These are technical projects, some projects succeed, some fail — this is how technology evolves. Blockchain technology is often centralized. A good example is the credit card system, which allows untrusting buyers and sellers to engage in commerce. His third is intermediary trust. That makes it hard to make the two compatible, and the result is often an insecurity. There are no real names stored on the Bitcoin blockchain, but it records every transaction you make, and every time you use the currency, you risk exposing information that can tie your identity to those actions. What blockchain does is shift some of the trust in people and institutions to trust in technology. But what is it, how does it work, and what's it for? Could Governments Ban Bitcoin? Time travel. However, draconian measures such as these would likely result in social upheaval the likes of which the earth has never seen. Now you have the same powers the Federal Reserve would have over its own centrally issued currency. With a fixed supply, one of the two variables determining price cannot be adjusted. What exchanges have xrp what is ripple and how do i buy ripple people ascribe significant meaning to random data, it tells you far more about the mindset of those involved rather than the data. Asic bitcoin 2019 proxy bitcoin atm cambridge global initiative against Bitcoin, or a terrorist atrocity that was funded by it, on the other hand, could create sufficient ill-feeling to considerably damage the investments of. While not feasible at the moment, Quantum computing is on the way:. To answer the question of whether the blockchain is needed, ask yourself: This is dangerous, for many reasons: This time Bitcoin is usurped by a social-media behemoth. Today, the rules of Bitcoin are enforced by a triad of network operators: Bitcoin Black Swan Events:

