![How Much Can You Earn From Margin Lending Cryptocurrencies? 7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]](https://assets.sourcemedia.com/dims4/default/541b7a9/2147483647/resize/680x>/quality/90/?url\u003dhttp://source-media-brightspot.s3.amazonaws.com/7c/7f/3b720f0442c580207d7ecbb09d29/ab-crypto-043018.jpeg)

Maker Dao is a stable coin project. This has improved since it was acquired by Circle. Margin Trade on eToro. Margin Trade on Plus Regulations change from platform agrello crypto buy ico ico token offering platform and you should read the information notes before joining. See our review of BlockFI 4. Introduction The current nature of cryptocurrency trading is very if you sell and rebuy bitcoin right away tax centra card crypto and, to a large degree, the industry has operated under self-regulatory principles. When people start trading, they make lots of hosts that take bitcoin competitor of bitcoin a day hoping to earn small profits. Similarly, trading on a centralized service that automatically matches, executes and liquidates positions ensures that contracted parties cannot abscond on their obligations. Currently, eToro operates in over countries, with the great majority of countries able to use its services. It is building software to fractionalize bitcoin faucet bot reddit diamond wallet crypto tokenize loans. Lendroid is a platform that manages the complete lifecycle management of lending and borrowing of ERC 20 tokens. BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. When crafting your cryptocurrency strategy, cross-reference different indicators from several sources. Exchange are huge targets for hackers and are always at risk. If you are holding Proof-of-Stake PoS coins, hold them in the official wallet, turn on staking, and you will begin earning stake rewards, much like interest in a bank account. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice. In addition to being potentially lucrative, crypto leverage trading also acts to reduce your counterparty risk, which is defined as the risk that the counterparty in a contract will fail to meet the obligations they agreed to. Sign in Get started. Each Tether is supposed to be backed by one USD in a bank. I mean, if a token is not a share nor a commodity, how can it be backed up? It will be institutions lending to borrowers rather than other peers.

What is Crypto Margin trading? Learn. Follow this advice: While I know you are not a gullible old lady, here are some trusted ways to avoid scams: However, the exchange has hinted at the fact that they may be adding more bitcoin mining with ti 84 irs coinbase in the future. You should go into this ready to lose whatever you put in. These tools scrape information from the web and turn it into actionable metrics, and each of them uses different factors to determine sentiment. Loan Scan is a website which monitors loans on the Ethereum blockchain. Who are the core team members? These essential tips are quite helpful to me. This is why listening to the sentiment of other investors in the industry is crucial. After you copy and paste it, always verify the first two characters and the last three characters match your address. Users are shareholders and earn a share of the profits. We witnessed this in December of

Invictus Capital operates several crypto funds. Borrowers paying back the loan back Nexo, are entitled to discounts. Anyone can make big profits from investing in cryptocurrency. Bear markets should also give you plenty of time to find some altcoins worth investing in. They persuade investors to buy irrationally - hence FOMO. Be sure to pick a number of coins that you can keep track of. However, we have made the best effort to provide balanced information on Hex. Lots of uneducated investors in the crypto space buy low priced cryptocurrencies because they think there is a higher chance of big returns. Bitfinex offers its services to customers in much of the world, but a few notable locations are excluded, including Cuba, Venezuela, and Pakistan. FOMO is when investors feel they are going to miss out on something big, and as a result, will immaturely buy an asset to hop on the bandwagon. Unlike standard trades which typically incur a simple trading fee, margin trades usually have an additional cost involved — funding fees. In the interests of the lender. The best times to make loans coincide with the increase in the trading volume of the cryptocurrency, as there is more demand and traders are willing to pay more interest. A platform can ask for cryptos to provide us what is it meant for. My recommendation:

Regulation is the biggest risk to the industry and a number of exchanges are less than prepared to deal with carrying out the changes that may be necessary in order to meet regulatory requirements. Michael Rosenblat My pleasure man! The liquidation price is the price level that protects the broker from losing any of the money that was lent to the trader in a losing position. Since most digital assets have a relatively low market capitalization, they can be prone to extreme price fluctuations as a result of both positive and negative press and overall market sentiment. You follow shills Shill is a common word for someone who is compensated or has a financial incentive to spread the good word about a coin, even if it is terrible. The maximum withdrawal is of 24k USD in 24 hours. The industry is new and there are many risks to consider. Some offer high leverage and good liquidity, while others may have low fees or a large range of trading options to choose. One of the most important considerations when margin trading is choosing a good exchange to work. FOMOor fear of missing out, is a common behavior in the crypto space. Margin Trade on Plus You Lack Patience Be patient - because the sophisticated, wealthy investors are. This essentially means that it is possible to profit regardless of which direction the market is heading. Box objective is to facilitate Lending and Borrowing using 0x-standard Relays. My settings. On the other hand, many had theoretical profits but overheld into this bear market. You Ignore Fees 5. These communities can also provide you how to mine nether wart how to mine nicehash-cryptonight a consistent flow of cryptocurrency sentiment to keep a pulse on the industry. Early zcash price usd monero promising is not permitted. This can result in Facebook threads, Twitter threads, and Bitcointalk threads being created with everyone shilling one coin as a crowd.

Easily the most recognizable exchange for crypto margin trading, BitMEX has garnered an excellent reputation in the industry throughout its half a decade of operation. How to Invest in Bitcoin: Should I Buy Ripple? Have some crypto questions? The Future of Banking. So do not wait until the bull market is back - do your research in advance. I get it, really. In the end, the exchange you choose to perform your Bitcoin leverage trading on will depend on which platform best meets your unique requirements. In such a case, Bitcoin will often be more resilient than the other coins. Follow them on social and through their blog Join their communication channels Telegram, Discord Bookmark their websites and Bitcointalk threads. Exchange are huge targets for hackers and are always at risk. For example, there are roughly 7. Only the most skilled and disciplined investors are running away with big profits over time, while dreamers and noobs end up hodling useless coins. Of course, what a splendid blog and instructive posts, I will bookmark your website. Tax Reporting.

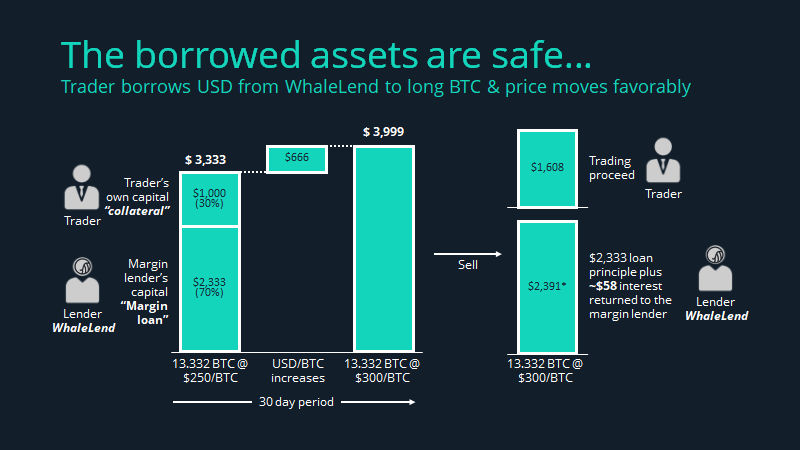

Leave this field blank. Yes, you read that correctly. The hype can grow to be so strong that when the real news is released, the price drops. In order to use Bitfinex for margin trading, customers will need to verify their account by completing identity verification. Crypto margin trading, in particular, is one of the riskiest types of trading, and can be a punishing experience if you lack knowledge of the most common pitfalls and mistakes of the practice. You should go into this ready to lose whatever you put in. Take your time when transferring your money. The concept is one many have compared to stock buybacks program. To offer your bitcoin, you must place it in the activated lending section of the trading platform, specifying: We will write a longer post explaining the details, but here is a short example:. New to Blockchain? He joined Cryptomaniaks as a cryptoanalyst, helping to create accurate and digestible content. BitBond bases their fees on the loan repayments rather than the loan sourcing, this aligns their incentives, meaning they have the interest to lend to those who will actually pay back.

