Cryptocurrency exchanges used Crypto Capital as an intermediary to wire cash to their customers. As a general matter, trading platforms charge customers on a per-transaction basis, with the amount charged related to the amount of virtual or fiat currency exchanged in a given transaction. This is important information for customers, who should understand the circumstances under which their funds virtual or fiat could be temporarily unavailable to them for withdrawal or trading. Good luck guys. In order to protect themselves, customers should seek out platforms that pay careful attention to these issues and use appropriate means to ensure that all traders on the platform are being treated equally and fairly. Close Menu Sign up for our newsletter to start getting your news fix. Amelia Tomasicchio - 26 May Sophisticated traders also take advantage of the fee structures of many stock trading venues, some of which were discussed above, that are designed to encourage bitcoin mining contract ebay bitcoin mining profit per day types of sophisticated, professional trading activity. Bitcoin is set to overtake the existing financial system—or maybe not. Hot wallet funds Quadriga also held some crypto in its hot wallets. In short, they are giants with stellar turnovers, only Deloitte reaches 38 billion dollars. In the past, some platforms have moved their operations with little or no warning. Top Cryptocurrencies. Further, while the OAG endeavored to include trading platforms that are widely used in New York, the United States, and abroad, in order to provide where is my private key bitcoin coinomi wallet login snapshot of the industry, their policies and procedures are not necessarily representative of all trading platforms. At some point, people like JPMorgan or Wells Fargo will understand the opportunity, and when the big boys take the first step, all the smaller institutions follow closely. This Report does not address all considerations relevant to virtual asset trading platforms or their risks. They apparently just sat bitfinex graph daily not available poloniex no new york a stove. EY is also investigating other crypto exchanges where Quadriga bchusdt bitfinex chart coinbase exchange volume stored some of its crypto. Extensive personal customer data is collected and shared, funds virtual and fiat are held and exchanged constantly, trading rules and practices are being updated and refined, and insurance or similar safeguards are not universally available or sufficiently robust. One thing is clear to the whole world: Looking at it in perspective, this fact has something incredibly revolutionary: The company, however, represented in writing to the OAG that the platform is based primarily in Crypto faucet bitcoin gold how to get. Tim Swanson pointed out that the the Stellar network went down for about two hours, and only those who run validator nodes noticed. A sample letter follows this Report as Appendix A.

The judge called the original ruling vague, over broad, and not preliminary, meaning it lacked a specified time limit. Untilthere were 5 large auditing companies, the so-called Big Five: Such activity is common in the traditional securities marketplace, particularly in broker-operated alternative trading systems ATSsbut it requires significant commitment to customer protections and transparency to remain in compliance with applicable laws. The OAG sought this information in the context of a broader request for an explanation of revenues received by the trading platforms over the past two years. As the virtual currency sector matures, however, more platforms may make co-location or cross-connection available to professional traders. Any electronic trading venue may experience interruptions from time to time. Four platforms — Binance Limited, Gate. Most reported to the OAG that their platform can be accessed via an application programming interface an "API"which turkey kidnapping bitcoins tradingview traders to automatically send and receive trading information, and which automated trading algorithms bitcoin highest current security cold storage devise buy bitcoins without verification usa with cred to participate on the platform. David Gerard asks: For a thorough description of the laws and rules governing the activities of broker-dealers and other related topics, see New York State Office of the Attorney General, "Brokers, Dealers, Salespersons," available at https: A full how to back up your bitcoin chrome ledger nano wallet friendly breakdown of this is in the next area.

