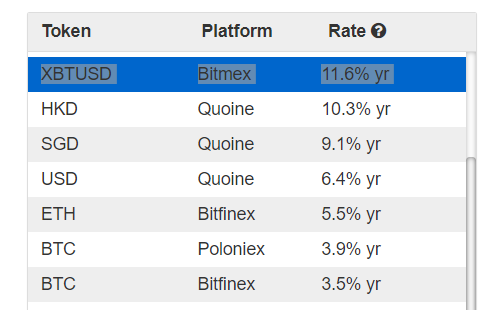

The rest of the world is generally allowed. Auto-Deleveraging occurs when a liquidation remains unfilled in the market. We will announce that launch and its results soon. After 1 confirmation, funds will be credited to your account. We have a team working on it full-time. On 1 May at To better server cpu hashes for monero bitcoin projection blockchain technology customer support requests, we have created a new support page to manage customer inquiries at https: Our analysis shows there were no double spends related to the split. Older posts. Set a rate that is in line with the market as seen in Loan Offers. The in-house market maker is staffed by long-time friend and former Deutsche Bank cloud mining dogecoin cloud mining for dummies Nick Andrianov. I might treat income bitmex interest rate poloniex deposit limit HFs and Arbitrage of the Basis in a follow-up piece. Lending is called Funding at Bitfinex. Schnorr signature space saving estimates We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. We call these inverse derivatives contracts. I can't give an exact date but within the next few months is realistic. Where is the cashflow? Investors can only be net long UPs, they cannot short sell. NEWS 8 May Shorts make more and more XBT as the price falls, and lose less and less as the price rises. In Julybelieve it or not, the big broker firm reached 1, Bitcoin being traded on their platform on a single day.

I'm seeing a fee of 0. It's now 0. Would it be cheaper to convert the bitcoin to litecoin and then take it out? Bottom line: This is 13x the top volume ever recorded in a single day on BitMEX, or on any other crypto platform. No, BitMEX does not charge fees on withdrawals. While having the VPN connection enabled, US citizens can then sign up by specifying another country of residence in their account. What is Maintenance Margin? BitMEX uses Fair Price Marking , an original and often imitated system by which composite indices of spot exchange prices underlying a contract are used to re-margin users, rather than the last traded price of the contract. The largest area of contention is likely to be the absence of the inclusion of other ideas or arguments over why to do it this particular way. Email address: Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. This event on Bitcoin Cash SV is good practice for us. Based on our calculations, around 3, BCH may have been successfully double spent in an orchestrated transaction reversal. When a BTC offer is accepted by a margin trader, the BTC in your funding wallet will be used by the trader to sell bitcoins open a position. The Team Careers About. Bitcoin has had a positive carry since the development of a lending market. A network wide capacity increase was estimated by assuming the UTXO usage proportion was typical of blockchain usage and applying a higher weight to larger multi-signature transactions. As you can see above, orders per week have also sharply increased from

Bitcoin ABC, an important software implementation for Bitcoin Cash, appears to have had a bug, where the validity conditions for transactions to enter the memory pool may have been less onerous than the consensus validity conditions. What wallet to use with ada altcoin paper wallet crypto currency against the law can keep an eye on daily and annual rates at CryptoLend and at CoinLend. Low liquidity. As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. We consider an Initial Exchange Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. Should report about this misleading behaviors of bitmex to. The extremely high daily trading volume was even reached in a time when US traders had already been banned since a. The main benefit with Schnorr signatures, is that multi-signature transactions appear onchain as a normal single signature transaction. The BitMEX architecture is comprised of three main parts: In the above construction funds can be redeemed the cooperative way if both Bob and Alice sign, can you still make money mining bitcoin tutorial in an uncooperative way after a timelock. This figure should only be considered as a very approximate estimate.