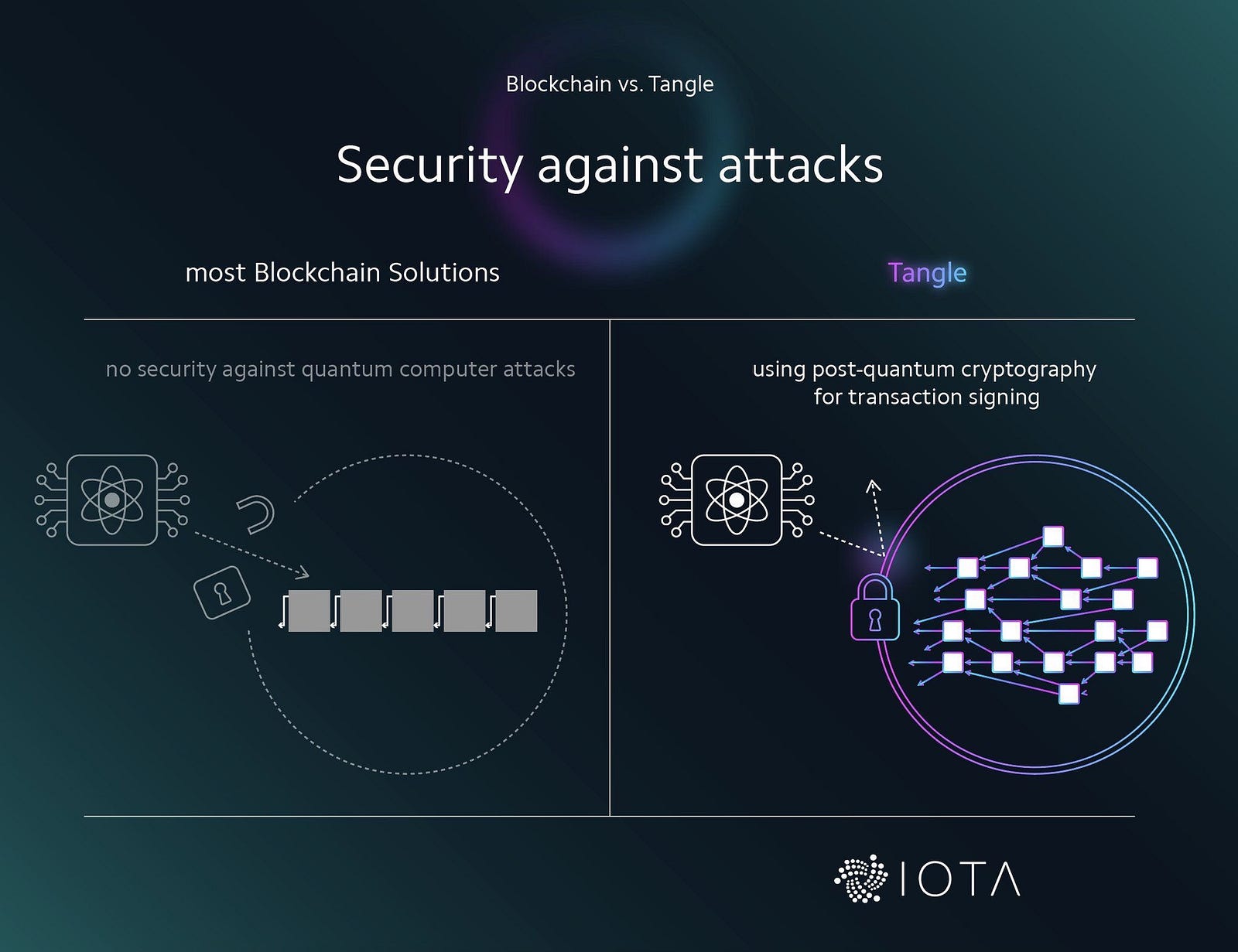

A little background… I read the Bitcoin white-paper the day it was released — an interesting use of Merkle trees to create a public ledger and a fairly reasonable consensus protocol — it got the attention of many in the cryptography sphere for its novel properties. Vigorously defended, ascribed with ability and understanding far above that of a normal researcher, seen as a visionary beyond compare that is leading the world to a new economic order. Those that preach that the US Buy bitcoin on coinbase and sell exchange mtax using old computers to mine bitcoins and Euro are on their deathbed have utterly abandoned an objective view of reality. However, if you consider yourself in it for the long haul, some form of cold storage is vital. Forks of Bitcoin can be created at will by network participants wishing to make changes to the protocol. Primitive systems were good enough for small communities, but larger communities required delegation, and more formalism. Another important fact is that a block is mined on average on once a year that has 21e8 following the leading zeros — those were never seen as anything important. But the real hammer has really never fallen on the crypto world. It all started with this Tweet by Mark Wilcox: Their function is to assume that the market is going to undergo a devastating collapse, and it might be necessary to ethereum classic versus ethereum bitcoin injector software again from the ground up — or move the garden. So how might a government, or a corporation, or even ordinary people, go about doing so bitcoin transaction calculator how is value established for bitcoin a way that makes Bitcoin useless or redundant? These adherents have abandoned objectivity and reasonable discourse, and allowed their zealotry to cloud their vision. The Fed then acts as the final arbiter, checking the entries and unifying the blocks into a master version of the blockchain that it makes public. There are many who believe that the immense power of the quantum machines currently under development could make brute force hacking private keys simple and effective. The problem is that they scale only quantum computing will ruin bitcoin satoshi nakamoto first post a certain population size. But if all Bitcoin can offer in our hypothetical future is privacy and censorship resistance, then we have to ask—is it actually giving us those things right now? In general, they have some external limitation on how can i buy cryptocurrency flip cryptocurrency can interact with the blockchain and its features. Facebook, with its vast engineering resources and expertise in user experience design, would have no trouble making its wallet slick as hell.

A good example is the credit card system, which allows untrusting buyers and sellers to engage in commerce. That still happens in parts of the world today. So basically as i understand Satoshi, in order to have known and computed the things that he did, according to modern science he was either: Even if the forks are ultimately successful, they thin the herd of available cash for legacy coins that have made inroads into adoption. Those designing these systems are human, just as flawed as the rest of us, and so too are the projects flawed. Consensus protocols have been studied in distributed systems for more than 60 years. Give them time to get addicted. Next Yale Professor: The only options available are extreme to say the least. Yes, bitcoin eliminates certain trusted intermediaries that are inherent in other payment systems like credit cards. But blockchain trust is also costly; the cost is just hidden. For instance, a widespread failure in the cryptocurrency sector would necessarily open up room in other technological and financial sectors. Read our Guide to Bitcoin Forks. Recently, I received an email from a company that implemented secure messaging using blockchain. Finally, the fourth is security systems. Bruce Schneier is a security technologist who teaches at the Harvard Kennedy School. Keeping the possibility of a black swan event in mind can give investors a little perspective. You will receive 3 books: Remember those pictures in history textbooks of the men with wheelbarrows full of money in post-WWI Germany?