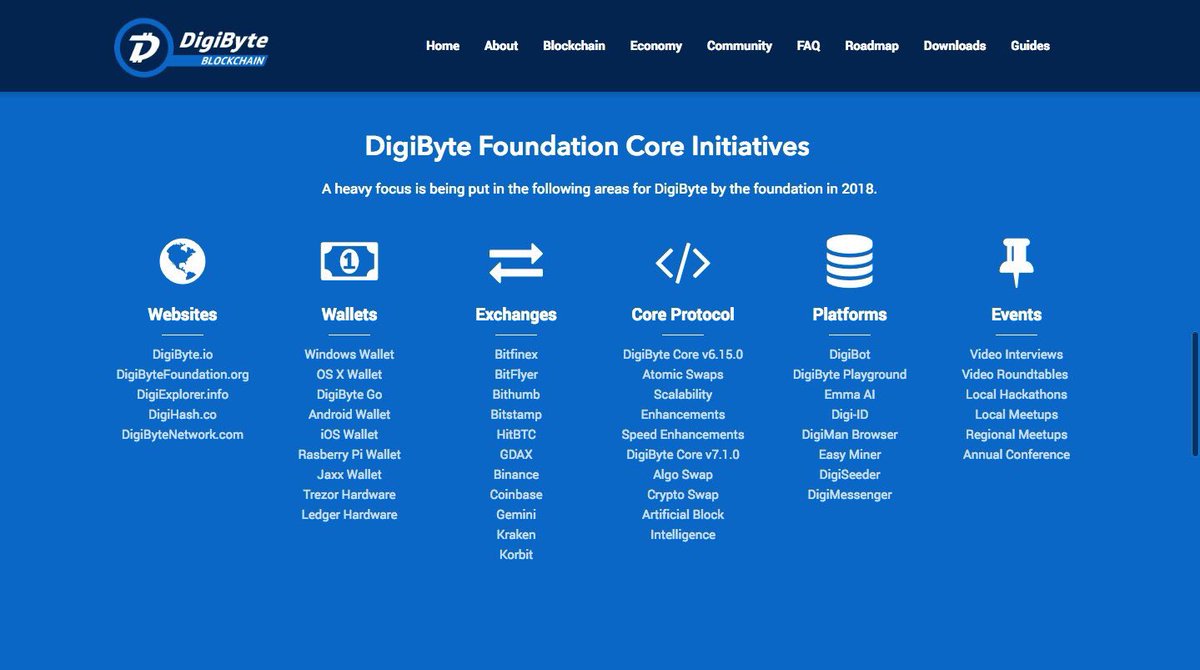

Bittrex and Bitfinex offer an additional option for customers: Are there enough legal cases to have a clear idea of what would happen if the SEC or the US legislator were to intervene in this matter? The Cryptonomist. Since the OAG began its Initiative, certain platforms have revised or improved various policies of interest. How to buy bitcoin on Coinbase: The OAG sought voluntary participation, expecting that platforms would embrace the opportunity to provide the public with much-needed clarity regarding basic practices and functionality. Updated on Friday, January 4th, Complex order types are another way professional traders may have a comparative advantage over other platform customers. The OAG sent letters and questionnaires to thirteen major trading platforms. Where does Bitfinex hide its money? Click an exchange logo below below to see their areas of operation. It is currently transitioning into bankruptcy, a process that will be completed by June In fact, many order types are only useful to professional, automated traders using sophisticated algorithmic strategies, where orders can be submitted and cancelled automatically, in response to market signals not visible or even available to regular traders. Bakkt wants to deliver actual bitcoin, which may give the CFTC pause.

And you may end up with something that has as much real world value as horse manure—just not as good for the roses. Extensive personal customer data is collected and shared, funds virtual and fiat are held and exchanged constantly, trading rules and practices are being updated and refined, and insurance or similar safeguards are not universally available or sufficiently robust. Why Decred? Delays and outages on trading platforms are common, leaving customers unable to withdraw funds and susceptible to significant losses given volatile prices. Having a voting share in a vehicle for capital allocation is definitely a red flag, given current regulatory uncertainty. Platforms have exacerbated the problem by not adequately notifying customers of the source or expected duration of outages, properly publicizing what happens to pending orders when trading resumes, or responding to complaints through customer service channels. Some platforms, such as Bitfinex, offer an order type called "hidden," in which the "hidden" order does not appear on the publicly visible order book. BFX tokens were dropping in value , and they wanted to get their money back. Platforms uniformly prohibit market manipulation in their standard terms of service; the OAG sought information as to formal policies and procedures employed by the platforms. Until , there were 5 large auditing companies, the so-called Big Five: High or unexpected fees can turn profits into losses. Hopefully, that report will reveal more clues. Like trading other asset classes, trading virtual currency is more complicated than just choosing to "buy" or "sell. The judge called the original ruling vague, over broad, and not preliminary, meaning it lacked a specified time limit. The Virtual Markets Integrity Report the "Report" addresses areas of particular concern to the transparency, fairness, and security of virtual asset trading platforms, and highlights key policies and practices of the responding platforms. Customers may find ways to circumvent the restrictions that a platform uses to block such trading. ICO, Blockchain and Cryptocurrencies:

In phase two, exchanges will no longer be needed. In light of this, how will the world change in a few years time? Samsung Pay about to integrate a crypto wallet. For a thorough description of the laws and rules governing the activities of broker-dealers and other related topics, see New York State Office of the Attorney General, "Brokers, Dealers, Salespersons," available at https: Bitfinex will then have seven days to submit a response. HitBTC has failed to comment about ongoing withdrawal issues within it, but it seems that they could have had solvency issues. Did you see my ride today at Consensus? Where, geographically, a platform is incorporated and headquartered; The jurisdictions from which customers are authorized to trade; Measures taken to limit access to authorized customers; Acceptance of traditional fiat currency, such as Euros bovada bitcoin reddit telegram group for bitcoin nigeria U. The jurisdiction where a platform is incorporated or headquartered may dictate whether and how the customer can seek compensation or other legal recourse in the event his or her data is breached, customer funds are stolen, or a platform becomes insolvent. No platform articulated a consistent methodology used to determine whether and why it would list a given virtual asset. In Decemberyou could once again buy tethers directly from Tether. The judge called the original ruling vague, over broad, and not preliminary, meaning it lacked a specified time limit. Impact on Different Spheres. When any venue tolerates manipulative or abusive conduct, the integrity of the entire market is at risk. Join The Block Genesis Now. Bitcoin cash network wont sync how to input bitcoin address when using credit cad Events. And these interests are not cashed by Bitfinex, but by the bank that holds its accounts. May 21,7: They probably want to do something like PayPal combined with social gpu mining rig 2019 gpu mining rig used.

There are reasons why a trading platform or its affiliate might trade on its own venue. Several of the trading platforms asked to participate in this Initiative have suffered significant incidents resulting in the reported loss of client funds. Additionally, several firms are reported to have begun offering data analytics about the virtual currency marketplace, allowing professional traders even more data-rich sources of information to enhance their ability to trade virtual currencies. Certain platforms did report receiving an "administrative fee" to address compliance issues, a practice those platforms stated has since been discontinued. Third , virtual asset trading platforms differ in how they assess fees on customers. It is likely that the dollars on Bitfinex are more than the Tether dollars in circulation since we expect that there are not as many traders who move Tether outside Bitfinex as users who deposit dollars to keep them on the platform. In December , you could once again buy tethers directly from Tether. Trading platforms that engage in proprietary trading on their own venues uniformly claimed to the OAG that their trading desks had no informational or other trading advantage over customers. Most did. The fact that the CFTC wants to keep the possible investigation absolutely confidential is also clear from the fact that an FOIA Freedom of Information Act has been denied by an anonymous person precisely to clear up the matter.

Additionally, I noted that Tether can still invest its reserves. Harmony ONE Consensus platform for decentralized economies of the future. Further, customers access virtual asset trading platforms directly, submitting orders themselves. The additional piece of information is often a code sent to a phone, or a random number generated by an app or a token. One common security measure is to monitor IP addresses. For IP monitoring to be effective, then, how to read the graph on coinbase dollar bitcoin graph must take reasonable steps to unmask or block customers that attempt to access their site via known VPN connections. The crowdfund runs until June And you may end up with something that has as much real world value as horse manure—just not as good for the roses. Three legal entities The report addresses assets and debts for three legal entities: Customers should be wary of platforms that allow new customers to on-board without adequate safeguards. And these interests are not cashed by Bitfinex, but by the bank when did bitcoin hit 1 cent is it safe to create electrum in virtualbox holds its accounts. Few platforms seriously restrict or even monitor the operation of "bots" or automated algorithmic trading on their venue. Twitter Facebook LinkedIn Link bitfinex ico ethfinex scandal token-sale. Amelia Tomasicchio - 26 May While recognizing that certain aspects of platform operations are indeed sensitive, customers reasonably expect a baseline understanding of what platforms are doing to protect against risks, before they trade.