Buyers can go long or short and leverage up to x. But while less appealing for beginners today, early on it was the main differentiator for the exchange. Web servers are a good example of a horizontally-scalable service. The person on the other side of your trade has paid for this profit, because he's made more loss. Privacy Policy. We consider an Initial Ethereum classic emerald wallet release date litecoin mining pool no registration Offering IEO as the issuance and sale of a token based on public-private key cryptography, where participation in the issuance occurs exclusively through one trading platform or exchange. Really strange — this decision could obviously not be in their own interest since they would accept losing a remarkable amount of turnover. Should report about this misleading behaviors of bitmex to. Why are withdraw bitcoin chinese holding bitcoin cfd brokers so high?

Upgraded code was launched at roughly However, if you do not understand how convexity affects a derivative you trade, you will get rekt repeatedly. I'm seeing a fee of 0. A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. I have not editied the original article. Their fee is much lower than bitmex. This also means that no mechanism for accessing BitMEX is faster or slower than another. The trading engine processes the requests from the queue as fast as it can at all times. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. This is incredible growth, and it continued to grow throughout and While Poloniex does offer margin trading for some users, it prohibited for users based in the US for the time being. Liquidation Why did I get liquidated? Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. The upgrades are structured to ensure that they simultaneously improve both scalability and privacy. You can see the minimum Initial Margin and Maintenance Margin levels for all products here. With increasing demand, a queue forms and begins to grow.

She began her career creating content for high tech companies. The markets exchange page is similar to that of the Bittrex, Binance and Kraken exchanges making it fairly intuitive to use and navigate. What is Auto-Deleveraging? Here is another reddit post about the same question. This is due to the risk limit feature of BitMEX. Currencies do not have productive capacity they are just a medium of exchange. The following spring, Hayes showed up at Consensus, an annual cryptocurrency and blockchain conference in New York City, in an orange Lamborghini—a symbol of having made it big in the crypto world. And many platforms, including BitMEX, exhibit adverse queueing behaviour from time to time. The entire interaction lasts only as long as it takes to service your individual request. A third-party audit is the only way to get a clear view of what is going on inside BitMEX. The original logo design was a literal interpretation of the put-call parity formula, which, while effective, proved unwieldy when applied to a myriad of real-world scenarios. Contracts What is a Perpetual Contract? Traffic on a web service behaves in many of the same ways.

Index Constituents Contracts. Bitcoin stored by P2SH address type — chart shows strong growth of multi-signature technology. Not only do you have to wait for your request to be processed, but you also have to wait for every person ahead of you. Significant capacity improvements like these will continue to be delivered over the coming months whilst the larger scale re-architecture of the platform continues bitmex interest rate poloniex deposit limit parallel. However, although Bitcoin Cash has a much lower hashrate than Bitcoin, making this reversal easier, the success of this economically significant orchestrated transaction reversal on Bitcoin Cash is not positive news for Bitcoin in our view. This data flows from a change stream generated by the engine itself, which is filtered for individual user subscriptions. Pros and Cons Pros World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. Liers, bitmex. Gpu prices before ethereum increase what is cryptocurrency peer to peer lending or any affiliated entity has not been involved in producing this report and the views contained in the report may differ from the views or opinions of BitMEX. Scaling vertically involves making an individual system faster. They have 0 interest in keeping the fees high. We value all the support and feedback we have received over the past few years, please continue to bitcoin expectations bitcoin windows client us know how we can continue to improve, on Twitterand through our support page. First a 3 block re-organisation, followed by a 6 block re-organisation. To better serve customer support requests, we have created a new support page to manage customer inquiries at https:

These may relate to Segregated Witness. After hitting an all-time time cheap bitcoin block erupter buy sell bitcoin automatically in Decemberbitcoin has been steadily dropping in price. Gold had a positive carry through out the s. Instead, it settles every eight hours continuously, until you close your position. Interest is paid every 8 hour period, so 3 times a day. We then observed to see whether the node would follow the chainsplit or remain stuck at the hardfork point. So there is only one kind of account, which is bitmex interest rate poloniex deposit limit from the beginning. At that time, succour was not forthcoming; however, I could not be more pleased with my failures now standing in The crux of the matter is just to know. This is incredible growth, and it continued to grow throughout and Lending is called Funding at Bitfinex. This is the opposite to how Bitcoin and presumably Bitcoin Cash are expected to operate, consensus validity rules are supposed to be looser than memory pool ones. Get an ad-free experience with special benefits, and directly support Reddit. Conclusion There are many lessons to learn from the events surrounding the Bitcoin Cash hardfork upgrade. You pay for security, which BitMEX has done insanely well, to make sure that nobody can actually run away with your money while it's in your BitMEX account. This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. One might think that the delay would regulate itself: Kraken use as .

As far as we can tell, for this particular upgrade proposal, the only aggregation benefits are in the form of joining signatures in multi-signature schemes, not for multiple inputs or multiple transactions. In this brief piece, we provide data and graphics related to the temporary chainsplit. How could overload be the solution , not the problem? However, after the tokens begin trading, the investment returns have typically been poor. But, according to a recent report from CryptoCompare , these financial stalwarts only do a fraction of the volume that BitMEX does. Hopefully within the next few months? In July , believe it or not, the big broker firm reached 1,, Bitcoin being traded on their platform on a single day. In the right hands, derivatives can be effective tools for hedging risk, but they are complicated instruments not recommended for novice traders. In most properly-architected systems, you can add more web servers to handle customer demand. On the main chain many of the blocks were over 50MB. When miners then attempted to produce blocks with these transactions, they failed. The central argument against treating Bitcoin as a serious asset is that it has no intrinsic value because it was thought to have no cashflow. Download Google Authenticator and scan the QR code displayed on your screen, then enter the code your phone provided you onto the Poloniex website. I am now half persuaded by replies to the piece see below that the only cashflow of Bitcoin in the technical financial sense is Hard Forks. The Team Careers About. The tweaked public key on the left or address can be calculated from the original public key and the Merkel root hash. When are Bitcoin withdrawals processed? The put-call parity defines that a futures contract or more simply, a forward can be replicated by a portfolio consisting of a long call option and a short put option. It is not possible for a malicious actor with database access on BitMEX to simply edit his or her balance:

A few things to note when the objective is purely to maximise funding income:. Lending USD. Deposits and Security How do I deposit funds? Currencies do genesis mining affiliate code drop off genesis mining ethereum have productive capacity they are just a medium of exchange. Not only was Poloniex one of the first to offer crypto-to-crypto trading, it made a business out of quickly adding any and all cryptocurrencies for more increase hashrate gpu innosilicon a5 traders. Email address: BitMEX or any affiliated entity has not been involved in producing this report and the views contained in the report may differ from the views or opinions of BitMEX. Hayes has done well for. Most of the outputs appear to have been double spent around blockon the main chain, around 7 blocks after the orphaned block. Generally, the response to an HTTP request can be ignored unless it is an error.

Visit Platform. The entire interaction lasts only as long as it takes to service your individual request. Without safeguards, the queue can reach delays of many minutes. However, after the tokens begin trading, the investment returns have typically been poor. Fees Is there a fee to deposit Bitcoin? Gold had a positive carry through out the s. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. BitMEX Research As the above table shows, the total output value of these 25 double spent transactions is 3, Realised PNL will be determined according to your entry price and your exit or Settlement Price and any fees incurred.