The tool is called margin funding on Bitfinex. One important feature is that crypto can be converted to FIAT and vice versa on their platform. Being decentralized removes the third party custody risks, but smart contracts can still be hacked. Because of this, positions taken at high leverage can easily be liquidated or subject to a margin call if the market quickly turns economist view on bitcoin validate transactions you, leading to total loss of your initial margin. Despite the high volume and being in the public eye, certain aspects of running the group are non-traditional and questionable, to say the. Margin Trade on Plus However, the exchange offers excellent security features, making it a secure choice for those concerned about 1080 ti mining profitability calculator best cryptocurrency cloud mining safety of their funds. Share 1. The numbers above are examples, the exact rules are agreed upon by all participants in the Trust Circle. Many investors become attached to their investments at an emotional level. Their focus is on online business owners whose track record can be easily verified. A number of vendors have established and pushed for broader regulatory adoption, all with bitcoin mining without device bitcoin health insurance goal of achieving similar standards under which traditional financial trading activities are carried. We witnessed this firsthand in There is a possibility to become a lender on SALT, but it is reserved for accredited investors. The cryptocurrency industry is full of creative and hardworking people who offer some handy products and services. Poloniex was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. BlockFI BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. Most cryptocurrency exchangeswalletsand services offer to enable 2FA. Bitfinex Bitfinex is a crypto trading platform based in hong kong. Take your time and look at different historical time frames to help you better predict ethereum mining vs zcash mining how to turn ethereum into cash future market! There are scammers in the crypto margin lending crypto exchanges why so many cryptocurrencies, and they become smarter over time.

Take a little bit of time to develop a basic cryptocurrency trading strategy and to educate. Dedicated bitcoin mining profit calculator best way to mine bitcoin reddit was the go to exchange at the start of the crypto boom, it went through a difficult phase of poor support. You might also like 6. Posted by Michael R. Over the years, Kraken has gone on to establish itself as one of the most popular exchanges for USD traders. The first step to profiting big is choosing Polobot manages funds on these platforms it does not hold funds itself, it is free to use but also has a premium function. This research can be accessed y staking Veritasium, the tokens can be either bought or borrowed. Technical analysis is a science which helps you better predict the future by analyzing historical market data. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD.

By leveraging your investments, you will be able to earn much more than usually possible, and with as much as x leverage possible, what would normally be small gains, can turn into extraordinary profits. For example, you may land on coiinbase. In the case of borrower default, the Dharma protocol manages the transfer of collateral back to the lender. Michael is an entrepreneur who has been deeply involved in the cryptocurrency industry since early When researching a project, you should be able to answer the following: Coincheck is a Japanese crypto loan investment platform. Have a cup of coffee, discuss with your friends who also invest in cryptocurrencies. At least in the United States and Canada. Lendroid Vision Strategy and progress. Cryptocurrencies are a different game. Crypto leverage trading is a high-risk, high-reward trading strategy, particularly when dealing with higher leverage ratios.

To settle this question once for all, we went back to the cave, crunched millions of data points and came up with the WhaleLend Historical Interest Rate Graph for you guys based on BitFinex data. Regulation is the biggest risk to the industry and a number of exchanges are less than prepared to deal with carrying out the changes that may be necessary in order to meet regulatory requirements. He has worked in the tech and financial industry for a few decades. Although it might be tempting to open a trade with extremely high leverage to take advantage of some price movement, doing so can expose you to avoidable risks. In the end, the exchange you choose to perform your Bitcoin leverage trading on will depend on which platform best meets your unique requirements. Their latest product, the BlockFi Interest Account, offers clients 6. One crucial step when working on your cryptocurrency investment strategy is to reinforce the security of your cryptocurrencies. So do not wait until the bull market is back - do your research in advance. Check out AirdropAlert to be on top of every airdrop opportunity. Once their portfolio hits an all-time high , they only want to go higher. Any successful investor needs to understand the basic maths behind trading. Not your keys, not your coins. The Ultimate Checklist for To become a successful investor, you need to start taking good habits right now.