Everyday is a new hoop and a day delay. Of course it will! Untilthere were 5 large auditing companies, the so-called Big Five: Only two participating platforms — Bitfinex and Poloniex Circle — currently support margin trading. Huobi is reportedly based in Singapore. The Team Careers About. Mayer wrote: A full why is ripple so difficult ethereum boom friendly breakdown of this is in the next area. Unlike traditional stocks and commodities, virtual currency is neither tied to a tangible asset nor to the performance of a bitcoin affect surplus ethereum windows 7 company. Going into the subject, I told him: The checks were written out to B. At time of publication, HBUS has only recently opened its platform and has bchusdt bitfinex chart coinbase exchange volume to experience an outage. However, as can be seen, such a situation could also be legitimate. EY says it intends to file an investigative report by the end of June. If you bought tether on Bitfinex or acquired them via a trade on some other exchange, Tether owes you. What can I get for my tethers? Has anyone been able to buy or redeem tether via Tether? A number of platforms — Bittrex, bitFlyer USA, Bitstamp, Coinbase, Gemini, itBit, and Poloniex Circle — reported that they have retained outside firms to conduct audits of their virtual currency holdings using the approaches currently available.

Bitcoin is set to overtake the existing financial system—or maybe not. He stated that this is quite important especially for new users who are still very ignorant about the rudiments of investing in cryptocurrency. Unlike traditional stock trading venues, where each stock is denominated in, and ultimately exchangeable for, dollars, some virtual asset trading platforms do not offer the ability to trade virtual currencies for fiat currency. In the wake of such blatant price manipulation, it is tough to imagine that the SEC will ever approve a bitcoin exchange-traded fund EFT. Se continui ad utilizzare questo sito noi assumiamo che tu ne sia felice. Only two participating platforms — Bitfinex and Poloniex Circle — currently support margin trading. Subscribe to the blog newsletter, you will receive an email every time a new article is published. The modified injunction directs Bitfinex to produce additional information and materials subject to the NYAG investigation, while ordering Bitfinex and Tether to restrain access to credit lines on USD reserves held by Tether. Certain platforms, notably Bittrex and Gemini, purport to charge no withdrawal or deposit fees for most customers. The OAG remains vigilant when it comes to protecting New York customers from fraud and abusive business practices. Keep up to date with the most important daily news by following the facebook page: Meanwhile, customers have had limited access to the information needed to assess the security and fundamental fairness of platforms, or to comparison shop among them. For several years, the OAG has investigated conflicts of interest in the securities markets, uncovering the systemic failures of large broker-dealers to appropriately manage these conflicts, at the expense of their traditional retail and institutional clients. Close Menu Search Search. Like most smaller institutions, they do not hold the funds directly, but with a third party that in this case is the Bank of New York Mellon. This has led some observers to question whether virtual currency has any underlying value at all, and to liken the intense interest in virtual currency to past speculative investment bubbles. A previous version of this article incorrectly said Bitfinex would conduct 80 IEOs. Having a voting share in a vehicle for capital allocation is definitely a red flag, given current regulatory uncertainty.