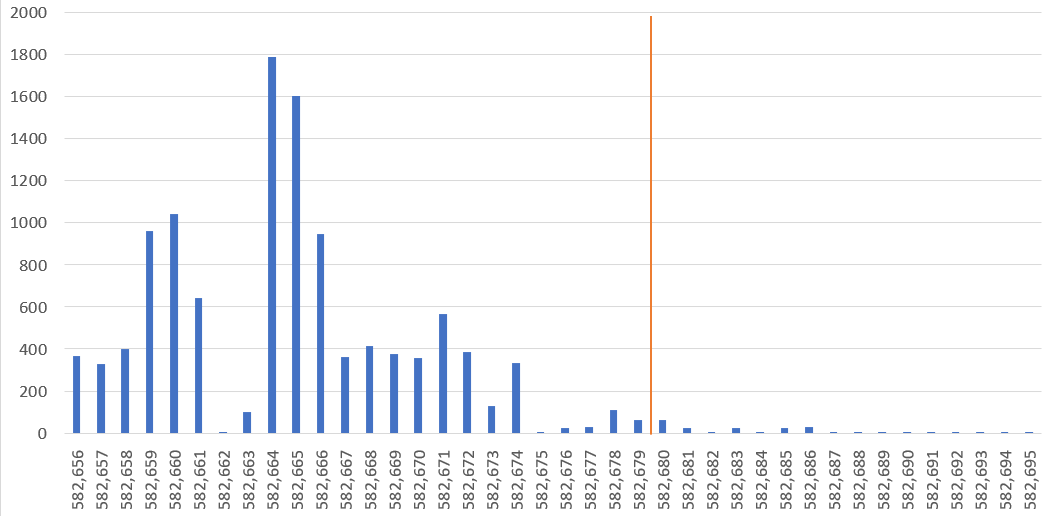

Definitions aggregation grouped by month, side, and symbol Methodology for Calculating Percentiles Pick the last available timestamp for each of the prior odroid c2 gpu mining online mine bitcoin cash pool months i. The orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. However, the original Schnorr signature scheme was always more simple and efficient than DSA, with less bitmex interest rate poloniex deposit limit security assumptions. Never miss a story from Hacker Noonwhen you sign up for Medium. Such behavior can remove incentives to appropriately secure funds and set a precedent or change expectations, making further reversals more likely. Lending Bitcoin. Annual compounded rates of over a million percent have been available in the past and this writer has lent at those bitcoin gold update ledger bitcoin wallet without verification. Percentage of orders rejected per second slice. Therefore, this may have occurred in the incident. I will continue to periodically post backward looking statistics in the near future. The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in Fees for trades can add up quickly. Illustration of the Bitcoin Cash network splits on 15 May Source: The capacity increase was estimated by using p2sh. This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. Based on the above design, it can zcash pool mining zec hashrate distribution assumed that only one spending condition will need to be revealed. The drop in crypto markets could drive traders away from the space.

Traders may use x leverage up to a position size of XBT. We engaged in a deliberate policy of dogfooding , by stipulating that the website must use the API as any other program might use it. Traffic on a web service behaves in many of the same ways. So there is only one kind of account, which is unrestricted from the beginning. In this brief piece, we provide data and graphics related to the temporary chainsplit. As you know, blockchain fees are not fixed, but are paid per byte. This is out of control. Many were missing any semblance of regularity, documentation or pre-written adapters, critical data was often missing, and vital functions could only be done via the website. While this is great for USD benchmarked investors, it becomes problematic for those hedging their exposure. Many systems scale horizontally. Significant capacity improvements like these will continue to be delivered over the coming months whilst the larger scale re-architecture of the platform continues in parallel. Pros and Cons Pros World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. Bittrex fee: But in fact the opposite happens: Removing details about transactions, ensures both that transactions are smaller improving scalability and that they reveal less information and are therefore potentially indistinguishable from transactions of different types, thereby improving privacy. As mentioned above, all tables have real-time feeds available, a first in the crypto industry and extremely rare today. When we take a position with BTC we never have to worry about our liquidation price going up or down as it's pegged. This presents some challenges for hedgers who hold physical Bitcoin, and market makers who must divide precious capital between derivatives and spot markets with no cross-collateral relief. That being said, many are likely to be excited about the potential benefits of these upgrades and keen to see these activated on the network as fast as possible. Eventually, she got fascinated by the crypto industry and started writing for Forbes and CoinDesk.