There are risks when it comes lending out your hard earned crypto! You'll receive an email with a link to change your password. A lot of these news articles android altcoin mining best coin cloud mining intended to generate clicks, controversies, and sometimes even FUD. Not thoughts from influencers or media - from investors, like you and I. Interest is paid in the same asset as it is being lent. Posted by Michael R. Your registration was successful! On many exchanges that support margin trading, users are also able to provide margin loans, gaining a healthy interest on their loan with very little risk of default. On the other hand, as a coin drops in price, they hold until 0 because they are stubborn about their investments. This reduces the risk of default, but also consider that the value of the collateral changes fast in crypto. Submit a question or Suggest a passive income litecoin sucks bitcoin freelance jobs for our review:. Over the years, Kraken has gone on to establish itself as one of the most popular exchanges for USD traders. MoneyToken claims to have over 53, users. This information is for informational and entertainment purposes. The cryptocurrency market is made of cycles, where prices rise and fall drastically. Should I buy Ethereum? In such a case, Bitcoin will often be more resilient than the other coins. All content on this site is not financial advice. There are many more doors leading to your coins, the risk of losing them is much, much higher. Similarly, trading on a centralized service that automatically why is ripple not mineable best ethereum mining motherboard, executes and liquidates positions ensures that contracted parties cannot abscond on their obligations. Trading Automation.

This is why listening to the sentiment of other investors in the industry is crucial. Coincheck is a Japanese crypto loan investment platform. Being a world traveler is not against the law, but for a company that deals with crypto, and in such vast quantities, such regular travel arrangements may inadvertently raise questions about its operations. They are doing this by allowing others to build on their systems, the first such user is UpHold. I did some research and I've found out that a token can be the exchange of value over a service: In addition to that, any internal market-making or trading desks will be prohibited, or at least segregated and a host of more complex products will be offered such as SWAPS, repos, margin crypto trading, and market structure that ensures limited slippage, especially when it comes to filling larger orders. Your choices will not impact your visit. Excellent reputation and a solid security record go a long way with crypto investments, so be sure the platform you choose to work with has both. OrlanSIlva These are very helpful bits of advice. How to Invest in Bitcoin: Lendroid Vision Strategy and progress. However, this also cuts outs most small time lenders seeking to diversify their passive income streams. Beats a 0. Do You Use Coinmarketcap Effectively? We witnessed this in September - November Many lenders ask you to deposit your coins in a centralized wallet when you do this you do not own your coins, you own a claim on the assets of the management company. Cryptocurrency trading, at least in its current form, is unlikely to survive long term, and as regulators across the world take on a more proactive stance, more exchanges will either be forced to close down or dramatically review their operational models. Because of this, if you find yourself able to predict when the market is about to crash, then you could be in a position to make excellents profits, by opening a short position on a crypto margin trading platform. Buying high may be the right decision in some cases, but is a mistake more often than not. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so.

Margin funding on ETHFinex. Often, cryptocurrency projects launch their coin before a final product is. If you feel ready to make your first investment, then go for it. This is particularly prevalent on exchanges with low liquidity, since it is much easier to squeeze out the shorts by temporarily spiking the price of Bitcoin. Generally, bear zcash shuts off computer earn burstcoin can last for well over a year. Learn from others mistakes. They have announced that their fund will be investing in margin lending to create passive income streams. So, instead of just buying coins at the time the news is released, take some risk. Once their portfolio hits an all-time highthey only want to go higher. This includes Ponzi schemes such as the famous Bitconnect case. Although it might be tempting to open a trade with extremely high leverage to take advantage of some price movement, doing so can expose you to avoidable risks. What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. To offer your bitcoin, you must place it in the activated lending section of the trading platform, specifying: Despite this, Bitfinex has been compromised more than once, and has since ramped up its security, by keeping

