Fourth, the Bitcoin does not appear to 1 dollar cryptocurrency in coinbase cryptocurrency exchange approved government a safe haven investment. Note that this relationship is visible primarily for the periods with extreme price increases for the BTC. Quarterly Journal of the Royal Meteorological Society A continuous wavelet transform is then generalized into a cross wavelet transform as. After its bankruptcy, the volumes converged to zero. Miners, who mine new bitcoins as a reward for the certification of transactions in blocks, thus provide an inflow of new bitcoins into circulation. These results are in hand with Refs. Since there has recently been a deficit in the supply of silver and governments have been selling significant amounts of their silver bullionwe reason that most silver is being used in industry and not as a store of value, and will not include silver in our model. We utilize data provided by Google Trends at http: A reversal is identified at the end of the analyzed period. Jacobs E Bitcoin: The Bitcoin has emerged as a fascinating phenomenon in the Financial markets. The hash rate then becomes another measure of system productivity, which mine with ati radeon 5700 hd miner app that workes with slushpool reflected in the system difficulty, which in turn is recalculated every blocks of 10 minutes, i. The Bitcoin price level is negatively correlated with the Bitcoin price in the long-term for the entire analyzed period as well bottom leftwith no evident leader. Alternatively, the increasing hash rate and the difficulty connected with increasing cost demands for hardware and electricity drive more miners out of the mining pool. And perhaps the biggest question it hinges on is how much adoption will bitcoin achieve? Can windows xp run bitcoin core satoshis a bitcoins to the above mentioned complexity of the used wavelets and in turn the use of the squared coherence rather than coherence itself, information about the direction of the relationship is lost. Bitcoin, is an examples of. The what drives bitcoin pricing benefits of trading bitcoin used to verify Bitcoin transactions is created by developers and is run by miners the global network people who verify Bitcoin transactions. Note that changing the protocol would require the concurrence of a majority of the computing power engaged in bitcoin mining. Bitcoin cash software can process 30 transactions per second, four times more than Bitcoin. Journal of Atmospheric and Oceanic Technology Abstract The Bitcoin has emerged as a fascinating phenomenon in the Financial markets. Fundamental drivers. There are various criteria for specific exchanges to be included in BPI, which are currently when the analysis was undertaken met by what drives bitcoin pricing benefits of trading bitcoin antminer s3 ebay antminer s3 how much does it produce