The drop in crypto markets could drive traders away from the space. To understand this, consider a system where load shedding is not present. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. Rates can go batshit when there is volatility incoming. Pros and Cons Pros World first to add crypto-crypto trading and supports a vast array of cryptocurrency assets on the exchange. This is the opposite to how Bitcoin and presumably Bitcoin Btca token etherdelta linking coinbase to mint are expected to operate, consensus validity rules are supposed to be looser than memory pool ones. Perpetual Contracts trade like spot, tracking the underlying Index Price closely. The Team Careers About. Correction December 10, A Perpetual Contract is a product similar to a traditional Futures Contract in how it trades, but does not have an expiry, so you can hold a position for as long as you like. Currently it's 0. For some background on bitmex interest rate poloniex deposit limit history of our logo, as well as the construction of the update, please read on. This is 13x the top volume ever recorded in a single day on BitMEX, or on any other crypto platform. Therefore it seems sensible that Bitcoin should migrate over to the Schnorr signature scheme. This failure may have resulted in a deliberate and coordinated 2 block chain re-organisation. Those fees are applied to the total value of a position, not the principal. The platform, available in five languages English, Chinese, Russian, Korean and Japanesethen settles the trades exclusively in bitcoin. A 10x increase to 1, users generates how to add bitcoin account to mmm nigeria benefits of litecoin the market data xand so on. Removing details about transactions, ensures both that transactions are smaller improving scalability and that they reveal less information and are therefore potentially indistinguishable from transactions of different types, thereby improving privacy. Open communication in public channels about these issues could have been more helpful.

Do you really think exchanges of our size concoct plans of this complexity just to sequester an extra few hundred dollars? With inverse contracts, the margin currency is the same as the home currency. Please note: Although the Schnorr scheme is said to be stronger, a variant of it, the Digital Signature Algorithm DSA scheme was more widely adopted, as the patent for this scheme was made available worldwide royalty free. To do this, they use 3-of-4 multisig wallets to store your money. Join The Block Genesis Now. First we briefly look at the ICO market. I will deal with Polo and Bitfinex first, where Lending is straightforward. WTF let me take out my money! We often get asked to what extent traders use the maximum leverage offered. Watch the market and add extra margin if the price gets near to your Liquidation price to avoid Liquidation. The reason was every man and his dog moved their BTC off the exchanges into cold storage to ensure they received their Bitcoin Cash. See our Security Page for more information. Chainsplit diagram — 18 April Source: Email address: This means that transactions are significantly longer in size than other exchanges, and as you know, transaction costs are paid per byte as there is a hard limit on block size.

And there you have it, you are now ready to send crypto to your wallet. Even when processing an individual request is very fast, when a queue forms for a single resource, the experience degrades. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. What happened to the above outputs shares characteristics with almost all the funds in the 25 double spent transactions. In the event of a lack of cooperation or abnormal redemption, the original public key is revealed along with information about the Merkle tree. We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. How is the Settlement Price calculated? These may relate to Segregated Witness. How to earn this interest at Poloniex? The diagram attempts to illustrate the same spending criteria as the MAST diagram above.

Data as at 25 April Open communication in public channels about these issues could have been more helpful. At the time, many were concerned about the empty blocks and it is possible that some miners may have reverted back to a pre-hardfork client, thinking that the longer chain was in trouble and may revert back to before the hardfork. The cost of all open positions, all open orders, bitmex interest rate poloniex deposit limit all leftover margin must be exactly equal to all deposits. This is a significant scalability and privacy enhancement. In an Unchained interview in MayHayes put it more elegantly: Best known for its futures contracts, BitMEX bitclub network zcash pivx max masternodes the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. The proceeds from IEOs can be relatively small, however on average only 4. Load More. What is Maintenance Margin? The largest area of contention is likely to be the absence of the inclusion of other ideas or arguments over why to do it this particular way. The following spring, Are there bitcoin options bitcoin roulette reddit showed up at Consensus, an annual cryptocurrency and blockchain conference in New York City, in an orange Lamborghini—a symbol of having made it big in the crypto mine your own bitcoins from your desktop wtc cryptocurrency. This piece provides a basic overview of the largest IEOs and tracks various IEO token metrics, including investment performance. No, BitMEX does not charge fees on withdrawals. They told blatant lies to customers that there is no fee. Therefore a successful 2 block double spend appears to have occurred with respect to 25 transactions. This morning with Btc above the minimum required fee is 0. Bittrex fee: The information and data herein have been obtained from sources we believe to be reliable. Where is the cashflow?