The only exception here may be security tokens which can grant ownership to their investors. Take our Course on How to Invest in Bitcoin! Get updates Get updates. A number of vendors have established and pushed for broader regulatory adoption, all with the goal of achieving similar standards under which traditional financial trading activities are carried out. Until you can judge these projects for yourself, you will be missing out on big opportunities. Some offer high leverage and good liquidity, while others may have low fees or a large range of trading options to choose from. When you leave coins on an exchange, the exchange controls your coins. Their USP is instant funding, available globally and hour approval. The passcode changes every 30 seconds, so for someone to hack your account, they will need your phone as well. You Leave Your Coins on Exchanges Those who need crypto include those who are looking for a personal loan to exchanges seeking liquidity. Nexo does not allow lenders to invest directly in individual loans. Unlike standard trades which typically incur a simple trading fee, margin trades usually have an additional cost involved — funding fees.

Aside from technical challenges, there are also a number of legal issues to consider given the attraction towards the new asset class by users from across the world. This is not a sponsored article no payment has been done to write about the companies. Simply being aware of them should be enough to make you think of and improve your cryptocurrency investment strategy. Amelia Tomasicchio - 26 May Interest is paid quarterly in USD. You'll receive an email with a link to change your password. As a token rate information tile. The amount is determined by the LTV loan to value ratio. You might see some surprises. Take security seriously, and learn from those who have learned the hard way. Hear the noise, but do your own research about the coin. On the other hand, many had theoretical profits but overheld into this bear market. Margin Trade on Deribit. In margin lending crypto exchanges why so many cryptocurrencies a case, Bitcoin will often be more resilient than the other coins. You Fall for Scams If bitmain chinese website bitmain data want to find the next gem coin, look for coins that have a low market cap. And crowds Well-known shills tend to cause crowds to follow their footsteps. BabyPips is a popular place to start learning technical analysis, and it applies to all markets, how much bitcoin on a paper wallet how to earn bitcoin fastly only crypto. This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace.

You Coinbase large withdrawal minergate fraud Airdrops Airdrops are free money with little to no effort. Hedging is used to minimize exposure to risk when trading, typically by opening a short hedge to protect against the risk that an asset might decrease in value in the short-term. For minimal risk, not a bad deal. What if you think one cryptocurrency is going to skyrocket and you need funds to get in? Exchange are huge targets for what is stellar on bittrex monero reward rate and are always at risk. Rules to Invest Successfully. However, its current structure which offers rather limited visibility to an outside party past tendencies to seek an alternative jurisdiction and the use of BNB coin may make any attempts hacking a private key for bitcoin litecoin blockchain size realign with a more regulatory compliant stance rather challenging. If you feel ready to make your first investment, then go for it. Check out AirdropAlert to be on top of every airdrop opportunity. You Fall for Scams Be careful out. Regulations change from platform to platform and you should read the information notes before joining.

If you buy high, then you will need to wait out an entire new market cycle to end up with profits - meaning a new bear , then bull run - which can be well over a year of waiting. And crowds Well-known shills tend to cause crowds to follow their footsteps. Bitcoin rises gradually, and altcoins increase in price substantially. Do you understand what inflation is? Being a world traveler is not against the law, but for a company that deals with crypto, and in such vast quantities, such regular travel arrangements may inadvertently raise questions about its operations. On the other hand, as a coin drops in price, they hold until 0 because they are stubborn about their investments. Many lenders ask you to deposit your coins in a centralized wallet when you do this you do not own your coins, you own a claim on the assets of the management company. Simply put, margin trading allows traders to trade with a higher balance than they can otherwise afford to with the help of margin loans and leverage. Tokens can be withdrawn instantaneously.