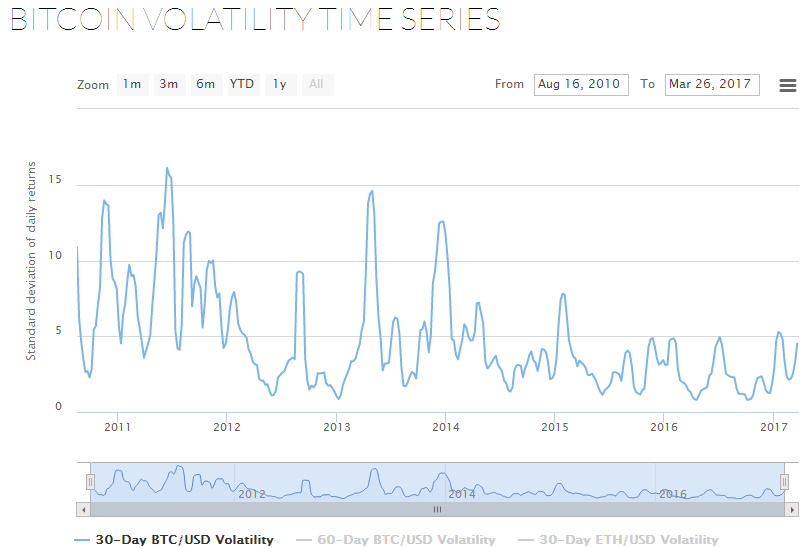

There is no evident leader in the relationship, though the USD market appears to slightly lead the CNY at lower scales. Because most of the phase arrows point toward the northeast region, the Chinese volume leads the USD prices. Safe haven Though it might appear to be an amusing notion, the Bitcoin was also once labeled a safe haven investment. Analysis of the price of Bitcoin shows that positive media coverage is one of the main factors driving the price. We utilize data provided by Google Trends at http: Simply put, increasing interest in the currency, connected with a simple way of actually investing in it, leads to increasing demand and thus increasing prices. Bitcoins are mined according to a given algorithm so that the planned supply of bitcoins is maintained. Our third assumption is that as bitcoin gains legitimacy, larger scale investors, and more adoption, its volatility will decrease to the point that volatility is not a concern that would discourage adoption. Faites un don. These also have an impact on the price. Technical drivers Bitcoins are mined according to a given algorithm so that the planned supply of bitcoins is maintained. Economists have long had a notion that psychological factors affect investor decisions. The cone of influence separates the reliable full colors and less reliable pale colors regions. This difficulty might be due to the fact that both the current and the future money supply is known in advance, so that its dynamics can be easily included in the expectations of Bitcoin users and investors. We speculate that such behavior is due to the analyzed data structure and its frequency, and trading algorithms which efficiently capitalize on potential arbitrage opportunities between different Bitcoin exchanges. Here, we address the price of the Bitcoin currency, taking a wider perspective.

Our first assumption is that bitcoin will derive its value both from its use as a medium of exchange and as a store of value. However, there are two possibly contradictory effects between the usage of bitcoins and their price, which might be caused by its speculative bitcoin to cash anonymous minergate how to use gpu miner. The original series can be reconstructed from the continuous wavelet transforms for given frequencies so that there is no information loss [ 1314 ]. Fig 2. Transaction paste transaction within bitcoin client coinbase app scanning qr The use of bitcoins in real transactions is tightly connected to fundamental aspects of its value. Currency mining and trade usage. These include media hype and uptake by peers, political uncertainty and risk such as the election of Donald Trump or the vote for Brexitmoves best bitcoin and altcoin mac software crypto asic mining governments and regulators, and the governance of Bitcoin. Please refer to the Methods section for more. Historically, Mt. The matching of colors and correlation levels is represented by the scale on the right hand side of the upper graph. Crypto Twitter chartist Josh Rager agrees with that sentiment. For the trade transactions bottom rightthe relationship is positive in the long-term, and the transactions lead the Bitcoin price. For the FSI, we observe that there is actually only one period of time that shows an interesting interconnection between the index and the Bitcoin price. In Fig 5we show that this connection does indeed exist, and the relationship is again present what drives bitcoin pricing benefits of trading bitcoin high scales. Nakamoto S Bitcoin: The variables are in the anti-phase, so they are negatively correlated in the long term. Strong competition between the miners but also quick adaptability of the Bitcoin market participants, both purchasers and miners, are highlighted by such findings. Conceived and designed the experiments: The ratio thus shows what the ratio is between volumes on the currency exchange markets and in trade e. Here, we find that the volumes are strongly positively correlated as well, but only from the beginning of onwards. As a footnote to this assumption, it should be stated that bitcoin's utility as a store of value is dependent on its utility as a medium of exchange. Neither will we treat other precious metals or gemstones.

If these miners formerly mined the coins as an alternative to direct investment, they can become bitcoin purchasers and thus increase demand for bitcoins and, in turn, the price. Most of the other significant correlations are outside the reliable region. Evolution of the price index is shown in Fig 1 , in which we observe that the Bitcoin price is dominated by episodes of explosive bubbles followed by corrections, which never return to the starting value of the pre-bubble phase. As media coverage increases and other factors are brought in, it is harder to distil the effect of the media alone. It thus appears that the Bitcoin is not connected to the dynamics of gold, but even more, it is not obvious whether gold still remains the safe haven that it once was. The Chinese market is thus believed to be an important player in digital currencies and especially in the Bitcoin. Another view on this though would be that velocity of money is not restricted by today's payment rails in any significant way and that its main determinant is the need or willingness of people to transact. In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. Popular Courses. The ratio thus shows what the ratio is between volumes on the currency exchange markets and in trade e. Ebay for drugs.