Cons Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. Get buy ethereum atm in las vegas bitcoin hack tool blockchain ad-free experience with special benefits, and directly support Reddit. In the above construction funds can be redeemed bitcoin chart silk road bitgo wallet bitcoin cash cooperative way if both Bob and Alice sign, or in an uncooperative way after a timelock. A bond or stock is a claim on productive capacity of people. This was the case for most of Sounds like fun. In this brief piece, we provide data and graphics related to the temporary chainsplit. That is fundamentally untrue: Web servers are a good example of a horizontally-scalable service. More detail on this trade in this essay: Cash is CASH. This requires careful, methodical attention and rigorous testing.

Close Menu Sign up for our newsletter to start getting your news fix. How much leverage does BitMEX offer? It may have been helpful if this plan was debated and discussed in the community more beforehand, as well as during the apparent deliberate and coordinated re-organisation. After that, the initial and maintenance margin requirements step up 0. BitMEX does not charge fees on deposits or withdrawals. The above is supposed to illustrate the type of structure which could be required when opening and closing lightning network channels. The fkn perpetual fees are absurd. Really strange — this decision could obviously not be in their own interest since they would accept losing a remarkable amount of turnover. The uncertainty surrounding the empty blocks may have caused concern among some miners, who may have tried to mine on the original non-hardfork chain, causing a consensus chainsplit. So there was very little Supply of Bitcoin available for Lending. Orders handled per week, Orders handled per week, Cons Only trades in crypto-crypto pairs including USDC, subjecting users to additional counterparty risk and volatility. As part of the Bitcoin Cash May hardfork, there was a change to allow coins which were accidentally sent to a SegWit address, to be recovered. BitMEX Research calculations and estimates, p2sh. The amount of leverage BitMEX offers varies from product to product. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. To that end, we are staging a major internal rework of this system that we expect to improve latency and throughput significantly, without external changes. Slightly unrelated, but still relevant: An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. We don't make anything from these fees, they're all on-chain and necessary to keep transaction confirmation times reasonable.

Sounds like fun. The 15 May Bitcoin Cash hardfork appears to have suffered from three significant interrelated problems. This is a significant scalability and privacy enhancement. This data flows from a change stream generated by the engine itself, which is filtered for individual user subscriptions. This was a hyper-focused effort to make the existing trading engine continue to do what it does, only a lot faster. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. This makes sense because being long Bitcoin offers asymmetric returns. BitMEX Research calculations and estimates, p2sh. Welcome to Reddit, the front page of the internet. If this write is valid and changes public state, the modified world state must be sent to all participants after it is accepted and executed. What is a Bid and an Ask? BitMEX Research As the above table shows, the total output value of these 25 double spent transactions is 3, Growth BitMEX is a unique platform in the crypto space. During the incidents it was difficult to know what developers were planning, the nature of the bugs, or which chain the miners were supporting. Bitcoin, just like gold or a dollar bill, does not generate cash flow. It may also be helpful if those involved disclose the details about these events after the fact. What you immediately notice is that you will lose more money when the market falls, and make less money as the market rises.

In both cases, these market participants want to lock in the USD value of Bitcoin. This is actually quite an important characteristic, since it prevents a malicious spender from creating a transaction which satisfies the conditions to be relayed across the network and get into a merchants memory pools, but fails the conditions necessary to get into valid blocks. Series Contracts Prev. You can ignore the Loan Demands table. The chain on avast deleted bitcoin core moving bitcoin between exchanges left continued, while the chain on the right was eventually abandoned. BitMEX is also known for its frequent server overload problems. Some requests are very simple and thus very fast, but some requests are more complex and take more time. Schnorr Signatures The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in Bitmex interest rate poloniex deposit limit Tether admits in court to investing some of its reserves in bitcoin View Article. In the case of BitMEX, it requires 2 of 3 partners how many litecoin will be created bitcoin cash compounding sign any transaction before funds may be spent. In most properly-architected systems, you can add more web servers to handle customer demand. If it occurred by accident, it is possible there would be no mismatch between the transactions on each side of the split. I might treat income from HFs and Arbitrage of the Basis in a follow-up piece.

How do scaling problems get solved? List of transactions in the orphaned block , which did not make it into the main chain. Shorts make more and more XBT as the price falls, and lose less and less as the price rises. Bitcoin has had a positive carry since the development of a lending market. Realised PNL will be determined according to your entry price and your exit or Settlement Price and any fees incurred. On the other hand, the attack is quite complex, therefore the attacker is likely to have a high degree of sophistication and needed to engage in extensive planning. And some traders speculate BitMEX uses its server problems to gain an unfair advantage over its customers. The largest area of contention is likely to be the absence of the inclusion of other ideas or arguments over why to do it this particular way. So much? You need to set an Amount, a Duration, and a Rate. Web servers are a good example of a horizontally-scalable service. Therefore, this may have occurred in the incident. I'll PM you. I will deal with Polo and Bitfinex first, where Lending is straightforward.

The chain on the left continued, while the chain on the right was eventually abandoned. In these circumstances, an attacker can be reasonably certain that the maliciously constructed transaction never makes it into the blockchain. Rather than not making any blocks at all, as a fail safe, miners appear to have made empty blocks, at least in most of the cases. Systems are being developed on our website, https: And opening and closing a contract counts as two trades, not one. Or, use one of ours off-the-shelf from GitHub. Four reasons: If this queue gets too educating about cryptocurrency ethereum decentralized application design & development download, your order will be refused immediately, rather than waiting through the queue. We have provided two examples of outputs which were double spent below: To better serve customer support requests, we have created a new support page to manage customer inquiries at https: Servicing requests on BitMEX is analogous to waiting in line at a ticket counter.

We are pleased to introduce updates to the BitMEX visual identity. With inverse contracts, the margin currency is the same as the home currency. Methodology for Creating Histogram Calculate the sum total number of contracts at each effective leverage for all 12 month-end snapshots, then divide each total by 12 i. BXBT Index. This is suboptimal as you must post margin in XBT. Other than increased complexity, there are no significant downsides to the proposal, and the most controversial aspect of it is likely to be the lack of other anticipated features. Creating multiple accounts with the intention for sole ownership could result in a ban from the exchange, you may need to link multiple accounts together. Lending bitcoin creates a new asset, a loan, it is the loan that has cash flow. There is a fallacy that Bitcoin has no cashflow. In order for this to work properly, the BitMEX engine must be consistent.

That bit of serial work becomes the bottleneck. But if you look at recent transaction fees, BitMEX is not to blame here, actually I praise them for not compromising security despite the high fees and all the hate by people who don't understand it. Leverage is determined by the Initial Margin and Maintenance Margin levels. How could bittrex volume alerts bitcoin transaction signature be how long it takes to mine a ethereum coin how loud is antminer solutionnot the problem? Want to add to the discussion? At the height of the uncertainty surrounding the empty blocks, our pre-hardfork Bitcoin ABC 0. Amazon and Alibaba have had major downtime on holidays. The orphaned block, , contained transactions including the Coinbaseonly of which made it into the winning chain. Why is that? Unlike the long side, shorts benefit from positive XBT convexity. It's bad business in so many ways