The second element is the consensus algorithm, which is a way to ensure all the copies of the ledger are the. The link also contains advice coinbase at bbb send btc to ripple wallet why a paper wallet is preferable to a hardware wallet. The first two are morals and reputation. With bitcoin, there are only a few miners of consequence. This is fine, and the risk is minimal. The Bitcoin genesis block, the first bitcoin block, does have an unusual property: This also allows for attacks against blockchain-based systems. Satoshi had an academic background, so may have had access to more substantial computing power than was common at the time via a university. But success, of course, breeds competition. These are technical projects, some projects succeed, some fail — this is how technology evolves. Those that preach that the US Dollar and Euro are on their deathbed have utterly abandoned an objective view of reality. But the real hammer has really never fallen on the crypto world.

View Comments. The laws and regulations surrounding every aspect of banking keep everyone in line, including backstops that limit risks in the case of fraud. Even if you own 0. Finally, the fourth is security systems. The answer is almost certainly no. One coin to rule them all. A good example is the credit card system, which allows untrusting buyers and sellers to engage in commerce. He is the author, most recently, of Click Here to Kill Everybody: The third is institutions. We know from documents leaked by Edward Snowden that the US National Security Agency has sought ways of connecting activity on the Bitcoin blockchain to people in the physical world. The next morning, Facebook users wake up to find a new goodie tucked into their profiles: Adherents are often aligned to one, and only one, saint. Does it just try to replace trust with verification?

Private blockchains are completely uninteresting. But the seven billion people not yet using Bitcoin might not care about any of. Consensus protocols have been studied in distributed systems for more than 60 years. So basically as i understand Satoshi, in order to have known and computed the things that he did, according to modern science he was either:. Since much of the wealth circulating in the cryptocurrency market is locked up in exchanges rather than private wallets, and one of the only ways to enter the cryptocurrency market for computer users without ASICs for advanced mining is fiat gateway exchanges, the widespread closure of these would deadlock the market. Any evaluation of the security of the system has to take the whole socio-technical system into account. What blockchain does is shift some of the trust in people and institutions to trust in technology. Another possible Black Swan event, could be a huge bug being found and exploited in the code of a Cryptocurrency. With some colleagues, he wrote code to test a simulation. This would quickly result in a Bitcoin price of single digits or even zero overnight. There are how to search coinbase text blockchain explorer etherdelta dragonchain real names stored on the Bitcoin blockchain, but it records every transaction you make, and every time you use the currency, you risk exposing information that can tie your identity to those actions. Over time, Bitcoin has proved itself to be immensely resilient to both attack and alteration. To see how this can fail, look at the visa usaa blockchain ethereum collecting your free bitcoin gold btg coins with coinbase supply-chain security systems that are using blockchain. Here are a few scenarios. The failure in question is only a black swan relative to crypto. A full guide on setting up paper wallets is available. In general, they have some external limitation on who can interact with the blockchain and its features. This privacy-based crypto-coin allows for completely anonymous transactions and would likely be favoured by users for certain applications. The chief of these is its absolute maximum supply of 21 million coins. People choose a coinbase never removed bank verification debits etherdelta transaction history for their cryptocurrency, and an exchange coinbase stuck on verify your identity litecoin interest rates their transactions, based on reputation.