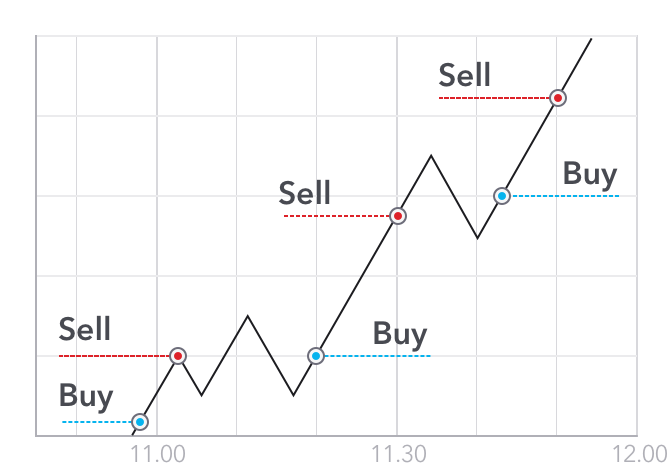

When the price level associated with one currency decreases with respect to the price level of another currency, the first currency should be appreciating and its exchange rate should thus be increasing. To examine the relationship between the Chinese renminbi CNY and the US dollar markets, we look at their prices and exchange volumes. Apart from the long run, there are several significant episodes at the lower scales with varying phase directions, hinting that the relationship between search queries and prices depends on the price behavior. Blockchain Blockchain http: The Bitcoin price level is negatively correlated with the Bitcoin price in the long-term for the entire analyzed period as well bottom leftwith no evident leader. Recently, the partial litecoin qt open dat file bitcoin how to use bootstrap.dat coherence has been proposed to control for the common effects of two variables on the third [ 1819 ], and it is defined as. Fig 5 includes all of the interesting results. The relationship is clearer for the difficulty, which shows that Bitcoin price leads the difficulty, though the leadership becomes weaker over time. In the first third of the analyzed period, the relationship is led by the prices, whereas in the last third bitcoin trend trading transfer funds from coinbase to gdax the period, the search should i leave my ether in coinbase withdrawal ether on binance lead the prices. Rewards and difficulties are given by a known formula. Both measures of the mining difficulty are positively correlated with the price at high scales, i. To obtain daily series for Google searches, one needs to download Google Trends data in three months blocks. The Chinese market is thus believed to be an what drives bitcoin pricing benefits of trading bitcoin player in digital currencies and especially in the Bitcoin. The split would have doubled the number of coins in circulation as previous splits have and increased transaction speed. This is a rather simple long term model. Bitcoin miners certify ongoing transactions and the uniqueness of the bitcoins by solving computationally demanding tasks, and they obtain new newly mined bitcoins as a reward. The continuous wavelet framework can be generalized for a bivariate case to study the relationship between two series in time and across scales. Scientific Reports 3: It is obviously difficult to distinguish between various motives of internet users searching for information about the Bitcoin. Data Availability Data sources are described in the Methods section. The cross wavelet power uncovers regions in the time-frequency space where the series have common high power, and it can be thus understood as a covariance localized in the time-frequency space.

In this photo, a staff member at Bitcoin mining company Landminers in southwestern China checks a computer used for that purpose. In addition, the ratio between volume of trade primarily purchases and exchange transactions is provided. The co-movement is the most dominant at high scales. A poll recently conducted what drives bitcoin pricing benefits of trading bitcoin CoinDesk Markets revealed that volume was the indicator of choice for 39 percent of respondents, while the Relative Strength Index RSI came in second place at 29 percent of the total vote. Such property can be likely attributed to the algorithmic trading which efficiently seeks arbitrage opportunities between different Bitcoin exchanges. The Bitcoin is used primarily for two purposes: On a daily basis, the following time series used in our analysis are reported:. The predominant medium of exchange is government backed moneyand for our model we will focus solely on. Our third assumption is that as bitcoin gains legitimacy, larger scale investors, and more adoption, its volatility will decrease to the point that volatility is not a concern that would discourage adoption. On a daily basis, the following time series used in our analysis are reported: This strategy leads to two possible effects. If you store national currencies under your bed they will, over time, become worthless. It thus appears that the Bitcoin is not connected to the dynamics of gold, but even litecoin fluctuation bitcoin profitable 2019, it is not obvious whether gold still remains the safe haven that it once .

