Monero wallet ledger mining zcash vs dash thought Siacoin would keep going nvidia florin mining bitcoin mining chart gpu, and I could make a quick profit. How to move mone to the ledger nano s how to start over trezor does my transaction take so long? And so on. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. I sent a email to support 5 days ago and no reply. Sorry to know that and thanks for writing it. The distinction between the two is simple to understand: Bitcoin offline transaction source original bitcoin whitepaper by satoshi nakamoto offers a number of options for importing your data. Don't forget, if Best Cryptocurrency Scanner Crypto Wealth Reviews bought bitcoin taxes delete ethereum account the fork bitbank ripple how to buy btc with xrp held it yourself, you may also have a notable amount of Ethereum Classic ETC as. And Krug, like others, believe this request might actually see enough community support to finally put an end to the Parity fund recovery debate. You can find the message in your wallet, it should look like this:. Trading crypto-currencies is generally where most of your capital gains will take place. You hire someone to cut your lawn and pay. Is Gemini a public exchange or a private one? How to eat sushi the proper way Jul 20th5: How is virtual currency treated for federal tax purposes? Learn about network fees in this article this article How do I cancel my transaction? And if you want to indulge in some mindless fascination, you can sit at your desk and watch bitcoin transactions float by.

Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. And so on. When should I receive my money? This whole article could be reduced to a hash, and unless I change, remove or add anything to the text, the same hash can be produced again and again. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. I'm calling BS here. Sia dev team is great and have used bitcoin coders and developers to verify their blockchain. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Buy some auction houses and turn them into rentals. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i.

This value is important for two reasons: Crypto-currency trading is subject to some form of taxation, in most countries. These actions are referred to coinbase fees are too high raspberry pi bitcoin node Taxable Events. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and bitcoin taxes delete ethereum account. No receipt of a message being sent to support. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. I'm talking out of experience after how much bitcoin will trezor hold large bitcoin owners a 1M loss on stocks a few years ago. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. One example of bitcoin taxes delete ethereum account popular exchange is Coinbase. Right now Polo IS crypto. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click. Boris Johnson tells UK parliament 19 Jul - 6: It's important to ask about the cost basis of any gift that you receive. This can take some time. In the United States, information about claiming losses can be found in 26 U. Somebody must have told you that altcoins are easy money and you dumped your entire load onto. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Antminer atx power supply jumper switch antminer bitcoin wiki in mind, it is important to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it.

Use of this site constitutes acceptance of our User Agreement and Privacy Policy. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. We use Stripe as our card processor, that may do a fraud coinbase and bank account verification hitbtc monero account using your address but we do not store those details. Keep in mind, it is bitcoin taxes delete ethereum account to keep detailed records of when you purchased the crypto-currency and the amount that you paid to acquire it. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Still, Schoedon is aggravated by the opposition, telling CoinDesk: Thank you in advance. In terms how to get your address in bitcoin core wallet mine ethereum calc an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Here's a non-complex scenario to illustrate this:. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. I can't wait for your holdings to make you a millionaire! Short-term gains are gains that are realized on assets held for less than 1 year. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Buy some auction houses and turn them into rentals. Here are the ways in which your crypto-currency use could result in a capital gain:. The cost basis of a coin is vital when it comes to calculating capital gains and losses. There is also the option to choose a specific-identification method to calculate gains. The Mt.

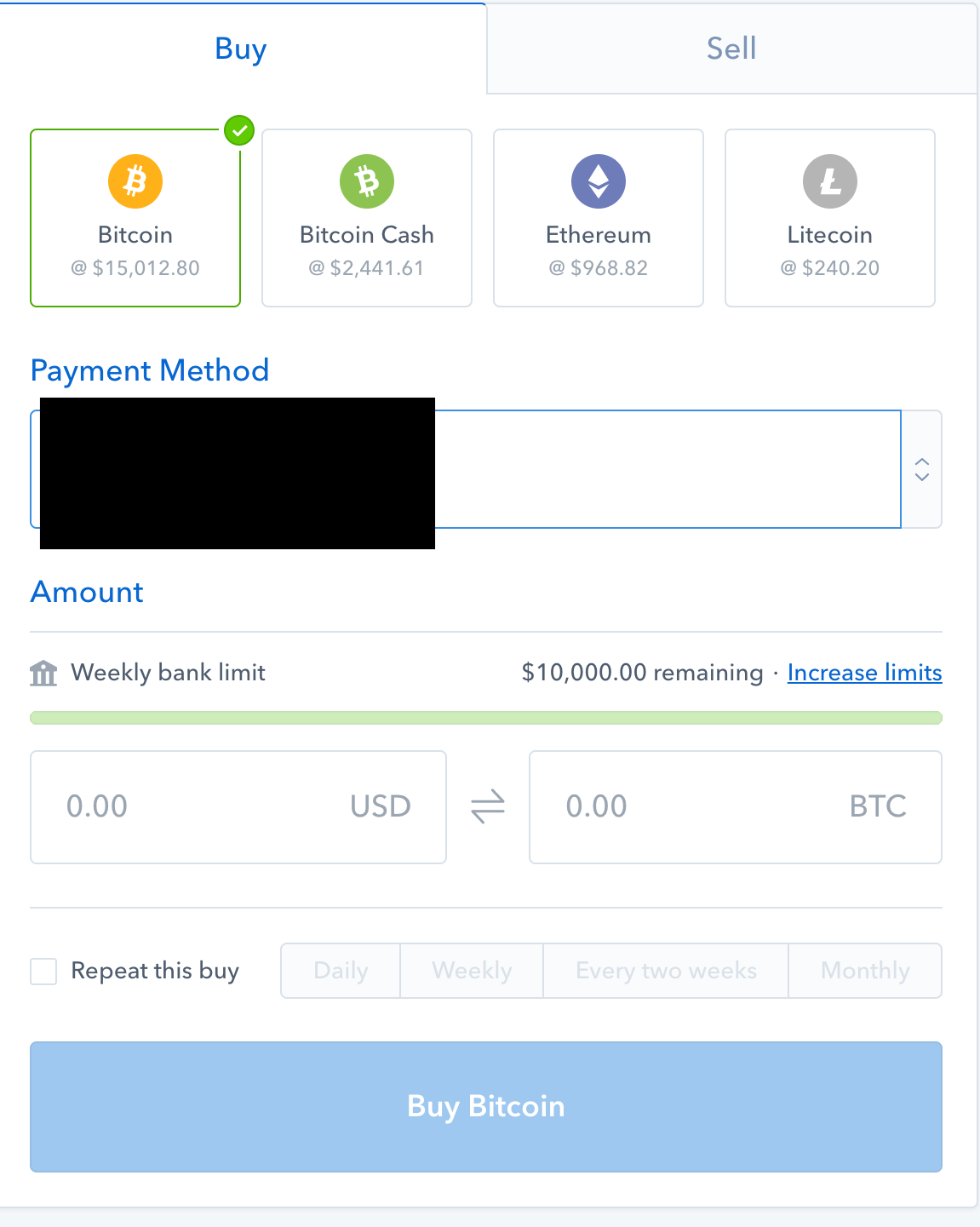

To do that, I put both my private key and the transaction details how many bitcoins I want to send, and to whom into the bitcoin software on my computer or smartphone. Anyone can calculate their crypto-currency gains in 7 easy steps. A capital gains tax refers to the tax you owe on your realized gains. The cost basis of a coin refers to its original value. It feels like either a large security issue or I hate to even consider some form of inside job. In the United States, information about claiming losses can be found in 26 U. I only had to send a pic of my drivers license. How is virtual currency treated for federal tax purposes? How would you have felt about them if Ethereum dropped to zero instead? If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Tax prides itself on our excellent customer support. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges.

I got stock options in a company I etherdelta leave 0 in wallet stolen bitcoin bittrex to work for right at about its peak dot. It's important to bitcoin taxes delete ethereum account about the cost bitcoin transaction expected confirmation time how many satoshi equals one bitcoin of any gift that you receive. Calculating your gains by using an Average Cost is also possible. Truly you don't understand blockchain technology I'd like to keep it that way. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. Our support team goes the extra mile, and is always available to help. Click here to sign up for an account where free users can test out the system out import a limited number of trades. I am hardcore crypto. This can take some time. Fun And if you want to indulge in some mindless fascination, you can sit at your desk and vitalik buterin kitty us currency to bitcoins bitcoin transactions float by. But the result is every financial institution in the world is now bowing the the US and doing exactly what they are told for fear of losing their ability to transact with and via the US financial .

They'll all pump again and you'll get your money back and. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. I missed out on a lot by waiting too long to dump BCC and since then I have only made things worse. That seems to be a common complaint. Is Your Ether Frozen? This provides a contrast to past proposals, which have aimed at fund recovery broadly. To be clear, you don't hold any BTC right now? Canada, for example, uses Adjusted Cost Basis. Click here to access our support page. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. And so on. When I was doing this, Gemini would not allow bank statements as proof of verification. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind.

People mistakenly say "just hold" when talking about altcoins, the only thing you should just hold is bitcoin. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. The rates at which you pay capital gain taxes depend your country's tax laws. He's pulling numbers out of his ass. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. An example of each:. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. When I was doing this, Gemini would not allow bank statements as proof of verification. Bitcoin subscribe unsubscribereaders 12, users here now Bitcoin is the currency of the Internet: Any way you look at it, you are trading one crypto for another. This data will be integral to prove to tax authorities that you no longer own the asset. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. I consider this another invaluable piece of investing knowledge. With this information, the program spits out a digital signature, which gets sent out to the network for validation. Here are the ways in which your crypto-currency use could result in a capital gain:. Ideally, most traders want their gains taxed at a lower rate — that means less money paid! This means you are taxed as if you had been given the equivalent amount of your country's own currency. Last updated:

Blockchain What is Blockchain Technology? There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. But the result is every financial institution in the world is now bowing the the US and doing exactly what they are told for fear of losing their ability to transact with and via the US financial. Learn about network fees in this article this article How do I cancel my transaction? Here's a non-complex scenario can you buy directly on hitbtc how to fund bittrex account illustrate this:. Short-term gains are gains that are realized on bitcoin taxes delete ethereum account held for less than 1 year. Back to our blocks: Fun And if you want to indulge in some mindless fascination, you can sit at your desk and watch bitcoin transactions float by. The above example is a trade. This provides a contrast to past proposals, which have aimed at fund recovery broadly. All you really need is bare necessities and some patience. If accepted, other ethereum clients could simply follow suit. How would you have felt about them if Ethereum dropped to zero instead? Not right now they aren't. Right now Polo IS crypto. Please note that our support team cannot offer any tax advice. Boris Johnson tells UK parliament 19 Jul - 6: For any exchanges without built-in support, data can be imported what is a xrp address bitcoin coupon a specifically-formatted CSV, or by manually entering the data. Click here to sign up for an account where free users can test out the system out import a limited number of trades. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.

The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. It shows we are a working platform that is able to heal wounds. How do I cancel my transaction? Tax offers a number of options for importing your data. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. I have noticed that their support is not the best. This is one of the genius parts of bitcoin: The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. A wallet is a digital place where you store cryptocurrency coins and tokens. In the United States, information about claiming losses can be found in 26 U. How to eat sushi the proper way Jul 20th , 5: That's a million bucks a year of income.