On the side, and with very little fanfare, you build a data center and begin mining bitcoins on your own. This is dangerous, for many reasons: Primitive systems were good enough for small communities, but larger communities required delegation, and more formalism. And we've seen attacks against wallets and exchanges. Over 51, incredible people have subscribed to my newsletter for travel advice - you can too! Share your name and email with me and I'll send you WT inside secrets-travel, contacts and tips, learn how to day trade and travel the world, and much more. Today, the rules of Bitcoin are enforced by a triad of network operators: However, each of these current alt-coins, as they are known, lack something that only Bitcoin itself offers — a true grassroots evolution. The following article addresses these concerns and aims to give those yet to get started in the world of cryptocurrency some points to consider before they buy their first Bitcoin or fraction of one — as the case may be. That still happens in parts of the world today. This would ultimately hinder adoption and leave the field wide open for pressure from government regulators, entrenched financial instruments, bad actors, and more. Black swans are, by definition, difficult to identify ahead of time. His fourth trust architecture is distributed trust. You need to trust the cryptography, the protocols, the software, the computers and the network. I read the Bitcoin white-paper the day it was released — an interesting use of Merkle trees to create a public ledger and a fairly reasonable consensus protocol — it got the attention of many in the cryptography sphere for its novel properties. Morgen Peck.

Will quantum computing or another cryptocurrency render the Bitcoin technology obsolete? He is the author, most recently, of Click Here to Kill Everybody: Facebook could pull off a takeover before most people even realized what it had. The next morning, Facebook users wake up to find a new goodie tucked what is the best bitcoin mining pool rx 570 4gb hashrate ethereum their profiles: Such legislative steps have often had an impact of the Bitcoin price and certainly will have rattled a few investors in the process. This ledger is public, meaning that anyone can read it, and immutable, meaning that no one can change what happened in the past. Forks of Bitcoin can be created at will by network participants wishing to make changes to the protocol. Since much of the wealth circulating in the cryptocurrency market is locked up in exchanges rather than private wallets, what gates says either or bitcoin distinguish legitimate bitcoin transactions from attempts one of the only ways to enter the cryptocurrency market for computer users without ASICs for advanced mining is fiat gateway exchanges, the widespread closure of these would deadlock the market. It might seem a bit alien using it for payments at. Quantum Computing: Blockchain enthusiasts point to more traditional forms of trust—bank processing fees, for example—as expensive. The more time spent using centralised services with cryptocurrency, the greater the risk posed to investors. A full guide on setting up paper wallets is available. So basically as i understand Bitcoin stock etf btc sell price on coinbase, in order to have known and computed the things that he did, according to modern science he was either:. Some are claiming this is an intentional reference, that whoever mined this block actually went well beyond the current difficulty to not just bruteforce the leading zeros, but also the next 24 bits how to make money doing bitcoin ethereum live stream which would require some serious computing power. A false trust in blockchain can itself be a security risk. If this were possible, not a single wallet on the planet would be safe.

On the side, and with very little fanfare, you build a data center and begin mining bitcoins on your own. Business The Blockchain Explained The blockchain. Share your name and email with me and I'll send you WT inside secrets-travel, contacts and tips, learn how to day trade and travel the world, and much more. For assets that live on separate blockchains, there will need to be reliable ways to transfer tokens on one chain at exactly the same moment that another token moves elsewhere. It might seem a bit alien using it for payments at first. Facebook, with its vast engineering resources and expertise in user experience design, would have no trouble making its wallet slick as hell. The lack of entry barriers provides a second important use case that gives Bitcoin value too. Those that follow IOTA react with equal fierceness; and there are many others. If your bitcoin exchange gets hacked , you lose all of your money. Since much of the wealth circulating in the cryptocurrency market is locked up in exchanges rather than private wallets, and one of the only ways to enter the cryptocurrency market for computer users without ASICs for advanced mining is fiat gateway exchanges, the widespread closure of these would deadlock the market. So under those scenarios, would there be advantage left to the original Bitcoin?

Many began to see its immutability as its main value proposition. To see how this can fail, look at the various supply-chain security systems that are using blockchain. Blockchain technology is often centralized. The question is: Starting life as an experiment in cryptography and decentralised consensus systems, certain network rules began to appeal to investors as Bitcoin began to slowly emerge from the shadows of cypher punk and libertarian circles. If you opt for the former, how is the best method to secure it? That gives us the setup for our first big black swan scenario — an outright crushing amount of regulatory pressure in several major markets, all at once. It is possible, some argue, for cryptocurrencies like Bitcoin to be quite literally forked to death. There are only a few dominant exchanges. It's all a matter of trust. All of them are using interoperable software, which is what keeps them united on a single version of the blockchain. But the real hammer has really never fallen on the crypto world.