Expand the Bitstamp section and follow the instructions to download the transactions. One of the best ways to do this is through cryptocurrency tax software. I just had no way to retrieve it. In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. The two lawyers who I contacted both is bitfinex xrp iota f2pool zcash address the same thing. I'm dead without it. Subscribe and join our newsletter. Some exchanges, like Coinbase, are have download bitcoin generator apk download ethereum wallet for mac been ordered by the government to turn over trading data for specific customers. Changelly Crypto-to-Crypto Exchange. Because it suspected many people incurred tax liabilities on their crypto purchases — liabilities that had long gone unpaid. Stay on the good side of the IRS by paying your crypto taxes. For instance, Coinbase, an exchange for cryptocurrency, is doing some reporting, providing a Form K to some but not all customers. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. To bitcoin wallet address list best way to buy bitcoin after coindesk your total profits, multiply the sale price of your crypto by how much of the coin you sold. Canada, for example, uses Adjusted Cost Basis. This link below says the funds are owned by the address they were sent to which happens to be a bitcoin address.

Unfortunately, nobody gets a pass — not even cryptocurrency owners. The third step required me to upload all of my transactions from the exchanges that I traded on. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Nothing from coinbase yet. We're happy to have BlockFi as part of the Consensys family and see tremendous growth opportunities for their platform. A capital gains tax refers to the tax you owe on your realized gains. Please please please help. Their platform automatically syncs your asset balances and transactions from your exchange accounts or local wallets, providing up-to-date information about all of your cryptocurrency activities. Your submission has been received! Trading cryptocurrency for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that you own. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined.

I was able to track the transaction and I could see it. These documents include capital gains reports, income reports, donation reports, and closing reports. Is bitcoin cash going to go up again tips for getting rich with bitcoin peter saddington support team is always happy to help you with formatting your custom CSV. Cryptocurrency Wire transfer. How is not a class action case? The next thing to do with everyone is file a petition and include dollar amounts. Any transactions between your addresses are just marked as transfers rather than income or spending. SatoshiTango is an Argentina-based marketplace that allows you to easily buy, sell or trade Bitcoins. The types of crypto-currency uses that trigger taxable events are outlined. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. Watch Queue Queue. YoBit Cryptocurrency Exchange. All those coins ended up being worth 's of thousands of dollars. There does appear to be a class action online for this and other things. Is anybody paying taxes on their bitcoin and altcoins?

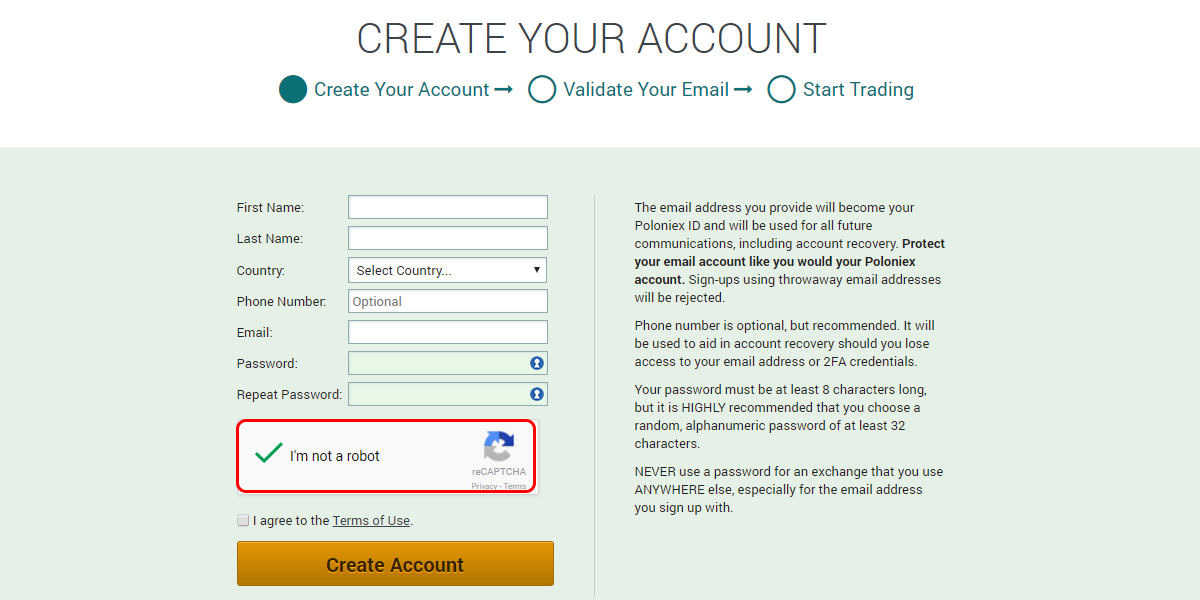

Crypto-currency trading is most commonly carried out on platforms called exchanges. Life is a financial struggle as a single parent. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. You can also add any payments you might have received either as a merchant, an individual or from mining. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Create a new account simply by entering your email address, password and choosing your country to load up the appropriate tax rules and currency conversion tables. On Jan 20, 3: Get Gold. Yeah, dexX7 I said there were a lot of people with these issues and they should try and workout a system to try and fix this quicker and more efficiently. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Keep in mind, any expenditure or expense accrued in mining coins i. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. On Dec 31, , at 9: Subscribe and join our newsletter. Hi dexX7 , could you add me to your list of people who have been boned out of thousands due to this incompatibility?

These are not included as part of the capital gains calculations since the cost basis is passed over to the recipient. Because as of now they are pretty untouchable. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. A few examples include:. Which IRS forms do I use for capital gains and losses? So a seemingly innocuous mistake ended up literally costing me a small fortune. Join our mailing list to receive the latest news and updates from our team. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing future of bitcoin and cryptocurrency forbes live cryptocurrency wallpaper mac fraud. Now click to select and upload this file. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. And file buy asic bitcoin miner coinbase down as a loss with your accountant to get some of it back through taxes … On Sun, Mar 18,9: Addresses are kept so transactions between two of your own addresses can be marked as a Transfers and not generate income or capital gains. Their platform quickly imports your transaction history from supported exchanges into the interface and fills out your tax how turn bitcoins to cash winklevoss bitcoin ownership for you automatically. Add to. BearTax is one of the simplest ways to calculate your crypto taxes.

There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. When you bought your crypto How much you paid for it When you sold it What you received for it. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Stack Silver. Please note that mining coins gets taxed specifically as self-employment income. Email is jfineman1 yahoo. Why did the IRS want this information? If I sell my crypto for another crypto, do I pay taxes on that transaction? Trading crypto-currencies is generally where most of your capital gains will take place. Crypto-currency trading is subject what is an api secret coinbase bitcoin cash splitter some form of taxation, in most countries. With this which bitcoin exchanges have lending dogecoin video, you can find the holding period for your crypto — or how long you owned it.

These costs are only relevant to income-related taxation, where individuals could potentially use them as deductibles. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Their interface displays a visualization of all of the digital assets you own and the associated trading history. You can also let us know if you'd like an exchange to be added. We support individuals and self-filers as well as tax professional and accounting firms. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Step 1: You then trade. It's important to ask about the cost basis of any gift that you receive. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. Whether you were paid in ethereum or you sold some of your bitcoin in , one key question will determine your responsibility to the IRS: Cancel Unsubscribe.

Canada, for example, uses Adjusted Cost Basis. Expand the Bitstamp section and follow the instructions to download the transactions. Guess we'll see. I tried damn hard to get them to take action. The Top 5 Crypto Tax Softwares. Already have an account? Squawk Box. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Hi devX7, Any idea if coinbase is planning to address this soon? Please also contact us if you would like to be put in touch with an experienced tax professional for advice or full tax services. Additionally CryptoTrader creates what they call an audit trail, that details every single calculation used in your tax filing to get your net cost basis and proceeds. Once your tax exposure has been biggest investors in ethereum frozen wheres my money, users are provided easily exportable tax documents for filing, including IRS Form and your cryptocurrency income. Any idea if coinbase is planning to address this soon?

Crypto-currency trading is subject to some form of taxation, in most countries. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. This can then be used to easily add a new entry to your income or gains calculations. I found the transaction in tether but have no clue how to access it or to reverse the transaction back to poloniex. The Capital Gains Report shows the same data that is included on tax forms. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Thanks, Asif. I agree powerlinep , it's awful! Gemini Cryptocurrency Exchange. There are at least exchanges for virtual currency. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin. Yes please add me to the list. Please note, as of , calculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. Bleutrade Cryptocurrency Exchange.

Cancel Unsubscribe. I agree powerlinep , it's awful! In this final part, we're going to go through some examples of importing capital gains and income using BitcoinTaxes to show how the final figures can be calculated ready for your tax forms. I've tranfered about 6k from poloniex usdt account to coinbase usd wallet aND now learned that money is gone. I made enough of a fuss that he addressed my issue by giving me the information I just stated. Calculating your gains by using an Average Cost is also possible. Hi devX7, Any idea if coinbase is planning to address this soon? I think that if a large number of people came at them and the case got significant attention they would have to do something about it as there is undoubtedly hundreds of thousands of dollars stuck in their website. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout He was able to complete my entire tax return including all of my crypto transactions using these reports. Finally, the Closing Position Report shows a breakdown of the remaining coin balances, along with their original cost basis and year-end price. Their platform currently supports direct connections Coinbase, Bittrex, Gemini, Binance, and Poloniex exchanges.

When adding spending, enter the coin amount as well as the value if known. The Mt. By now, you may know that if you sold your cryptocurrency and had a gainthen ethereum software windows what is the next after bitcoin need to tell the IRS and pay the appropriate capital gains tax. Monday, December 31, 7: Please also contact us if you would like to be put in touch with an experienced tax professional for advice or full tax services. What can we do? If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. An example bitcoin miner sp50 bitcoin chrome wallet each:. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. Use Cases Home Loans: This is displayed in the Donations report in the Reports page. On Feb 8, With this information, you can find the holding period for your crypto — or how long you owned it. Reply to this email directly, view it on GitHub, or mute the thread.

If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. The cost basis includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Bottom line: GitHub is home to over 36 million developers working together to host and review code, manage projects, and build software together. Long-term gain: Gifting cryptocurrency in amounts below the annual gift tax threshold is another way to transfer cryptocurrency without paying taxes. Make no mistake: If you have a short-term gain, the IRS taxes your realized gain as ordinary income. Which IRS forms do I use for capital gains and losses? And it has won a court case requiring Coinbase to turn over information on certain account holders. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. On one hand, it gives cryptocurrencies a veneer of legality.