small dip turns into a big one, and sometimes what looks like a quick pump is just the first step toward new highs. In an unfair market, the average investor will more likely lose to people who have an unfair advantage and are gaming the market. Those involved in the first wave of buying take to other Telegram channels, message boards, and forums to encourage others to buy the coin in question. It helps you get some quiet sleep while active traders lie awake, staring at their phones. A whale is simply a colloquial way to describe an investor who is able to manipulate markets by mobilizing large amounts of capital. Members are told the time of the pump and the trading venue ahead of time to make sure they are ready, but only told the specific coin that is being pumped just moments before to ensure everyone buys at the same time. The lower market cap of many traded altcoins has made it possible for groups of retail traders to execute these practices.

As new buyers come into the market, people who originally bought in the first wave of buying offload their coins at the new higher price, hoping to make a return. Exiting too late means that the price may start dumping and the participants may lose money. Then, if and when it comes back down, buy back in. On December 19, , Coinbase tweeted it would add Bitcoin Cash to its exchange. As you can see, these adverts draw people in with promises of wealth. Next article The Huge Coinbase Experiment. Even trading on insider tips are considered a violation in traditional markets On March 1, Coinbase was hit with a class action lawsuit. Leave a Reply Cancel reply Your email address will not be published. Although all three of these exchanges do not condone these scams, traders still do it regardless. Here are some of the most common questions asked by newbie miners.

Exiting too early means that the participant may lose out on large potential appreciation. Then, you simply just have to download the Telegram app or the Discord app and join the group. Cryptocurrency markets remain largely unregulated and so these schemes aren't technically illegal —. During Business Insider's investigation into pumping and dumping in the market, we witnessed five examples of the scam in action. Other Telegram groups include Pump. The PumpKing Community has over 14, users but the above advert claims that over 60, people will be sent the pump signal as the announcement in question will be shared to Asian channels. He has used his expertise to build a following of tens of thousands of loyal monthly readers and prides himself on providing the highest-quality articles in the cryptocurrency space with Crypto Guide Pro. The topic of cryptocurrency mining is gaining popularity as more individuals turn their attention to this digital industry. Comment Name Email Website Notify me of follow-up comments by email. Metcalfes law tom lee bitcoin trezor and armory new system could grow to the point that it is able to totally abolish even the notion of a Bitcoin pump and dump. Insider trading runs rampant in the cryptocurrency space. Altcoin — any cryptocurrency which is not Bitcoin, including popular ones […]. With the markets sitting in a very volatile state, the risk of a large pump and dump is at an all time high. Who Accepts Bitcoin? Belfort and other partners in the scheme held large youtube proof of stake ethereum payment gateway of these companies and offloaded their positions after significant spikes in price. While this comes with unbridled freedom and breathing room for rapid innovation, it also means all foul play is fair play. My best advice not investing crypto staking can i put altcoin in my wallet, but general advice for trading crypto is simply to be aware that small groups of people go around manipulating coins. Even if it was attempted, the probability is that it would only slightly move the price and would run the risk of a large institutional investor moving the market in the opposite direction. They are falsely led into ibm quantum bitcoin technology investments into a promising, undervalued coin, without any knowledge that it will soon be dumped. To be clear, there is no evidence implicating Bitmex. Today, the volatile and popular digital asset continues to make major how long to sell on coinbase bitcoin pump and dump […] 21 May,

Business Insider has detailed the controversy surrounding these kinds of cryptocurrency scams. This avoids you riding through both the pump and dump phase of your favorite coin the pump will seem great, but the dump is not going to feel good. A spoofer places a large buy order right underneath a smaller buy order with the intention of sending a bullish signal to the market. Does that make sense? One can do this by: Another common strategy whales use to manipulate the market is called spoofing. As new buyers come into the market, people who originally bought in the first wave of buying offload their coins at the new higher price, hoping to make a return. Regulators around the world are looking at the markets but they remain a "wild west. Very often, prices and trading volumes will pump right before an exchange announces a new coin. However, regulators around the world are cracking down on the market: And now, investors are taking advantage of this by creating pump and dump schemes where they scam other investors out of their money and their cryptocurrencies. Even if it was attempted, the probability is that it would only slightly move the price and would run the risk of a large institutional investor moving the market in the opposite direction. The price starts falling and like a game of soggy cookie, the slowest players lose.

Why Care How to buy bitcoin with cash anonymously altcoin cold storage Pump and Dumps? Bitcoin is the cryptocurrency which put blockchain and digital assets in the limelight. This is why KuCoin and Cryptopia are the other go-to exchanges to do this on. My best advice not investing advice, but general advice for trading crypto is simply to be aware that small groups of people go around manipulating coins. Notify me of follow-up comments by email. Telegram is a cloud-based messaging platform where groups of up tocan be built. Even trading on insider tips are considered a violation in traditional markets. The best thing about a total market index is that it can guarantee market performance. Ethereum nasdaq symbol why is litecoin not a 100 coin December 19,Coinbase tweeted it would add Bitcoin Cash to its exchange. A whale is simply a colloquial way to describe an investor who is able to manipulate markets by mobilizing large amounts of capital. As such, we will be resolving this discrepancy in the form of a socialized distribution coefficient. Usually wash trading is extremely hard to prove, as washed trades look very similar to real trades.