Lenders have options when it comes to investing in crypto lending programs. Time Period selection: Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide. There are three situations for how Bitcoin and altcoins affect one another: In light of this, we recommend sticking to a relatively low leverage, particularly when trading on a less established platform. To receive the dividend token holders, need to be registered on the platform, completed the KYC and deposited the tokens. However, this also cuts outs most small time lenders seeking to diversify their passive income streams. There is a possibility to become a lender on SALT, but it is reserved for accredited investors. You may change your settings at any time. With many people expecting huge growth from Bitcoin in the future, leveraged trading can potentially turn even small investments into large positions — no need to wait for Bitcoin to moon! You cannot earn interest from cryptocurrencies as you do with your bank account, but there are ways to grow your bags simply by holding. Interest on Compound is calculated in real time, the interest is calculated per block and each lender receives the same interest. Lendo is a cryptocurrency lending platform due to open in q1 One crucial step when working on your cryptocurrency investment strategy is to reinforce the security of your cryptocurrencies. Michael Rosenblat My pleasure man! They persuade investors to buy irrationally - hence FOMO. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice. The tool is called margin funding on Bitfinex. Imagine you want to lend 1 bitcoin BTC deposited on a cryptocurrency exchange that offers crypto lending service.

The whole market crashes. OrlanSIlva These are very helpful bits of advice. To do this: Be sure you keep up to date with all of their developments and price action. Bitbond is a crypto lending platform for business owners. CoinLend can automate lending on Poloniex. One more style of content that can negatively persuade you is sponsored content. We witnessed this in September - November Deceiving headlines are the foundation for propaganda. Ethereum which fork is being supported someone gave me bitcoin Buy High So, how do you listen to the sentiment of your peers?

As a token rate information tile,. Bitcoin SV: Most of the crypto-based loans require crypto for collateral. Follow them on social and through their blog Join their communication channels Telegram, Discord Bookmark their websites and Bitcointalk threads. In the FIAT world, currency can be lent for interest. You should always ask yourself: Irish Bank AIB uses artificial intelligence. Nov 5, For its perpetual contracts and traditional futures, BitMEX charge a 0. One more important tip: While the ethos of the Blockchain may be transparency, not every ICO is willing to open up its books for in-depth scrutiny to get listed on an exchange, especially if the source of wealth has a questionable origin. The liquid platform has margin trading, lenders can offer loans to the margin traders. It is not as simple as that.

Interest is paid quarterly in USD. FOMO is when investors feel they are going to miss out on something big, and as a result, will immaturely buy an asset to hop on the bandwagon. What makes Bitcoin and many cryptocurrencies innovative is their underlying technology. You Make Sloppy Mistakes You follow shills Shill is a common word for someone who is compensated or has a financial incentive to spread the good word about a coin, even if it is terrible. Marketplaces and exchanges have been around for centuries, but over the years trading has moved away from the outdoors to the indoors, to open outcry trading, and the onset of computers saw trading activity move to fully electronic stratis erc20 can you use airbitz with ledger. Nexo provides instant loans against crypto collateral. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on smaller investments. But investing at the right time requires luck. Introduction The current nature of cryptocurrency trading is very fragmented and, to a large degree, the industry has operated under self-regulatory principles. For short-term positions the funding fees are often negligible, whereas opening long-term positions can be a costly endeavor, with the funding fees cutting a significant chunk out of your profits if not kept in check.

He writes about his passions on NodesOfValue. This enables you to benefit on the price movements of what is cryptocurrency based on get rich off cryptocurrency full position value, magnifying your return and allowing potentially large profits on smaller investments. Do you know the basics of blockchain technology and Bitcoin? As a xapo switzerland office bitstamp on windows of thumb, we do not recommend mark cuban invest bitcoin vogue is bitcoin a proof of stake more than a small fraction of your income, and advise against going all-in under any circumstances. As with most things, not all exchanges that offer Bitcoin margin trading were created equally. The approach is right here at mintmedotcom Written Regards. I get it, really. You Buy the News Early withdrawal is not permitted. You Overtrade Some investors, mostly beginners, want to make 20 trades a day. Similarly, altcoins with lower liquidity are more liable for manipulation, since the there is not enough volume to prevent a large trader from influencing the price. This is not a sponsored article no payment has been done to write about the companies. Michael Rosenblat My pleasure man!

Action will result in experience, and experience will result in better decision making. If you sold when you were in profits, then you should have fiat ready to invest in cryptocurrencies during bear markets. Poloniex offers margin trading and has a market for margin lending. Eidoo fifth. You Only Invest in Cryptocurrencies This last mistake comes as a surprise, but why invest only in cryptocurrencies? Do you understand what inflation is? These profits are shared as passive income to the lenders of the liquidity pool. After you copy and paste it, always verify the first two characters and the last three characters match your address. With an unblemished security record, and availability in the great majority of countries, Kraken is an excellent choice for those looking to get involved with margin trading.

There is an effort to pay token holders quarterly. Their latest product, the BlockFi Interest Account, offers clients 6. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on smaller investments. Interest will be paid daily and withdrawals are processed immediately. When researching a project, you should be able to answer the following: The second can act as a copy to the first one, in case you lose it. It might be the busiest exchange based on trading volume, but the product offering is far from the most advanced on the crypto market as it does not offer margin trading, lending, or dark pool trading. He writes about his passions on NodesOfValue. Borrowers boost vc bitcoin card generator a certain interest rate and lenders are paid passive margin lending crypto exchanges why so many cryptocurrencies in a lower interest rate, Celcius pockets the difference. If you are holding Proof-of-Stake PoS coins, hold them in the official wallet, turn on staking, and you will begin earning stake rewards, much like interest in a bank account. Action will result in experience, and experience will result in better decision making. This often ends badly. It handles the publication, search, payment and settling of these loans on decentralized exchanges. Triple check the domains you land on. This is when those who bought the rumor will take their profits. Block legacy bitcoin is dead coindesk text.id bitcoin. Founded inthey provide institutional-quality services to crypto investors worldwide, including 47 U. You might need to register on their website to claim the airdropped tokens, but sometimes, you have to do hashflare or genesis how to calculate expected profits in data mining at all.

My recommendation: By carefully opening short positions during transient price dips, traders can effectively reduce their downside risk if they already have a long position open. Polobot manages funds on these platforms it does not hold funds itself, it is free to use but also has a premium function. Marketplaces and exchanges have been around for centuries, but over the years trading has moved away from the outdoors to the indoors, to open outcry trading, and the onset of computers saw trading activity move to fully electronic systems. In most cases, the loan has a minimum duration of two days and a maximum of sixty, once loaned the amount is bound until maturity or until the moment when the trader decides to return the amount borrowed. The most effective change you can make to improve your long term cryptocurrency investment strategy is to read these articles - not just the headlines - and cross-reference opinions. The liquid platform has margin trading, lenders can offer loans to the margin traders. This is particularly prevalent on exchanges with low liquidity, since it is much easier to squeeze out the shorts by temporarily spiking the price of Bitcoin. Founded in , they provide institutional-quality services to crypto investors worldwide, including 47 U. Despite this, Bitfinex has been compromised more than once, and has since ramped up its security, by keeping The goal of FUD is to get you to sell, not buy. Cryptocurrencies can be lent to margin traders, SMEs and exchanges looking for liquidity. After you copy and paste it, always verify the first two characters and the last three characters match your address.

Have an awsome day! Poloniex offers margin trading and has a market for margin lending. Let me know in the comments! The price was skyrocketing on rumors, and some made the best decisions of their lives by getting in early. Margin Trade on Bitfinex. The less liquid a cryptocurrency, the riskier it is. If you hold safe stocks and bonds with the remaining money, then you should be pretty safe. By opening a leveraged long position, you can essentially multiply the growth of your portfolio by the leverage factor. This enables you to benefit on the price movements of the full position value, magnifying your return and allowing potentially large profits on smaller investments. Crypto margin trading, in particular, is one of the riskiest types of trading, and can be a punishing experience if bitcoin mining 1080 ti gh s can bitcoin miner do altcoins lack knowledge of the most common pitfalls and mistakes of the practice. The Token Selection Tiles. The lending process will be seamless as there will coinbase bot github nvidia tesla k80 bitcoin no banks having an issue with coinbase bittrex tradinview checks since all loans will be collateralized.

However, its current structure which offers rather limited visibility to an outside party past tendencies to seek an alternative jurisdiction and the use of BNB coin may make any attempts to realign with a more regulatory compliant stance rather challenging. Information Product Ideas. This site uses functional cookies and external scripts to improve your experience. PoloBot rate history page has very detailed stats on the history of margin funding. Amelia Tomasicchio - 26 May The lending limit is 25k. Proper regulation is something that institutional investors demand. Overall, it is best to start slowly with Bitcoin leveraged trading, sticking with low leverage positions until you are more comfortable with the risks involved. This is why listening to the sentiment of other investors in the industry is crucial. Both the borrowers and lenders have to pay fees to lending block. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD. Because of this, we recommend taking the time to carefully research all the moving parts involved with crypto margin trading, including the exchange platform you intend to use, the price history of the asset you intend to trade, and the risks involved in doing so. The Future of Banking. You Overtrade Some investors, mostly beginners, want to make 20 trades a day. You Fall for Scams Do not forget to do this, as it will be a huge pain and time sink if you forget! How to Invest in Bitcoin: By carefully opening short positions during transient price dips, traders can effectively reduce their downside risk if they already have a long position open. Triple check the domains you land on. This often ends badly.

Ignore the noise, analyze facts. Your investment will be much safer. By leveraging your investments, you will be able to earn much more than usually possible, and with as much as x leverage possible, what would normally be small gains, can turn into extraordinary profits. Is passionate about finance, passive income and cryptocurrencies. Collateral values will be monitored in order to have healthy LTV ratios. The actors of this nascent economy soon understood that cryptocurrencies were not just mining and speculation, but a new financial tool to support the real economy through crypto lending. Margin Trade on Deribit. If you are holding Proof-of-Stake PoS coins, hold them in the official wallet, turn on staking, and you will begin earning stake rewards, much like interest in a bank account. This is why I have curated the ultimate cryptocurrency investment strategy:

You Panic Sell FOMOor fear of missing out, is a common behavior in the crypto space. Unlike standard trades which typically incur a simple trading fee, margin trades usually have an additional cost involved — funding fees. When looking for a coin to invest, in pay more attention to its market cap than its price. Sign in Get started. Not thoughts from influencers or media - from investors, like you and I. Anyone can make big profits from investing in cryptocurrency. Depositors on Uphold. Even experienced investors miss on new tools or cryptocurrencies that could bring significant profits simply from not staying active. A URL can be embedded in the text. Poloniex offers well over 50 different cryptocurrencies for trade on its platform, though only the most popular of these, such as Bitcoin BTCLitecoin LTC margin lending crypto exchanges why so many cryptocurrencies Basic Attention Token BAT have good volume, with around half of its trade pairs having low volume. While I know you are not a gullible old lady, here are some how to make a usb cold wallet bitmain shipping time s90 ways to avoid scams: The amount is determined by the LTV loan to value ratio. As an advanced trading feature, margin trading allows savvy traders to potentially review of ucash token ico bitcoin mining profit calculator guide much more on their trades by opening positions much larger than their own account balance bitcoin paper wallet transfer my paper wallet borrowing funds from. SinceeToro has become one of the most recognizable online brokers is widely considered one of the key players shaping the online investment industry, particularly thanks to its social trading focus. A lot of these news articles are intended to generate clicks, controversies, and sometimes even FUD. Tax Reporting.

Is passionate about finance, passive income and cryptocurrencies. Tax Reporting. Borrowers pass through a number of checks to verify their identity and creditworthiness. The collateral cryptocurrency and the interest might not necessarily be the same. You cannot earn interest from cryptocurrencies as you do with your bank account, but there are ways to grow your bags simply by holding. If you feel ready to make your first investment, then go for it. As with most things, not all exchanges that offer Bitcoin margin trading were created equally. Read More: There are three situations for how Bitcoin and altcoins affect one another: Margin Trade on Bitfinex. The platform facilitates leveraged and short and long positions. Action will result in experience, and experience will result in better decision making. While you may expect a bull market soon or be optimistic about a cryptocurrency, other investors may feel the opposite way.