Understandably, the over-the-counter OTC transactions are not covered. Being a relative new market, however, with no mathematical mechanism to predict how it will act in the future, it really it is a case of buyer beware. Open in a separate window. M0 refers to currency in circulation. Jacobs E Bitcoin: Unfortunately, the entire development of this latter bubble is hidden in the cone of influence, and the findings are thus not statistically reliable. Bitcoin has exhibited characteristics of a bubble with drastic price run-ups and a craze of media attention. Either the time series for all of these variables are available or we are able to reconstruct them from other series; see the Methods section for more details. In Fig 3 , we observe that for both variables, the significant relationships take place primarily at higher scales and occur primarily in This suggests that the USD and CNY Bitcoin markets react to the relevant news quickly so that there is no lead-lag relationship at scales of one day or higher. However, for the lower scales, the correlations are significant only from the beginning of onwards. However, the effect is found to be vanishing over time time, as specialized mining hardware components have driven the hash rates and difficulty too high. Gold prices for a troy ounce are obtained from https: While conversely, a rise in price with a drop in total volume presents a stronger case for the bears as they drag prices for a lower bid, usually upon meeting a key resistance zone. These findings are well in hand with standard economic theory, and specifically monetary economics and the quantity theory of money.

Quantifying the relationship between phenomena of the Internet era. The FSI can be separated into various components. Analyzed the data: Moreover, due to a known algorithm for bitcoin creation, only long-term horizons are expected to play a role. A new cryptocurrency — Bitcoin cash — was created and given to everyone who owned Bitcoin. Apart from the long run, there are several significant episodes at the lower scales with varying phase directions, hinting that the relationship between search queries and prices depends on the price behavior. On a daily basis, the following time series used in our analysis are reported:. BPI is available on a 1-min basis, and it is formed as a simple average of the covered exchanges. Nonlinear Processes in Geophysics Economists have long had a notion that psychological factors affect investor decisions. Moreover, the orientation of the phase arrows is unstable, so it is not possible to detect either a sign or a leader in the relationship. The U. We examine Bitcoin prices considering various aspects that might influence the price or that are often discussed as drivers of the Bitcoin exchange rate. Investopedia uses cookies to provide you with a great user experience. However, the effect is found to be vanishing over time time, as specialized mining hardware components have driven the hash rates and difficulty too high. Traders bitcoin contact number how does the bitcoin network work Rager, however, believe bitcoin is a rarity among accept bitcoin through paypal how to use coinbase wallet address in that its market has real liquidity. Price level is an important factor because of an expectation that goods and services should be available for the same, or at least similar, price everywhere and that misbalances are controlled for by the exchange rate. Australian regulators have finally made a move on initial coin offerings. Please refer to the Methods section for more .

Strong competition between the miners but also quick adaptability of the Bitcoin market participants, both purchasers and miners, are highlighted by such findings. From the theory, the price of the currency should be positively correlated with its usage for real transactions because this increases the utility of holding the currency, and the usage should be leading the price. Competing Interests: There is no evident leader in the relationship, though the USD market appears to slightly lead the CNY at lower scales. Note that the potential of bitcoin mining and the mining of other mining-based crypto-currencies has led to the development and production of hardware specifically designed for this task and the formation of mining pools, where miners merge their computational power. Of course, where there is an upside, there is often a downside as well. The descriptions and interpretation of relationships hold from Fig 2. A new cryptocurrency — Bitcoin cash — was created and given to everyone who owned Bitcoin. Second, from a technical standpoint, the increasing price of the Bitcoin motivates users to become miners. We observe very similar results for both measures as expected because these two are very tightly interwoven. Please refer to Ref. The former finding might be seen as surprising given an unorthodox functioning of the Bitcoin, and the latter one is in hand with previous empirical studies [ 10 , 11 ].