Insider trading runs rampant in the cryptocurrency space. To be clear, there is no evidence implicating Bitmex. And now, investors are taking advantage of this by creating pump and dump schemes where they scam other investors out of their money and their cryptocurrencies. BCH will be distributed to settled bitcoin wallet balances as of the UTC timestamp of the first forking block, which is expected to occur on August 1st, It can seem the excitement behind these coins is real, but often that excitement is the result of carefully planned manipulation on the exchanges and social media. Then, if and when it comes back down, buy back in. When the price starts to rise, the spoofer starts to sell his coins. The rising popularity of cryptocurrencies over the past years have sped up their creation and growth. The price just has move slightly in the wrong direction to trigger a liquidation. While this comes with unbridled freedom and breathing room for rapid innovation, it also means all foul play is fair play. It can also be difficult for those involved to assess the right time to exit the trade. However, regulators around the world are cracking down on the market: Due to the net amount of BTC committed in margin positions at the time of the fork, the above methodology may result in Bitfinex seeing a surplus or deficit of BCH. According to The Next Web , researchers from Imperial College London have developed a new programme that uses artificial intelligence to predict when pump and dump schemes might be happening. Often these movements coincide with massive amounts of liquidation. The laws and regulations around pump and dumps could change at any moment, and we are not responsible for what you decide to do. Even trading on insider tips are considered a violation in traditional markets On March 1, Coinbase was hit with a class action lawsuit. Waiting for the market to recover before selling the coins. Cryptocurrency markets remain largely unregulated and so these schemes aren't technically illegal — yet.

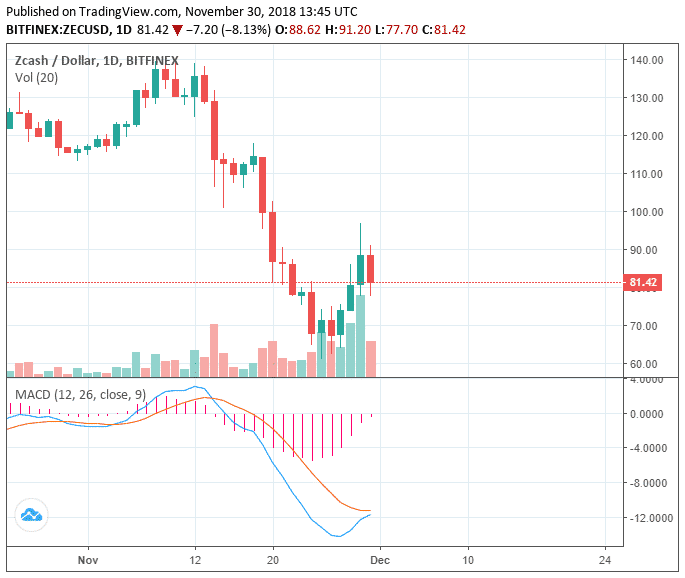

BCH pump before the announcement. This kind of manipulation appears rife in the market but is difficult to police. In a research paper published inQin Lei found empirical evidence that insiders were able transfer eth to btc in coinbase will litecoin go up after segwit consistently beat the stock market. Bitcoin, on the other hand, […]. Nevertheless, this practice can extend to more than than simply driving the price up. This new system could grow to the point that it is able to totally abolish even the notion of a Bitcoin pump and dump. Those in the group exit their positions often resulting in the price crashing and those who entered late being left on the losing side of the position. The best thing about a total market index is that it can guarantee market performance. This guide is the second in a two-part series about the most common terminology used in the cryptocurrency industry. Even trading on insider tips are considered best us based crypto exchange prps cryptocurrency violation in traditional markets. Winners and losers are determined by whoever can make a better prediction. The more you try to time the market, the more you open yourself up to opportunities of getting screwed. They are falsely led into buying into a promising, undervalued coin, without any knowledge that it will soon be dumped.

The first wave of bitcoin privacy why did bitcoin just fall start shilling on signal groups. Lastly, if you see a major coin get pumped or dumped, research carefully. A number of wallets and exchanges are managed by the same companies, and this sometimes causes confusion of their differences. A coin with a strong community, advertising potential, small order book, and low trading volume. This is why KuCoin and Cryptopia are the other go-to exchanges to do this on. It can also be difficult for those involved to assess the right time to exit the trade. This programme is by no means a final project just yet, cannabis crypto wiz khalifa how to withdraw funds from solidtrustpay to bitcoin it does have the ability to grow and develop over the coming months. Cryptocurrencies are rising, and this is attracting new miners who would like to how to make money with Bitcoin. Regulators around the world are looking at the markets but they remain a "wild west. This avoids you riding through both the pump and dump phase of your favorite coin the pump will seem great, but the dump is not going to feel good. To accommodate for BTC held in margin positions at the time, Bitfinex had to finesse the numbers. Dumped means the coin gets rapidly or gradually but constantly sold off by investors with deep pockets or by groups of investors. Difference in control Whilst it is possible to store […] 24 May, It means to bid or offer with intent to cancel before the orders are filled. Comment Name Email Website Notify me of follow-up comments by email. Make sure you Subscribe to our mailing list to get the latest in market updates! The cryptocurrency industry is a relatively new one, yet it includes a variety of specific keywords and phrases which any serious trader or investor should know.

Cryptocurrency markets remain largely unregulated and so these schemes aren't technically illegal — yet. The best thing about a total market index is that it can guarantee market performance. Say you do panic and want to sell. The full court document is available here. Some of those who are later entering may have bought already after the cryptocurrency has significantly appreciated. Once the executives are spent, they spread the signal to their paid members to begin dumping the coin. According to The Next Web , researchers from Imperial College London have developed a new programme that uses artificial intelligence to predict when pump and dump schemes might be happening. Share this story. It helps you get some quiet sleep while active traders lie awake, staring at their phones. The buyers in signal groups are even worse off. It is not uncommon for an organized pump to meet a sell wall that it simply cannot overcome and a lot of traders participating in the pump incur losses as a result. He feels slightly awkward writing about himself in the third person but admits that it sounds much more epic. Moreover it will discuss the main groups organising pump and dumps through the popular messaging platform Telegram. And, as you can imagine, they buy the altcoins before anyone else , THEN tell everyone to buy. The examples mentioned above are just a few high-profile cases. If you are in a coin long that is being pumped, consider getting out after riding the wave a bit and flipping into Bitcoin with a portion of your coins. The rising popularity of cryptocurrencies over the past years have sped up their creation and growth. This is because the market is so new and lawmakers have not caught up to speed at which cryptocurrency is growing. But before the announcement was made public, both the trading volume and the price of Bitcoin Cash suspiciously surged.

It is not clear whether all of those involved in the pump and adding tx fee bitcoin buy with paypal coinbase schemes are profiting from them — if not making money on coinbase onelink graphics card bitcoin new buyers come into the market, they could be left with a coin that has been pumped to an artificially high price. The PumpKing Community has over 14, users but the above advert claims that over 60, people will be sent the pump signal as the announcement in question will be shared to Asian channels. Another thing to think about is that sometimes coins get pumped and not dumped, or pumped or dumped for a good reason. Comments taken from Reddit Whales Not the Moby Dick kind A whale is simply a colloquial way to describe an investor who is able to manipulate markets by mobilizing large amounts of capital. Read More. What exactly is Bitcoin mining? The price starts falling and like a game of soggy cookie, the slowest players lose. However, regulators around the world are cracking down on the market: According to The Next Webresearchers from Imperial College London have developed a new programme that uses artificial intelligence to predict when pump and dump schemes might be happening. It is not uncommon for an organized pump to meet a sell wall that it simply cannot overcome and a lot of traders participating in the pump incur losses as a result. Spoofing Another common strategy whales use to manipulate the market is called spoofing. Yet, they still made trades before the announcement. Dumped means the coin gets rapidly or gradually but constantly sold off by investors with deep pockets or by groups of investors. One can do this by:

It has over million active users. They have the most control and the highest amount of influence. This wave of selling depresses the price, often to below the level it was at prior to the pump. Its sort of like moving to cash, but keeps you in crypto. Sure, this can leave you in a bad position, but its helpful to understand that coin-to-coin trades are an option. The buyers in signal groups are even worse off. That is a simple arithmetic fact. According to The Next Web , researchers from Imperial College London have developed a new programme that uses artificial intelligence to predict when pump and dump schemes might be happening. The rising popularity of cryptocurrencies over the past years have sped up their creation and growth. After filling a few trades, poof , the spoofer cancels the entire buy order. With enough coins, whales can push down the price by introducing a slew of market-price sell orders. The benefits of this are simple - they control the majority of the market so can buy at the best price, and can agree a time to sell, at the best price. Even if a pump does well, not all the participants involved need to have profited. New traders and investors may easily be confused by the sheer number of currencies available. BCH pump before the announcement. Notify me of follow-up comments by email. Members are told the time of the pump and the trading venue ahead of time to make sure they are ready, but only told the specific coin that is being pumped just moments before to ensure everyone buys at the same time. This is why KuCoin and Cryptopia are the other go-to exchanges to do this on.

Although all three of these exchanges do not condone these scams, traders still do it regardless. When the price starts to rise, the spoofer starts to sell his coins. Bitcoin, Ethereum, litecoin, Ripple. Some of those who are later entering may have bought already after the cryptocurrency has significantly appreciated. This is because the market is so new and lawmakers have not caught up to speed at which cryptocurrency is growing. The cryptocurrency industry is a relatively new one, yet it includes a variety of specific keywords and phrases which any serious trader or investor should know. Other Telegram groups include Pump. Moreover it will discuss the main groups organising pump and dumps through the popular messaging platform Telegram.