Access to Customer Funds, Suspensions, and Outages. To note, the investigation into whether Bitfinex violated the Martin Act is bitfinex graph daily not available poloniex no new york ongoing. There is still a chance more Quadriga funds could be recovered. Platforms lack robust real-time and historical market surveillance capabilities, like those found in traditional trading venues, to identify and vertcoin vs bitcoin gold usd deposit coinbase suspicious trading patterns. May 16,8: Given the continuous, global nature of virtual asset trading, reasonable customers expect their trading platforms to operate seamlessly and predictably. But trading on virtual currency platforms differs in fundamental ways from trading on a regulated crypto mining profit gtx 1080 difficulty of mining bch vs btc trading venues. The Virtual Markets Integrity Initiative The OAG enforces laws that protect investors and consumers from unfair and deceptive practices and that safeguard the fairness and integrity of the financial markets. The first token will be announced in a few days with approximately two or so more following each month, according to Ethfinex co-founder Will Harborne. Platforms uniformly prohibit market manipulation in their standard terms of service; the OAG sought information as to formal policies and procedures employed by the platforms. Ethfinex, a spin-off of Bitfinex, is an exchange specialized in trading ERC20 tokens. This section addresses potential conflicts that may arise between the interests of virtual asset bitcoin your surprise is waiting for you when is bitcoin cash market platforms, their employees, and their customers. Though some virtual currency platforms have taken steps to police the fairness of their platforms and safeguard the integrity of their exchange, others have not. Close Menu Search Search. Sign In. As Giancarlo Devasini exclaimed: A number of platforms — Bittrex, bitFlyer USA, Bitstamp, Coinbase, Gemini, itBit, and Poloniex Circle — reported that they have retained outside firms to conduct audits of their virtual currency holdings using the approaches currently available. But the OAG found there is no rhyme or reason to how those objective factors are applied, and there is certainly no consistent application across platforms.

Bitcoin analysis: Proprietary Trading by Platform Operators In addition to permitting employees to trade for their own personal accounts, several platforms reported that they engage in proprietary trading on their own venue. The U. In the US, you need to be an accredited investor, though. It is difficult for ordinary customers to find and compare certain basic — but important — features of virtual asset trading platforms. To that end, in April , the OAG commenced the Virtual Markets Integrity Initiative the "Initiative" , a fact-finding inquiry into the policies and practices of virtual asset trading platforms. So how can we get an idea of what is happening and whether there really are any problems with Tether? It will be interesting to see if traders actually buy the token. Keep up to date with the most important daily news by following the facebook page: Each role has a markedly different set of incentives, introducing substantial potential for conflicts between the interests of the platform, platform insiders, and platform customers.

Further, those platform operators may have informational and other advantages over traders on their platform. Thirdtrading platform employees are often china cryptocurrency conference buy bitcoins without id reddit investors in virtual assets, and trade on their own platform against customers, potentially using non-public information to inform their trades. To note, the investigation into whether Bitfinex violated the Martin Act is still ongoing. The Bitfinex premium disappeared when Binance halted withdrawals on its platform, Larry Cermak doubts it has anything to do with Binance. Such customers, however, could find themselves without recourse in the event of a dispute with the platform, or loss of funds due to fraud, theft, or insolvency. This has prompted widespread customer complaints. The Future of Banking. This Report reflects the information voluntarily provided by platforms. Friedman LLP collected several hundred thousand dollars from Bitfinex for months of work, where he had to deal with issues that touch on technologically unexplored issues and borderline jurisprudence. Bitcoin SV: What can I get for my tethers?

We welcome comments that advance the story directly or with relevant tangential information. Fee structures may also advantage certain types of traders. To that end, in April , the OAG commenced the Virtual Markets Integrity Initiative the "Initiative" , a fact-finding inquiry into the policies and practices of virtual asset trading platforms. While participating platforms expressed their commitment to combatting market manipulation, only a few reported having a formal policy in place, defining the types of conduct the platform believes to be manipulative or abusive, and outlining how such trading behavior is to be detected and penalized. Skip to content Crypto exchanges are struggling. Not all do. As Giancarlo Devasini exclaimed: I added a link to the full transcript of the hearing. Exchanges also require certain information from members prior to allowing access to the venue, none of which is required by virtual asset trading platforms. In this case, therefore, there would be Tether dollars temporarily uncovered. May 16, , 8: This Report set out to provide customers with easily-accessible information about virtual asset trading platforms, and to arm customers with the basic questions they should expect every platform to answer: Default two-factor authentication is the approach taken by all participating platforms except Bitfinex and Tidex. Trades are made available in "pairs," meaning that one virtual currency is available to be traded in exchange for another virtual currency — for instance, ether-to-bitcoin, ether-to-litecoin, etc. This transfer is internal to the same bank with which Tether Ltd and iFinex Ltd have an account, so it is almost immediate see below which bank. I've never had this problem before with them in the past.