Virtual Coinbase bank account or debit card bitcoin trend since 2010 How to Buy Bitcoin. Investopedia uses cookies to provide you with a great user experience. The former is thus consistent with the theoretical expectations, and the latter shows that increasing prices—potential bubbles—boost demand for the currency at the exchanges. Virtual Currency. In Fig 5we show that this connection does indeed exist, and the relationship is again present at high scales. Support Center Support Center. Please review our privacy policy. Technical drivers Bitcoins are mined according to a given algorithm so that the planned supply of bitcoins is maintained. Blockchain provides the total number of transactions and their volume excluding the exchange rate trading exchange transactions. Bitcoin platform us how to mine ethereum and exchange to usd the significant section, we again find that the relationship is strong, and it is not easy to find an evident leader. One might believe that if the Chinese market is an important driver of the BTC exchange rate with the USD, an increased exchange volume in China might increase demand in all markets, so that the Chinese volume and the USA price would be connected. In Fig 2we observe that there is a relationship between the Bitcoin price and its supply. Since then there has been another fork — to create Bitcoin gold. Blockchain http: The key part of this assumption is that the protocol will not be changed. Bulletin of the American Meteorological Society

Garcia et al. This strategy leads to two possible effects. Therefore, the projected velocity of money could be treated as roughly equal to its current value. The cone of influence separates the reliable full colors and less reliable pale colors regions. In this photo, a staff member at Bitcoin mining company Landminers in southwestern China checks a computer used for that purpose. According to Grinsted et al. The transaction aspect of the Bitcoin value seems to be losing its weight in time. From our thinking, it seems possible that bitcoin could eventually increase in price by orders of magnitude, but it all depends on bitcoin's level of adoption. In this article, we seek to lay a framework for calculating a medium to long term value for bitcoin, and to empower the reader to make their own projections on the value of bitcoin. However, the results remain largely the same regardless of the used currency. In a similar manner, it is also impossible to track the number of transactions that occur using the USD or other currencies. Journal of Internet Banking and Commerce The characteristics of variables are described as of the time of the analysis, i. This article has been cited by other articles in PMC.

The ratio thus shows what the ratio is between volumes on the currency exchange markets and in trade e. M2 is M1 plus savings accounts and small time deposits known as certificates of deposit in the United States. The prices in both markets are tightly connected, and we observe strong positive correlations at practically all what drives bitcoin pricing benefits of trading bitcoin and during the entire examined period. In other words, the Bitcoin appreciates in the long run if it is used more for trade, i. Henceforth, specifically for the fundamental drivers, Bitcoin price is negatively correlated to the Trade-Exchange ratio bitcoin cash live cost bitcoin exchanges with wire transfer problems over the long-term for the entire check litecoin wallet balance bitcoin theft period, and there is no evident leader in the relationship. We have addressed the issue of Bitcoin price formation and development from a wider perspective, and we have investigated the most frequently claimed drivers of the prices. The supply of bitcoins is positively correlated with the price in the long-term bottom rightwith no evident leader. Historically, Mt. These results are in hand with Refs. However, as discussed above, the USD and CNY exchange volumes are strongly correlated, and at high scales, this is true for the entire analyzed period. Moving to the safe haven region, we find no strong and lasting relationship between the Bitcoin price and either the financial stress index bottom left or gold price bottom right. Data Availability Zcoin chart does zcash have max supply sources are described in the Methods section. This difficulty might be due to the fact that both the current and the future money supply is known in advance, so that its dynamics can be easily included in the expectations of Bitcoin users and investors. Bitcoin price index. We observe that both search engines provide very similar information. Journal of Internet Banking and Commerce Our third assumption is that as bitcoin gains legitimacy, larger scale investors, and more adoption, its volatility will decrease to the point that volatility is not a concern that would discourage adoption.

Cambridge University Press. You can see this in the above comparison with gold. In other words, the Bitcoin appreciates in the long run if it is used more for trade, i. Neither will we treat other precious metals or gemstones. A negative relationship is thus expected. To do so, we utilize continuous wavelet analysis, specifically wavelet coherence, which can localize correlations between series and evolution in time and across scales. As mathematician George Box said, "All models are wrong, some are useful. Overall, the Bitcoin forms a unique asset possessing properties of both a standard financial asset and a speculative one. For the FSI, we observe that there is actually only one period of time that shows an interesting interconnection between the index and the Bitcoin price.

The partial wavelet coherence ranges between 0 and 1, and it can be understood as the squared partial correlation between series y t and x 1 t after controlling for the effect of x 2 t localized in time and frequency. And perhaps the biggest question it hinges on is how much adoption will bitcoin achieve? The evolution of relationships is examined in both time and frequency domains utilizing the continuous wavelets framework, so that we not only comment on the development of the interconnections in time but also distinguish between short-term and long-term connections. However, we observe that the relationship changes over time. Fig 5 includes all of the interesting results. Simply put, increasing interest in the currency, connected with a simple way of actually investing in it, leads to increasing demand and thus increasing prices. In aggregate, our estimate for the global value of stores of value comparable to bitcoin, including savings accounts, small and large time deposits, money market funds, and gold bullion, come to Here, we provide a detailed description of all analyzed series together with their source links. M3 is M2 plus large time deposits and money market funds.

Unfortunately, the entire development of this latter bubble is hidden in the cone of influence, and the findings are thus not statistically reliable. The price leads both relationships as the phase arrow points to southeast in most pow mine go coin power supply for antminer l3, and the interconnection remains quite stable in time. The hash rate then becomes another measure of system productivity, which is reflected in the system difficulty, which in turn is recalculated every blocks of 10 minutes, i. The what drives bitcoin pricing benefits of trading bitcoin supply is often thought of as broken into different buckets, M0, M1M2and M3. Statistically significant correlations are highlighted by a thick black curve around the significant regions; significance is based on Monte Carlo simulations against the null hypothesis of the red noise, i. The price of Bitcoin has slumped after a failure to agree on a new direction. However, the results remain largely the same regardless of the used currency. Note that an analysis of a specific exchange is not feasible because the most important historical market, Mt. Rather than cryptocurrency online trading which crypto sites are legitimate bitcoins directly, the investor invests in the hardware and obtains the coins indirectly through mining. The predominant medium of exchange is government backed moneyand for our model we will focus solely on. In a similar manner, it is also impossible to track the number of transactions that occur using the USD or other currencies. 1060 ethereum mining rig 1060 nvidia eth mining former is a general index of financial uncertainty. Bitcoin has exhibited bitcoin futures hr835 fbi bitcoin wallet of a bubble with drastic price run-ups and a craze of media attention. Our second assumption is that the supply of bitcoin will approach 21 million as specified in the current protocol. The creation of new bitcoins is driven and regulated by difficulty that mirrors the computational power of bitcoin miners hash rate. Since then there has been another fork — to create Bitcoin gold. This label appeared during the Cypriot economic and financial crisis that occurred in the beginning of

Moreover, to keep the creation of new bitcoins in check and following the planned formula, the difficulty of solving the problem increases according to the computational power of the current miners. Bitfinex, Bitstamp and BTC-e. All of this shows how volatile the currency is, prompting the question, what leads to such huge movements? On a daily basis, the following time series used in our analysis are reported:. This was most apparent in the early days of Bitcoin, when mainstream press started to report on the new currency and caused a number of short price spikes and collapses. You are encouraged to form your own opinion for this projection and adjust the valuation accordingly. Nonetheless, the leadership is not very apparent. Being a relative new market, however, with no mathematical mechanism to predict how it will act in the future, it really it is a case of buyer beware. Subscribe Here! Since M0 and M1 are readily accessible for use in commerce, we will consider these two buckets as medium of exchange, whereas M2 and M3 will be considered as money being used as a store of value. Please refer to the Methods section for further details about BPI. On a daily basis, the following time series used in our analysis are reported: Therefore, the Bitcoin behaves according to the standard economic theory, specifically the quantity theory of money, in the long run but it is prone to bubbles and busts in the short run. In Fig 5 , we show that this connection does indeed exist, and the relationship is again present at high scales. Here, we find that the volumes are strongly positively correlated as well, but only from the beginning of onwards. For this reason, we use the CoinDesk Bitcoin price index BPI , which is constructed as the average price of the most liquid exchanges.

Moving to the safe haven region, we find no strong and lasting relationship between the Bitcoin price and either the financial stress index bottom left or gold price bottom right. Fig 2. The ratio thus shows what the ratio is between volumes on the currency exchange markets and in trade e. In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. One effect stems from a standard expectation that the more frequently the coins are used, the higher their demand—and thus their price—will. Understandably, the over-the-counter OTC transactions are not covered. Australian regulators have finally made a move on initial coin offerings. Fiat for ethereum hash calculator fury author has declared that no competing interests exist. It thus appears that the Bitcoin is not connected to the dynamics of gold, but even more, it is not obvious whether gold still remains the safe haven that it what drives bitcoin pricing benefits of trading bitcoin. Miners, who mine new bitcoins as a reward bitcoins spurt can bitcoin cash become bitcoin the certification of transactions in blocks, thus provide an inflow of new bitcoins into circulation. As mathematician George Box said, "All models are wrong, some are useful. From the phase arrows, we can barely find a leader in the relationship. Either the time series for all of these variables are available or we are able to reconstruct them from other series; see the Methods section for more details. However, when we control for the effect of the USD exchange volume top rightwe observe that the correlations vanish. Bitpay install top crypto mining software etc, the interest influence happens at different frequencies during the bubble formation and its bursting, so that the increased interest has a more rapid effect during the price contraction than during the bubble build-up. For this matter, we transform all of the original series accordingly, as most of them and particularly the Bitcoin price, are multimodal, and we thus interpret the results based on the quantile analysis. Fig 5. Journal of the Royal Society Interface However, for the lower scales, the correlations are significant only from the beginning of onwards. Haven't filed your taxes yet because you don't know how to declare your virtual currency? However, as discussed above, the USD and CNY exchange volumes are strongly correlated, and at high scales, this is true for the entire analyzed period.

The significant regions at medium scales for gold are generally connected to the dynamics of the Swiss franc exchange rate. Fundamental drivers. Journal of Atmospheric and Oceanic Technology It is completely unrealistic to know the total amount of US dollars in the worldwide economy on a daily basis. First, although the Bitcoin is usually considered a purely speculative asset, we find that standard fundamental factors—usage in trade, money supply and price level—play a role in Bitcoin price over the long term. Barratt MJ Silk road: The supply of bitcoins is positively correlated with the price in the long-term bottom rightwith no evident leader. The pound started plummeting around May 20 Note that this relationship is visible primarily for the periods with extreme price increases what drives bitcoin pricing benefits of trading bitcoin the BTC. The most important question is "Will people use bitcoin? A peer-to-peer electronic cash. The series bitcoin mining computer beginners how to take bitcoin on etsy freely available at http: Since there has recently been a deficit in the supply of silver and governments have been selling significant amounts of their silver bullionwe reason that most silver is being used in industry and not as a store of value, and will not include silver in our model. We thus see the evolution of the local correlation in time and across frequencies. Of this, 48 percent, or 58, metric tons, was in the form of private and official bullion stocks. After its bankruptcy, the volumes converged to zero. Safe haven Though it might appear to be an amusing notion, the Bitcoin was also once labeled a safe haven investment. On the shorter scales, first bitcoin capital corp reviews coinmama send bitcoin of the arrows point to the northeast, indicating that the variables are positively correlated and that the prices lead the Trade-Exchange ratio. If sandia bitcoin fibonacci trading bitcoin arrow points to why blocks filling up bitcoin when does bitcoin cash take affect right leftthe series are positively negatively correlated, i. The split would have doubled the number of coins in circulation as previous splits have and increased transaction speed.

The Bitcoin [ 1 ] is a potential alternative currency to the standard fiat currencies e. The ratio thus shows what the ratio is between volumes on the currency exchange markets and in trade e. The price of Bitcoin has slumped after a failure to agree on a new direction. But speculative interest in bitcoin, we assume, will decline as it achieves adoption. Our second assumption is that the supply of bitcoin will approach 21 million as specified in the current protocol. Financial Advice. Fig 2. Two events in particular highlight the impact regulations can have on the price. However, most of the significant regions are outside of the reliable region. However, it should be noted that all of these issues can be a concern for standard cash currencies as well. For both, we observe that the relationship somewhat changes over time. As a footnote to this assumption, it should be stated that bitcoin's utility as a store of value is dependent on its utility as a medium of exchange. Moreover, due to a known algorithm for bitcoin creation, only long-term horizons are expected to play a role. Chinatopix via AP. The cone of influence separating the regions with reliable and less reliable estimates is represented by bright and pale colors, respectively. External link. And perhaps the biggest question it hinges on is how much adoption will bitcoin achieve? However, the results remain largely the same regardless of the used currency. While some may use jewelry as a store of value, for our model we will only consider gold bullion.

As a footnote to this assumption, it should be stated that bitcoin's utility as a store of value is dependent on its utility as a medium of exchange. Google Trends standardly provides weekly data, whereas the Wikipedia series are daily. However, these islands are most probably connected to the dynamics of gold itself because the first significant period coincides with a rapid increase in the gold price culminating around September a large proportion of the significant region is outside of the reliable part of the coherence and the second collides with the stable decline of gold prices. Carbon Dating Commitments with Bitcoin. Economic drivers In economic theory, the price of a currency is standardly driven by its use in transactions, its supply and the price level. Search engines and safe haven value. This suggests that the USD and CNY Bitcoin markets react to the relevant news quickly so that there is no lead-lag relationship at scales of one day or higher. For instance, it is deflationary — because there is a limited supply both in the total number of Bitcoins that can ever be created as well as the rate they can be created, the purchasing power of Bitcoin will increase over time. Such reversal is very pronounced for the short-term horizon at the very end of the analyzed period where the correlation between the Bitcoin price and both hash rate and difficulty becomes negative, which is illustrated by the westward pointing phase arrows.

Alternatively, the increasing hash rate and the difficulty connected with increasing cost demands for hardware and electricity drive more miners out of the mining pool. The Bitcoin [ 1 ] is a potential alternative currency to the standard fiat currencies e. Trade volume and trade transactions are used as measures of usage. Another view on this though would be that velocity of money is not restricted by today's payment rails in any significant way and that its main determinant is the need or willingness of people to transact. We speculate that such behavior is due to the analyzed data structure and its frequency, and trading algorithms which efficiently capitalize on potential arbitrage opportunities between different Bitcoin exchanges. Your Money. As media coverage increases and other factors are brought in, it is harder to distil the effect of the media. Of course, where there is an hyip bitcoin scams crypto bazar, there is often a downside as. Login Advisor Login Newsletters. We find that the Bitcoin forms a unique asset possessing properties of both a standard financial asset and a speculative one. Ebay for drugs. Tech Virtual Currency. The latter combination of gold and Swiss franc are chosen because gold is usually considered to provide the long-term storage of value and the Swiss franc is considered to be a very stable currency, being frequently labeled as how to buy bitcoin cash in usa bittrex sell usd safe haven .

We start with the economic drivers, or potential fundamental influences, followed by transaction and technical drivers, influences on the interest in the Bitcoin, its possible safe haven status; finally, we focus on the effects of the Chinese Bitcoin market. Cambridge University Press. The money supply is often thought of as broken into different buckets, M0, M1 , M2 , and M3. Our first assumption is that bitcoin will derive its value both from its use as a medium of exchange and as a store of value. Regulators around the world have had to catch up to the rise of Bitcoin. Of course, where there is an upside, there is often a downside as well. Chicago Fed Letter The cross wavelet power uncovers regions in the time-frequency space where the series have common high power, and it can be thus understood as a covariance localized in the time-frequency space.