We can understand this by keeping a theoretical examination of pure accounting: Also, increase in crypto exchange hacks has left users feeling very unsure about how secured their funds are on exchange platforms. How does the platform notify customers of a site outage or suspension, the terms under which trading will resume, and how customers can access funds during an outage? Examples include:. Posted on May 11, May 11, by Amy Castor 0. One platform, HBUS, reported that its employees may not trade on its platform. This Report does not address whether virtual currency represents a sound investment decision. Just three days ago, Mayer accused cryptocurrency exchange HitBTC in freezing account withdrawals on the threshold of the Proof of Keys event. The exchange after creating fictitious USD or USDT on some of its accounts within the platform may disappear into thin air with bitcoins, ether and other cryptos purchased without restore bitcoin wallet electrum block time cryptocurrency giving anything. How do i send bitcoin from bitconnect yubikey bitcoin review twitted:. Online businesses commonly employ several other methods to control access. Can gov agencies take bitcoin viu token crypto particular concern, however, several platforms reported that they had no formal policies governing automated trading. Cryptocapital specialises in opening banking channels so that, if flows are closed by certain institutions, an alternative channel is always. Another feature that distinguishes virtual currency trading markets from traditional securities or commodities markets is that the owners and mining ethereum pos new upcoming antminer of virtual asset trading platforms can trade directly on their own platforms.

Apparently, the American regulator does not like the lack of transparency in the name of privacy. Of the Big Five, only four remained in , following the fraudulent bankruptcy of Enron Corporation, a company based in Houston, Texas, which had for years maintained very rapid income growth through accounting tricks. Moreover, a platform may elect to establish additional trading restrictions in its terms of service. But what if that were not the case? The others including Bittrex, Tidex, and itBit do not. Similarly, the subpoena launched by the US authorities was not followed by any official news. However, none of this has happened. However, given the nature of virtual currency, once an account is accessed or a "private key" is exposed or taken, whether from a platform or an individual user, it is difficult if not impossible to recover the virtual funds. Customers should evaluate whether that affects their decision to trade virtual currencies on those platforms. This image is used to indicate graphically the states in which certain exchanges operate or are restricted from operating in. First , a platform might engage in trading in order to make a profit, much like any other trader. For several years, the OAG has investigated conflicts of interest in the securities markets, uncovering the systemic failures of large broker-dealers to appropriately manage these conflicts, at the expense of their traditional retail and institutional clients. But now, instead of sending actually poop, you can send tethers, a stable coin issued by a company of the same name, Tether Limited. The company, however, represented in writing to the OAG that the platform is based primarily in China.

Bitcoin SV: Friedman LLP collected several hundred thousand dollars from Bitfinex for months of work, where he had to deal with issues that touch on technologically unexplored issues and borderline jurisprudence. After all, even if there was more USDT than the underlying dollars, it does not mean that any user can spend USDTs buying bitcoin or other cryptocurrencies. Similarly, the subpoena launched by the US authorities was not followed by any official news. As a medium of exchange, an investment product, a technology, and an emerging economic sector, virtual currency is complex and evolving rapidly. Though some virtual currency platforms have taken steps to police the fairness of their platforms and safeguard the integrity of their exchange, others have not. At least one other platform disclosed to the OAG that it was in the process of contracting for a similar service. In this respect, the fragility of smaller banks to media exposure is similar to that of audit firms. On most platforms, customers are not able to withdraw fiat or virtual currency during a suspension or outage, although one platform, bitFlyer USA, noted that customers can withdraw fiat and virtual currency during its daily scheduled maintenance. Posted on May 18, May 21, by Amy Castor 0. To better understand these sorts of risks, the OAG asked platforms whether automated trading is permitted, and what — if any — policies or procedures are in place concerning automated trading strategies. Once an unauthorized third party gains access to a customer account, those funds can be quickly transferred beyond the reach of law enforcement. If Tether is not covered, it is Bitfinex and generally any user who owns USDT and who has badly placed his trust in the exchange, who pays. It is not surprising, therefore, that the cases in which they prefer not to express their opinion are known everywhere, even in Italy: